There are several factors that influence the decision of

selecting an ETF for investment. Such factors include the past

performance, holdings, sector exposure and concentration. Beyond

these examples, expenses can also play an important role in the

decision making process as well.

The expense ratio of an asset fund refers to the total

percentage of fund assets that are taken on a yearly basis to pay

for administrative, management, advertising and all other costs

that go into running an ETF. While these ratios are much smaller

for ETFs than they are for mutual funds on average, investors

should note that expenses still play a crucial role in determining

the best fund in a segment.

Furthermore, while many products may appear similar on the

surface—with similar industry, holdings, and market cap focuses—the

expense ratio can often be the main, and usually key, difference

between two products. After all, why would investors want to pay

three times as much for virtually the same product? (see more in

the Zacks ETF Center)

Beyond this, some investors are bent on keeping expenses at

their lowest possible level, only purchasing the cheapest products

in the industry. By doing this, some can build a well diversified

portfolio for under 25 basis points including major holdings which

cost investors less than 0.12% per year. For these investors, we

have highlighted the 25 Cheapest ETFs on the market today in

ascending order of expense ratios:

Focus Morningstar Large Cap ETF

(FLG)

Investors seeking to invest in large cap companies of the U.S

market at the lowest cost should look at FLG which replicates the

Morningstar Large Cap Index. The product charges investors just

five basis points a year, tied for the lowest in the entire ETF

world.

With large cap companies like Apple Inc. (AAPL), Exxon Mobil

Corporation (XOM), Microsoft Corporation (MSFT) in the top 3

position of the holding list, the fund also appears to be

diversified with just 23.86% of assets in the top 10 holdings.

FLG has a net asset value of $26.8 million and has total

holdings of 261 stocks.

The attractive holding pattern coupled with low cost has helped

the fund to deliver a solid returns for many large cap focused

investors while those who have a Scottrade account were able to

trade this security—and other FocusShares products—for free.

Focus Morningstar US Market ETF

(FMU)

Another low cost choice is FMU, a fund that tracks securities

across market capitalization levels and charges just five basis

points a year in fees. In total, the product holds just under 1,100

firms while putting under 18% in its top ten holdings.

Apple Inc. (AAPL), Exxon Mobil Corporation (XOM) and

International Business Machines Corp. (IBM) occupy the top 3

position in the fund. The fund delivered a total return of 7.6%

over a period of one year.

Vanguard S&P 500 ETF

(VOO)

Investors looking to invest in the large cap sector of U.S

equity market or S&P 500 index stocks at the minimal cost

should look to VOO as the fund charges a premium of just 6 basis

points (read Looking For Safety? Try These Money Market ETFs).

The fund’s holding has a total of 503 stocks with just 20.1%

invested in the top 10 holdings, implying that the assets of the

fund are spread out among companies. The low cost structure of the

fund has helped it to deliver a return of 8.5% over a period of one

year.

Schwab U.S. Broad Market ETF

(SCHB)

Launched in November 2009, the fund with a focus on multi cap

equities seeks to replicate the performance of the Dow Jones US

Broad Stock Market Total Return Index. The fund, which has a total

asset base of $1.0 billion invested in 1,721 stocks, charges a

premium of just 6 basis points from investors on a yearly

basis.

The fund also offers diversification benefit with just 16.97% of

its asset base invested in the top 10 holdings. With low cost,

attractive holding pattern and diversification benefit, the fund

has delivered decent returns and could be a low cost pick for those

who have Charles Schwab accounts due to the commission-free trading

the broker offers on its ETFs.

Vanguard Total Stock Market ETF

(VTI)

With a focus on large, mid and small capitalization companies,

the fund seeks to track the performance of the MSCI US Broad Market

Index at a minimal cost of just 7 basis points. The fund holds a

total of 3,302 stocks and offers investors diversification with

just 16.5% of assets invested in the top 10 holdings (read Five

Great Global ETFs For Complete Exposure).

Apple Inc. (AAPL), Exxon Mobil Corporation (XOM) and Microsoft

Corporation (MSFT) occupy the top 3 position in the fund. The

product has performed admirably over the past year and remains a

solid choice for those looking for broad market exposure across

market cap levels.

Schwab U.S. Large-Cap ETF

(SCHX)

Launched in November 2009, this fund looks to invest in large

cap equity by following the performance of the Dow Jones US

Large-Cap Total Stock Market Index. The fund, which has a total

asset base of $867.9 million invests in 748 stocks, charges a

premium of just 8 basis points from the investors.

The fund also offers solid diversification benefits as just

18.96% of its asset base is invested in the top 10 holdings. With

low cost, attractive holding pattern and diversification benefit,

the fund has delivered a return in-line with other large cap ETFs

over the past one year.

PIMCO 1-3 Year U.S. Treasury Index Fund

(TUZ)

Investors that look for a stable principal value and virtually

no credit risk should invest in TUZ. TUZ is designed to track the

Merrill Lynch 1-3 Year U.S. Treasury Index which puts the product

in short-term U.S. Treasury securities.

With maturities ranging from one to three years, price

fluctuations may be low relative to longer-dated bonds, yet yields

may be much lower than higher duration securities as well. For

this, the fund charges a premium of 9 basis points delivering a

total return of 1.45% over a period of one year.

S&P 500 Index Fund (IVV)

Another ETF which tracks the performance of the large

capitalization sector of the U.S. equity market or S&P 500 is

IVV but with an expense ratio of 9 basis points, three basis points

higher than what VOO charges.

The fund holds a total of 501 stocks in the portfolio with total

net assets invested amounting to $29,624.1 million. Still, the

concentration risk is quite low while the product has

unsurprisingly performed in-line with VOO over the past year.

SPDR S&P 500

(SPY)

Initiated in January 1993, SPY is one of the inexpensive ETFs

with the highest traded volume. It has been designed to track the

performance of the S&P 500 Index. The most popular fund among

investors, SPY trades about 135 million shares in a regular session

and charges a fee of just 0.10% to investors (read Three Unlucky

Equity ETFs).

The fund’s concentration risk is also low at 20.53%, which means

the fund is nicely spread out among its top components. Meanwhile,

the product also pays out a decent yield of 2% and is a great proxy

for the U.S. market as a whole.

Schwab U.S. Aggregate Bond ETF

(SCHZ)

Launched in July 2011, the ETF seeks investment results that

track the total return of the Barclays Capital U.S. Aggregate Bond

Index, before fees and expenses. This inexpensive fund charges a

premium of 10 basis points with total holdings of 624 stocks.

The fund also appears to be diversified as it just invests

13.27% of the asset in top 10 holdings. The fund has delivered a

return of 1.36% over a period of 6 months.

Vanguard Total Bond Market ETF

(BND)

Launched in April 2007, BND tracks the Barclays Capital U.S

Aggregate Bond Index, charging an expense ratio of 11 basis points

from investors. The index, which BND replicates, measures the

performance of the U.S. investment grade bond market.

The fund has a total of 5,086 bonds in its portfolio with an

average maturity of 7.2 years and with total net assets amounting

to $16.1 billion. The fund has 69.7% of assets invested in

government bonds. (Time To Get Regional With Bond

ETFs)

SPDR Barclays Capital Short Term Corporate Bond ETF

(SCPB)

The SPDR Barclays Capital Short Term Corporate Bond ETF seeks to

provide investment results that, before fees and expenses,

correspond generally to the price and yield performance of the

Barclays Capital U.S. 1-3 Year Corporate Bond Index.

The fund, with total net assets of $902.9 million, charges a

premium of 12 basis points. SCPB delivered a total return of 2.46%

over a period of one year (read Van Eck Launches Fallen Angel Bond

ETF).

Schwab Short-Term U.S. Treasury ETF

(SCHO)

Investors that look to invest in government bonds should look to

SCHO. SCHO is designed to track the Barclays Capital U.S 1-3 Year

U.S. Treasury Index. This fund primarily invests in U.S. Treasury

Securities with maturities ranging from one to three years and for

this the fund charges a premium of 12 basis points for a total

holding of 38 bonds. It delivered a total return of 1.28% over a

period of one year.

Schwab Intermediate-Term U.S. Treasuries ETF

(SCHR)

This ETF, with an expense ratio of 12 basis points, seeks

investment results that track the price and yield performance,

before fees and expenses, of the Barclays Capital U.S. 3-10 Year

Treasury Bond Index. The ETF invests in U.S Treasury securities

that have a remaining maturity of three to ten years, are rated

investment grade, and have $250 million or more of outstanding face

value.

The fund invests its total asset of $148 million in roughly 48

bonds. The product puts a modest 35.84% of its assets in the top

ten holdings and could be a nice compliment to investments that are

made in either short or long term government securities.

Focus Morningstar Real Estate ETF

(FRL)

Launched in March 2011, the fund seeks to replicate the

Morningstar Real Estate Index with an expense ratio of 12 basis

points. The Underlying Index is a subset of the Morningstar US

Market Index and consists of mortgage companies, property

management companies and REITs (see Real Estate ETFs: Unexpected

Safe Haven).

The fund has a total of 99 stocks in its basket while putting

about 41% of assets in the top ten. Over the past year the product

has been a solid performer as real estate has rebounded in recent

months while the product has also stood out from a yield

perspective as well.

Vanguard MSCI EAFE ETF

(VEA)

This ETF with an expense ratio of 12 basis points seeks to track

the performance of the MSCI EAFE Index, which measures the

performance of equity markets in European, Australasian, and Far

Eastern markets. VEA is currently focused on Europe (nearly

two-thirds of the portfolio) while a big chunk still goes to

Pacific assets as well.

The fund has a total holding of 898 stocks but puts a modest

14.7% in its top ten holdings. Unfortunately, European stocks have

underperformed as of late, as the product is slumping compared to

its American focused counterparts.

Vanguard REIT ETF (VNQ)

Launched in September 2004, the fund tracks the U.S. REIT market

by following the performance of the MSCI US REIT Index. The fund,

which has a total asset base of $24.4 billion, is invested in 113

stocks in total and charges a premium of just 12 basis points to

investors (see Top Three Mortgage Finance ETFs).

The fund also offers a decent diversification benefit as 45.8%

of its asset base is invested in the top 10 holdings. With low

cost, attractive holding pattern and diversification benefit, the

fund, much like FRL, has delivered solid returns over the past one

year period.

Vanguard Russell 1000 ETF

(VONE)

VONE has been structured to invest in stocks in the Russell 1000

Index, a broadly diversified index made up of large U.S. companies,

at a cost as low as possible of 12 basis points.

The fund holds a total of 980 stocks with just 18.1% invested in

the top 10 holdings, justifying the fact that the assets of the

fund are spread out among companies. The low cost structure of the

fund has helped it to deliver a return of 7.76% over a period of

one year.

SPDR Barclays Capital Short Term Treasury ETF

(SST)

The ETF with an expense ratio of 12 basis points seeks

investment results that track the price and yield performance,

before fees and expenses, of the Barclays Capital 1-5 Year U.S.

Treasury Index. The ETF invests in U.S Treasury securities that

have a remaining maturity of one to five years, are rated

investment grade, and have $250 million or more of outstanding face

value (read Seven Biggest Bond ETFs By AUM).

Despite the cheap cost of the fund, it hasn’t really caught on

with investors and has amassed just six million in AUM.

Nevertheless, the product could be another interesting way to

diversify a portfolio into low risk securities.

Wilshire 5000 Total Market ETF

(WFVK)

With a focus on large, mid and small capitalization companies,

the fund seeks to track the performance of the Wilshire 5000 Index

at a minimal cost of just 12 basis points. The fund holds a total

stock of 1185 stocks and offers investors diversification with just

17.5% of assets invested in the top 10 holdings.

Apple Inc. (AAPL), Exxon Mobil Corporation (XOM) and Microsoft

Corporation (MSFT) occupy the top 3 positions in the fund, and like

many products on the list, it has had a solid start to the year

although it has tumbled back in the spring.

Focus Morningstar Small Cap ETF

(FOS)

Investors seeking to invest in small cap companies of the U.S.

market at the lowest cost should look for FOS which replicates the

Morningstar Small Cap Index. The product charges just 12 basis

points a year and hasn’t really amassed a great deal of assets with

the total AUM coming in below $6 million at this time.

Top holdings aren’t exactly household names as small cap

companies like Superior Energy Services, Inc. (SPN), Solutia Inc.

(SOA), Amylin Pharmaceuticals, Inc. (AMLN) are the top three firms

in the ETF. The fund also appears to be highly diversified with

just 3.09% of assets in the top 10 holdings with over 700 stocks

overall in the portfolio.

Focus Morningstar Mid Cap ETF

(FMM)

Launched in March 2011, this is one of the cheapest ways to play

the often overlooked mid cap space. The product follows the

Morningstar Mid Cap Index but hasn’t really caught on with

investors, trading just 6,000 shares a day on average (see Mid Cap

ETF Investing 101).

Nevertheless, the ultra low 12 basis point cost and the solid

portfolio could make it an interesting pick for some investors. The

product puts just 4.5% of its portfolio in the top ten holdings

making it a well diversified play and also one that investors

aren’t likely to have a great deal of exposure to on their own

anyway.

Vanguard Large-Cap ETF

(VV)

With a focus on large cap companies, the fund seeks to track the

performance of the MSCI US Prime Market 750 Index at a minimal cost

of just 12 basis points. The fund, which holds a total of 750

stocks, offers investors diversification with just 18.8% of assets

invested in the top 10 holdings.

Apple Inc. (AAPL), Exxon Mobil Corporation (XOM) and Microsoft

Corporation (MSFT) occupy the top 3 position in the fund. The fund

delivered a total return of 8.16% over a period of one year.

International Equity ETF

(SCHF)

The fund with an expense ratio of 13 basis points seeks to track

the performance of the FTSE Developed ex US Index. The FTSE

Developed ex-US Index comprised approximately 85% large-cap stocks

and 15% mid-cap stocks from more than 20 developed markets

excluding the U.S (see Three Overlooked Emerging Market ETFs).

The fund has a total holding of 1,055 stocks with 10.57% of

assets invested in the top 10 holdings. The fund delivered a total

return of negative 11.76% over a period of one

year.

U.S. Small-Cap ETF

(SCHA)

Investors seeking to invest in small cap companies of the U.S.

market at the lowest cost should look for SCHA which replicates the

Dow Jones US Small Cap Total Stock Market Total Return Index and is

one of the cheapest funds in the ETF world with an expense ratio of

just 13 basis points.

With small cap companies like MICROS Systems, Inc. (MCRS),

Taubman Centers Inc. (TCO), and Arthur J Gallagher & Co. (AJG)

in the top 3 position of the holding list, the fund appears to be

highly diversified with just 2.41% of assets in the top 10 holdings

while possessing over 1,750 stocks in its entire basket.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

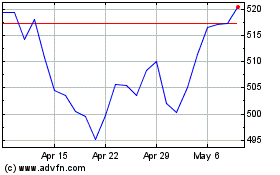

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

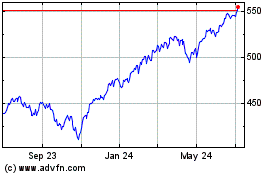

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024