SABMiller Hammered by Currencies, Weak Volume

November 12 2015 - 4:20AM

Dow Jones News

LONDON—SABMiller PLC on Thursday reported an 18% slide in

first-half profit as the world's second-largest brewer was hammered

by currency volatility and world-wide lager volumes were flat.

Brewers have seen consumers in developed markets flock to craft

beer and other spirits, which has weakened demand for mainstream

lagers. SABMiller, which has a strong footprint in Africa and Latin

America, has benefited from stronger volume from these regions but

continued to report lower volume in Europe and the U.S.

The London-based brewer posted pretax profit of $2.33 billion

for the six months to Sept. 30, down from $2.83 billion the

previous year. Adjusted per-share earnings of $1.10 were lower than

the $1.23 reported a year earlier. Revenue fell 12% to $9.99

billion, but rose 5% at constant currency.

"Our reported results were again negatively impacted by the

depreciation of major operating currencies against the U.S.

dollar," said Chief Executive Alan Clark.

The company said foreign exchange movements had dragged down

earnings before interest, taxes, depreciation and amortization by

$497 million. Ebitda for the period was down 11% from a year

earlier at $2.92 billion.

The results come a day after Anheuser-Busch NV agreed to buy

SABMiller for $108 billion, a deal that is expected to close in the

second half of next year.

The owner of the Grolsch and Peroni beer brands reported strong

growth in Latin America and Africa at constant exchange rates, with

net producer revenue—which strips out excise duties and other

taxes—rising 8% and 9% respectively in those regions.

Soft drinks again showed more fizz than lager, with sales volume

increasing 4% while lager volumes were flat, continuing a recent

trend. SAB has expanded aggressively into nonalcoholic beverages in

recent years, forming alliances with Coca-Cola Co. to bottle soda

and releasing a range of malt-based drinks, mainly in West

Africa.

A key question that hangs over the deal with AB InBev is whether

the Belgian brewer can continue to bottle for PepsiCo Inc. while

also bottling for Coke. AB InBev CEO Carlos Brito declined to

comment on the issue on Wednesday, telling analysts that it was

"too early to speculate."

Razak Musah Baba contributed to this article

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=BE0003793107

Access Investor Kit for "AB InBev"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US03524A1088

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 12, 2015 04:05 ET (09:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

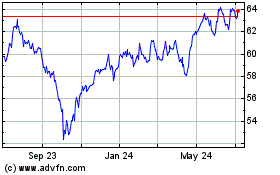

Coca Cola (NYSE:KO)

Historical Stock Chart

From Aug 2024 to Sep 2024

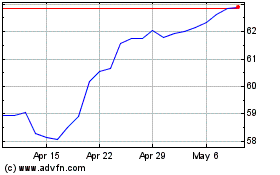

Coca Cola (NYSE:KO)

Historical Stock Chart

From Sep 2023 to Sep 2024