MasterCard to Acquire Big Stake in U.K.'s VocaLink -Update

July 21 2016 - 12:10PM

Dow Jones News

By Anne Steele

MasterCard Inc. said it was buying most of VocaLink Holdings

Ltd., a bank-owned technology company in the U.K. that provides the

backbone for non-card transactions such as employer payroll

deposits and consumer bill payments.

The deal, valued at about $920 million, is the latest

transaction involving a U.K. company following last month's Brexit

vote. Officials of both companies said, however, that the deal

wasn't related to the political climate and negotiations had been

ongoing for months.

In addition to providing the technology backbone for non-card

payments, VocaLink also unites the infrastructure of Britain's

automated teller machine network among its participating banks.

VocaLink reported $240 million in revenue last year and processed

more than 11 billion transactions.

The deal "is an important component of our strategy to actively

participate in all types of electronic payments and payment flows,"

said Martina Hund-Mejean, MasterCard's chief financial officer, in

a conference call with analysts to discuss the deal.

VocaLink is involved in payments technology elsewhere in the

world as countries upgrade their systems so that money can move

instantly between business, consumer and government accounts. The

company is also developing an instant mobile-payments system for

non-card transactions.

Ms. Hund-Mejean said the deal doesn't change MasterCard's view

on its core card-based business, but reflects "an expansion of our

capability."

She also said the deal isn't expected to cannibalize

MasterCard's card business because consumers and businesses are the

ones who ultimately decide what type of payment they want to

make.

Executives said the deal is unlikely to be affected by the

uncertainty surrounding Brexit.

"We have to support locally every country. It doesn't really

matter if you are part of the EU or not part of the EU," said

VocaLink Chief Executive David Yates, who will join MasterCard's

management committee after the deal is completed.

He said that VocaLink had "outgrown" its shareholder base and

needed new ownership in order to expand. Additionally, he said, the

company's bank owners were under some regulatory pressure to sell

their positions so that the company would have a non-bank

owner.

Banks that own VocaLink include Barclays Bank plc, Royal Bank of

Scotland Group, Lloyds Banking Group, HSBC and Santander.

Following the deal's completion, MasterCard will own 92.4% of

the company. A majority of VocaLink's current owners will retain a

7.6% stake for at least three years. The deal terms also extend the

potential that existing shareholders could earn up to an additional

$220 million if certain performance targets are met.

MasterCard said the deal would add 5 cents to earnings per share

in 2017 and 2018 if it closes as expected early next year.

Foreign bidders have made a raft of deals since Britain's

referendum to leave the European Union on June 23 as the pound has

dropped about 10% against the dollar in the past month. U.S.-based

cinema operator unit AMC Entertainment Holdings Inc. agreed to buy

Europe's largest cinema chain, Britain-based Odeon UCI Cinemas

Group. It said the lower pound was a major factor, and AMC's CEO

warned "there may even be a stampede of U.S. acquirers looking at

the United Kingdom."

Anne Steele contributed to this report

Write to Robin Sidel at robin.sidel@wsj.com

(END) Dow Jones Newswires

July 21, 2016 11:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

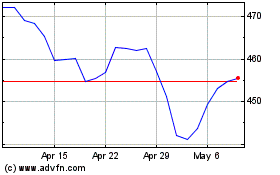

MasterCard (NYSE:MA)

Historical Stock Chart

From Aug 2024 to Sep 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Sep 2023 to Sep 2024