In-Line Q4 Loss at Plug Power, Shares Up - Analyst Blog

March 14 2014 - 9:00AM

Zacks

A leader in fuel cell technology

Plug Power Inc. (PLUG) reported a loss of 8 cents

per share in the fourth quarter of 2013, in line with the Zacks

Consensus Estimate. However, loss was much narrower than the 25

cents of loss incurred in the comparable year-ago quarter.

On a GAAP basis, the company reported a loss of 28 cents per share

versus a loss of 22 cents in the year-ago quarter. The difference

between the operating and GAAP loss in the reported quarter was due

to charges related to the change in fair value of previously issued

common stock warrants of $20.9 million.

The 2013 loss of 34 cents per share was much narrower than the

Zacks Consensus Estimate of a loss of 48 cents and the prior-year

loss of $1.07 per share.

The loss in the quarter as well as for the full year was primarily

due to higher cost of product and service revenues.

Not only did Plug Power meet the market expectation with an in-line

loss, a solid order book propelled its shares 17.65% higher in

yesterday’s trading session to close at $8.00.

Total Revenue

Plug Power’s quarterly revenues of $8 million surpassed the Zacks

Consensus Estimate of $7 million by 14.3%.Total revenues were

higher than the year-ago revenues of $5.92 million by 35.1%.

2013 total revenues of $26.6 million exceeded the Zacks Consensus

Estimate of $26.0 million by 2.3% and the prior-year revenue of

$26.1 million by 1.9%.

The top line of the company was driven by product sales and

maintenance orders from the likes of Wal-Mart

(WMT), The Kroger Co. (KR), BMW and Mercedes-Benz.

In addition, order bookings in the fourth quarter touched $32

million.

Highlights of the Release

Plug Power has taken a number of initiatives to lower its operating

expenses. The company expects its strategic moves like global

sourcing, positive discussion with suppliers to adjust costs and

design improvement will help to improve margins by 10% in the first

half of 2014.

Plug Power shipped 279 units in the reported quarter compared with

518 units in the fourth quarter of 2012. For the full year, the

company shipped 918 units compared with 1,391 units in 2012.

The company reported research & development (R&D) expenses

of $3.1 million in 2013, down from $5.4 million in 2012. A cut in

R&D did not however stop the company from launching innovative

products like the new all-inclusive GenKey solution.

Financial Update

Plug Power exited the year with $5 million of cash and cash

equivalents versus $9.4 million at 2012 end.

Net cash used in operating activities for full year 2013 was $26.9

million versus $20.2 million in 2012.

Guidance

Plug Power expects total revenues in the first quarter to range

from $5 million to $6 million. The strong orders booked in the

fourth quarter of 2013 are expected to translate into revenues in

the second quarter of 2014. Accordingly, revenues in the said

quarter are expected to climb to a $16–$18 million range.

2014 total revenues are expected to touch $70 million, with order

bookings of $150 million for the year.

The company expects to achieve break even EBITDA in the third

quarter 2014 and report net income in the final quarter of the

year.

At the Peer

FuelCell Energy (FCEL) posted a loss of 4 cents

per share in the first quarter 2014, in line with the Zacks

Consensus Estimate.

Our View

Plug Power is one of the prime companies in the fuel cell

technology space. This niche energy space has literally been the

talk of the town with share prices on the roll. Plug Power’s 2014

order booking guidance (four times the order booked in 2013)

reflects this optimism. Since this technology is in hot

demand, one shouldn’t be surprised if the company revises the order

guidance upwards. Sales order for 2014 has already exceeded $60

million.

Though still in the red, we believe the bright prospects and the

solid order booking will drive the company going forward.

Plug Power has a Zacks Rank #3 (Hold).

FUELCELL ENERGY (FCEL): Free Stock Analysis Report

KROGER CO (KR): Free Stock Analysis Report

PLUG POWER INC (PLUG): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

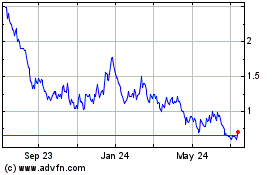

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024