Cisco to Buy Collaboration Company Acano for $700 Million -- Update

November 20 2015 - 3:14PM

Dow Jones News

By Don Clark And Lisa Beilfuss

Cisco Systems Inc. agreed to buy closely held Acano Ltd. for

$700 million in cash, the latest move by the Silicon Valley giant

to expand its videoconferencing and other collaboration

businesses.

Cisco, though best known for networking equipment, was already a

major player in the collaboration market. Prior acquisitions gave

it a formidable portfolio, including the 2010 purchase of the

Norwegian videoconferencing company Tandberg ASA for $3.3 billion

and a 2007 deal to buy Web meeting service WebEx Communications for

$3.2 billion.

The San Jose, Calif., company this month reported that revenue

from collaboration products rose 17% to $1.12 billion in its first

fiscal quarter.

Cisco estimated Friday that only one in 10 corporate conference

rooms are connected with video, vowing to change the ratio to one

in four over the next decade.

Acano, based in London, specializes in hardware that companies

or cloud services install to manage videoconferences. One of its

key selling points is the ability to connect conference room

systems from different hardware providers.

"Our big customers are telling us, 'we want to do more with

Cisco but it has to coexist with our legacy infrastructure,'" said

Rowan Trollope, a senior vice president who is general manager of

Cisco's collaboration technology group. "Acano is the bridge that

makes everything work with everything else."

Another draw is the preference of many companies to let external

cloud providers manage any video communications, Mr. Trollope said.

Cisco already offers such services, which Acano's technology could

enhance, he said.

The company, known for many billion-dollar acquisitions, has

lately expressed a preference for smaller deals while forging

partnerships with large companies. Cisco, for example, this month

announced a broad collaboration with the Swedish telecommunications

equipment company Ericsson AB.

Last month, Cisco struck a deal to buy security specialist

Lancope Inc. for about $453 million. In June Cisco announced a $635

million deal to buy OpenDNS, which maintains a network of

domain-name servers to help route Web traffic and can use that

technology to help block attacks carried out over the Internet.

The Acanos transaction is expected to be completed in Cisco's

quarter ending April 30, Cisco said.

Write to Don Clark at don.clark@wsj.com and Lisa Beilfuss at

lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 14:59 ET (19:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

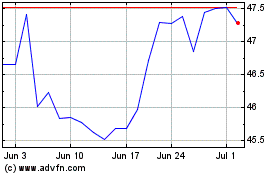

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

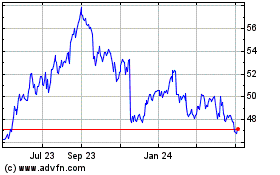

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024