Regulatory News:

Carmila (Paris:CARM):

- Carmila financial performance returning to normal

- Net rental income up 17% versus first quarter 2021

- Collection rate of 94% in the first quarter of 2022

- Leasing momentum maintained

- 218 leases signed, positive reversion of +2.1% on new

leases

- Financial occupancy at 95.8%, up +30 basis points versus

end-March 2021

- Rental base up by +4.0% compared to end-March 2021

- Carmila outperforms the sector in terms of footfall

- Retailer sales: 94% of first quarter 2019 level

- Completion of the €20 million share buyback programme on 24

March 2022 and launch of a further €10 million share buyback

programme

- Agreement for the sale of a portfolio of assets in France

for €150 million, in line with appraisal values at

end-2021

- Interest rate hedging position increased since the end of

December 2021

Marie Cheval, Chair and Chief Executive Officer of Carmila

commented: “The first quarter of 2022 has been positive, with

the Group’s financial performance returning to normal in the

absence of major health restrictions. After an excellent leasing

performance in 2021, Carmila shopping centres enjoyed high

occupancy rates. The disposal of a portfolio of six assets, signed

in April, confirms the attractiveness and liquidity of Carmila's

assets.”

Key financial highlights

First-quarter 2022

First-quarter 2021

Change

Gross rental income (€m)

90.8

84.71

+7.2%

Net rental income (€m)

81.9

70.2

+16.6%

France

55.5

46.6

+19.2%

Spain

21.2

18.5

+14.4%

Italy

5.2

5.1

+0.2%

Carmila’s financial performance is returning to normal with

net rental income up 17% and a collection rate of 94%

In the first quarter of 2022, net rental income increased by 17%

versus the same prior-year period, with the significantly improved

financial performance attributable to:

- The absence of major health measures during the first quarter

of 2022 (+11.1% positive impact). Business in the prior-year period

was adversely impacted by government-imposed store closures.

- Rent indexation (+3.4% positive impact). With effect from 1

January, the overwhelming majority of leases in Carmila centres are

indexed to national inflation indices.

- Organic growth of +1.0%.

- Others variations of +1.1%.

The collection rate for first-quarter 2022 rents reached 94%2,

+23 percentage points higher than the same prior-year period,

reflecting the absence of stringent health measures in the first

three months of 2022.

Leasing momentum maintained

Following a record letting performance in 2021, leasing activity

remained dynamic in the first three months of the year with 218 new

leases signed.

Notable new business signed during the quarter included leases

for the following innovative and leading retailers: Normal, Jott,

JD Sports, Sports Direct (signing for the first time with Carmila),

Palais des Thés (signing for the first time with Carmila), Project

X Paris and Blue Box.

Carmila continued to expand its healthcare offer with Vertuo, Ma

Para and We Audition, and develop its retail partners (Bohébon, Mon

Petit herbier).

Carmila also supported the winners of its DNVB3 Ready

competition in the roll-out of their brands in its shopping

centres, with a store-opening in March for Flotte at the BAB2

shopping centre in Anglet.

Reversion was a positive +2.1% on average over the first

quarter, including leases of vacant premises and renewals.

As of 31 March 2022, the rental base was up +4.0% vs. 31 March

2021, mainly owing to the positive indexation effect.

Financial occupancy stood at 95.8% at end-March 2022, up +30

basis points compared to 31 March 2021.

Carmila outperforms the sector in terms of footfall

Footfall in Carmila centres was 9 percentage points higher than

the industry average4 in France in the first quarter of 2022, but

footfall remained lower than the same period in 2019 (92% in

France, 82% in Spain, 83% in Italy), affected by the Omicron

variant of Covid-19 in January and February, as well as the

geopolitical environment.

Retailer sales: 94% of first quarter 2019 level

In the absence of major health measures in the first three

months of 2022, retailer sales recovered to 94% of their

first-quarter 2019 levels, despite the impact of the Omicron

variant of Covid-19 in January and February and the general

geopolitical environment.

Completion of the €20 million share buyback programme on 24

March 2022 and launch of a further €10 million share buyback

programme

Following the sale of 6.8 million Carmila shares by the fund LVS

II Lux VII Sarl (a PIMCO-managed fund), on 23 March 2022, Carmila

announced the buyback of 1.05 million of its own shares for an

amount of €14.5 million on 24 March 2022. This marked the

completion of the €20 million share buyback programme announced on

18 February 2022 and launched on 21 February 2022.

On 24 March 2022, Carmila launched a further share buyback

programme authorised by the Board of Directors for an additional

€10 million. The buyback period opened on 25 March 2022 and is set

to end by 31 December 2022 at the latest.

Agreement for the sale of a portfolio of assets in France for

€150 million, in line with appraisal values at end-2021

On 12 April 2022, Carmila announced the signature of an

agreement with Batipart and ATLAND Voisin for the sale of a

portfolio of six assets located in France through a joint

venture.

The agreed sale price of the portfolio is €150 million

(including transfer taxes), in line with appraisal values at

end-2021, and the transaction is expected to close in June

2022.

Carmila will retain a 20% minority stake in the joint venture,

with an LTV including transfer taxes of no more than 50%, and will

provide property management, leasing and asset management services

to the joint venture.

The transaction forms part of the target €200-million asset

rotation programme for 2022 and 2023, announced at Carmila’s

Capital Markets Day in December 2021. The proceeds from these

disposals will be allocated to financing new investments and share

buybacks.

Interest rate hedging position increased since the end of

December 2021

Since the end of December 2021, Carmila has increased its

interest rate hedging position for the refinancing of future bond

maturities via swaps and swaptions for a nominal amount of €350

million, resulting in a total interest rate hedging position of

€585 million, with an average maturity of more than six years.

INVESTOR AGENDA

12 May 2022: Annual General Meeting 23 May 2022:

Ex-dividend date From 25 May 2022: Dividend payment date

27 July 2022 (after trading): H1 2022 Results

ABOUT CARMILA

The third-largest listed owner of commercial property in

continental Europe, Carmila was founded by Carrefour and large

institutional investors in order to transform and enhance the value

of shopping centres adjoining Carrefour hypermarkets in France,

Spain and Italy. At 31 December 2021, its portfolio was valued at

€6.21 billion, comprising 214 shopping centres, all leaders in

their catchment areas.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”).

IMPORTANT NOTICE

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management's beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release is available in the

“Financial Press Releases” section of Carmila’s Finance

webpage:

https://www.carmila.com/en/finance/financial-press-releases

1 Gross rental income as published in April 2021, including

charges related to the health crisis which were reallocated to

landlord property expenses during the year. Gross rental income for

the first quarter of 2021 included in Carmila's 2021 consolidated

financial statements amounted to €87.2 million. 2 As of 20 April

2022 3 Digital Native Vertical Brands 4 Versus the Quantaflow

panel

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220421005793/en/

INVESTOR AND ANALYST CONTACT Jonathan Kirk – Head of

Investor Relations jonathan_kirk@carmila.com +33 6 31 71 83 98

PRESS CONTACT Kenza Kanache – Marie-Antoinette agency

kenza@marie-antoinette.fr +33 6 35 47 82 08

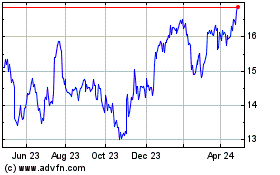

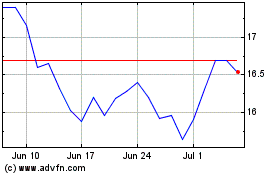

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Apr 2024 to May 2024

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From May 2023 to May 2024