TIDMHOC

RNS Number : 4714D

Hochschild Mining PLC

27 April 2017

__________________________________________________________________________________

27 April 2017

Production Report for the 3 months ended 31 March 2017

Ignacio Bustamante, Chief Executive Officer said:

I am pleased to report that we have delivered another solid

operational period and remain on track to meet our 2017 output and

cost targets. In addition, our new Pablo vein is showing better

than expected grades, whilst the Company's 2017 brownfield

exploration programme is underway with some encouraging results

achieved so far at San Jose."

Operational highlights

-- Strong Q1 2017 attributable production

o 4.1 million ounces of silver

o 60.6 thousand ounces of gold

o 8.6 million silver equivalent ounces, up 16% versus Q1 2016

(7.4 million ounces)

o 116.2 thousand gold equivalent ounces (Q1 2016: 100.6 thousand

ounces)

-- Production performance achieved despite stoppages at

Pallancata and Inmaculada

-- On track to deliver overall 2017 production target of 37

million silver equivalent ounces

-- 2017 all-in sustaining costs per silver equivalent ounce on

track to meet $12.2-12.7 guidance

Strengthening financial position

-- Total cash of approximately $98 million as at 31 March 2017

($140 million as at 31 December 2016)

-- $25 million of debt repaid in Q1 2017

-- Stoppage related delays in Q1 at Pallancata and Inmaculada

and a commercial delay at Arcata temporarily impacted working

capital. Full recovery expected from Q2 onwards.

-- Net debt of approximately $199 million as at 31 March 2017

($187 million as at 31 December 2016)

-- Current Net Debt/LTM EBITDA of approximately 0.6x as of 31

March 2017

__________________________________________________________________________________

A conference call will be held at 2.30pm (London time) on

Thursday 27 April 2017 for analysts and investors.

Dial in details as follows:

International Dial in: +44 (0) 20 3139 4830

UK Toll-Free Number: +44(0) 808 237 0030

Pin: 77185861#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

International: +44 (0) 20 3426 2807

UK Toll Free: +44(0) 808 237 0026

Pin: 686128#

_________________________________________________________________________________

1 All equivalent figures assume a gold/silver ratio of 74x.

Overview

In Q1 2017, the Company delivered attributable production of

116.2 thousand gold equivalent ounces or 8.6 million silver

equivalent ounces. This was comprised of 4.1 million ounces of

silver and 60.6 thousand ounces of gold.

The Company reiterates that its all-in sustaining costs per

silver equivalent ounce for 2017 is on track to be between $12.2

and $12.7.

TOTAL GROUP PRODUCTION

Q1 2017 Q4 2016 Q1 2016 12 mths

2016

------------------- -------- -------- -------- --------

Silver production

(koz) 4,830 4,910 4,329 20,562

Gold production

(koz) 70.98 74.29 60.04 292.63

Total silver

equivalent

(koz) 10,083 10,407 8,772 42,217

Total gold

equivalent

(koz) 136.26 140.63 118.54 570.50

Silver sold

(koz) 4,600 4,996 4,471 21,091

Gold sold (koz) 67.72 75.02 62.54 298.96

------------------- -------- -------- -------- --------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose.

ATTRIBUTABLE GROUP PRODUCTION

Q1 2017 Q4 2016 Q1 2016 12 mths

2016

------------------- -------- -------- -------- --------

Silver production

(koz) 4,113 4,075 3,662 17,284

Gold production

(koz) 60.62 61.57 51.08 246.08

Silver equivalent

(koz) 8,599 8,631 7,442 35,493

Gold equivalent

(koz) 116.20 116.64 100.56 479.64

------------------- -------- -------- -------- --------

Attributable production includes 100% of all production from

Arcata, Inmaculada, Pallancata and 51% from San Jose.

Production

Inmaculada

Product Q1 2017 Q4 2016 Q1 2016 12 mths

2016

------------------- -------- ------------ ------------------ -----------------

Ore production

(tonnes treated) 283,959 344,199 280,530 1,306,606

Average grade

silver (g/t) 135 134 121 133

Average grade

gold (g/t) 4.33 4.26 4.05 4.21

Silver produced

(koz) 1,239 1,220 974 4,908

Gold produced

(koz) 41.79 41.03 34.02 162.71

Silver equivalent

(koz) 4,331 4,256 3,492 16,948

Gold equivalent

(koz) 58.53 57.51 47.19 229.03

Silver sold

(koz) 1,195 1,266 882 5,004

Gold sold (koz) 39.98 41.93 31.91 164.75

------------------- -------- ------------ ------------------ -----------------

Inmaculada's overall first quarter production was 41,790 ounces

of gold and 1.2 million ounces of silver which amounts to gold

equivalent production of 59 thousand ounces and represents a 24%

increase on the same period in 2016. However, as has already been

reported by the Company, on 31 January an accident occurred

underground at the mine and operations were temporarily halted in

order to carry out a full investigation. Whilst this procedure, as

well as a full review of safety measures was ongoing, the plant

continued to operate and process existing high-grade stockpiled

material. A total of 79,000 tonnes of this ore was treated in the

period at average grades of 5.6 grammes of gold per tonne and 191

grammes of silver per tonne. Mining operations are currently being

steadily ramped up back to full production and Inmaculada remains

on track to meet its full year forecast of approximately 230,000

gold equivalent ounces (17 million silver equivalent ounces).

Arcata

Product Q1 2017 Q4 2016 Q1 2016 12 mths

2016

------------------- -------- ------------ -------- --------

Ore production

(tonnes treated) 132,428 170,128 161,092 677,309

Average grade

silver (g/t) 310 344 309 337

Average grade

gold (g/t) 1.12 1.21 1.13 1.24

Silver produced

(koz) 1,165 1,669 1,377 6,343

Gold produced

(koz) 4.14 5.85 4.68 22.54

Silver equivalent

(koz) 1,471 2,101 1,724 8,011

Gold equivalent

(koz) 19.88 28.40 23.29 108.26

Silver sold

(koz) 1,121 1,673 1,349 6,346

Gold sold (koz) 4.23 5.65 4.43 22.04

------------------- -------- ------------ -------- --------

At Arcata, silver production in the first quarter was 1.2

million ounces with gold production of 4,141 ounces which resulted

in silver equivalent production of 1.5 million ounces. Tonnage and

silver grades fell following a revision of the mine plan to

accommodate a reduced number of stopes and narrower veins, although

silver grades are expected to increase from the second quarter. The

focus at Arcata is to improve its cost position whilst increasing

high quality resources through the brownfield exploration

programme.

Pallancata

Product Q1 2017 Q4 2016 Q1 2016 12 mths

2016

------------------- -------- ------------- -------- --------

Ore production

(tonnes treated) 71,662 26,881 69,423 244,765

Average grade

silver (g/t) 468 414 324 381

Average grade

gold (g/t) 1.94 1.98 1.69 1.86

Silver produced

(koz) 964 317 615 2,620

Gold produced

(koz) 3.89 1.47 3.05 12.37

Silver equivalent

(koz) 1,252 426 841 3,536

Gold equivalent

(koz) 16.92 5.75 11.37 47.78

Silver sold

(koz) 878 322 559 2,660

Gold sold (koz) 3.49 1.45 2.74 12.41

------------------- -------- ------------- -------- --------

At Pallancata, production in Q1 2017 was 964,000 ounces of

silver and 3,895 ounces of gold bringing the silver equivalent

total to 1.3 million ounces. This material improvement was

partially offset by the previously reported road blockade at the

mine which resulted in output this year commencing later than

expected.

San Jose (the Company has a 51% interest in San Jose)

Product Q1 2017 Q4 2016 Q1 2016 12 mths

2016

------------------- -------- ------------ -------- --------

Ore production

(tonnes treated) 114,956 146,892 101,937 536,024

Average grade

silver (g/t) 458 418 470 444

Average grade

gold (g/t) 6.50 6.32 6.27 6.28

Silver produced

(koz) 1,463 1,704 1,362 6,691

Gold produced

(koz) 21.15 25.95 18.28 95.01

Silver equivalent

(koz) 3,029 3,624 2,715 13,721

Gold equivalent

(koz) 40.93 48.97 36.69 185.42

Silver sold

(koz) 1,405 1,734 1,681 7,081

Gold sold (koz) 20.02 26.00 23.46 99.76

------------------- -------- ------------ -------- --------

In a traditionally shorter period of operation due to scheduled

hourly workers vacation in March, San Jose has continued to be a

consistent performer with production of 1.5 million ounces of

silver and 21,155 ounces of gold (3.0 million silver equivalent

ounces) principally driven by higher than expected tonnage.

Average realisable prices and sales

Average realisable precious metal prices in Q1 2017 (which are

reported before the deduction of commercial discounts) were

$1,238/ounce for gold and $18.3/ounce for silver (Q1 2016:

$1,266/ounce for gold and $16.2/ounce for silver).

Brownfield exploration

At Arcata, 2,366m of resource drilling was carried out at the

Tunel 4, Paralela 3, Ramal Marion and Paralela Sur veins although

there were a few delays in surface drilling due to the heavy rain

in Peru. During the second quarter, 14,400m of further resource

drilling is planned.

Long horizontal drilling for potential resources has also

started recently in the Pamela vein system with 2,000m due to be

completed in the second quarter along with a similar programme of

1,700m through the Paralelas veins.

At Pallancata, the plan for the second quarter is to drill

1,000m of potential resource drilling in the Marco vein, a

structure identified close to the Pablo vein.

At San Jose, 4,837m of potential drilling has been carried out

at the Aguas Vivas zone as well as the Juanita structure with

preliminary results from Aguas Vivas below:

Vein Results

--------------- -----------------------------------

Aguas Vivas NW SJD-1627: 2.6m @ 0.1g/t Au, 43g/t

Ag, 8.2% Pb & 5.5% Zn

SJD-1616: 2.8m @ 0.3g/t Au, 40g/t

Ag, 7.0% Pb & 6.0% Zn

--------------- -----------------------------------

In the second quarter, a further 4,000m of potential drilling

will be carried out in structures in the Platifero zone to the

south of San Jose.

Financial position

Total cash was approximately $98 million as at 31 March 2017

resulting in net debt of approximately $199 million. The cash

figure reflects the repayment of short term debt in February ($25

million) but also a temporary increase in accounts receivable of

approximately $35 million arising from timing differences on sales

contracts at Arcata and San Jose as well as at Pallancata which

experienced shipment delays resulting from the stoppage.

Outlook

The Company remains on track to deliver its overall production

target for 2017 of 37.0 million silver equivalent ounces or 500

thousand gold equivalent ounces and also reiterates its all-in

sustaining cost per silver equivalent ounce forecast of between

$12.2 and $12.7.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 3709 3264

Head of Investor Relations

Hudson Sandler

Charlie Jack +44 (0)207 796 4133

Public Relations

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

__________________________________________________________________________________

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

This announcement contains information which prior to its

release could be considered inside information.

- ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLDQLFLDZFLBBE

(END) Dow Jones Newswires

April 27, 2017 02:00 ET (06:00 GMT)

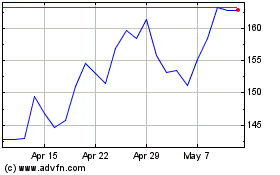

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Sep 2023 to Sep 2024