TIDMFKE

RNS Number : 4852R

Fiske PLC

28 February 2019

28 February 2019

Fiske Plc

('Fiske' or 'the Company')

Correction: Interim Results

This announcement replaces the announcement of Interim Results

that was issued at 07:28 on 28 February 2019. The paragraph in Note

2 Taxation in the Notes to the Interim Financial Statements has

been replaced with the following paragraph:

No tax credit on the loss for the period has been recognised for

the six months to 30 November 2018, due to uncertainty over

sufficient future taxable profits being available.

All other information is unchanged

Interim Results

Fiske Plc (the 'Company') announces its interim results for the

six months ended 30 November 2018. In accordance with rule 26 of

the AIM Rules for Companies this information is also available,

under the Investors section, at the Company's website,

http://www.fiskeplc.com .

For further information please contact:

-- Samantha Harrison/Harrison Clarke/Niall McDonald, Grant

Thornton UK LLP (Nominated Adviser)

(tel: 020 7383 5100)

-- Gerard Luchini, Fiske Plc - Compliance Officer

(tel: 020 7448 4700)

Chairman's Statement

Trading

Our results for the half year to 30 November 2018 were

disappointing with a pre-tax loss of GBP492,000 compared to a

profit of GBP190,000 for the comparable period in 2017. This

resulted in part from the uncertain and weak markets depressing our

commission revenues but also from some non-recurring items

affecting both our costs and fee revenues.

Our commission revenues were some GBP246,000 lower than the

prior year comparative which represents a reduction of

approximately 20%. Our operating expenses increased by 30% to

GBP2.544 million (2017: GBP1.955 million) for a number of reasons.

Firstly we incurred non-recurring items relating to the acquisition

of Fieldings Investment Management Limited. These included

additional audit fees relating to determining the application of

appropriate acquisition accounting rules, as well as agreed

deferred consideration bonus payments which fell due, the latter of

which amounted to GBP129,000.

Secondly a review of management fee revenue and a subsequent

tightening of revenue recognition criteria resulted in a one-off

revenue adjustment of GBP118,000 in the period.

Lastly, as we have previously highlighted, the increasing burden

of regulation has resulted in a general increase in our operating

expenses. These relate to the continued implementation of MiFID II

specifically the costs and charges element, initial work on the

Senior Managers and Certification Regime which is due for

implementation in December 2019 and further development of our

internal controls around the Client Money and Assets rules

(CASS).

On a more positive note we are pleased with the successful

launch in May 2018 of our own unit trust, Ocean UK Equity. Despite

having to navigate a very challenging period for global markets the

fund has delivered a top quartile performance over its first six

months.

Balance Sheet

We continue to maintain our strong financial position with our

cash balance standing at GBP2,014,000 at the period end. On the

30th January 2019 the London Stock Exchange Group (LSEG) announced

its acquisition of an aggregate 4.92% stake in Euroclear's share

capital for EUR278.5 million, which equates to a value of EUR1,798

per share. We believe this commercial collaboration will benefit

both customers and shareholders alike further strengthening the

value of our holding of 3,618 shares in Euroclear.

Dividend

The Board has resolved not to pay an interim dividend for the

six month period to 30th November 2018.

Markets

The current market outlook is less clear than it has been for

many years. We have the major uncertainties of the Federal

Reserve's future interest rate policy and their quantitative

tightening, the US/China trade discussions, Brexit and the gentle

slide of the Eurozone into recession to contend with. Although

markets have recovered well since the start of the year a certain

degree of caution is warranted.

Outlook

The second half of our financial year began during a period of

weak markets with December being particularly quiet. However

sentiment turned quickly in January and markets have continued to

improve through February. We now anticipate a busy period leading

up to the end of the UK income tax year.

Clive F Harrison

Chairman

27 February 2019

Independent Review Report to Fiske plc

We have been engaged by the Group to review the condensed set of

financial statements in the half-yearly financial report for the

six months ended 30 November 2018 which comprise the consolidated

statement of comprehensive income, the consolidated statement of

changes in equity, the consolidated statement of financial

position, the consolidated cash flow statement and the related

notes 1 to 4. We have read the other information contained in the

half-yearly financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

This report is made solely to the Group in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our work has been undertaken so that we might state to the

Group those matters we are required to state to them in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Group, for our review work, for this

report, or for the conclusions we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules of the London Stock Exchange.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards (IFRSs) as adopted by the European Union. The

condensed set of financial statements included in this half-yearly

financial report have been prepared in accordance with the

accounting policies the Group intends to use in preparing its next

annual financial statements.

Our responsibility

Our responsibility is to express to the Group a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

November 2018 is not prepared, in all material respects, in

accordance with accounting policies the Group intends to use in

preparing its next annual financial statements and the AIM Rules of

the London Stock Exchange.

Deloitte LLP

Statutory Auditor

London

United Kingdom

27 February 2019

Consolidated Statement of Comprehensive Income

for the six months ended 30 November 2018

Six months Six months Year ended

ended ended 31 May

30 November 30 November 2018

2018 2017 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------ ----------

Fee and commission income 2,015 2,074 4,283

Other income - 75 80

Fair value through other

comprehensive income

(FVTOCI) 4 (4) 18

TOTAL REVENUE 2,019 2,145 4,381

Operating expenses (2,544) (1,955) (4,020)

-------------------------------------- ------------ ------------ ----------

OPERATING (LOSS) / PROFIT (525) 190 361

-------------------------------------- ------------ ------------ ----------

Investment revenue - - 103

Finance income 33 - -

(Loss) / Profit on ordinary

activities before taxation (492) 190 464

Taxation - - (4)

-------------------------------------- ------------ ------------ ----------

(Loss)/Profit on ordinary

activities after taxation (492) 190 460

-------------------------------------- ------------ ------------ ----------

Other comprehensive income/(expense)

Movement in unrealised

appreciation of investments 20 25 26

Deferred tax on movement

in unrealised appreciation

of investments (4) 12 12

-------------------------------------- ------------ ------------ ----------

Net other comprehensive

(expense)/ income 16 37 38

====================================== ============ ============ ==========

Total comprehensive (loss)

/ income for the period/year

attributable to equity

shareholders (476) 227 498

====================================== ============ ============ ==========

(Loss) / Earnings per

ordinary share (pence),

excluding other comprehensive

income

Basic (4.5p) 1.9p 4.2p

Diluted (4.5p) 1.8p 4.2p

All results are from continuing operations and are attributable

to equity shareholders of the parent company.

Consolidated Statement of Changes in Equity

Share Share Revaluation Retained Total

Capital Premium Reserve Earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- -------- -------- ----------- --------- -------

Balance at 1 December

2017 2,115 1,222 1,459 (1,309) 3,487

Profit on ordinary

activities after

taxation - - - 460 460

Movement in unrealised

appreciation of investments - - 26 - 26

Deferred tax on movement

in unrealised appreciation

of investments - - 12 - 12

Share based payment

transactions - - - 1 1

Issue of ordinary

share capital 775 775 - - 1550

----------------------------- -------- -------- ----------- --------- -------

Balance at 31 May

2018 2,890 1,997 1,497 (848) 5,536

----------------------------- -------- -------- ----------- --------- -------

(Loss) on ordinary

activities after

taxation - - - (492) (492)

Other comprehensive

income - - - 2 2

Movement in unrealised

appreciation of investments - - 21 - 21

Deferred tax on movement

in unrealised appreciation

of investments - - (4) - (4)

----------------------------- -------- -------- ----------- --------- -------

Total comprehensive

(loss) for the period - - 17 (490) (473)

----------------------------- -------- -------- ----------- --------- -------

Dividends paid - - - - -

----------------------------- -------- -------- ----------- --------- -------

Share based payment

transactions - - - 1 1

----------------------------- -------- -------- ----------- --------- -------

Balance at 30 November

2018 2,890 1,997 1,514 (1,337) 5,064

============================= ======== ======== =========== ========= =======

Consolidated Statement of Financial Position

30 November 2018

As at As at As at

30 November 30 November 31 May

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ------------ ------------ --------

Non-current assets

Goodwill and intangible

assets 1,510 1,524 1,576

Other intangible assets 113 146 130

Property, plant and equipment 37 20 35

Equity investments 2,491 2,468 2,470

Total non-current assets 4,151 4,158 4,211

------------------------------------ ------------ ------------ --------

Current assets

Trade and other receivables 2,364 2,508 4,087

Investments held at fair

value through other comprehensive

income (FVTOCI) - 8 0

Cash and cash equivalents 2,014 2,252 2,453

------------------------------------ ------------ ------------ --------

Total current assets 4,378 4,768 6,540

------------------------------------ ------------ ------------ --------

Current liabilities

Trade and other payables 3,212 3,418 4,965

Current tax liabilities 36 71 36

Total current liabilities 3,248 3,489 5,001

------------------------------------ ------------ ------------ --------

Net current assets 1,130 1,279 1,539

------------------------------------ ------------ ------------ --------

Non-current liabilities

Deferred tax liabilities 217 213 214

------------------------------------ ------------ ------------ --------

Total non-current liabilities 217 213 214

------------------------------------ ------------ ------------ --------

Net assets 5,064 5,224 5,536

==================================== ============ ============ ========

Equity

Share capital 2,890 2,890 2,890

Share premium 1,997 1,957 1,997

Revaluation reserve 1,514 1,496 1,497

Retained earnings (1,337) (1,119) (848)

------------------------------------ ------------ ------------ --------

Shareholders' equity 5,064 5,224 5,536

==================================== ============ ============ ========

Consolidated Cash Flow Statement

For the six months ended 30 November 2018

Six months Six months Year ended

ended ended 31 May

30 November 30 November 2018

2018 2017 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

-------------------------------- ------------ ------------ ----------

Operating activities (525) 190 361

Amortisation of intangibles 17 - 26

Depreciation of tangible

and intangible assets 9 32 20

Decrease/(increase) in

investments - 11 19

Remove opening receivables

of acquisition - (568) -

Amortisation of intangible

asset - customer relationships - 131 -

Remove opening payables

of acquisition - 475 -

Write down of goodwill 66 - -

Decrease/(increase) in

receivables 1,723 (252) (1,397)

Increase/(decrease) in

payables (1,751) 768 730

-------------------------------- ------------ ------------ ----------

Cash generated from / (used

in) operations (461) 656 (110)

Tax recovered - 71 (38)

-------------------------------- ------------ ------------ ----------

Net cash (used in)/generated

from operating activities (461) 727 (148)

-------------------------------- ------------ ------------ ----------

Investing activities

Interest received 33 - -

Investment income received - - 103

Interest paid - (1) -

Purchases of property,

plant and equipment (11) (12) (45)

Purchases of other intangible

assets - - (12)

Payments to acquire subsidiary

undertaking - (3,357) (2,092)

Cash acquired with subsidiary

undertaking - 2,320 2,320

Net cash (used in)/ generated

from investing activities 22 (1,060) 274

-------------------------------- ------------ ------------ ----------

Financing activities

Proceeds from issue of

ordinary share capital - 1,550 1,292

Dividends paid - - -

-------------------------------- ------------ ------------ ----------

Net cash used in financing

activities - 1,550 1,292

-------------------------------- ------------ ------------ ----------

Net (decrease) / increase

in cash and cash equivalents (439) 1,217 1,418

Cash and cash equivalents

at beginning of period 2,453 1,035 1,035

Cash and cash equivalents

at end of period/year 2,014 2,252 2,453

-------------------------------- ------------ ------------ ----------

Notes to the Interim Financial Statements

1. Basis of preparation

The financial information contained in this half-yearly

financial report does not constitute statutory accounts as defined

in section 434 of the Companies Act 2006.

The figures and financial information for the period ended 31

May 2018 are extracted from the latest published audited financial

statements of the Group and do not constitute the statutory

financial statements for that period. The audited financial

statements for the period ended 31 May 2018 have been filed with

the Registrar of Companies. The report of the independent auditors

on those financial statements contained no qualification or

statement under section 498(2) or section 498(3) of the Companies

Act 2006.

The condensed set of financial statements has been prepared

using accounting policies consistent with International Financial

Reporting Standards (IFRSs) as adopted by the European Union. The

financial information has been prepared under the historical cost

convention, except for the revaluation of certain financial

instruments. The same accounting policies, presentation and methods

of computation are followed in these condensed set of financial

statements as applied in the Group's latest, and intends to use in

preparing its next, annual audited financial statements. While the

financial figures included in this half-yearly report have been

computed in accordance with IFRSs applicable to interim periods,

this half-yearly report does not contain sufficient information to

constitute an interim financial report as that term is defined in

IAS 34.

In the current period, no standards or interpretations, new or

revised, have been adopted that have had a significant impact on

the amounts reported in the financial statements. This is the first

set of the Group's financial statements where IFRS 9 and IFRS 15

have been applied. These new standards were adopted from 1 June

2018 and have not had a significant impact on the amounts reported

in these financial statements.

Under IAS 27 these financial statements are prepared on a

consolidated basis where the Group consists of Fiske plc, the

parent, with the following subsidiaries in which it owns 100% of

the voting rights:

VOR Financial Strategy Limited

Ionian Group Limited

Fiske Nominees Limited

Fieldings Investment Management Limited

The directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. Thus they continue to adopt the going concern

basis of accounting in preparing this half-yearly financial

report.

There has been no impact on the classification and measurement

of the Group's financial assets and liabilities, except for equity

assets that were classified as available--for--sale under IAS 39

which, at the date of initial application of IFRS 9, the Group is

applying the Fair Value through Other Comprehensive Income

("FVOCI") option. A review of the expected credit loss on

receivables has been conducted and the impact thereof is expected

to be de-minimis.

2. Taxation

No tax credit on the loss for the period has been recognised for

the six months to 30 November 2018, due to uncertainty over

sufficient future taxable profits being available.

3. Dividends paid

Dividends paid in the first period of 2019 GBPnil (2018 -

GBPnil).

4. IAS39 and IFRS9

The change in classification of the Euroclear holding from IAS39

to IFRS9 will result in the financial asset continuing to be valued

at fair value but subsequent gains or losses will be recognised in

other comprehensive income rather than profit and loss

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BUGDDLDDBGCI

(END) Dow Jones Newswires

February 28, 2019 10:34 ET (15:34 GMT)

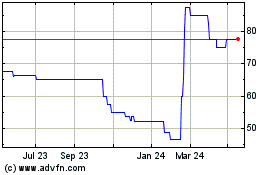

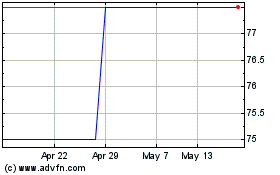

Fiske (LSE:FKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fiske (LSE:FKE)

Historical Stock Chart

From Apr 2023 to Apr 2024