AMD CEO Downplays Impact Hard-Drive Shortage Is Having On PCs

December 13 2011 - 1:08PM

Dow Jones News

Advanced Micro Devices Inc.'s (AMD) chief executive Tuesday

contradicted the chip company's main rival by downplaying the

impact hard-disk drive shortages are having on the PC market,

saying he doesn't expect much pressure on the quarter.

About 40% of the world's hard drives are manufactured in

Thailand, where months of heavy rains have disrupted operations.

Monday, AMD rival Intel Corp. (INTC), which supplies chips that

power about 80% of the world's computers, lowered its

fourth-quarter revenue guidance, citing the shortage's toll on

computer production.

Tuesday, AMD Chief Executive Rory Read said while there's

pressure in the market, he doesn't "see major pressure in terms of

the quarter." He said hard-disk supply in the channel at the

beginning of the period has kept the market "going pretty

well."

"In 1Q and 2Q, maybe you see some manifestations, but I wouldn't

bet against the supply chain," Read said at a Raymond James

conference. "They're very resilient."

He added AMD still has a lot of opportunity to take market share

even if the PC industry pares back its overall production.

In Thailand, most industrial zones that were inundated by the

floodwaters are now dry, though high waters linger in some areas

and authorities have warned it could be several months before all

the affected factories are up and running again, as companies

continue to assess the damage.

Many tech companies with operations in Thailand, including

hard-drive maker Western Digital Corp. (WDC) and component supplier

Hutchinson Technology Inc. (HTCH), have had to suspend some

operations there.

ON Semiconductor Corp. (ONNN)--which makes audio and

power-management chips used in mobile phones, cars and portable

electronics--late last week said it was ending all production at

its Sanyo Semiconductor unit sites in Ayutthaya, Thailand, and

would maintain only limited production at its Bang Pa In site.

"The bulk of the company's Thailand operations will be

permanently transferred to other existing ON Semiconductor

facilities that have available production equipment capacity and

excess floor space, and to some external subcontractors as

appropriate," the company said on its website.

Most production will be moved to Malaysia, the Philippines and

China, ON Semiconductor said.

Meanwhile, Read on Tuesday said AMD must focus more on its

customers and market than it does on its chief rival Intel in order

to gain share and boost performance. He noted AMD also needs to

focus on companies that license ARM Holdings PLC (ARMH, ARM.LN)

architecture, such as Qualcomm Inc. (QCOM).

"It's not that we turn our back on the competitors," Read said.

"It's that we become customer- and market-focused."

Read didn't dismiss the possibility for AMD to license ARM

architecture, saying it will depend on where the market goes and

what customers want.

"What's most important is that you always listen to the

customer," Read said. "When the customer speaks, the industry

speaks, you've got to listen."

He said it would be a "very simple" decision to work with ARM if

that was the direction the market went. But Read said AMD will

continue focusing on improving its x86-based chips.

Read added Intel, with its dominant position in the PC market,

will hesitate to make big changes as it seeks to protect the status

quo. And companies making chips based on ARM architecture will face

their own struggles with expanding into new markets, he said.

"We have a lot of IP and a lot of capability," Read said. "We're

going to continue to play those cards, but as you move forward,

making sure that you're able to be ambidextrous is definitely a

winning hand."

-By Shara Tibken, Dow Jones Newswires; 212-416-2189;

shara.tibken@dowjones.com

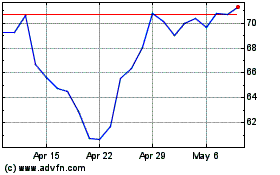

ON Semiconductor (NASDAQ:ON)

Historical Stock Chart

From Apr 2024 to May 2024

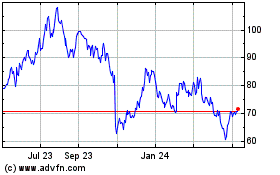

ON Semiconductor (NASDAQ:ON)

Historical Stock Chart

From May 2023 to May 2024