Definitive Materials Filed by Investment Companies. (497)

December 23 2022 - 9:55AM

Edgar (US Regulatory)

GOF

P33 12/22

SUPPLEMENT

DATED DECEMBER 23, 2022

TO THE CURRENTLY EFFECTIVE PROSPECTUS

OF

FRANKLIN HIGH YIELD CORPORATE

ETF

FRANKLIN

INVESTMENT GRADE CORPORATE ETF

FRANKLIN INTERNATIONAL AGGREGATE BOND ETF

FRANKLIN SENIOR LOAN ETF

FRANKLIN U.S. CORE BOND

ETF

FRANKLIN

ULTRA SHORT BOND ETF

FRANKLIN DISRUPTIVE COMMERCE ETF

FRANKLIN GENOMIC ADVANCEMENTS ETF

FRANKLIN INTELLIGENT MACHINES

ETF

FRANKLIN

EXPONENTIAL DATA ETF

(each a series of Franklin Templeton ETF Trust)

FRANKLIN SHORT DURATION

U.S. GOVERNMENT ETF

(a series of Franklin ETF Trust)

I. For

Franklin International Aggregate Bond ETF, Franklin Investment Grade Corporate ETF,

Franklin

Senior Loan ETF, Franklin U.S. Core Bond ETF, Franklin Ultra Short

Bond ETF, Franklin Disruptive Commerce ETF, Franklin Genomic Advancements

ETF

and

Franklin Intelligent Machines ETF, the “ESG Considerations” risk in the

“Fund Details – Principal Risks” section of the prospectus is replaced with the following:

ESG Considerations

ESG considerations are one

of a number of factors that the investment manager examines when considering investments for the Fund’s

portfolio. In light of this, the issuers in which the Fund invests may not be considered ESG-focused

issuers and may have lower or adverse ESG assessments. Consideration of ESG factors may affect the Fund’s

exposure to certain issuers or industries and may not work as intended. In addition, ESG considerations

assessed as part of the Fund’s investment process may vary across types of eligible investments and

issuers. The investment manager does not assess every investment for ESG factors and, when it does,

not every ESG factor may be identified or evaluated. The investment manager’s assessment of an issuer’s

ESG factors is subjective and will likely differ from that of investors, third party service providers

(e.g., ratings providers) and other funds. As a result, securities selected by the investment manager

may not reflect the beliefs and values of any particular investor. The investment manager also may be

dependent on the availability of timely, complete and accurate ESG data reported by issuers and/or third-party

research providers, the timeliness, completeness and accuracy of which is out of the investment manager’s

control. ESG factors are often not uniformly measured or defined, which could impact the investment manager’s

ability to assess an issuer. While the investment manager views ESG considerations as having the potential

to contribute to the Fund’s long-term performance, there is no guarantee that such results will be

achieved.

II. For Franklin High Yield Corporate ETF and Franklin Exponential

Data ETF, the “ESG Considerations” risk in the “Fund Details –

Principal Risks” section of the prospectus is replaced with the following:

ESG

Considerations

ESG considerations are one of a number

of factors that the investment manager examines when considering investments for the Fund’s portfolio.

In light of this, the issuers in which the Fund invests may not be considered ESG-focused issuers and

may have lower or adverse ESG assessments. Consideration of ESG factors may affect the Fund’s exposure

to certain issuers or industries and may not work as intended. In addition, ESG considerations assessed

as part of the Fund’s investment process may vary across types of eligible investments and issuers.

In certain circumstances, there may be times when not every investment is assessed for ESG factors and,

when they are, not every ESG factor may be identified or evaluated. The investment manager’s assessment

of an issuer’s ESG factors is subjective and will likely differ from that of investors, third party

service providers (e.g., ratings providers)

and other funds. As a result, securities selected by the investment

manager may not reflect the beliefs and values of any particular investor. The investment manager also

may be dependent on the availability of timely, complete and accurate ESG data reported by issuers and/or

third-party research providers, the timeliness, completeness and accuracy of which is out of the investment

manager’s control. ESG factors are often not uniformly measured or defined, which could impact the

investment manager’s ability to assess an issuer. While the investment manager views ESG considerations

as having the potential to contribute to the Fund’s long-term performance, there is no guarantee that

such results will be achieved.

III. For

Franklin Short Duration U.S. Government ETF, the “ESG Considerations” risk in the “Fund Details

– Principal Risks” section of the prospectus is replaced with the following:

Social

and Governance Considerations

Social and/or governance

considerations are not the only factors considered by the investment manager and may not be a determinative

factor in the investment manager’s selection of securities for the Fund. In addition, the investment

manager may not be able to give such considerations meaningful weight if the availability of appropriate

securities for the Fund’s portfolio is limited. The investment manager does not assess every investment

for ESG factors and, when it does, not every ESG factor may be identified or evaluated. The investment

manager’s assessment of certain investments may differ from that of investors, third party service

providers, such as ratings providers, or other funds. While the investment manager views social and governance

considerations as having the potential to contribute to the Fund’s performance, there is no guarantee

that such results will be achieved.

Please keep this supplement with your prospectus

for future reference.

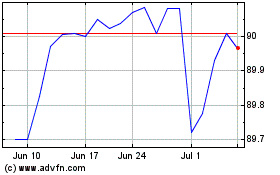

Franklin Short Duration ... (AMEX:FTSD)

Historical Stock Chart

From Apr 2024 to May 2024

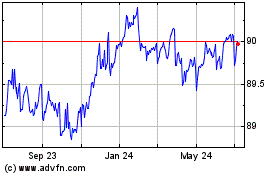

Franklin Short Duration ... (AMEX:FTSD)

Historical Stock Chart

From May 2023 to May 2024