First Quarter Revenues Increase 6.5% to

$438.5 million; up 6.0% on Constant Currency Basis

First Quarter GAAP Diluted EPS of $0.77 up

20.3%; Adjusted Diluted EPS of $1.22 up 15.1%

Restructuring Plan to Improve Cost Structure

of Corporation Announced

2014 Guidance Ranges for Constant Currency

Revenue Growth of 7% to 9% and Adjusted Diluted EPS of $5.35

to $5.55 Reaffirmed

Teleflex Incorporated (NYSE: TFX) (the “Company”) today

announced financial results for the first quarter ended March 30,

2014.

First quarter 2014 net revenues were $438.5 million, an increase

of 6.5% over the prior year period. Excluding the impact of foreign

currency fluctuations, first quarter 2014 net revenues increased

6.0% over the prior year period.

First quarter 2014 GAAP diluted earnings per share from

continuing operations were $0.77, as compared to $0.64 in the prior

year period, an increase of 20.3%. First quarter 2014 adjusted

diluted earnings per share from continuing operations were $1.22,

as compared to $1.06 in the prior year period, an increase of

15.1%.

“Teleflex delivered a solid start to 2014, exceeding our

expectations for constant currency revenue growth and adjusted

earnings per share,” said Benson Smith, Chairman, President and

Chief Executive Officer. “Our first quarter performance was aided

by the contribution from the acquisitions of Vidacare in December

of 2013 and Mayo Healthcare in February of 2014 , an improvement in

the average selling price of products and the introduction of new

products to the market as compared to the prior year period.”

Added Mr. Smith, “Teleflex’s performance in the first quarter

supports our belief that the Company remains on target to achieve

our previously provided constant currency revenue growth and

adjusted diluted earnings per share guidance for 2014. In addition,

the Company announced a restructuring plan that is intended to

enhance our competitive position in the medical device industry and

improve our longer-term profitability. The plan will focus on the

consolidation of certain facilities and the relocation of

manufacturing operations from certain higher-cost locations to

existing lower-cost locations and will allow the Company to invest

in higher growth opportunities.”

FIRST QUARTER NET REVENUE BY SEGMENT

Effective January 1, 2014, the Company realigned its

operating segments. The realignment in operating segments resulted

from changes in the Company’s internal reporting structure. The

Vascular, Anesthesia/Respiratory and Surgical businesses, which

previously comprised much of the Americas reportable segment, are

now separate reportable segments. As a result, the Company now has

six reportable segments: Vascular North America,

Anesthesia/Respiratory North America, Surgical North America, EMEA,

Asia and OEM. Certain operating segments have been aggregated and

are therefore included in the “All other” line item.

Vascular North America first quarter 2014 net revenues were

$62.5 million, an increase of 10.3% compared to the prior year

period. Excluding the impact of foreign currency fluctuations,

first quarter 2014 net revenues increased 10.8% compared to the

prior year period. The increase in constant currency revenue was

largely due to Vidacare product sales, the introduction of new

products to the market and price increases. This was somewhat

offset by lower sales volume of existing products.

Anesthesia/Respiratory North America first quarter 2014 net

revenues were $54.7 million, a decrease of 5.9% compared to the

prior year period. Excluding the impact of foreign currency

fluctuations, first quarter 2014 net revenues decreased 5.6%

compared to the prior year period. The decrease in constant

currency revenue was largely due to lower sales volume of existing

products. This was somewhat offset by the introduction of new

products to the market and price increases.

Surgical North America first quarter 2014 net revenues were

$35.2 million, a decrease of 4.0% compared to the prior year

period. Excluding the impact of foreign currency fluctuations,

first quarter 2014 net revenues decreased 3.0% compared to the

prior year period. The decrease in constant currency revenue was

largely due to lower sales volume of existing products. This was

somewhat offset by price increases and the introduction of new

products to the market.

EMEA first quarter 2014 net revenues were $150.2 million, an

increase of 5.5% compared to the prior year period. Excluding the

impact of foreign currency fluctuations, first quarter 2014 net

revenues increased 2.5% compared to the prior year period. The

increase in constant currency revenue was largely due to Vidacare

product sales, price increases and the introduction of new products

to the market. This was somewhat offset by lower sales volume of

existing products.

Asia first quarter 2014 net revenues were $49.6 million, an

increase of 17.1% compared to the prior year period. Excluding the

impact of foreign currency fluctuations, first quarter 2014 net

revenues increased 20.3% compared to the prior year period. The

increase in constant currency revenue was largely due to Mayo

Healthcare and Vidacare product sales, price increases and higher

sales volume of existing products.

OEM and Development Services (“OEM”) first quarter 2014 net

revenues were $33.2 million, an increase of 5.9% compared to the

prior year period. Excluding the impact of foreign currency

fluctuations, first quarter 2014 net revenues increased 5.3%

compared to the prior year period. The increase in constant

currency revenue was largely due to higher sales volume of existing

products and the introduction of new products to the market. This

was somewhat offset by lower average selling prices.

Three Months Ended % Increase/

(Decrease)

Constant Foreign Total

March 30, 2014

March 31, 2013

Currency Currency Change (Dollars in millions)

Vascular North America $ 62.5 $ 56.7 10.8% (0.5% ) 10.3%

Anesthesia/Respiratory North America 54.7 58.2 (5.6% ) (0.3% )

(5.9% ) Surgical North America 35.2 36.7 (3.0% ) (1.0% ) (4.0% )

EMEA 150.2 142.4 2.5% 3.0% 5.5% Asia 49.6 42.4 20.3% (3.2% ) 17.1%

OEM 33.2 31.3 5.3% 0.6% 5.9% All Other 53.1 44.2

20.9% (0.9% ) 20.0% Total $ 438.5 $ 411.9 6.0% 0.5% 6.5%

OTHER FINANCIAL HIGHLIGHTS AND KEY PERFORMANCE

METRICS

Depreciation expense and amortization of intangible assets and

deferred financing costs for first three months of 2014 were $31.4

million compared to $26.3 million for the prior year period.

Cash and cash equivalents at March 30, 2014 were $421.6 million

compared to $432.0 million at December 31, 2013.

Net accounts receivable at March 30, 2014 were $295.5 million

compared to $295.3 million at December 31, 2013.

Net inventories at March 30, 2014 were $349.7 million compared

to $333.6 million at December 31, 2013.

Net debt obligations at March 30, 2014 were $913.1 million

compared to $902.7 million at December 31, 2013.

2014 RESTRUCTURING PLAN

On April 28, 2014, the Board of Directors of the Company

approved a restructuring plan (the “Plan”) designed to reduce

costs, improve operating efficiencies and enhance the Company’s

long term competitive position. The Plan, which was developed in

response to continuing cost pressures in the healthcare industry,

involves the consolidation of operations and a related reduction in

workforce at certain of the Company’s facilities, and will include

the relocation of manufacturing operations from certain higher-cost

locations to existing lower-cost locations. These actions will

commence in the second quarter 2014 and are expected to be

substantially completed by the end of 2017.

The Company estimates that it will incur aggregate pre-tax

charges in connection with these restructuring activities of

approximately $42 million to $53 million, of which the Company

expects approximately $22 million to $23 million will be incurred

in 2014 and most of the balance will be incurred prior to the end

of 2016. Generally, the Company expects that it will exclude these

charges from its adjusted diluted earnings per share results. The

Company estimates that $32 million to $40 million of the aggregate

pre-tax charges will result in future cash outlays, of which the

Company expects approximately $9 million to $11 million will be

made in 2014 and most of the balance will be made prior to the end

of 2016. In addition, the Company expects to make $24 million to

$30 million in capital expenditures in connection with the Plan, of

which the Company expects approximately $10 million to $15 million

will be made in 2014.

The following table provides a summary of the Company’s current

cost estimates by major type of cost associated with the Plan:

Total estimated amount Type

of cost expected to be incurred

Termination benefits $12 million to $15 million

Facility

closure and other exit costs (1) $2 million to $5 million

Accelerated depreciation charges $10 million to $12 million

Other (2) $18 million to $21 million

$42 million to $53

million (1) Includes costs to transfer product lines

among facilities and outplacement and employee relocation costs.

(2) Consists of other costs directly related to the Plan, including

project management, legal and other regulatory costs.

The Company currently expects to achieve annualized savings of

$28 million to $35 million once the Plan is fully implemented, and

currently expects to realize Plan-related savings beginning in

2015.

As the Plan is implemented, management will continue to evaluate

the estimated costs and anticipated savings set forth above, and

may revise its estimates of such costs and anticipated savings and

the accounting charges relating thereto, as appropriate, consistent

with generally accepted accounting principles.

2014 OUTLOOK

The Company reaffirmed full year 2014 financial estimates as

follows:

Constant currency revenue growth between 7% and 9%.

Adjusted diluted earnings per share in the range of $5.35 to

$5.55.

FORECASTED 2014 CONSTANT CURRENCY

REVENUE GROWTH RECONCILIATION

Low High

Forecasted 2014 GAAP revenue growth 6.0 % 8.0 % Estimated

impact of foreign currency fluctuations 1.0 %

1.0 % Forecasted 2014 constant currency revenue

growth 7.0 % 9.0 %

FORECASTED 2014 ADJUSTED EARNINGS PER

SHARE RECONCILIATION

Low High Forecasted 2014

diluted earnings per share attributable to common shareholders $

3.40 $ 3.55 Restructuring, impairment charges and special

items, net of tax $ 0.88 $ 0.93 Intangible amortization

expense, net of tax $ 0.90 $ 0.90 Amortization of debt

discount on convertible notes, net of tax $ 0.17

$ 0.17 Forecasted 2014 adjusted diluted

earnings per share $ 5.35 $ 5.55

CONFERENCE CALL WEBCAST AND ADDITIONAL INFORMATION

As previously announced, Teleflex will comment on its financial

results on a conference call to be held today at 8:00 a.m. (ET).

The call will be available live and archived on the company’s

website at www.teleflex.com and the accompanying

presentation will be posted prior to the call. An audio replay will

be available until May 7, 2014 at 11:59pm (ET), by calling

888-286-8010 (U.S./Canada) or 617-801-6888 (International),

Passcode: 11286884.

ADDITIONAL NOTES

Constant currency revenue and growth exclude the impact of

translating the results of international subsidiaries at different

currency exchange rates from period to period.

Certain financial information is presented on a rounded basis,

which may cause minor differences.

Segment results and commentary exclude the impact of

discontinued operations, items included in restructuring and

impairment charges, and losses and other charges set forth in the

condensed consolidated statements of income and in the

Reconciliation of Consolidated Statement of Income Items set forth

below.

NOTES ON NON-GAAP FINANCIAL MEASURES

This press release includes certain non-GAAP financial measures,

which include:

Adjusted diluted earnings per share. This measure excludes,

depending on the period presented (i) the effect of charges

associated with our restructuring programs, as well as goodwill and

other asset impairment charges; (ii) loss on extinguishment of

debt; (iii) the gain or loss on sales of businesses and assets;

(iv) losses and other charges related to acquisition and

integration costs, the reversal of liabilities related to certain

contingent consideration arrangements, the establishment of a

litigation reserve and a litigation verdict against the Company

with respect to a non-operating joint venture; (v) amortization of

the debt discount on the Company’s convertible notes; (vi)

intangible amortization expense; and (vii) tax benefits resulting

from the resolution of prior years’ tax matters and the filing of

prior years’ amended tax returns. In addition, the calculation of

diluted shares within adjusted earnings per share gives effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that

otherwise would occur upon conversion of the Company’s senior

subordinated convertible notes (under GAAP, the anti-dilutive

impact of the convertible note hedge agreements is not reflected in

diluted shares).

Constant currency revenue. This measure excludes the impact of

translating the results of international subsidiaries at different

currency exchange rates from period to period.

Management believes these measures are useful to investors

because they eliminate items that do not reflect Teleflex’s

day-to-day operations. In addition, management believes that the

calculation of non-GAAP diluted shares is useful to investors

because it provides insight into the offsetting economic effect of

the convertible note hedge against conversions of the convertible

notes. Management uses these financial measures for internal

managerial purposes, when publicly providing guidance on possible

future results, and to assist in our evaluation of period-to-period

comparisons. These financial measures are presented in addition to

results presented in accordance with generally accepted accounting

principles (“GAAP”) and should not be relied upon as a substitute

for GAAP financial measures. Tables reconciling historical non-GAAP

measures to the most directly comparable historical GAAP measures

are set forth below. Tables reconciling forecasted non-GAAP

measures to the most directly comparable forecasted GAAP measures

are set forth above.

RECONCILIATION OF CONSOLIDATED STATEMENT OF INCOME

ITEMS Dollars in millions, except per share amounts

Quarter Ended – March

30, 2014 Net income Shares used in

(loss) attributable calculation of Selling,

Restructuring to common

Diluted earnings

GAAP and Cost general and and other

shareholders

per share available

adjusted of administrative impairment

Interest Income from continuing

to common

earnings per goods sold expenses

charges expense, net taxes operations

shareholders

share GAAP Basis $ 217.4 $ 140.3 $ 7.8 $ 15.2 $ 8.5 $

35.1 $ 0.77 45,749 Adjustments

Restructuring and other impairment

charges

— — 7.8 — 1.1 6.7 $ 0.15 —

Losses and other charges (A)

— (0.1 ) — — 0.8 (0.9 ) ($0.02 ) —

Amortization of debt discount on

convertible notes

— — — 3.0 1.1 1.9 $ 0.04 — Intangible amortization expense — 16.0 —

— 5.5 10.5 $ 0.23 — Tax adjustment (B) — — — — 0.2 (0.2 ) — —

Shares due to Teleflex under note hedge

(C)

— — — — — — $ 0.06 (2,450 ) Adjusted basis $ 217.4 $ 124.4 — $ 12.2

$ 17.2 $ 53.0 $ 1.22 43,299

Quarter Ended - March

31, 2013 Net income Shares used in (loss)

attributable calculation of Selling,

Restructuring to common

Diluted earnings

GAAP and Cost general and and other

shareholders

per share available

adjusted of administrative impairment

Interest Income from continuing

to common

earnings per goods sold expenses

charges expense, net taxes operations

shareholders

share GAAP Basis $ 211.4 $ 127.0 $ 9.2 $ 14.0 $ 7.7 $

27.5 $ 0.64 43,047 Adjustments

Restructuring and other impairment

charges

— — 9.2 — 2.6 6.6 $ 0.15 — Losses and other charges (A) 0.5 1.5 — —

0.7 1.3 $ 0.03 —

Amortization of debt discount on

convertible notes

— — — 2.8 1.0 1.7 $ 0.04 — Intangible amortization expense — 12.4 —

— 4.3 8.1 $ 0.19 —

Tax adjustment (B)

— — — — 0.9 (0.9 ) ($0.02 ) —

Shares due to Teleflex under note hedge

(C)

— — — — — — $ 0.03 (1,372 ) Adjusted basis $ 210.8 $ 113.0 — $ 11.3

$ 17.2 $ 44.3 $ 1.06 41,675 (A) In 2014, losses and other

charges include approximately ($2.3) million, net of tax, or

($0.05) per share, related to the reversal of contingent

consideration liabilities; and approximately $1.4 million, net of

tax, or $0.03 per share, related to acquisition and integration

costs. In 2013, losses and other charges include approximately

($1.0) million, net of tax, or ($0.02) per share, related to the

reversal of contingent consideration liabilities; approximately

$0.8 million, net of tax, or $0.02 per share, related to a

litigation verdict against the Company with respect to a

non-operating joint venture; and $1.5 million, net of tax, or $0.03

per share, related to acquisition and integration costs. (B)

The tax adjustment represents a net benefit resulting from the

resolution of, or the expiration of statute of limitations with

respect to various prior years’ U.S. federal, state and foreign tax

matters. (C) Adjusted diluted shares are calculated by

giving effect to the anti-dilutive impact of the Company’s

convertible note hedge agreements, which reduce the potential

economic dilution that otherwise would occur upon conversion of our

senior subordinated convertible notes. Under GAAP, the

anti-dilutive impact of the convertible note hedge agreements is

not reflected in diluted shares.

RECONCILIATION OF NET DEBT

OBLIGATIONS

March 30, 2014 December 31, 2013

(Dollars in thousands) Note payable and current portion of long

term borrowings $ 359,261 $ 356,287 Long term

borrowings 930,000 930,000 Unamortized debt discount 45,439

48,413 Total debt obligations 1,334,700 1,334,700

Less: cash and cash equivalents 421,649 431,984 Net debt

obligations $ 913,051 $ 902,716

ABOUT TELEFLEX INCORPORATED

Teleflex is a leading global provider of specialty medical

devices for a range of procedures in critical care and surgery. Our

mission is to provide solutions that enable healthcare providers to

improve outcomes and enhance patient and provider safety.

Headquartered in Wayne, PA, Teleflex employs approximately 11,400

people worldwide and serves healthcare providers in more than 150

countries. For additional information about Teleflex please refer

to www.teleflex.com.

CAUTION CONCERNING FORWARD-LOOKING INFORMATION

This press release contains forward-looking statements,

including, but not limited to, forecasted 2014 GAAP and constant

currency revenue growth and GAAP and adjusted diluted earnings per

share; and our expectations with respect to the Plan, including the

timing for commencement and completion of actions under the Plan,

our estimates with respect to the amount of pre-tax charges we

expect to incur under the Plan and the amount of those charges that

will result in future cash outlays, our expectations with respect

to the timing for the incurrence of those the pre-tax charges and

cash outlays and our estimates with respect to the annualized

savings we expect to achieve once the Plan has been fully

implemented. Actual results could differ materially from those in

the forward-looking statements due to, among other things,

conditions in the end markets we serve, customer reaction to new

products and programs, our ability to achieve sales growth, price

increases or cost reductions; changes in the reimbursement

practices of third party payors; our ability to realize

efficiencies and to execute on our strategic initiatives, including

the Plan; changes in material costs and surcharges; market

acceptance and unanticipated difficulties in connection with the

introduction of new products and product line extensions; product

recalls; unanticipated difficulties in connection with the

consolidation of manufacturing and administrative functions,

including as a result of difficulties with various employees, labor

representatives or regulators; the loss of skilled employees in

connection with such initiatives; unanticipated difficulties,

expenditures and delays in complying with government regulations

applicable to our businesses; the impact of government healthcare

reform legislation; our ability to meet our debt obligations;

changes in general and international economic conditions; and other

factors described or incorporated in our filings with the

Securities and Exchange Commission, including our Annual Report on

Form 10-K for the year ended December 31, 2013.

TELEFLEX INCORPORATED AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited)

Three Months Ended March 30, March

31, 2014 2013 (Dollars and shares in

thousands, except per share) Net revenues $

438,546 $ 411,877 Cost of goods sold 217,387

211,357 Gross profit 221,159 200,520 Selling, general and

administrative expenses 140,297 126,950 Research and development

expenses 14,062 15,007 Restructuring and other impairment charges

7,780 9,159 Income from continuing

operations before interest and taxes 59,020 49,404 Interest expense

15,404 14,193 Interest income (187 ) (157 ) Income

from continuing operations before taxes 43,803 35,368 Taxes on

income from continuing operations 8,534 7,667

Income from continuing operations 35,269

27,701 Operating loss from discontinued operations

(25 ) (758 ) Taxes (benefit) on loss from discontinued operations

100 (296 ) Loss from discontinued operations

(125 ) (462 ) Net income 35,144 27,239 Less: Income

from continuing operations attributable to noncontrolling interest

186 201 Net income attributable to

common shareholders $ 34,958 $ 27,038 Earnings

per share available to common shareholders: Basic: Income from

continuing operations $ 0.85 $ 0.67 Loss from discontinued

operations — (0.01 ) Net income $ 0.85

$ 0.66 Diluted: Income from continuing operations $

0.77 $ 0.64 Loss from discontinued operations (0.01 )

(0.01 ) Net income $ 0.76 $ 0.63 Dividends per

share $ 0.34 $ 0.34 Weighted average common shares

outstanding: Basic 41,262 41,014 Diluted 45,749 43,047

Amounts attributable to common shareholders: Income from continuing

operations, net of tax $ 35,083 $ 27,500 Loss from discontinued

operations, net of tax (125 ) (462 ) Net income $

34,958 $ 27,038

TELEFLEX INCORPORATED AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

March 30, December 31, 2014 2013

(Dollars in thousands) ASSETS Current assets

Cash and cash equivalents $ 421,649 $ 431,984 Accounts receivable,

net 295,514 295,290 Inventories, net 349,745 333,621 Prepaid

expenses and other current assets 47,543 39,810 Prepaid taxes

42,470 36,504 Deferred tax assets 51,983 52,917 Assets held for

sale 11,714 10,428 Total current assets 1,220,618

1,200,554 Property, plant and equipment, net 328,679 325,900

Goodwill 1,372,058 1,354,203 Intangible assets, net 1,250,533

1,255,597 Investments in affiliates 1,513 1,715 Deferred tax assets

944 943 Other assets 67,789 70,095 Total assets $

4,242,134 $ 4,209,007

LIABILITIES AND EQUITY Current

liabilities Current borrowings $ 359,261 $ 356,287 Accounts payable

71,094 71,967 Accrued expenses 79,455 74,868 Current portion of

contingent consideration 1,658 4,131 Payroll and benefit-related

liabilities 60,185 73,090 Accrued interest 9,066 8,725 Income taxes

payable 27,451 23,821 Other current liabilities 23,637

22,231 Total current liabilities 631,807 635,120 Long-term

borrowings 930,000 930,000 Deferred tax liabilities 523,445 514,715

Pension and postretirement benefit liabilities 106,092 109,498

Noncurrent liability for uncertain tax positions 55,956 55,152

Other liabilities 49,607 48,506 Total liabilities

2,296,907 2,292,991 Commitments and contingencies Total common

shareholders’ equity 1,942,486 1,913,527 Noncontrolling interest

2,741 2,489 Total equity 1,945,227

1,916,016 Total liabilities and equity $ 4,242,134 $ 4,209,007

TELEFLEX INCORPORATED AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Three Months Ended March 30, 2014

March 31, 2013 (Dollars in thousands) Cash Flows from

Operating Activities of Continuing Operations: Net income $ 35,144

$ 27,239 Adjustments to reconcile net income to net cash provided

by operating activities: Loss from discontinued operations 125 462

Depreciation expense 11,580 10,153 Amortization expense of

intangible assets 16,019 12,438 Amortization expense of deferred

financing costs and debt discount 3,814 3,750 Changes in contingent

consideration (2,371 ) (1,193 ) Stock-based compensation 3,074

2,791 Deferred income taxes, net 3,515 (353 ) Other (3,105 ) (7,415

)

Changes in operating assets and

liabilities, net of effects of acquisitions and disposals:

Accounts receivable 5,966 (16,420 ) Inventories (7,473 ) (13,693 )

Prepaid expenses and other current assets (6,027 ) (435 ) Accounts

payable and accrued expenses (24,447 ) (13,199 ) Income taxes

receivable and payable, net (2,214 ) 1,139 Net

cash provided by operating activities from continuing operations

33,600 5,264 Cash Flows from

Investing Activities of Continuing Operations: Expenditures for

property, plant and equipment (12,109 ) (15,635 ) Proceeds from

sale of assets and investments 1,669 — Payments for businesses and

intangibles acquired, net of cash acquired (28,991 ) 1,500

Investment in affiliates (60 ) — Net cash used

in investing activities from continuing operations (39,491 )

(14,135 ) Cash Flows from Financing Activities of

Continuing Operations: Proceeds and tax benefits from share based

compensation plans 8,641 5,155 Debt extinguishment, issuance and

amendment fees (90 ) — Payments for contingent consideration —

(7,179 ) Dividends (14,051 ) (13,964 ) Net cash used

in financing activities from continuing operations (5,500 )

(15,988 ) Cash Flows from Discontinued Operations:

Net cash used in operating activities (1,167 ) (629 )

Net cash used in discontinued operations (1,167 )

(629 ) Effect of exchange rate changes on cash and cash

equivalents 2,223 (4,997 ) Net decrease in

cash and cash equivalents (10,335 ) (30,485 ) Cash and cash

equivalents at the beginning of the period 431,984

337,039 Cash and cash equivalents at the end of the

period $ 421,649 $ 306,554

Teleflex IncorporatedJake ElguiczeTreasurer and Vice President

of Investor Relations610-948-2836

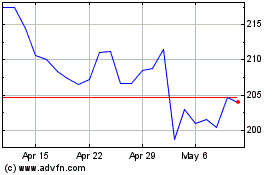

Teleflex (NYSE:TFX)

Historical Stock Chart

From Aug 2024 to Sep 2024

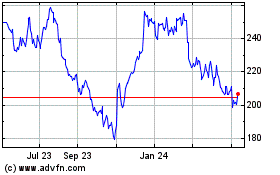

Teleflex (NYSE:TFX)

Historical Stock Chart

From Sep 2023 to Sep 2024