Gateley (Holdings) PLC Payment of Gateley Hamer Earn Out Consideration (7812R)

June 19 2018 - 2:00AM

UK Regulatory

TIDMGTLY

RNS Number : 7812R

Gateley (Holdings) PLC

19 June 2018

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon publication of

this announcement, this information is now considered to be in the

public domain.

Gateley (Holdings) Plc

('Gateley' or the 'Group')

Payment of Earn Out Consideration for Gateley Hamer

Gateley (Holdings) Plc (AIM:GTLY), the national commercial law

and complementary professional services group, is pleased to

announce, in accordance with the acquisition agreement of Gateley

Hamer (formerly Hamer Associates Limited), that a total earn out

consideration of GBP470,317 has been paid. The earn out

consideration is split equally between cash and shares.

Accordingly, 138,329 ordinary shares of 10p each in Gateley

("Ordinary Shares") have been issued and application has been made

to London Stock Exchange plc for these shares to be admitted to

trading on AIM ("Admission"). Admission is expected at 8.00 a.m. on

22 June 2018.

Michael Ward, CEO of Gateley, said:

"We are pleased with the contribution made by Gateley Hamer.

Increased cross-selling of services between traditional Gateley and

Hamer clients and expansion of the specialist team, including

establishing a new presence in our London office, positions Gateley

Hamer well to generate increased revenue and profit in the current

financial year."

Total Voting Rights

The new Ordinary Shares being issued will rank pari passu with

the existing Ordinary Shares in issue. Following Admission,

Gateley's total issued share capital will comprise 108,184,558

Ordinary Shares. This number may be used by shareholders in Gateley

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change in their interest in, the share capital of Gateley under the

FCA's Disclosure Guidance and Transparency Rules.

Enquiries:

Gateley (Holdings) Plc

Neil Smith, Finance Director Tel: +44 (0) 121 234 0196

Nick Smith, Acquisitions Director and Head of Investor Relations Tel: +44 (0) 20 7653 1665

Cara Zachariou, Head of Communications Tel: +44 (0) 121 234 0074 or

+44 7703 684 946

Cantor Fitzgerald Europe - Nominated adviser and broker

David Foreman, Marc Milmo, Michael Boot (Corporate Finance) Tel: +44 (0) 20 7894 7000

Caspar Shand Kydd, Alex Pollen (Sales)

Arden Partners - Broker

John Llewellyn-Lloyd, Benjamin Cryer (Corporate Finance) Tel: +44 (0) 20 7614 5900

James Reed-Daunter (Corporate Broking)

IFC Advisory - Financial PR Adviser

Tim Metcalfe, Miles Nolan Tel: +44 (0) 20 3934 6630

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEVVLFFVQFEBBK

(END) Dow Jones Newswires

June 19, 2018 02:00 ET (06:00 GMT)

Gateley (holdings) (LSE:GTLY)

Historical Stock Chart

From Apr 2024 to May 2024

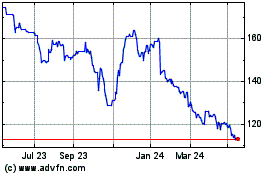

Gateley (holdings) (LSE:GTLY)

Historical Stock Chart

From May 2023 to May 2024