US To Sell 41,500 Bitcoin (BTC) In Four Batches, Crash Inevitable?

March 31 2023 - 3:00PM

NEWSBTC

According to a recent Twitter post by crypto researcher “db,” the

US government sold 9,800 Bitcoin (BTC) on March 14th, seized from

criminals involved in illegal activities on the Silk Road website.

At the time of the auction, the price of Bitcoin was approximately

$26,000. As per a court filing, the US Government sold 9,800 BTC

during a recent transaction, valued at approximately $215 million.

The US Government plans to sell another 41,500 BTC in connection

with Silk Road, an online marketplace that facilitated illegal

activities and was seized by law enforcement agencies in 2013.

Related Reading: Shiba Inu Whale Accumulates 99 Billion Tokens in

Massive Buying Spree US Government Bitcoin Sell-Off Will Trigger

Another Price Drop? According to “db” it is not clear whether the

US government used a Coinbase time-weighted average price (TWAP) to

determine the sale price on March 14th; this remains a possibility.

Although it is more likely that the U.S. used an over-the-counter

(OTC) transaction. The TWAP is a trading strategy that involves

executing trades at regular intervals over a specified period to

achieve an average price. The transaction occurred on the

crypto exchange Coinbase, the largest cryptocurrency exchange in

the US. Its TWAP trading strategy involves executing trades

regularly over a specified period to achieve an average price.

Given Coinbase’s popularity and the US Government’s need for a

reliable pricing mechanism, it is possible that they may use

Coinbase’s TWAP again for the sale of the remaining 41,500 BTC

connected to the Silk Road, which will be sold in four batches over

the year If there is no demand for Bitcoin when the US government

sells the remaining 41,500 BTC in the market, it could lead to a

drop in Bitcoin’s price, creating market volatility. If no buyers

are willing to purchase at the offered price, it could lead to a

temporary drop and delay BTC’s rally. However, on March 14th,

Bitcoin’s price was up and continued the trend afterward,

indicating a strong demand for Bitcoin. Buyers were willing to pay

a premium for the cryptocurrency. US Government Subject Of A Fraud

Involving The BTC Trade? The crypto community has been speculating

about the impact and the U.S. BTC trade. The crypto researcher and

analyst under the pseudonym “CL” alleges that fraud may have been

involved in the transaction. CL believes that an “insider” may have

corrupted the trade. According to him, on March 14th, Binance

futures traded $14 billion worth of Bitcoin, indicating that the

market was “extremely liquid then.” CL believes that even at the

lowest price of the day, the US government should have received

more than $240 million for the trade. According to CL, there

may have been fraudulent activity involved in the trade. CL

suggests that an “insider” may have “corrupted” the transaction,

resulting in a $30 million “slippage” in an over-the-counter (OTC)

trade. It is important to note that the sale of Bitcoin by

the US Government could potentially impact the price of the

cryptocurrency and the broader market. It remains to be seen how

the market will react to the sale of such a large volume of

Bitcoin. Related Reading: XLM: How It Plans To Navigate Bearish

Market Sentiment Featured image from Unsplash, chart from

TradingView.com

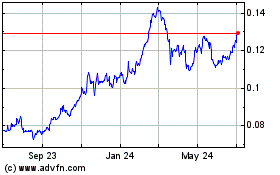

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

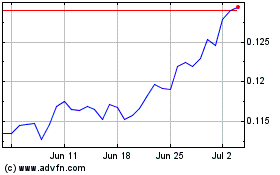

TRON (COIN:TRXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024