UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): May 29, 2015

AMERICAN TOWER CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-14195 |

|

65-0723837 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File

Number) |

|

(IRS Employer Identification

No.) |

116 Huntington Avenue

Boston, Massachusetts 02116

(Address of Principal Executive Offices) (Zip Code)

(617) 375-7500

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

| ¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive

Agreement.

On May 29, 2015, certain subsidiaries of American Tower Corporation (the “Company”) entered into a Third

Amended and Restated Indenture (the “Indenture”) with The Bank of New York Mellon (the “Indenture Trustee”) and two related series supplements. The description of the Indenture set forth in Item 2.03 of this Report is

incorporated herein by reference.

Item 1.02 Termination of a Material Definitive

Agreement.

On May 29, 2015, GTP Acquisition Partners I, LLC (“GTP Acquisition Partners”) repaid all outstanding

amounts under the Secured Tower Revenue Notes, Global Tower Series 2011-1, Class C, Secured Tower Revenue Notes, Global Tower Series 2011-2, Class C and Class F and Secured Tower Revenue Notes, Global Tower Series 2013-1, Class C and Class F (the

“Existing Notes”), plus prepayment consideration and other costs and expenses related thereto.

For a summary of the material

terms of the Existing Notes, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, filed on February 24, 2015.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant.

On May 29, 2015, GTP Acquisition Partners issued in a private transaction (the

“Transaction”), $350 million of American Tower Secured Revenue Notes, Series 2015-1, Class A (the “Series 2015-1 Notes”), and $525 million of American Tower Secured Revenue Notes, Series 2015-2, Class A (the

“Series 2015-2 Notes,” and together with the Series 2015-1 Notes, the “Notes”) pursuant to the Indenture and related series supplements. The Notes are guaranteed by the subsidiaries of GTP Acquisition Partners and secured

primarily by 3,621 communications sites (the “Sites”) owned by those subsidiaries.

Certain terms of each series of the Notes

are indicated in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series |

|

Initial Principal

Balance |

|

|

Interest Rate

|

|

|

Anticipated

Repayment Date |

|

Final Repayment

Date |

|

Rating

(Moody’s/Fitch) |

| Series 2015-1 |

|

$ |

350,000,000 |

|

|

|

2.350% |

|

|

June 15, 2020 |

|

June 15, 2045 |

|

Aaa(sf)/AAA(sf) |

| Series 2015-2 |

|

$ |

525,000,000 |

|

|

|

3.482% |

|

|

June 16, 2025 |

|

June 15, 2050 |

|

Aaa(sf)/AAA(sf) |

GTP Acquisition Partners used all of the net proceeds from this issuance, together with cash on hand, to repay

the Existing Notes and pay prepayment consideration and other costs and expenses related thereto.

Amounts due under the Notes will be

paid solely from the cash flows generated from the operation of the Sites. GTP Acquisition Partners is required to make monthly payments of interest on the Notes, commencing in July 2015. Subject to certain limited exceptions described below, no

payments of principal will be required to be made prior to the monthly payment date in June 2020, which is the anticipated repayment date for the Series 2015-1 Notes. However, if the debt service coverage ratio, generally calculated as the ratio of

net cash flow (as defined in the Indenture) to the amount of interest, servicing fees and trustee fees that the Issuer will be required to pay over the succeeding twelve Payment Dates is 1.30x or less for one calendar quarter (the “Cash Trap

DSCR”), then all cash flow in excess of amounts required to make debt service payments, to fund required reserves, to pay management fees and budgeted operating expenses and to make certain other payments required under the Indenture, referred

to as excess cash flow, will be deposited into a reserve account instead of being released to GTP Acquisition Partners. The funds in the reserve account will not be released to GTP Acquisition Partners unless and until the debt service coverage

ratio exceeds the Cash Trap DSCR for two consecutive calendar quarters. Additionally, an “amortization period” commences if, as of the end of any calendar quarter, the debt service coverage ratio falls below 1.15x (the “Minimum

DSCR”) and will continue to exist until the debt service coverage ratio exceeds the Minimum DSCR for two consecutive calendar quarters. During an amortization period, excess cash flow is applied to repay the Notes.

The Notes may be prepaid in whole or in part at any time, provided such payment is accompanied by

the applicable prepayment consideration. If prepayment occurs within twelve months of the anticipated repayment date, with respect to the Series 2015-1 Notes, or eighteen months of the anticipated repayment date with respect to the Series 2015-2

Notes, no prepayment consideration is due. The entire unpaid principal balance of Series 2015-1 Notes will be due in June 2045 and the entire unpaid principal balance of the Series 2015-2 Notes will be due in June 2050. If the Series 2015-1 Notes or

the Series 2015-2 Notes have not been repaid in full on the applicable anticipated repayment date, additional interest will accrue on the unpaid principal balance of the applicable series of Notes and such series will begin to amortize on a monthly

basis from excess cash flow.

The Notes are secured by (1) mortgages, deeds of trust and deeds to secure debt on substantially all of

the Sites and their operating cash flows, (2) a security interest in substantially all of the personal property and fixtures of the GTP Acquisition Partners and its subsidiaries (the “GTP Entities”), including GTP Acquisition

Partners’ equity interests in its subsidiaries, and (3) the rights of the GTP Entities under a Management Agreement (as defined below). American Tower Holding Sub II, LLC (the “Guarantor”), whose only material assets are its

equity interests in GTP Acquisition Partners, has guaranteed repayment of the Notes and pledged its equity interests in GTP Acquisition Partners as security for such payment obligations.

The Indenture includes covenants customary for notes issued in rated securitizations. Among other things, the GTP Entities are prohibited from

incurring other indebtedness for borrowed money or further encumbering their assets. The organizational documents of the GTP Entities contain provisions consistent with rating agency securitization criteria for special purpose entities, including

the requirement that they maintain independent directors.

In connection with the issuance and sale of the Notes, the GTP Entities entered

into a First Amended and Restated Management Agreement, dated as of May 29, 2015 (the “Management Agreement”) with Global Tower, LLC (“Global Tower”) as manager (in that capacity, “Manager”). Global Tower is an

indirect wholly-owned subsidiary of the Company. Pursuant to the Management Agreement, the Manager will perform, on behalf of the GTP Entities, those functions reasonably necessary to maintain, market, operate, manage and administer the Sites.

Also in connection with the issuance and sale of the Notes, the Guarantor entered into a First Amended and Restated Guaranty and Security

Agreement, dated as of May 29, 2015 (the “Security Agreement”). Pursuant to the Security Agreement, the Guarantor guarantees the repayment of the Notes and the other payment obligations of the GTP Entities in connection with the

Transaction and pledges the equity interests it holds in GTP Acquisition Partners as security for those payment obligations.

The

foregoing is only a summary of certain provisions of the Notes and is qualified in its entirety by the terms of the Indenture and related series supplements, copies of which will be filed as exhibits to the Company’s Quarterly Report on Form

10-Q for the quarter ended June 30, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN TOWER CORPORATION |

|

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date: June 1, 2015 |

|

|

|

By: |

|

/s/ THOMAS A. BARTLETT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas A. Bartlett |

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer |

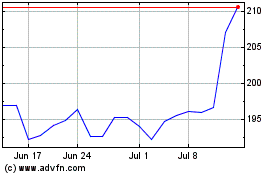

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

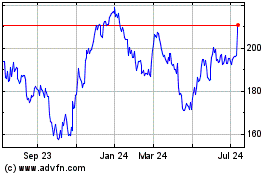

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024