Ares Management Taking Stake in Montage Hotels

January 26 2016 - 5:50PM

Dow Jones News

Asset management firm Ares Management LP has reached an

agreement to acquire up to a 20% equity stake in Montage Hotels

& Resorts LLC, a luxury hospitality company owned in part by

eBay Inc. founder Pierre Omidyar.

Under the agreement, Ares will also provide up to $200 million

in equity toward building or acquiring properties for Montage's

expansion, Montage President Jason Herthel told The Wall Street

Journal. Other financial terms weren't disclosed.

Mr. Herthel said Montage has been in conversations for more than

year about partnering or selling a stake in the company as it

looked to accelerate its expansion.

The Laguna Beach, Calif., privately held company has five luxury

hotels open under the Montage flagship brand and recently launched

a high-end lifestyle brand, with more contemporary design and aimed

at a younger clientele, known as Pendry Hotels.

Ares, based in Los Angeles, is a publicly traded investment firm

with about $92 billion of assets under management in debt, private

equity, real estate and other funds.

The first Pendry property, a 317-room hotel, is slated to open

this fall in San Diego's Gaslamp entertainment district. While

Montage will manage the property, it is owned in part by Ares. That

initial partnership evolved into the larger investment, Mr. Herthel

said. Ares becomes the third largest stakeholder in Montage.

Hospitality veteran and Montage chief executive officer Alan

Fuerstman founded the company in 2002 and took on Mr. Omidyar as a

minority partner. The flagship brand aims to compete with top

luxury names like Four Seasons and Ritz Carlton.

Montage's deal with Ares is the latest sign that merger and

acquisition activity is heating up in the lodging sector. With many

analysts saying the hotel business cycle is looking past its prime,

a number of hospitality companies view mergers or cash from new

equity investors as the best path to growth.

Last year, U.S. hotel deals had a total value of $25.7 billion,

the largest amount since 2007. The year was highlighted by Marriott

International Inc.'s $12.2 billion agreement to buy Starwood Hotels

& Resorts Worldwide Inc. The deal, which would create a company

with more than one million rooms and 30 brands, is expected to

close at midyear.

Write to Craig Karmin at craig.karmin@wsj.com

(END) Dow Jones Newswires

January 26, 2016 17:35 ET (22:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

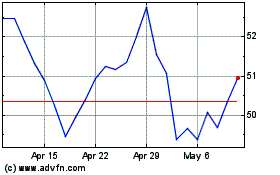

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Aug 2024 to Sep 2024

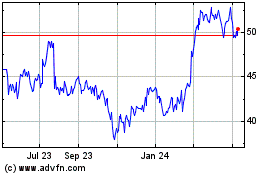

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Sep 2023 to Sep 2024