AptarGroup, Inc. (NYSE:ATR) today reported first quarter sales

and earnings per share. Excluding currency effects, comparable

earnings per share increased significantly over the prior year

despite a slight decline in sales.

First Quarter 2015 Summary

- Excluding currency translation

effects, core sales declined 1%

- Earnings per share reached $0.70, a

17% increase over the prior year currency-adjusted earnings per

share of $0.60

- Reported sales and earnings per

share were negatively impacted by weak foreign currencies,

primarily the Euro

- Reported sales decreased 13% to $590

million and reported earnings per share decreased 1% to $0.70 per

share from $0.71 per share reported in the prior year

- Pharma segment delivered excellent

results with core sales growth in each market

- Each business segment achieved

operating profit margins equal to or above the prior year’s

levels

FIRST QUARTER RESULTS

For the quarter ended March 31, 2015, reported sales decreased

13% to $590 million from $676 million a year ago. Excluding the

negative impact from changes in currency exchange rates, core sales

decreased by 1%.

First Quarter Segment Sales Analysis (Change Over Prior

Year) Beauty + Food + Total Home

Pharma Beverage AptarGroup Sales Growth Before

Currency Effects (Core Sales) (4%) 7% (4%) (1%) Currency Effects

(1) (12%) (15%) (6%) (12%) Total Reported

Sales Growth (16%) (8%) (10%) (13%)

(1) - Currency effects are determined by translating last year's

amounts at this year's foreign exchange rates.

Commenting on the quarter, Stephen Hagge, President and CEO,

said, “I am pleased that we were able to achieve strong earnings

per share growth on a comparable currency-adjusted basis despite

softness in certain markets. Our results were primarily driven by

another excellent quarter for our Pharma segment that grew cores

sales in each of its markets. We also benefited from cost

containment efforts and lower raw material costs across each

business segment. We are on the right track toward improving the

margin profile of our Beauty + Home segment and while we are in the

early stages, I think this quarter’s result was a good start. In

addition, after a slow start to the quarter, our Food + Beverage

segment’s sales gained momentum as the quarter progressed.”

AptarGroup reported earnings per share of $0.70 compared to

$0.71 per share a year ago. Assuming a comparable foreign currency

exchange rate environment, comparable earnings per share for the

prior year were approximately $0.60.

OUTLOOK

Commenting on AptarGroup’s outlook, Hagge said, “As we look

forward to the second quarter, we are expecting another quarter of

solid earnings growth on a comparable currency-adjusted basis. The

weak foreign currency environment should continue to be a

significant headwind on our translated results. Recent near-term

macro-economic forecasts point to deceleration in the developing

regions and there remains some uncertainty around the pace of

growth in the US and Europe. However, our level of project dialog

with customers is good and we are optimistic that we will continue

to drive growth through our targeted market approach with the

industry’s broadest product portfolio. We will also continue to

focus on cost containment as we create affordable innovation for

our customers and consumers.”

AptarGroup expects earnings per share for the second quarter to

be in the range of $0.73 to $0.78 per share compared to $0.79 per

share reported in the prior year. Assuming a comparable foreign

currency exchange rate environment, comparable earnings per share

for the prior year were approximately $0.66.

CASH DIVIDEND

As previously reported, the Board of Directors declared a

quarterly cash dividend of $0.28 per share. The payment date is May

20, 2015, to stockholders of record as of April 29, 2015.

OPEN CONFERENCE CALL

There will be a conference call on Friday, May 1, 2015 at 8:00

a.m. Central Time to discuss AptarGroup’s first quarter results for

2015. The call will last approximately one hour. Interested parties

are invited to listen to a live webcast by visiting the Investor

Relations page at www.aptar.com. Replay of the conference call can

also be accessed on the Investor Relations page of the website.

AptarGroup, Inc. is a leading global supplier of a broad range

of innovative dispensing solutions for the beauty, personal care,

home care, prescription drug, consumer health care, injectables,

food, and beverage markets. AptarGroup is headquartered in Crystal

Lake, Illinois, with manufacturing facilities in North America,

Europe, Asia and South America. For more information, visit

www.aptar.com.

This press release contains forward-looking statements. Words

such as “expects,” “anticipates,” “believes,” “estimates,” and

other similar expressions or future or conditional verbs such as

“will,” “should,” “would” and “could” are intended to identify such

forward-looking statements. Forward-looking statements are made

pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934 and are based on management’s beliefs as well as

assumptions made by and information currently available to

management. Accordingly, AptarGroup’s actual results may differ

materially from those expressed or implied in such forward-looking

statements due to known or unknown risks and uncertainties that

exist including, but not limited to, economic, environmental or

political conditions in the various markets and countries in which

AptarGroup operates; changes in customer and/or consumer spending

levels; financial conditions of customers and suppliers;

consolidations within our customer or supplier bases; fluctuations

in the cost of raw materials, components and other input costs; the

Company’s ability to increase prices, contain costs and improve

productivity; changes in capital availability or cost, including

interest rate fluctuations; the competitive marketplace; fiscal and

monetary policies and other regulations; inflationary pressures and

changes in foreign currency exchange rates; direct or indirect

consequences of acts of war or terrorism; and labor relations. For

additional information on these and other risks and uncertainties,

please see AptarGroup’s filings with the Securities and Exchange

Commission, including its Form 10-K’s and Form 10-Q’s. Readers are

cautioned not to place undue reliance on forward-looking

statements. AptarGroup undertakes no obligation to update

any forward-looking statements, whether as a result of new

information, future events or otherwise.

APTARGROUP, INC. Condensed Consolidated Financial

Statements (Unaudited) (In Thousands, Except Per

Share Data)

CONSOLIDATED STATEMENTS OF INCOME Three

Months Ended March 31,

2015

2014 Net Sales $ 589,811 $ 676,051 Cost

of Sales (exclusive of depreciation shown below) 385,979 453,411

Selling, Research & Development and Administrative 96,187

106,674 Depreciation and Amortization

34,060

37,247 Operating Income 73,585

78,719 Other Income/(Expense): Interest Expense (7,303 ) (4,881 )

Interest Income 1,731 1,016 Equity in income of affiliates (119 )

(1,546 ) Miscellaneous, net

(199 )

372 Income before Income Taxes 67,695

73,680 Provision for Income Taxes

22,596

25,272 Net Income $ 45,099 $ 48,408

Net Loss/(Income) Attributable to Noncontrolling Interests

72 (19

) Net Income Attributable to AptarGroup, Inc.

$ 45,171 $

48,389 Net Income Attributable to AptarGroup,

Inc. Per Common Share: Basic

$ 0.73

$ 0.74 Diluted

$ 0.70 $

0.71 Average Numbers of Shares

Outstanding: Basic 62,292 65,468 Diluted 64,494 68,232

APTARGROUP, INC. Condensed Consolidated Financial

Statements (Unaudited) (continued) (In Thousands)

CONSOLIDATED BALANCE SHEETS March 31, 2015

December 31, 2014 ASSETS Cash and Equivalents $ 385,693 $

399,762 Receivables, net 421,560 406,976 Inventories 284,579

311,072 Other Current Assets

103,494

96,128 Total Current Assets 1,195,326 1,213,938 Net

Property, Plant and Equipment 756,488 811,655 Goodwill, net 309,396

329,741 Other Assets

73,816

81,856 Total Assets

$

2,335,026 $ 2,437,190

LIABILITIES AND EQUITY Short-Term Obligations $ 22,587 $

251,976 Accounts Payable and Accrued Liabilities

340,334 352,762 Total Current

Liabilities 362,921 604,738 Long-Term Obligations 812,232 588,892

Deferred Liabilities

133,075

139,644 Total Liabilities 1,308,228 1,333,274

AptarGroup, Inc. Stockholders' Equity 1,026,361 1,103,407

Noncontrolling Interests in Subsidiaries

437

509 Total Equity

1,026,798

1,103,916 Total Liabilities and Equity

$ 2,335,026 $

2,437,190 APTARGROUP, INC. Condensed

Consolidated Financial Statements (Unaudited) (continued) (In

Thousands)

SEGMENT INFORMATION Three Months

Ended March 31,

2015

2014

NET SALES

Beauty + Home $ 329,414 $ 391,236 Pharma 178,669 194,349 Food +

Beverage

81,728

90,466 Total Net Sales $

589,811 $ 676,051

SEGMENT INCOME

(1)

Beauty + Home $ 23,375 $ 27,781 Pharma 52,001 52,482 Food +

Beverage 9,050 9,080 Corporate and Other

(11,159 ) (11,798

) Total Income Before Interest and Taxes $ 73,267 $

77,545 Interest Expense, Net

(5,572

) (3,865 ) Income

before Income Taxes $ 67,695

$ 73,680

SEGMENT INCOME AS %

OF NET SALES

Beauty + Home 7.1 % 7.1 % Pharma 29.1 % 27.0 % Food + Beverage 11.1

% 10.0 % Notes to Condensed Consolidated Financial Statements: (1)

- The Company evaluates performance of its business units and

allocates resources based upon segment income defined as earnings

before net interest expense, certain corporate expenses, and income

taxes.

AptarGroup, Inc.Matthew DellaMaria, 815-477-0424

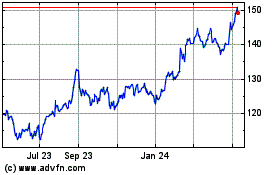

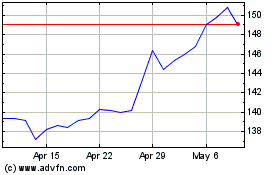

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024