AVGO: Broadcom Stock Gains Post Fiscal Q4 Results

December 13 2021 - 9:06AM

Finscreener.org

Shares of technology

heavyweight Broadcom (NYSE: AVGO)

have gained momentum after the company reported its Q4 results of

fiscal 2021. At the time of writing, Broadcom stock is up over 6%

in pre-market trading on December 10.

AVGO stock went public back in

August 2009 and has since returned a staggering 4,550% to investors

in dividend-adjusted gains. Comparatively, the

S&P 500

and the Technology Select Sector

SPDR Fund (AMEX:

XLK) have returned 489% and 936% respectively in

this period. Let’s see how Broadcom performed in fiscal Q4 and if

the company remains a top bet for long-term investors.

Broadcom reports revenue of $7.41 billion

In the fiscal Q4 of 2021, which

ended in October, Broadcom reported revenue of $7.41 billion and

earnings per share of $7.81. Wall Street forecast revenue of $7.36

billion and adjusted earnings of $7.74 per share in Q4. While sales

were up 15% year over year, net income surged by almost 25% in

Q4.

Broadcom reported an operating

cash flow of $3.54 billion while its adjusted EBITDA and free cash

flow stood at $4.54 billion and $3.45 billion respectively. The

company ended fiscal 2021 with an adjusted EBITDA margin of 60% and

$13.3 billion of free cash flow which was 49% of

revenue.

This allowed Broadcom to increase

its quarterly dividend by 14% to $4.10 per share as well as

announce a share repurchase program of $10 billion.

Company CEO,

Kirsten Spears

stated, “In fiscal 2021,

we achieved record adjusted EBITDA margin of 60%, generating $13.3

billion of free cash flow, or 49% of revenue. Consistent with our

commitment to return excess cash to shareholders, we are increasing

our target quarterly common stock dividend by 14 percent to $4.10

per share per quarter for fiscal year 2022, and announcing a new

$10 billion share repurchase program.”

Broadcom forecast fiscal Q1 of

2022 sales of $7.6 billion which was higher than consensus

estimates of $7.25 billion.

What next for AVGO stock investors?

Broadcom remains a top bet for

growth and income-seeking investors. It has a wide portfolio of

products and solutions that are used across industries. The

semiconductor heavyweight still spends around $5 billion in

research and development to ensure its product development pipeline

is robust.

While Broadcom is part of several

expanding addressable markets, it has grown top-line by several

acquisitions that include CA Technologies and the enterprise

security business of Symantec.

In fiscal 2021, its:

- Operating cash flow rose by

$1.70 billion to $13.76 billion

- Adjusted EBITDA rose by $2.92

billion to $16.57 billion

- Free cash flow rose by $1.72

billion to $13.3 billion

Its solid expansion of cash flows

and profit margins has allowed Broadcom to increase dividends at a

stellar pace over the years. Right now, its annual

dividend payouts stand at

$16.4 per share, indicating a forward yield of 2.6% which is more

than twice the yield of the S&P 500 that stands at

1.3%.

Broadcom’s quarterly dividends

stood at just $0.07 per share in 2010. In the last 11 years, its

dividends have increased at an annual rate of 39%, making it a top

dividend growth stock to place your bets on.

The key takeaway

Valued at a market cap of $240

billion, Broadcom is forecast to increase sales by 7.6% to $29.54

billion in fiscal 2022 and by 4.6% to $30.91 billion in fiscal

2023. Its adjusted earnings per share are expected to increase from

$28 in fiscal 2021 to $33.1 in fiscal 2022.

AVGO stock is trading at a

forward price to sales multiple of 8.1x and a price to earnings

multiple of 20x which is quite reasonable. Broadcom should be part

of your long-term equity portfolio given its expanding profit

margins, strong revenue growth, low payout ratio, and reasonable

valuation.

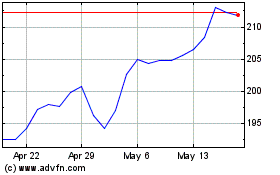

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

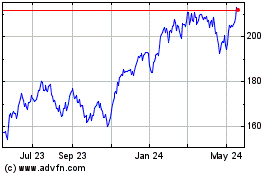

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From Apr 2023 to Apr 2024