FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of a Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

|

For the month of April, 2015

Commission File Number: 001-13928

|

Royal Bank of Canada

(Name of registrant)

| |

|

|

|

200 Bay Street

Royal Bank Plaza

Toronto, Ontario

Canada M5J 2J5

Attention: Vice-President

& Corporate Secretary

|

|

1 Place Ville Marie

Montreal, Quebec

Canada H3C 3A9

Attention: Vice-President

& Corporate Secretary

|

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

|

|

THIS REPORT ON FORM 6-K AND THE EXHIBITS HERETO SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE AS EXHIBITS TO ROYAL BANK OF CANADA’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-189888) AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

|

Exhibits are filed herewith in connection with the issuance of the following Senior Global Medium-Term Notes, Series F (the “Notes”) by Royal Bank of Canada (the “Bank”) on the date of this report on Form 6-K, pursuant to the Bank’s shelf registration statement on Form F-3 (File No. 333-189888):

|

|

·

|

$500,000,000 aggregate principal amount of 1.000% Senior Notes, due April 27, 2017

|

EXHIBITS

| |

|

|

|

Exhibit

|

|

Description of Exhibit

|

|

5.1

|

|

Opinion of Sullivan & Cromwell LLP, U.S. counsel for the Bank, as to the validity of the Notes under New York law.

|

| |

|

|

|

5.2

|

|

Opinion of Norton Rose Fulbright Canada LLP, Canadian counsel for the Bank, as to certain matters under Canadian, Ontario and Québec law.

|

| |

|

|

|

8.1

|

|

Opinion of Sullivan & Cromwell LLP, U.S. counsel for the Bank, as to certain matters of United States federal income taxation.

|

| |

|

|

|

23.1

|

|

Consent of Sullivan & Cromwell LLP (included in Exhibits 5.1 and 8.1 above).

|

| |

|

|

|

23.2

|

|

Consent of Norton Rose Fulbright Canada LLP (included in Exhibit 5.2 above).

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

|

|

| |

|

ROYAL BANK OF CANADA

|

|

| |

|

|

|

|

|

| |

|

By:

|

|

/s/ James Salem

|

|

| |

|

Name:

Title:

|

|

James Salem

Executive Vice-President and Treasurer

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

Date: April 27, 2015

|

|

Exhibit 5.1

[Letterheard of Sullivan & Cromwell LLP]

April 27, 2015

Royal Bank of Canada,

200 Bay Street,

Royal Bank Plaza,

Toronto, Ontario,

Canada M5J 2J5.

Ladies and Gentlemen:

This opinion is delivered in connection with the issuance and delivery of the debt securities of Royal Bank of Canada (the “Bank”) identified in Annex A to this letter (the “Notes”). The Bank filed with the Securities and Exchange Commission a registration statement on Form F-3 (File No. 333-189888) (the “Registration Statement”) under the Securities Act of 1933 (the “Act”) that was declared effective on July 23, 2013, relating to, among other things, the proposed offer and sale of up to $25,000,000,000 aggregate initial offering price of debt securities which may be senior obligations or subordinated obligations. The Notes are being issued pursuant to the Indenture, dated as of October 23, 2003, as supplemented by the First Supplemental Indenture, dated as of July 21, 2006 and by the Second Supplemental Indenture, dated as of February 28, 2007 (as so supplemented, the “Indenture”), between the Bank and The Bank of New York Mellon, as successor to the corporate trust business of JPMorgan Chase Bank, N.A., as trustee (the “Trustee”).

In rendering this opinion, we have examined the following documents:

|

|

2.

|

Certificates of officers of the Bank with respect to the authorization of the Notes, the determination of the terms of the Notes and related matters.

|

|

|

3.

|

A specimen of the master global security with respect to the Senior Global Medium-Term Notes, Series F, dated July 23, 2013 (the “Master Note”).

|

|

|

4.

|

The prospectus dated July 23, 2013, the prospectus supplement dated July 23, 2013 and the disclosure documents relating to the Notes as indicated in Annex A, to the extent that portions of such documents are being

|

|

Royal Bank of Canada

|

- 2 - |

|

|

|

incorporated into the Master Note in accordance with the terms of the Master Note and the Indenture.

|

We have also examined such questions of United States federal and New York state law as we have considered necessary or appropriate for the purposes of this opinion.

Upon the basis of such examination, we advise you that, in our opinion, the Notes constitute valid and legally binding obligations of the Bank, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles.

The foregoing opinion is limited to the Federal laws of the United States and the laws of the State of New York, and we are expressing no opinion as to the effect of the laws of any other jurisdiction. With respect to all matters of the laws of Canada, Québec and Ontario, we understand that you are relying upon the opinion, dated the date hereof, of Norton Rose Fulbright Canada LLP, Canadian counsel for the Bank, and our opinion is subject to the same assumptions, qualifications and limitations with respect to such matters as are contained in such opinion of Norton Rose Fulbright Canada LLP.

In rendering the foregoing opinion, we are not passing upon, and assume no responsibility for, any disclosure in the Registration Statement or any related prospectus or other offering material regarding the Bank or the Notes or their offering and sale.

We have relied as to certain factual matters on information obtained from public officials, officers of the Bank and other sources believed by us to be responsible, and we have assumed that each of the Indenture and the Master Note have been duly authorized, executed and delivered by the Bank, and that the Notes have been duly authorized by the Bank, in each case insofar as the laws of Canada, Québec and Ontario are concerned, and that the Indenture relating to the Notes has been duly authorized, executed and delivered by the Trustee thereunder, that an authorized officer of the Trustee has notated the issuance of the Notes on the Master Note representing the Notes as required by Section 207 of the Indenture, that the Notes have been delivered against payment as contemplated in the Registration Statement and that the signatures on all documents examined by us are genuine, assumptions which we have not independently verified.

|

Royal Bank of Canada

|

- 3 - |

We hereby consent to this filing of this opinion as an exhibit to a Current Report on Form 6-K to be incorporated by reference in the Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

| |

Very truly yours,

|

| |

|

| |

/s/ Sullivan & Cromwell LLP |

Annex A

|

Title of Note

|

|

Disclosure

Documents

|

| |

|

|

|

$500,000,000 aggregate principal amount of 1.000% Senior Notes, due April 27, 2017

|

|

Pricing supplement dated April 23, 2015

|

Exhibit 5.2

[Letterhead of Norton Rose Fulbright Canada LLP]

Royal Bank of Canada

200 Bay Street

Royal Bank Plaza

Toronto, Ontario

Canada, M5T 2J5

| Re: |

Royal Bank of Canada

Senior Global Medium-Term Notes, Series F - U.S. $500,000,000 aggregate principal amount of 1.000% Senior Notes due April 27, 2017 (the Offered Securities)

|

We have acted as Canadian counsel to Royal Bank of Canada (the Bank) in connection with the issue of the Offered Securities pursuant to the terms agreement dated as of April 22, 2015, with respect to $325,000,000 aggregate principal amount of the Offered Securities, and as of April 23, 2015, with respect to $175,000,000 aggregate principal amount of the Offered Securities (the Terms Agreement), between RBC Capital Markets, LLC, as lead agent on behalf of the Purchasing Agents listed therein (collectively, the Agents), and the Bank entered into pursuant to the Distribution Agreement dated July 23, 2013 (the Distribution Agreement) relating to the Bank’s Senior Global Medium-Term Notes, Series F, in an aggregate principal amount of up to U.S. $25,000,000,000, or the equivalent thereof in other currencies or currency units (such series of securities being hereinafter referred to as the Series), to be issued pursuant to the Indenture, dated as of October 23, 2003, as supplemented by the First Supplemental Indenture, dated as of July 21, 2006, and by the Second Supplemental Indenture, dated as of February 28, 2007 (collectively, the Indenture), between the Bank and The Bank of New York Mellon (formerly known as The Bank of New York) as successor to the corporate trust business of JPMorgan Chase Bank, N.A., as Trustee (the Trustee).

We have participated, together with Sullivan & Cromwell LLP, United States counsel to the Bank, in the preparation of the following:

|

|

(i)

|

the Distribution Agreement;

|

|

|

(iii)

|

the registration statement of the Bank on Form F-3 (File No. 333-189888) dated July 10, 2013, as amended on July 23, 2013 (the Registration Statement); and

|

|

|

(iv)

|

the prospectus of the Bank dated July 23, 2013 included in the Registration Statement (the Basic Prospectus) as supplemented by the prospectus supplement dated July 23, 2013 specifically relating to the Series (the Prospectus Supplement, and together with the Basic Prospectus, the Program Prospectus).

|

We understand that the Registration Statement and the Program Prospectus were filed with the United States Securities and Exchange Commission in connection with the Series and that a Pricing Supplement dated April 23, 2015 relating to the Offered Securities has been filed with the United States Securities and Exchange Commission.

For the purposes of our opinions below, we have examined such statutes, public and corporate records, certificates and other documents, and considered such questions of law, as we have considered relevant and necessary as a basis for the opinions hereinafter set forth. In such examination we have assumed the genuineness of all signatures and the authenticity of all documents submitted to us as originals, and the conformity to original documents of all documents submitted to us as certified or photostatic copies or facsimiles. For the purposes of the opinions expressed herein, we have, without independent investigation or verification, assumed that the Indenture has been duly authorized, executed and delivered by, and constitutes a legal, valid and binding obligation of, each party thereto other than the Bank.

With respect to the continuing existence of the Bank as a Schedule I bank under the Bank Act (Canada) referred to in paragraph 1 below, we have relied, without independent investigation or verification, exclusively upon a Certificate of Confirmation dated April 27, 2015 issued by the Office of the Superintendent of Financial Institutions.

In giving this opinion, we express no opinion as to any laws other than the laws, at the date hereof, of the Provinces of Ontario and Québec and the federal laws of Canada applicable therein.

Based and relying upon and subject to the qualifications set forth herein, we are of the opinion that:

|

1.

|

the Bank validly exists as a Schedule I bank under the Bank Act (Canada) and has the corporate power to create the Series and to create, issue and sell the Offered Securities;

|

|

2.

|

the issue and sale of the Offered Securities has been duly authorized by all necessary corporate action of the Bank in conformity with the Indenture, and such Offered Securities have been duly executed, authenticated and issued in accordance with the Indenture, and such Offered Securities are validly issued and to the extent validity of the Offered Securities is a matter governed by the laws of the Provinces of Ontario or Québec, or the laws of Canada applicable therein, are valid obligations of the Bank;

|

|

3.

|

the Distribution Agreement has been duly authorized, executed and, to the extent delivery is a matter governed by the laws of the Provinces of Québec or Ontario and the federal laws of Canada applicable therein, delivered by the Bank; and

|

|

4.

|

the Indenture has been duly authorized, executed and, to the extent delivery is a matter governed by the laws of the Provinces of Québec or Ontario and the federal laws of Canada applicable therein, delivered by the Bank and, to the extent validity thereof is a matter governed by the laws of the Provinces of Québec or Ontario and the federal laws of Canada applicable therein, is valid and, with respect to the provisions thereof governed by the laws of the Province of Ontario and the federal laws of Canada applicable therein, constitutes a legal, valid and binding obligation of the Bank enforceable in accordance with its terms.

|

The opinions set forth in paragraphs 2 and 4 above as to the validity of the Offered Securities and the enforceability of the Indenture are subject to the following qualifications:

|

|

(i)

|

equitable remedies, such as specific performance and injunctive relief, are remedies which may only be granted at the discretion of a court of competent authority;

|

|

|

(ii)

|

enforceability may be limited by bankruptcy, insolvency and other laws of general application affecting the rights of creditors (including the provisions of the Bank Act (Canada) respecting such matters); and

|

|

|

(iii)

|

pursuant to the Currency Act (Canada), a judgment by a court in any province in Canada may be awarded in Canadian currency only and such judgment may be based on a rate of exchange which may be the rate in existence on a day other than the day of payment of such judgment.

|

The opinions expressed herein are provided solely for the benefit of the addressee in connection with the issue of the Offered Securities and are not to be transmitted to any other person, nor are they to be relied upon by any other person or for any other purpose or referred to in any public document or filed with any government agency or other person without our prior express consent. The opinions expressed herein may be relied upon by Sullivan & Cromwell LLP for the purposes of its opinion dated the date hereof addressed to the Bank with respect to the subject matter hereof.

We hereby consent to the filing of this opinion as an exhibit to the Bank’s Report of Foreign Private Issuer on Form 6-K. In giving such consent, we do not thereby admit that we come within the category of persons whose consent is required by the Act or the rules and regulations promulgated thereunder.

Yours very truly,

/s/ Norton Rose Fulbright Canada LLP

Exhibit 8.1

[Letterhead of Sullivan & Cromwell LLP]

April 27, 2015

Royal Bank of Canada,

200 Bay Street,

Royal Bank Plaza,

Toronto, Ontario,

Canada M5J 2J5.

Ladies and Gentlemen:

We are acting as special United States federal taxation counsel to Royal Bank of Canada (the “Bank”), in connection with the issuance and delivery of the debt securities identified in Annex A to this letter (the “Notes”) as described in the Pricing Supplement dated April 23, 2015 (the “Pricing Supplement”) to the Prospectus Supplement dated July 23, 2013 and the Prospectus dated July 23, 2013 (the “Prospectus”) contained in the Registration Statement on Form F-3, File No. 333-189888 (the “Registration Statement”). We hereby confirm to you that the statements of U.S. tax law set forth under the heading “U.S. Federal Income Tax Considerations” in the Pricing Supplement are our opinion, subject to the limitations and exceptions set forth in the Pricing Supplement and the Prospectus.

We hereby consent to the filing of this opinion as an exhibit to a Current Report on Form 6-K incorporated by reference in the Registration Statement, and to the reference to our opinion in the Pricing Supplements. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

| |

Very truly yours,

|

| |

|

| |

/s/ Sullivan & Cromwell LLP |

Annex A

|

Title of Note

|

|

Date of Pricing Supplement

|

Date of Issue of Note

|

| |

|

|

|

|

$500,000,000 aggregate principal amount of 1.000% Senior Notes, due April 27, 2017

|

|

April 23, 2015

|

April 27, 2015

|

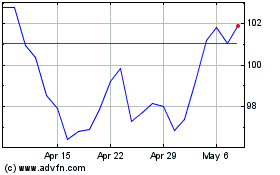

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024