Strategic Equity Capital plc

Unaudited results for the period ended 30 June 2006

Key highlights:

� The Company listed on 19 July 2005 having raised �70.4 million . In November

2005, a further 2,226,000 shares were issued at a small premium to net asset

value, raising a further �2.3 million.

� At 30 June 2006, the Company had net assets of �75.6 million (104.1p per

share).

� At 30 June 2006, the investment portfolio was approximately 83% invested and

committed1 and we anticipate that the Company's portfolio will be fully

invested by the end of 2006.

� Since inception, eight out of the 16 portfolio companies have been involved

in corporate activity either in the form of M&A, capital raisings or

organisational restructuring.

� The Board proposes to declare a final dividend of 1.3p to shareholders on the

register at the close of business on 13 October 2006, payable on 8 November

2006.

John Hodson, Chairman of Strategic Equity Capital plc, commented:

"Following a successful launch in July 2005, th ese are Strategic Equity

Capital's first full preliminary results and I am pleased to report on the

progress made to date. It was the Company's intention to be substantially

invested by its year-end and this has been achieved. With each portfolio

company the Investment Manager has identified a specific route for exit and

value creation for shareholders. As these companies undertake strategic,

management or operational change over the medium term, I believe we will see

further results and opportunities for value creation taking effect."

For further information, please contact:

Capita Sinclair Henderson Limited 01392 412 122

Tracey Brady/ Michael Buckley

SVG Investment Managers Limited 020 7010 8900

Tony Dalwood / Rebecca Hartley

Penrose Financial 020 7786 4888

Emma Thorpe

Copies of the press release and other corporate information can be found on the

company website at: http://www.strategicequitycapital.com

Chairman's statement

Following a successful launch in July 2005, th ese are Strategic Equity

Capital's first full results and I am pleased to report on the progress made to

date.

It was the Company's intention to be substantially invested by its year-end and

this has been achieved. At 30 June 2006, the investment portfolio is

approximately 83% invested and committed and we anticipate that the Company's

portfolio will be fully invested by the end of 2006.

Performance

Strategic Equity Capital listed on London Stock Exchange on 19 July 2005 with

net assets of �69.3 million (98.5p per share). In October, the Company issued

a further 2,226,000 shares at a small premium to net asset value, raising a

further �2.3 million and taking net assets to �72.6 million (99.9p).

At 30 June 2006, the Company had net assets of �75.6 million (104.1p per

share).

Share Price performance

The Company's shares have traded at an average premium to net asset value of 3%

since it listed in July. Recently, the Company's share price has been impacted

by the general correction in equity markets and at the year-end was trading at

a 2 .5% discount to net asset value.

Investment Manager

The Company's portfolio is managed by SVG's Public Equity Team. Their

investment processes and techniques are modelled on that of successful private

equity investors, focusing on companies that can benefit from strategic,

operational or management initiatives.

Investment strategy

The Company's investment strategy is to achieve absolute returns for

shareholders through a strategy of using private equity techniques and a

practice of constructive corporate engagement.

In the Company's first year it has been particularly pleasing to see evidence

of the value of the Investment Manager's investment model realised with

companies such as Mowlem (acquired by Carillion) and Chorion (taken private by

3i Group) exiting from the portfolio at attractive valuations. The only other

disposal during the year, Sanctuary, was disappointing and it was realised at a

loss.

With each portfolio company the Investment Manager has identified a specific

route for exit and value creation for shareholders. As these companies

undertake strategic, management or operational change over the medium term, I

believe we will see further results and opportunities for value creation taking

effect.

The Board

During the Company's first year the Board has worked well together. Full

details can be found in the Company's Annual Report and Accounts, available on

request from the Company Secretary or the Investment Manager.

Dividend

The Directors expect that any returns for shareholders will derive primarily

from the capital appreciation of the Ordinary shares rather than from

dividends. The Directors intend only to declare final dividends and then to

the extent necessary to maintain investment trust status. Accordingly, the

Board proposes to declare a final dividend of 1.3p to shareholders on the

register at the close of business on 13 October 2006, payable on 8 November

2006.

Annual General Meeting

The AGM for the Company will be held at 11.30am on Wednesday, 1 November 2006,

at 111 Strand, London WC2R OAG. In addition to the formal business of the

meeting, the Investment Managers will provide an update on the Company's

investment portfolio and answer any questions from shareholders.

Directorate Appointment

We are delighted to announce the appointment of John Cornish as a non-executive

Director of the Company with effect from 6 September 2006. We believe his

extensive experience and knowledge of the investment trust sector will be of

considerable value to the Board.

Outlook

I believe the Investment Manager's experience of applying private equity

investment techniques in the public markets, involving an in-depth screening,

due-diligence and investment strategy will ensure that we will continue to see

further value creation from the portfolio holdings.

Applying private equity techniques within the public markets is becoming

increasingly relevant as boundaries between asset classes have started to

merge. Established in 2002, SVG's Public Equity Team has become a leading

specialist in this field .

John Hodson, Chairman

8 September 2006

Investment Manager's report

At 30 June 2006, Strategic Equity Capital had net assets of �75.6 million and

was approximately 83% invested and committed, with a portfolio of 16

companies. We are currently at varying stages of due-diligence on a number of

potential further investments and expect the portfolio to be fully invested by

the end of 2006.

The investment process is focused on identifying companies that we believe are

undervalued and could benefit from strategic, management or operational

initiatives in order for their value to be fully realised.

Throughout the investment process, wherever possible, we work alongside

management and/or other shareholders as a supportive investor to identify long

term shareholder value. Past experiences have shown that where we have

developed a strong relationship with the management team and have been able to

support the company in a shared vision of the strategy of the business, the

investment has proved more successful.

Performance

At 30 June 2006, the gross IRR on portfolio investments was 10.6%. Key

positive contributors to performance since launch have been Filtronic,

Elementis, Hampson Industries and Chorion, which was taken private by 3i Group

in May this year.

Filtronic is a manufacturer of complex components for mobile telecommunications

systems. Following Strategic Equity Capital's initial investment in March

2006, Filtronic have announced the proposed sale of its wireless infrastructure

division to Powerwave, which has resulted in a re-rating of its share price.

In March, Elementis announced the results of the second stage of its strategic

review, in which attention was focused on the Specialties division. Trading

for the first half of 2006 was ahead of expectations due to an improved

operating environment. We believe the steps taken within the strategic review

will continue to provide a platform for future growth and cash flow generation.

Hampson Industries, the international precision engineering group, continues to

make good progress. In November 2005, Strategic Equity Capital participated in

a discounted equity placing to fund the acquisition of two US aerospace

companies. These two acquisitions have been successfully integrated and are

performing ahead of management's expectations. We believe that the group is

well placed to build on their strong platform for continuing growth.

Key negative contributors to performance include Communisis, a print and direct

mail business, Sanctuary, a music rights and management company, and the media

conglomerate SMG.

In January 2006, Communisis disappointed the market by announcing that talks

with potential buyers of the business had been called off. The company is now

focused on reducing capacity in its print manufacturing business and changes

have been announced at both the CEO and CFO level. Rationalisation of the

manufacturing business and a reinvigoration of the strategy under new

management should deliver benefits.

In March 2006 we participated in the rescue rights issue in which Sanctuary

Group raised �110 million through an equity placing to repay debt, anticipating

a significant recovery in earnings coupled with strategic and senior management

change. Following the equity placing, Sanctuary's auditors issued an adverse

audit opinion on the year-end results and the company warned that trading would

be significantly worse than had previously been expected. The holding was sold

at a loss.

SMG has been negatively impacted by the uncertain outlook for commercial

television advertising. However, as evidenced by the recent approach to ITV,

there is corporate interest in this area and we remain positive that

significant value can be unlocked in SMG through strategic change as we believe

the company continues to trade at a significant discount to comparable

transaction multiples. Since the period end, the group has announced the

resignation of its Chief Executive with immediate effect and a search has begun

for a replacement.

Portfolio activity

Given the relatively long term investment horizon of our investment process, we

are encouraged with the progress of the portfolio to date. Since inception,

eight out of the 16 portfolio companies have been involved in corporate

activity either in the form of M&A, capital raisings or organisational

restructuring. In addition to Sanctuary Group (discussed above), two other

portfolio holdings have been fully realised, Chorion and Mowlem, both of which

were the subject of takeover offers.

Chorion is an intellectual property business, with brands such as Agatha

Christie, Enid Blyton and Mr Men. Funds managed by SVG's Public Equity Team

originally invested in Chorion in 2002. In the four years since, we have

worked extensively with the company's management, supporting capital raisings

to fund the growth of the business and ultimately encouraging the public to

private offer led by 3i Group, which was completed in May 2006.

We announced the partial realisation of Mowlem in the interim accounts.

Following Carillion's completion of its acquisition of Mowlem, the remaining

holding in the company was realised in February 2006.

New investments

Since December 2005, the Company has made six new investments:

Alpha Airports is a provider of retail and catering services for airlines and

airports. A significant deterioration in profitability, brought about by the

loss of a major contract, as well as losses experienced in various parts of its

overseas business led to a de-rating of Alpha's share price. At the same time,

there has been considerable structural change in the airline catering industry

whilst passenger numbers continue to rise. It is our belief that profitability

will recover and that significant value can be created through implementing

strategic change to recognise the value in the distinct retail and catering

businesses. Since our investment there have been management changes. We

believe that the new management team will drive the necessary strategic and

operational change to realise the value of the business.

Cardpoint, is an independent cash machine supplier with operations in the UK,

Germany and The Netherlands. The company acquired Moneybox, a leading provider

of independent UK ATM's in July 2005 and is in the process of integrating the

business. SVG's Public Equity Team had done significant due-diligence on

Moneybox prior to this acquisition. We believe Cardpoint's current valuation

does not reflect the potential for growth within the industry or the strategic

benefits of the Moneybox acquisition given the embedded value of the enlarged

ATM estate.

Entertainment Rights is a global media group focused on the ownership of

children's and family programming, characters and brands. The group has a well

diversified portfolio of children's properties, including Postman Pat�, Rupert

Bear� andHe-Man and the Masters of the Universe�. The group's value is

underpinned by an extensive library of over 1800 hours of programming content

which we believe will benefit from the continued convergence in the media

sector. There has been significant private equity activity in this sector over

the last couple of years.

As mentioned previously, Filtronic is a manufacturer of complex components for

mobile telecommunications systems. Following the proposed sale of its wireless

infrastructure division to Powerwave, which is expected to be completed in the

third quarter of 2006, the majority of the remaining business is represented by

the semi-conductor fabrication plant located at Newton Aycliffe in County

Durham. Historically Newton Aycliffe has operated at a loss, but recent

technological developments have resulted in strong market growth within the

Compound Semiconductor division as the mobile handset industry continues to

adopt switches based on this technology. In our view, the market price of

Filtronic continues to place little value on the Newton Aycliffe foundry and we

believe there is further value upside in this remaining part of the business.

Melrose is a specialist aerospace and precision engineering business. The

company has a management team with a history of shareholder value creation and

its key businesses are highly cash generative, with strong market positions.

We do not believe that the current valuation of this company correctly values

the company's future cashflows, nor does it recognise the potential for value

accretive disposals.

Finally Strategic Equity Capital made its first unlisted investment; Ora

Capital Partners. Ora is a start up company which aims to build a franchise by

investing in specialist public and private equity situations in four key

sectors: resources, financials, special situations and intellectual property.

Ora will look to invest in six to 12 companies a year with an investment size

of �100,000 to �8 million.

Portfolio analysis

The investment portfolio is typically focused towards small and medium sized

companies, with market capitalisations ranging from approximately �30 million

to �500 million. It is our experience that we have a greater ability to create

value through strategic, management and operational initiatives in companies

within this size range.

Our stock specific investment approach ensures that we do not focus on any

particular sector. Although the current portfolio has a greater emphasis

towards companies within media and support services, these two sectors in

themselves are both very diverse and have given rise to particular

opportunities where valuation anomalies exist.

Top 10 holdings

A summary of the activities of the top 10 investments, which represent

approximately 65% of net assets is given below.

Company Sector classification Cost Valuation % of invested % of net

portfolio assets

�'000 �'000

Melrose Industrial engineering 5,634 6,115 11.1 8.1

Watermark Support services 6,102 6,068 11.0 8.0

Group

Filtronic Technology, hardware & 4,646 5,691 10.3 7.5

equipment

Hampson Aerospace & defence 4,624 5,314 9.7 7.0

Industries

Pinewood Media 4,510 5,190 9.4 6.9

Shepperton

Elementis Speciality chemicals 4,104 5,158 9.4 6.8

Evolution Investment services 5,155 5,139 9.3 6.8

Group

SMG Media 4,216 3,855 7.0 5.1

Mecom Group Equity investment 3,547 3,398 6.2 4.5

instruments

Cardpoint Support services 3,591 3,276 6.0 4.3

Outlook

In June 2006, Strategic Equity Capital committed to be a cornerstone investor

in Redstone's �20 million equity placing to fund the acquisition of Symphony

Telecom Holdings plc. During the last year the new Chief Executive of Redstone

has successfully integrated the acquisition of Xpert Technologies, announced in

April 2005 and proving his ability to integrate businesses. We believe the

acquisition of Symphony will lead to significant further earnings growth for

the group. There has been considerable corporate activity in the industry and

the valuation differential between private equity transactions in this sector

and Redstone's valuation remains substantial. We believe the company is well

placed to benefit from this sector consolidation. The placing was completed on

18 July 2006 making Redstone the Company's largest holding representing 7.7% of

net assets (as at 31 August 2006).

Since the period end, Strategic Equity Capital's NAV has fallen from 104.1p to

95.0p as at

1 September 2006, due largely to a fall in the share price of Watermark, a

portfolio company providing products and services to the airline industry. We

are actively engaged with the company, working closely to recover the position.

Also since 30 June 2006, Strategic Equity Capital has exited its investment in

Elementis. The company's recent results were evidence of our original

investment and we have subsequently realised our holding.

Since March 2003, the UK market has performed strongly. In our opinion, this

was initially driven by M&A activity and the general re-rating of small and mid

cap stocks. More recently, performance has been driven by earnings momentum

and the out-performance of a few specific sectors, such as resources.

Since May 2006 we have experienced increased volatility as macroeconomic

factors have had a negative effect on the broader equity markets. Uncertainty

surrounding rising inflation coupled with increases in commodity and energy

prices have put pressure on markets, and as a result the early gains of 2006

were given up.

On a price to earnings and yield basis, the market appears to be reasonably

valued however corporate profit margins are historically high. Rising input

costs including energy, rents and the cost of money may put pressure on

corporate earnings. In this environment, the ability to create value in a

controlled way through our focused stock selection and investment process

should be of benefit.

SVG Investment Managers Limited

All statements of opinion and/ or belief contained in this Investment Manager's

report and all views expressed and all projections, forecasts or statements

relating to expectations regarding future events or the possible future

performance of the Company represent SVG Investment Managers Limited's own

assessment and interpretation of information available to it as at the date of

this report. As a result of various risks and uncertainties, actual events or

results may differ materially from such statements, views, projections or

forecasts. No representation is made or assurance given that such statements,

views, projections or forecasts are correct or that the objectives of the

Company will be achieved.

The Directors announce the unaudited statement of results for the period 20

July 2005 to 30 June 2006 as follows:

Income statement

(unaudited) for the period ended 30 June 2006

20 July 2005 to 30 June

2006 10 May 2005 to 19 July 2005

Revenue Capital Total Revenue Capital Total

�'000 �'000 �'000 �'000 �'000 �'000

Investments

Gains on investments - 2,839 2,839 - - -

Net investment result - 2,839 2,839 - - -

Income

Dividends and interest 2,357 - 2,357 - - -

Underwriting commission 2 - 2 - - -

Total income 2,359 - 2,359 - - -

Expenses

Investment management fee (inc. of VAT) 595 - 595 - - -

Other expenses 280 - 280 12 - 12

Total expenses 875 - 875 12 - 12

Net return before taxation 1,484 2,839 4,323 (12) - (12)

Taxation (274) - (274) - - -

Net return after taxation for the period 1,210 2,839 4,049 (12) - (12)

Earnings per Ordinary share pence pence pence pence pence pence

Basic and diluted 1.68 3.94 5.62 (1.21) 0.00 (1.21)

Weighted average number of shares in issue in the period 71,982,647 991,569

Earnings per Ordinary share are calculated based on the weighted average number

of Ordinary shares in issue throughout the period.

The total column of this statement is the income statement of the Company. The

supplementary revenue and capital return columns are both prepared under

guidance published by the Association of Investment Trust Companies.

All items in the above statement derive from continuing operations. No

operations were acquired or discontinued during the period.

These accounts are unaudited and are not the Company's statutory accounts.

Statement of changes in equity

(unaudited) for the period ended 30 June 2006

Share Capital Capital

Share premium Special reserve reserve Revenue

capital account reserve realised unrealised reserve Total

�'000 �'000 �'000 �'000 �'000 �'000 �'000

Period 20 July 2005

to 30 June 2006

20 July 2005 7,040 62,282 - - - (12) 69,310

Return for the period - - - 383 2,456 1,210 4,049

Transfer to special reserve1 - (62,282) 62,282 - - - -

Issue of share capital 222 2,042 - - - - 2,264

30 June 2006 7,262 2,042 62,282 383 2,456 1,198 75,623

Period 10 May 2005

to 19 July 2005

10 May 2005 - - - - - - -

Return for the period - - - - - (12) (12)

Issue of share capital (net of expenses) 7,040 62,282 - - - - 69,322

19 July 2005 7,040 62,282 - - - (12) 69,310

1 On 14 September 2005, the High Court approved the cancellation of the

Company's share premium account arising on the issue of the share's pursuant to

the original placing, with the balance being transferred to a special reserve.

Balance sheet

(unaudited) as at 30 June 2006

30 June 19 July

2006 2005

�'000 �'000

Non-current assets

Fair value through profit or loss investments

- Portfolio 55,022 -

55,022 -

Current assets

Trade and other receivables 989 70,400

Cash and cash equivalents 20,458 50

21,447 70,450

Total assets 76,469 70,450

Current liabilities

Other payables 846 1,140

846 1,140

Total assets less current liabilities 75,623 69,310

Net assets 75,623 69,310

Capital and reserves:

Share capital 7,262 7,040

Share premium account 2,042 62,282

Special reserve 62,282 -

Capital reserve - realised 383 -

Capital reserve - unrealised 2,456 -

Revenue reserve 1,198 (12)

Total shareholders' equity 75,623 69,310

Net asset value per share pence pence

Ordinary share 104.13 98.45

Ordinary shares in issue 72,626,000 70,400,000

Net asset value per share include s current period revenue for the unaudited

values at 30 June 2006.

Statement of cash flows

(unaudited) for the period ended 30 June 2006

Period Period

20 July 2005 10 May 2005

to 30 June 2006 to 19 July 2005

�'000 �'000

Operating activities

Net return before tax 4,323 (12)

Adjustment for gains on investments (2,839) -

Operating cashflows before movements in working capital 1,484 (12)

Increase in receivables (250) -

Increase in payables 245 12

Net cash inflow from operating activities 1,479 -

Investing activities

Purchases of investments (59,885) -

Sales of investments 7,250 -

Net cash outflow from investing activities (52,635) -

Financing activities

Proceeds of Redeemable share issue - 50

Proceeds of Ordinary share issue 71,564 -

Net cash inflow from financing activities 71,564 50

Increase in cash and cash equivalents for period 20,408 50

Cash and cash equivalents at start of period 50 -

Cash and cash equivalents at 30 June 2006 20,458 50

1 General information

The financial information contained in this announcement does not constitute

statutory financial statements as defined in Section 240 of the Companies Act

1985. The financial information is unaudited and has been prepared on the

basis of the accounting policies set out in the statutory financial statements

for the period ended 19 July 2005, which contained an unqualified auditors'

report and have been lodged with the Registrar of Companies and did not contain

a statement required under Section 237(2) or (3) of the Companies act 1985.

Statutory financial statements for the period ended 30 June 2006 have not yet

been approved, audited or filed and will be delivered to the Registrar of

Companies following the Annual General Meeting.

END

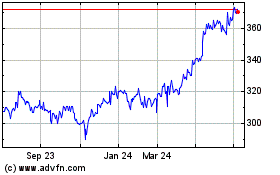

Strategic Equity Capital (LSE:SEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

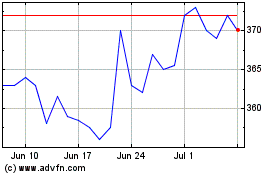

Strategic Equity Capital (LSE:SEC)

Historical Stock Chart

From Apr 2023 to Apr 2024