Bristol-Myers Squibb Cuts Guidance on Cancer Drug Problems--Update

January 26 2017 - 1:40PM

Dow Jones News

By Anne Steele and Jonathan D. Rockoff

Bristol-Myers Squibb Co. cut its earnings guidance for the year

as the drugmaker contends with dimmed prospects for its top cancer

drug after major setbacks last year.

For 2017, the company now expects adjusted earnings of $2.70 to

$2.90 a share, down from its previous guidance of $2.85 to

$3.05.

Bristol pioneered cancer immunotherapy, a type of treatment that

aims to fight cancer by harnessing the body's immune system, but it

has been struggling in recent months to cope with competition from

Merck & Co.'s Keytruda and most recently Tecentriq from Roche

Holding AG.

After Bristol announced in August that its immunotherapy Opdivo

failed to meet the main goal of a critical study exploring the

drug's use in advanced lung cancer patients who hadn't previously

been treated, the company sought to persuade investors it still had

bright prospects treating such patients, known as "first-line" lung

cancer patients, by combining Opdivo with Bristol's other

immunotherapy, Yervoy. The combination is under study.

But last week, Bristol said it won't pursue speedy U.S.

regulatory approval to market that combination as a first-line

treatment for lung cancer. That announcement fed investor fears the

company is losing ground in the race for this all-important patient

group.

In a conference call Thursday, Bristol said it was adjusting its

sales strategy for lung-cancer patients. Executives said they

expect Opdivo sales to grow overseas but to be flat in the U.S.,

where Bristol will concentrate on serving lung-cancer patients who

have already received treatment until its trials studying

combinations of therapies for untreated patients finish.

"We do believe we have a meaningful role to play in lung cancer

in the future," Bristol CEO Giovanni Caforio said on the conference

call.

Mr. Caforio also pointed to Bristol's pipeline of new kinds of

immunotherapies in development. "I remain confident in our

significant long-term opportunity in immuno-oncology," Mr. Caforio

said.

During the fourth quarter, Opdivo sales rose to $1.3 billion, up

from $475 million during the period a year earlier. Yervoy sales

edged 0.4% lower to $264 million world-wide. Revenue from another

key Bristol product, the blood thinner Eliquis, jumped 57% to $948

million globally.

In all for the December period, Bristol-Myers Squibb posted

earnings of $894 million, or 53 cents a share, compared with a loss

of $197 million, or 12 cents a share, a year earlier. The 2015

results included after-tax charges of 24 cents a share from the

Five Prime Therapeutics Inc. and Cardioxyl Pharmaceuticals Inc.

business development transactions and 8 cents a share for the

transfer of the Erbitux business in North America to Eli Lilly

& Co.

Excluding certain items, adjusted earnings rose to 63 cents a

share from 38 cents. Revenue surged 22%, to $5.24 billion.

Analysts polled by Thomson Reuters had predicted earnings of 67

cents a share on $5.13 billion in revenue.

In the previous quarter, Bristol said it had begun a

reorganization to streamline certain operations, such as its supply

chain for pills. The company provided no update on the

reorganization in Thursday's report.

Write to Anne Steele at Anne.Steele@wsj.com and Jonathan D.

Rockoff at Jonathan.Rockoff@wsj.com

(END) Dow Jones Newswires

January 26, 2017 13:25 ET (18:25 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

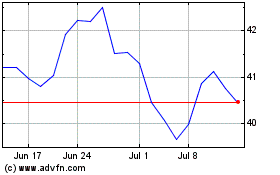

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Aug 2024 to Sep 2024

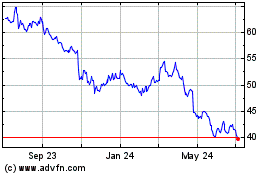

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Sep 2023 to Sep 2024