Aflac at an Inflection Point - Analyst Blog

March 26 2014 - 3:00PM

Zacks

On Mar 19, 2014, we issued an updated research report on

Aflac Inc. (AFL). This supplemental health and

life insurer has been facing the brunt of a sluggish economy and

low interest rates in Japan – the region that generates about

three-fourth of the company’s total revenue.

Aflac continues to be harshly hit by sluggish sales, portfolio

de-risking, intense economic volatility, and consistent fluctuation

of the yen against the dollar along with changes in interest rates,

credit spreads and defaults. Despite the re-pricing initiatives

taken in Apr 2013, Aflac continues to project deteriorating trends

in the WAYS sales in 2014 as well, after driving a decline of 51.3%

in bank sales in 2013.

The yen/dollar exchange rate was 18.2% weaker in 2013 compared

with 2012, declining operating cash flow and implying deterioration

in the upcoming quarters. These factors coupled with an increase in

Japan's consumption tax coming up in Apr 2014 have further impelled

management to peg its earnings growth guidance in low single digits

in 2014.

Light at the End of Tunnel

Despite weak sales, Aflac has been achieving its earnings target

for the past 24 years, including year 2013. As a result of the

shift to newer products, lower loss ratios, favorable claim trends

and disciplined management of existing accounts and expenses, we

expect the benefit ratio to continue to improve in the upcoming

years as in 2013.

Further, Aflac has been able to maintain healthy capital and

solvency ratios, also supporting its accelerated capital

deployment. Along with consistent dividend hikes for the last 31

years, shares worth $800 million were repurchased in 2013 itself.

Management further aims to accelerate its share buyback target by

$800 million to $1.0 billion in 2014, now that most of the

de-risking program has been successfully completed, thereby

instilling confidence of the rating agencies and of investors in

the stock.

Once the economy treads on a more stable path, we believe Aflac

will be able to gain from the increased client activity and

enhanced group product platform, which will be eventually reflected

in top- and bottom-line growth. Based on these factors, management

also expects earnings growth to gradually rebound 2015 onwards.

Overall, a balanced risk-reward balance in the near term has

lifted the estimate for 2014 by 2 cents per share but have kept the

same intact for 2015 in the past 30 days. The Zacks Consensus

Estimate for 2014 and 2015 now stands at $6.20 a share and $6.61

per share, respectively. However, on a year-over-year basis,

earnings are expected to grow by 0.3% in 2014 and 6.7% in 2015.

Key Picks in the Sector

While Aflac carries a Zacks Rank #3 (Hold), some better-ranked

stocks in the financial sector include Discover Financial

Services (DFS), Unum Group (UNM) and

Tree.Com Inc. (TREE). All these stocks bear a

Zacks Rank #2 (Buy).

AFLAC INC (AFL): Free Stock Analysis Report

DISCOVER FIN SV (DFS): Free Stock Analysis Report

TREE.COM INC (TREE): Free Stock Analysis Report

UNUM GROUP (UNM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

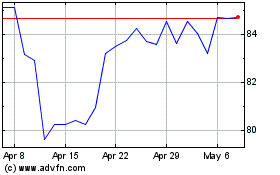

AFLAC (NYSE:AFL)

Historical Stock Chart

From Aug 2024 to Sep 2024

AFLAC (NYSE:AFL)

Historical Stock Chart

From Sep 2023 to Sep 2024