UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2014

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number: 000-53408

MEDICAN ENTERPRISES, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

|

87-0474017

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

3440 East Russell Road

|

|

|

|

Las Vegas, NV

|

|

89120

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(800) 416-8802

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark if the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

(1) Yes [X] No [ ] (2) Yes [X] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company:

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate estimated market value was determined by multiplying the approximate number of shares of common stock held by non-affiliates by the average bid price of such stock $1.89 on the last day of the Company’s second fiscal quarter, as quoted on the Over-the-Counter Bulletin Board (the “OTCBB”) of the Financial Industry Regulatory Authority (“FINRA”). There were 21,393,336 shares of common voting stock held by non-affiliates, valued in the aggregate at $40,433,405.

Outstanding Shares

As of April 15, 2015, the Registrant had 447,063,367 shares of common stock outstanding.

Documents Incorporated by Reference

See Part IV, Item 15.

TABLE OF CONTENTS

| |

Page

|

|

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

|

ii |

| |

|

|

PART I

|

1 |

| |

|

|

ITEM 1. BUSINESS

|

1 |

| |

|

|

ITEM 1A. RISK FACTORS

|

8

|

| |

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS

|

17

|

| |

|

|

ITEM 2: PROPERTIES

|

17

|

| |

|

|

ITEM 3: LEGAL PROCEEDINGS

|

17

|

| |

|

|

ITEM 4: MINE SAFETY DISCLOSURES

|

17 |

| |

|

|

PART II

|

18 |

| |

|

|

ITEM 5: MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

18

|

| |

|

|

ITEM 6: SELECTED FINANCIAL DATA

|

26

|

| |

|

|

ITEM 7: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

26

|

| |

|

|

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

27

|

| |

|

|

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

28

|

| |

|

|

ITEM 9A: CONTROLS AND PROCEDURES

|

45

|

| |

|

|

ITEM 9B: OTHER INFORMATION

|

45

|

| |

|

|

PART III

|

46 |

| |

|

|

ITEM 10: DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

46

|

| |

|

|

ITEM 11: EXECUTIVE COMPENSATION

|

49 |

| |

|

|

ITEM 12: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

50 |

| |

|

|

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

51 |

| |

|

|

ITEM 14: PRINCIPAL ACCOUNTING FEES AND SERVICES

|

52 |

| |

|

|

PART IV

|

52 |

| |

|

|

ITEM 15: EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

52 |

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

This Annual Report and the documents we have filed with the United States Securities and Exchange Commission (the “SEC”) that are incorporated by reference herein contain forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve significant risks and uncertainties. Any statements contained, or incorporated by reference, in this Annual Report that are not statements of historical fact may be forward-looking statements. When we use the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” and other similar terms and phrases, including references to assumptions, we are identifying forward-looking statements. Forward-looking statements involve significant risks and uncertainties which may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements.

A variety of factors, some of which are outside our control, may cause our operating results to fluctuate significantly. They include, but are not limited to:

|

|

•

|

the new and evolving regulatory requirements in the U.S. and Canada regarding the production and distribution of medical marijuana;

|

|

|

•

|

our ability to secure and maintain our relationships with our key commercial partners or otherwise establish our business;

|

|

|

•

|

our expectations regarding the commercial market for our products;

|

|

|

•

|

the effect of competition; and

|

|

|

•

|

the availability of required additional financing.

|

As more fully described in this Annual Report under the heading “Risk Factors,” many important factors may affect our ability to achieve our stated objectives and to manufacture and commercialize our products, including, among other things, our ability to:

|

|

•

|

obtain substantial additional funds to commence and expand our planned operations;

|

|

|

•

|

obtain and maintain all necessary regulatory approvals and licenses and to operate our business in compliance with the same;

|

|

|

•

|

meet obligations and required milestones under agreements;

|

|

|

•

|

retain key executives, and attract, retain and motivate qualified personnel;

|

|

|

•

|

be capable of manufacturing and distributing our product in commercial quantities at reasonable costs; and

|

|

|

•

|

compete against others in a profitable manner.

|

Moreover, new risks regularly emerge and it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this Annual Report are based on information available to us on the date hereof. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this Annual Report and the documents we have filed with the SEC.

PART I

ITEM 1. BUSINESS

Medican Enterprises, Inc. is a bio-pharmaceutical company focused on pursuing business opportunities in the growing medical and recreational marijuana sector. Through our subsidiaries, we are seeking to invest in businesses associated with the growing, marketing, research and development, training, distribution and retail sale of medical and recreational marijuana, both in the United States and Canada. We are seeking to establish and expand a real estate and leasing services business under which we would lease real estate that is outfitted with turnkey solutions for legally compliant marijuana growing facilities to licensed growers. As of the date of this report, we have not commenced the actual the production and sale of medical marijuana but are seeking to lay the foundation to commence this business or related business in the marijuana sector. References in this report to “we,” “us,” “our” and “the Company” are to Medican Enterprises, Inc. and its subsidiaries.

Other businesses have been operated through our company in the past. The following are the material organizational business developments related to our company since inception:

Corporate History (1990-2012)

We were organized under the laws of the State of Nevada on October 27, 1988, under the name “Extant Investments, Inc.”

Commencing on or about December 5, 1990, pursuant to a Registration Statement on Form S-18 filed with the SEC and Exchange Commission and a prospectus dated as of such date, our company offered and sold units consisting of common stock and warrants that was closed on January 31, 1991.

Effective May 17, 1991, we acquired all of the issued and outstanding shares of common stock of Sentinel Diagnostics, Inc., an Arizona corporation, pursuant to an Agreement and Plan of Reorganization, and changed our name to “Sentinel Scientific, Inc.” The Sentinel Diagnostics business operations were discontinued in late 1992 for lack of funding.

Effective August 10, 1993, and pursuant to a Reorganization Agreement, we acquired all of the outstanding shares of common stock of A.F.C. Entertainment, Inc., a corporation organized under The Companies Act of Barbados, and changed our name to “TC X Calibur, Inc.”

Effective December 31, 1993, we acquired all of the outstanding shares of common stock of Film Opticals Investments, Limited, a corporation organized under the laws of the Province of Ontario, Canada (“Film Opticals”).

In 1993, Film Opticals of Canada Limited, a wholly-owned subsidiary of Film Opticals (“Film Opticals of Canada”), sought court protection by filing a Notice of Intention to Make a Proposal pursuant to Subsection 50.4(1) of the Bankruptcy and Insolvency Act of Canada, because of a dispute with a creditor pursuant to a secured promissory note, and a trustee (the “Trustee”) was appointed to oversee Film Opticals of Canada’s financial management in the Ontario Justice Court, General Division, Case No. B163/94. Operation of the Film Opticals business continued pending a resolution of the dispute with this creditor.

On or about December 28, 2004, pursuant to resolutions adopted by our Board of Directors and approved by the holders of a majority our outstanding shares of common stock, we sold substantially all of our assets by the conveyance of our wholly-owned subsidiary, Film Opticals (and its subsidiary, Film Opticals of Canada), and our film library (“Film Library”), to Film Opticals of Canada 2004 Limited, a newly formed corporation organized under the Province of Ontario, Canada (“New Film Opticals”), and a wholly-owned subsidiary of Berliner Holdings, Inc. (“Berliner”). Berliner was wholly-owned by our then President, Claus Voellmecke. As consideration of the purchase and sale of these assets, Berliner agreed to cancel 500,000 shares of our common stock that it owned and agreed, together with New Film Opticals, to assume, pay and/or compromise all of our outstanding claims or liabilities related to Film Opticals and our Film Library and indemnify and hold us harmless from them. For additional information, please see our 8-K Current Report, our 8-K/A-1 Current Report and our 8-K/A-2 Current Report that have been previously filed with the Securities and Exchange Commission on or about December 8, 2004, December 9, 2004 and January 4, 2005, respectively, and which include a copy of the Definitive Proxy Statement that was mailed to our stockholders on or about December 8, 2004.

In addition to the above referenced sale of substantially all of our assets on or about December 28, 2004, pursuant to resolutions adopted by our Board of Directors and approved by the holders of a majority of our outstanding shares of common stock, we amended our Articles of Incorporation to change our capitalization to add a class of preferred stock, and gave our Board of Directors authority to effect recapitalizations and/or name changes without further stockholder approval.

On or about September 15, 2005, certain shares of our outstanding common stock were acquired pursuant to a private transactions which shares, when accumulated with shares of our common stock that were already owned by these persons, represented a controlling interest in us.

On November 2, 2007, we announced the execution of a Letter of Intent to acquire EV Rental, LLC, a California limited liability company. On March 3, 2008, we terminated our obligations under the Letter of Intent.

On December 28, 2007, in the OTCBB trading market on that date, we effected a forward split of our outstanding common stock on a basis of 2.3943 for one, while retaining the current par value of $0.001 per share, with all fractional shares rounded up to the nearest whole share, and with appropriate adjustments in our capital accounts. All share references and computations herein take into account this recapitalization.

On February 28, 2008, we filed Restated Articles of Incorporation with the State of Nevada, a copy of which is incorporated herein by reference. See Part IV, Item 15.

On September 11, 2008, we filed a registration statement on Form 10 of the SEC registering our common stock under Section 12(g) of the Exchange Act. This registration statement became effective on or about November 9, 2008.

There were no material business developments in 2009.

On November 29, 2010, in the OTCBB trading market on that date, we effected a reverse split of our outstanding common stock on a basis of one for four, while retaining the current par value of $0.001 per share, with all fractional shares rounded up to the nearest whole share, and with appropriate adjustments in our capital accounts. All share references and computations herein take into account this recapitalization.

There were no material business developments in 2011 or 2012.

Recent Developments

On January 21, 2014, we appointed a new director, Gary Johnson.

On February 18, 2014, we appointed a new Chief Financial Officer, Wayne Hansen.

During 2014, we sought to acquire a 51% interest in International Herbs Medical Marijuana Ltd. (“IHMML”), a company that is applying to obtain licensed producer status from Health Canada and seeking to establish marijuana growing and distribution facilities in Canada. On July 25, 2014, we and our CanaLeaf subsidiary entered into a Non-binding Letter of Intent (the “LOI”) with Zenabis Limited Partnership (“Zenabis”) and IHMML. Pursuant to the LOI, we sought to restructure our proposed acquisition of an interest in IHMML so that we would acquire an outright 51% interest in IHMML and an option to acquire the remainder and, in return, IHMML and its affiliates would obtain a majority ownership interest in and control of our company. Due to regulatory challenges in Canada and other structuring challenges, this opportunity is not presently the focus of our operations, but we will continue to monitor IHMML and potentially revisit the opportunity should conditions warrant.

In early March 2014, our Board of Directors and majority stockholder approved an increase of our authorized shares of common stock from 50,000,000 to 100,000,000 shares.

In October, 2014, the Company appointed Drew Milburn to the position of CEO of our subsidiary, Medican (US) Systems, Inc.

On October 21, 2014, the Company entered into a binding letter of intent to acquire Future Harvest Development Ltd. (“Future Harvest”), a Canadian manufacturing company in the home and garden, indoor growing, and hydroponic sector. Under the terms of the letter of intent, the Company will acquire 70% interest in Future Harvest, with an option to acquire the remaining 30%, for approximately $5 million in a combination of cash and common stock. Medican has not been able reach a mutually acceptable agreement with the various parties involved. As a result, the parties have terminated the letter of intent and the refundable portion of the deposit funds have been returned to Medican.

On December 2, 2014, the Company signed an agreement to acquire a 67,000 square foot facility in Phoenix, Arizona which the company plans to lease as a marijuana growing and warehouse facility to licensed growers. The industrial building sits on 2.55 acres of industrial zoned land. The anticipated final purchase price for the property is $2,340,310 and a closing is planned during the first quarter of 2015 pending, among other closing conditions, a variance to zone the building for the cultivation of marijuana. The acquisition of this property will launch Medican’s real estate and leasing services business under which the company would lease real estate that is outfitted with turnkey solutions for legally compliant growing facilities to licensed growers.

On January 20, 2015, the Company entered into a purchase agreement to acquire a 7,200 square foot retail and commercial property in Phoenix, Arizona. The property is currently leased through August 2018 to an Arizona state licensed medical marijuana dispensary. Per the purchase agreement, the lease agreement will be assigned to Medican. The rental amount of the current lease is in excess of $200,000 annually, triple net. The lease provides for two five-year tenant renewal options. The lease rate increases at 3 percent per year or CPI, whichever is greater. Total purchase price for the property is $2,250,000, which Medican expects to pay through a combination of mortgage debt and an $850,000 convertible promissory note secured by the property. The property’s value has been appraised at $2,385,000 and was substantiated by an independent appraiser. As per the Amendment No. 2 and 3 to the original agreement, the closing for the purchase of this property is expected to occur on or before May 31, 2015.

On February 16, 2015, the Company filed with the State of Nevada a Certificate of Amendment to its Articles of Incorporation increasing the authorized amount of shares of common stock to 1,000,000,000 shares, par value $0.001 per share. The Company is also authorized, according to the Definitive Information Statement dated January 26, 2015, to enact a reverse split in an amount up to 1:10 according to the Board of Director’s discretion.

Overview of Current Business

We are a bio-pharmaceutical business currently focused on pursuing business opportunities in the growing medical and recreational marijuana sector. We also are actively searching to acquire smaller operations in the medical and recreational marijuana industry in Canada and the United States with the intention of increasing their profits through economies of scale.

We currently have five wholly-owned subsidiaries through which we operate our business.

Medican Systems Inc. (“Medican Systems”) is a corporation incorporated under the laws of the Territory of the Yukon under incorporation number 535642 on December 30, 2013. The authorized share structure is an unlimited number of common shares without par value, with 100 common shares issued to our company, making Medican Systems our direct wholly-owned subsidiary. The primary focus of Medican Systems is to function as a holding company for Canadian based investments, joint ventures and opportunities.

Medican (Delta) Systems Inc. is a corporation incorporated under the laws of the Province of British Columbia under incorporation number BC0989867 on December 31, 2013. The authorized share structure is an unlimited number of common shares without par value, with 100 common shares issued to Medican Systems. The primary focus of Medican Delta is to pursue opportunities in the medical marijuana industry in and around the city of Delta in British Columbia, Canada.

CanaLeaf Systems Inc. is a corporation incorporated under laws of Canada under the Canada Business Corporation Act under incorporation number 883348-6 on March 25, 2014. The authorized share structure is an unlimited number of common shares. CanaLeaf is our operating subsidiary focused on business opportunities.

Medican (US) Systems, Inc. (“Medican US”) is a corporation incorporated under laws of Nevada on September 26, 2014 and is also a subsidiary of Medican Systems. Medican US is our operating subsidiary focused on business opportunities in the United States. The new entity, operating out of Las Vegas, Nevada, will:

|

|

·

|

seek investments in commercial real estate which it can lease to marijuana growers in states where growing is legal;

|

|

|

·

|

provide dispensary management and professional consulting services to the medical marijuana and recreational marijuana sectors; and

|

|

|

·

|

offer a broad range of leasing and financing solutions to dispensaries, kitchens and cultivations centers.

|

Medican Nations, LLC (“Medican Nations”) is a corporation incorporated under the laws of Nevada on February 6, 2015 and is also a subsidiary of Medican Systems. Medican Nations will be focused on building strategic partnerships with Indian communities in the United States and Canada to create and build business solutions within the indoor gardening and marijuana industries.

Our plan of operation for the next 12 months is to continue to seek to acquire or establish joint ventures with businesses in the medical and recreational marijuana sector. To that end, in the last quarter of 2014 and first quarter of 2015, we entered into purchase agreements to acquire a 7,200 square foot retail and commercial property in Phoenix, Arizona, and an agreement to acquire a 67,000 square foot facility in Phoenix, Arizona which the company plans to lease as a marijuana growing and warehouse facility to licensed growers. We are actively seeking similar and other business opportunities in the marijuana sector, including operating businesses such as these and the possibility of acquiring real estate which we can then lease to licensed growers in jurisdictions where such activities are permissible.

Our Products and Markets

We are actively meeting with other companies and individuals in the medical marijuana industry to establish relationships and partnerships that we believe will benefit us and out subsidiaries going forward.

Currently, there are a number of other companies that are in the marijuana industry, many of which we consider to be our competition. Many of these companies provide similar products and/or services, such as leasing of real estate, warehouse sales, and consulting services. In the future the Company fully expects that other companies will recognize the value of ancillary businesses serving the marijuana industry and enter into the marketplace as competitors.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. We file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the SEC in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the SEC if they become necessary in the course of our Company’s operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Effect of Existing or Probable Governmental Regulations on the Business

United States

Marijuana is a Schedule I controlled substance and is illegal under federal law. Even in those states in which the use of marijuana has been legalized, its use remains a violation of federal laws.

A Schedule I controlled substance is defined as a substance that has no currently accepted medical use in the United States, a lack of safety for use under medical supervision and a high potential for abuse. The Department of Justice defines Schedule I controlled substances as “the most dangerous drugs of all the drug schedules with potentially severe psychological or physical dependence.” If the federal government decides to enforce the Controlled Substances Act in Colorado with respect to marijuana, persons that are charged with distributing, possessing with intent to distribute, or growing marijuana could be subject to fines and terms of imprisonment, the maximum being life imprisonment and a $50 million fine.

As of January 13, 2015, 23 states and the District of Columbia allow their residents to use medical marijuana. Voters in the states of Colorado, Washington, Oregon and Alaska have approved ballot measures to legalize cannabis for adult use. The state laws are in conflict with the federal Controlled Substances Act, which makes marijuana use and possession illegal on a national level. The Obama administration has effectively stated that it is not an efficient use of resources to direct law federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical marijuana. However, there is no guarantee that the administration will not change its stated policy regarding the low-priority enforcement of federal laws. Additionally, any new administration that follows could change this policy and decide to enforce the federal laws strongly. Any such change in the federal government’s enforcement of current federal laws could cause significant financial damage to us. While we do not intend to harvest, distribute or sell cannabis, we may be irreparably harmed by a change in enforcement by the federal or state governments.

Despite the Obama administration’s statements, the Department of Justice has stated that it will continue to enforce the Controlled Substance Act with respect to marijuana in Colorado to prevent:

|

1.

|

the distribution of marijuana to minors;

|

|

2.

|

criminal enterprises, gangs and cartels receiving revenue from the sale of marijuana;

|

|

3.

|

the diversion of marijuana from states where it is legal under state law to other states;

|

|

4.

|

state-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity;

|

|

5.

|

violence and the use of firearms in the cultivation and distribution of marijuana;

|

|

6.

|

driving while impaired and the exacerbation of other adverse public health consequences associated with marijuana use;

|

|

7.

|

the growing of marijuana on public lands; and

|

|

8.

|

marijuana possession or use on federal property.

|

We do not presently grow or distribute marijuana. However, our anticipated business of providing of ancillary products and services to state-approved marijuana growers and dispensary facilities could be deemed to be aiding and abetting illegal activities, a violation of federal law. We intend to remain within the guidelines outlined in the Cole Memo (see the “Risk Factors” section below), which does not alter the Department of Justice’s authority to enforce federal law, including federal laws relating to marijuana, but does recommend that U.S. Attorneys prioritize enforcement of federal law away from the marijuana industry operating as permitted under certain state laws, so long as certain conditions are met. Where the individual state framework fails to protect the public, the Justice Department has instructed federal prosecutors to enforce the Controlled Substances Act of 1970. However, we cannot provide assurance that the Company is in full compliance with the Cole Memo or any other federal laws or regulations.

Our ongoing and future business plans rely on our ability to successfully establish and maintain effective controls that follow the United States Treasury Department’s Financial Crimes Enforcement Network (“FinCEN”) Guidance, “BSA Expectations Regarding Marijuana-Related Businesses,” in vetting and monitoring potential tenants, customers and clients of the Company. On February 14, 2014, FinCEN issued guidance to clarify Bank Secrecy Act (“BSA”) expectations for financial institutions seeking to provide services to marijuana-related businesses. FinCEN issued this guidance in light of certain state initiatives to legalize certain marijuana-related enforcement priorities. The FinCEN guidance clarifies how financial institutions can provide services to marijuana-related businesses consistent with their BSA obligations, and aligns the information provided by financial institutions in BSA reports with federal and state law enforcement priorities. This FinCEN guidance is intended to enhance the availability of financial services for, and the financial transparency of, marijuana-related businesses.

While ACS is not currently subject to the BSA or FinCEN guidelines, we will institute policies and procedures that mirror the stated goals of the FinCEN guidelines and will provide a framework, by which the Company believes it can comply with the federal government’s stated objectives with respect to the potential conflict of law. The Company plans to use the FinCEN Guidelines, as may be amended, as the basis for assessing its relationships with potential tenants, clients and customers.

Where applicable, we will apply for state licenses that are necessary to conduct our business in compliance with local laws.

Smaller Reporting Company Status

We are subject to the reporting requirements of Section 13 of the Exchange Act, and we are subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K, including comprehensive information in the Summary Compensation Tables, a reduction of information included in the Management’s Discussion and Analysis section, and decreased reporting obligations in Item 404 Transactions with Related Persons.

Sarbanes-Oxley Act

We are also subject to the Sarbanes-Oxley Act of 2002 and related rules and regulations. The Sarbanes-Oxley Act created a strong and independent accounting oversight board to oversee the conduct of auditors of public companies and strengthens auditor independence. It also requires steps to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; creates guidelines for audit committee members’ appointment, compensation and oversight of the work of public companies’ auditors; management assessment of our internal controls; auditor attestation to management’s conclusions about internal controls; prohibits certain insider trading during pension fund blackout periods; requires companies and auditors to evaluate internal controls and procedures; and establishes a federal crime of securities fraud, among other provisions. Compliance with the requirements of the Sarbanes-Oxley Act has the potential to substantially increase our legal and accounting costs.

Exchange Act Reporting Requirements

Section 14(a) of the Exchange Act requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders at a special or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information outlined in Schedules 14A or 14C of Regulation 14; preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies of this information are forwarded to our stockholders.

On September 11, 2008, we filed a registration statement on Form 10 of the SEC registering our $0.001 par value common stock under Section 12(g) of the Exchange Act. This registration statement became effective on or about November 9, 2008.

We are required to file Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q with the SEC on a regular basis, and are required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in a Current Report on Form 8-K. We are not considered an emerging growth company under the JOBS Act because the Company sold securities pursuant to an effective registration statement prior to December 8, 2011.

Research and Development Costs During the Last Two Fiscal Years

None; not applicable.

Cost and Effects of Compliance with Environmental Laws

We do not believe that our current or intended business operations are subject to any material environmental laws, rules or regulations that would have an adverse material effect on our business operations or financial condition or result in a material compliance cost; however, we will become subject to all such governmental requirements to which the reorganized, merged or acquired entity is subject or may become subject.

As of March 31, 2015, we have three employees, our CEO, Ken Williams, our CFO, Wayne Hansen, and CEO of Medican (US) Systems, Inc., Drew Milburn.

Additional Information

You may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may also find all of the reports or registration statements that we have previously filed electronically with the SEC at its Internet site at www.sec.gov. Please call the SEC at 1-202-551-8090 for further information on this or other Public Reference Rooms.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Annual Report, before making an investment decision. If any of the following or similar risks actually occurs, our business, financial condition or results of operations could suffer and our business might fail. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Cautionary Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this Annual Report.

Risks Related to Our Business

We have only recently commenced operations and are thus subject to the risks associated with new businesses.

We have only recently commenced developing and pursuing business opportunities in the medical and recreational marijuana market. As of the date of this Annual Report, we have no cash resources, products, manufacturing facilities or sales and marketing operations. As such, we are a “start-up” company with no history of revenue-generating operations. We are, and expect for the foreseeable future to be, subject to all the risks and uncertainties, inherent in a new business. As a result, we still must establish many functions necessary to operate a business, including finalizing our managerial and administrative structure, acquiring our manufacturing facilities, continuing product development, assessing and commencing our marketing activities, implementing financial systems and controls, and recruiting personnel.

Accordingly, you should consider our prospects in light of the costs, uncertainties, delays, and difficulties frequently encountered by companies in their pre-revenue generating stages, particularly those in heavily regulated industries like the medical marijuana industry. Potential investors should carefully consider the risks and uncertainties that a company with no operating history will face. In particular, potential investors should consider that there is a significant risk that we will not be able to:

|

|

·

|

implement or execute our current business plan, or that our business plan is sound;

|

|

|

·

|

raise sufficient funds in the capital markets or otherwise to effectuate our business plan;

|

|

|

·

|

maintain and expand our management team and Board of Directors;

|

|

|

·

|

determine that the processes that we are developing are commercially viable; and/or

|

|

|

·

|

attract, enter into, or maintain contracts with, and retain customers.

|

If we cannot execute any one of the foregoing, our business may fail, in which case you would lose the entire amount of your investment in our company.

We currently have no cash resources and therefore must raise additional funds in the near term and again thereafter in order to continue our business, and we will continue to need additional financing to carry out our business plan.

We currently have no cash resources. We need to obtain significant additional funding to successfully continue our business. Such additional funds may not be readily available or may not be available on terms acceptable to us. As such, our failure to raise funding in the near future would have a significantly adverse impact on our business viability and could cause our business to fail. We do not currently have any arrangements or credit facilities in place as a source of funds, and there can be no assurance that we will be able to raise sufficient additional capital on acceptable terms, or at all.

If we raise additional capital by issuing equity securities, the percentage ownership of our existing stockholders may be reduced, and accordingly these stockholders may experience substantial dilution. We may also issue equity securities that provide for rights, preferences and privileges senior to those of our common stock. Given our need for cash and that equity raising is the most common type of fundraising for companies like ours, the risk of dilution is particularly significant for stockholders of our company.

Debt financing, if obtained, may involve agreements that include liens on our assets, covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, could increase our expenses and require that our assets be provided as a security for such debt. Debt financing would also be required to be repaid regardless of our operating results.

If we raise additional funds through collaborations and licensing arrangements, we may be required to relinquish some rights to our technologies or candidate products, or to grant licenses on terms that are not favorable to us.

We cannot accurately predict the volume or timing of any future sales, making the timing of any revenues difficult to predict.

We may be faced with regulatory or operational challenges that could impede our ability to commence sales of our marijuana products. Consequently, we may incur substantial expenses and devote significant management effort and expense in launching sales efforts, which may not result in revenue generation. We must also obtain regulatory approvals to engage in our business, which is subject to risk and potential delays, and which may not actually occur. As such, we cannot accurately predict the volume or timing of any future sales of our products.

We may not be able to effectively manage our growth.

If we are able to launch our business, any growth in or expansion of our business is likely to place a strain on our management and administrative resources, infrastructure, and systems. As with other growing businesses, we expect that we will need to further refine and expand our business development capabilities, our systems and processes, and our access to financing sources. We also will need to hire, train, supervise, and manage new employees. These processes are time consuming and expensive, will increase management responsibilities, and will divert management attention. We cannot assure you that we will be able to:

|

·

|

expand our products effectively or efficiently or in a timely manner;

|

|

·

|

allocate our human resources optimally;

|

|

·

|

meet our capital needs;

|

|

·

|

identify and hire qualified employees or retain valued employees; or

|

|

·

|

incorporate effectively the components of any business or product line that we may acquire in our effort to achieve growth.

|

Our inability or failure to manage our growth and expansion effectively could harm our business and materially and adversely affect our operating results and financial condition.

If we incur substantial liability from litigation, complaints, or enforcement actions our financial condition could suffer.

Litigation, complaints, and enforcement actions involving us could consume considerable amounts of financial and other corporate resources, which could have a negative impact on our sales, revenue, profitability and growth prospects. We have not been, and are not currently, subject to any material litigation, complaint or enforcement action regarding our publications by any federal, state or foreign regulatory authority.

We will be required to attract and retain top quality talent to compete in the marketplace.

We believe our future growth and success will depend in part on our ability to attract and retain highly skilled managerial, product development, sales and marketing, and finance personnel. There can be no assurance of success in attracting and retaining such personnel. Shortages in qualified personnel could limit our ability to increase sales of existing products and services and launch new product and service offerings. The population of the area and preference for youth to move from the North to the South of Canada is a risk factor that will require considerable planning and recruitment efforts.

Our forecasts are highly speculative in nature and we cannot predict results in a development stage company with a high degree of accuracy.

Any financial projections, especially those based on ventures with minimal operating history, are inherently subject to a high degree of uncertainty, and their ultimate achievement depends on the timing and occurrence of a complex series of future events, both internal and external to the enterprise. There can be no assurance that potential revenues or expenses we project will, in fact, be received or incurred.

We will be subject to evolving and expensive corporate governance regulations and requirements. Our failure to adequately adhere to these requirements or the failure or circumvention of our controls and procedures could seriously harm our business.

As a publicly traded company, we are subject to various federal, state, and other rules and regulations, including applicable requirements of the Sarbanes-Oxley Act of 2002. Compliance with these evolving regulations is costly and requires a significant diversion of management time and attention, particularly with regard to our disclosure controls and procedures and our internal controls over financial reporting. Our internal controls and procedures may not be able to prevent errors or fraud in the future. Faulty judgments, simple errors or mistakes, or the failure of our personnel to adhere to established controls and procedures, may make it difficult for us to ensure that the objectives of the control system are met. A failure of our controls and procedures to detect other than inconsequential errors or fraud could seriously harm our business and results of operations. Moreover, our internal controls and our ability to comply with applicable laws, rules and regulations is impaired as we do not maintain independent audit and compensation committees of our board of directors.

The limited size of our senior management team may hamper our ability to effectively manage a publicly traded company while developing our products, which may harm our business.

Our management team has experience in the management of publicly traded companies and complying with federal securities laws, including compliance with recently adopted disclosure requirements on a timely basis. They realize it will take significant resources to meet these requirements while simultaneously working on developing, marketing, distributing, and protecting our products. Our management will be required to design and implement appropriate programs and policies in responding to increased legal, regulatory compliance and reporting requirements, and any failure to do so could lead to the imposition of fines and penalties and harm our business. The limited size of our management team may hinder our ability to effectively expand our R&D, conduct clinical trials and horticulture advancements, meet regulatory demands, or otherwise develop, market, or sell our products.

Our independent auditor's reports on our financial statements for the years ended December 31, 2014 and 2013 includes a "going concern" explanatory paragraph.

Our independent auditor has presented our financial statements on the basis that we are a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business over a reasonable length of time. This means that we may not generate enough funds to pay our general operating expenses and bills from professionals and other advisors that we are obligated to pay.

We may not acquire the facilities as planned and will therefore not be able to commence operations on the timetable or the scale that we have planned.

A key component to our growth and future operations are the retrofitting of two potential facilities in New Brunswick to house our growing and business operations. If these facilities are not obtained or if something happens to these facilities, the company may experience significant delays and expenses as it finds new facilities.

Risks Related to Our Industry

Federal regulation and enforcement may adversely affect the implementation of medical marijuana laws and regulations may preclude us from operating our proposed business, and even of we do operate such business, could negatively impact our revenues and potential profits.

Our business plan is to operate promising business opportunities in the marijuana space. Marijuana is a schedule-I controlled substance and is illegal under federal law. Even in those states in which the use of marijuana has been legalized, its use remains a violation of federal law. Since federal law criminalizing the use of marijuana preempts state laws that legalize its use, strict enforcement of federal law regarding marijuana would likely result in our inability to proceed with our business plan and the failure of our company.

Currently, there are 23 states plus the District of Columbia that have laws and/or regulations that recognize, in one form or another, legitimate medical uses for cannabis and consumer use of cannabis in connection with medical treatment. Many other states are considering similar legislation. Conversely, under the Controlled Substance Act (the “CSA”), the policies and regulations of the Federal government and its agencies are that cannabis has no medical benefit and a range of activities including cultivation and the personal use of cannabis is prohibited. Unless and until Congress amends the CSA with respect to medical marijuana, as to the timing or scope of any such potential amendments there can be no assurance, there is a risk that federal authorities may enforce current federal law, and we may be deemed to be producing, cultivating or dispensing marijuana in violation of federal law with respect to our proposed business operations or we may be deemed to be facilitating the selling or distribution of drug paraphernalia in violation of federal law. Active enforcement of the current federal regulatory position on cannabis may thus indirectly and adversely affect our revenues and profits. The risk of strict enforcement of the CSA in light of Congressional activity, judicial holdings and stated federal policy remains uncertain.

The U.S. Supreme Court declined to hear a case brought by San Diego County, California that sought to establish federal preemption over state medical marijuana laws. The preemption claim was rejected by every court that reviewed the case. The California 4th District Court of Appeals wrote in its unanimous ruling, “Congress does not have the authority to compel the states to direct their law enforcement personnel to enforce federal laws.” However, in another case, the U.S. Supreme Court held that, as long as the CSA contains prohibitions againstmarijuana, under the Commerce Clause of the United States Constitution, the United States may criminalize the production and use of homegrown cannabis even where states approve its use for medical purposes.

In an effort to provide guidance to federal law enforcement, the Department of Justice (the “DOJ”) has issued Guidance Regarding Marijuana Enforcement to all United States Attorneys in a memorandum from Deputy Attorney General David Ogden on October 19, 2009, in a memorandum from Deputy Attorney General James Cole on June 29, 2011 and in a memorandum from Deputy Attorney General James Cole on August 29, 2013. Each memorandum provides that the DOJ is committed to the enforcement of the CSA, but, the DOJ is also committed to using its limited investigative and prosecutorial resources to address the most significant threats in the most effective, consistent and rational way.

The August 29, 2013 memorandum provides updated guidance to federal prosecutors concerning marijuana enforcement in light of state laws legalizing medical and recreational marijuana possession in small amounts. The memorandum sets forth certain enforcement priorities that are important to the federal government:

| |

·

|

Distribution of marijuana to children;

|

| |

·

|

Revenue from the sale of marijuana going to criminals;

|

| |

·

|

Diversion of medical marijuana from states where it is legal to states where it is not;

|

| |

·

|

Using state authorized marijuana activity as a pretext of other illegal drug activity;

|

| |

·

|

Preventing violence in the cultivation and distribution of marijuana;

|

| |

·

|

Preventing drugged driving;

|

| |

·

|

Growing marijuana on federal property; and

|

| |

·

|

Preventing possession or use of marijuana on federal property.

|

The DOJ has not historically devoted resources to prosecuting individuals whose conduct is limited to possession of small amounts of marijuana for use on private property but has relied on state and local law enforcement to address marijuana activity. In the event the DOJ reverses its stated policy and begins strict enforcement of the CSA in states that have laws legalizing medical marijuana and recreational marijuana in small amounts, there may be a direct and adverse impact to our proposed business and our revenue and profits.

We could be found to be violating laws related to medical cannabis, but current enforcement standards are uncertain.

Unless and until Congress amends the CSA with respect to medical marijuana, there is a risk that federal authorities may enforce current federal law against us. The risk of strict enforcement of the CSA in light of Congressional activity, judicial holdings and stated federal policy remains uncertain. Should it be determined under the CSA that our products or services (once we begin to provide the same) are deemed to fall under the definition of drugs or drug paraphernalia because they are determined to be primarily intended or designed for use in manufacturing or producing cannabis, we could be found to be in violation of federal drug laws and there may be a direct and adverse effect on our business and our revenues and profits. Further, even if we obtain the necessary state and local government approvals and permits and obtain the necessary funding to commence our marijuana related businesses (of which no assurances are given), we could be found in violation of the CSA. This would cause a direct and adverse effect on our subsidiaries’ intended business and on our revenue and profits.

Variations in state and local regulation and enforcement in states that have legalized medical cannabis that may restrict marijuana-related activities, including activities related to medical cannabis may negatively impact our revenues and profits.

Individual state laws do not always conform to the federal standard or to other states laws. A number of states have decriminalized marijuana to varying degrees, other states have created exemptions specifically for medical cannabis, and several have both decriminalization and medical laws. Two states, Colorado and Washington, have legalized the recreational use of cannabis. Variations exist among states that have legalized, decriminalized or created medical marijuana exemptions. For example, Alaska and Colorado have limits on the number of marijuana plants that can be homegrown. In most states, the cultivation of marijuana for personal use continues to be prohibited except for those states that allow small-scale cultivation by the individual in possession of medical marijuana needing care or that person’s caregiver. Active enforcement of state laws that prohibit personal cultivation of marijuana may indirectly and adversely affect our business and our revenue and profits.

Prospective customers may be deterred from doing business with a company with a significant nationwide online presence because of fears of federal or state enforcement of laws prohibiting possession and sale of medical or recreational marijuana.

Our website is visible in jurisdictions where medicinal and/or recreational use of marijuana is not permitted and, as a result, we may be found to be violating the laws of those jurisdictions. We could lose potential customers as they could fear federal prosecution for growing marijuanawith our equipment, reducing our revenue. In most states in which the production and sale of marijuana have been legalized, there are additional laws or licenses required and some states altogether prohibit home cultivation, all of which could make the loss of potential customers more likely.

Laws and regulations affecting the medical marijuana industry are constantly changing, which could detrimentally affect our proposed operations.

Local, state and federal medical marijuana laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter certain aspects of our business plan. In addition, violations of these laws, or allegations of such violations, could disrupt certain aspects of our business plan and result in a material adverse effect on certain aspects of our planned operations. In addition, it is possible that regulations may be enacted in the future that will be directly applicable to certain aspects of our proposed medical marijuana businesses. We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business.

We may not obtain the necessary permits and authorizations to operate medical or recreational marijuana businesses.

We may not be able to obtain or maintain the necessary licenses, permits, authorizations or accreditations, or may only be able to do so at great cost, to operate its medical marijuana business. In addition, we may not be able to comply fully with the wide variety of laws and regulations applicable to the medical marijuana industry. Failure to comply with or to obtain the necessary licenses, permits, authorizations or accreditations could result in restrictions on our ability to operate the medical marijuana business, which could have a material adverse effect on our business.

If we incur substantial liability from litigation, complaints, or enforcement actions, our financial condition could suffer.

Our proposed participation in the medical marijuana industry may lead to litigation, formal or informal complaints, enforcement actions, and inquiries by various federal, state, or local governmental authorities against these subsidiaries. Litigation, complaints, and enforcement actions involving these subsidiaries could consume considerable amounts of financial and other corporate resources, which could have a negative impact on our sales, revenue, profitability, and growth prospects.

We may have difficulty accessing the service of banks, which may make it difficult for us to operate.

Since the use of marijuana is illegal under federal law, there is a strong argument that banks cannot accept for deposit funds from businesses involved with the marijuana industry. Consequently, businesses involved in the marijuana industry often have difficulty finding a bank willing to accept their business. The inability to open bank accounts may make it difficult for us to operate our contemplated medical or recreational marijuana businesses.

The marijuana industry faces significant opposition.

It is believed by many that large well-funded businesses may have a strong economic opposition to the marijuana industry. For example, medical marijuana will likely adversely impact the existing market for the current “marijuana pill” sold by mainstream pharmaceutical companies. Further, the medical marijuana industry could face a material threat from the pharmaceutical industry, should marijuana displace other drugs or encroach upon the pharmaceutical industry’s products. The pharmaceutical industry is well funded with a strong and experienced lobby that eclipses the funding of the medical marijuana industry. Any inroads the pharmaceutical industry could make in halting or impeding the marijuana industry could have a detrimental impact on our proposed business.

We are operating in a highly competitive industry and may not be able to compete successfully.

We are involved in a highly competitive industry where we may compete with numerous other companies in the medical marijuana industry, who may have far greater resources, more experience, and personnel perhaps more qualified than we do. There can be no assurance that we will be able to successfully compete against these other entities, particularly since we are just a start-up enterprise. Moreover, there is no aspect of our business which is protected by patents, copyrights, trademarks, or trade names. As a result, potential competitors could duplicate our business model with little effort. Some of our potential competitors may have significantly greater resources than we have, which may make it difficult for us to compete. There can be no assurance that we will be able to successfully compete against these other entities.

Our reputation in the industry will be very important as we grow our proposed business, and any negative impact on our reputation could be damaging to our business.

As a company involved in businesses related to cannabis, a substance that has been commonly associated with various other narcotics, violence, and criminal activities, it is expected that such a venture will likely result in widespread negative publicity and public opinion. Lack of understanding and awareness of the medical benefits associated with cannabis is poorly understood across the mainstream public despite various efforts to build such awareness.

There are risks related to the quality and quality control of our products.

We may be subject to liability of our products and must ensure quality control of the product at every stage. If a patient has an adverse reaction to the products, we may be subject to product liability related to the products and their quality in relation to the intended use of the products.

Increased popularity with the legalization of medical cannabis in Canada and the United States could result in unfavorable media coverage, which could ultimately negatively affect our business.

Our business industry receives a high degree of media coverage in the United States. The legalization of cannabis, both for medical uses and recreational uses, is becoming popular in the United States and Canada. This will increase the amount of media coverage our business industry receives. This media coverage could be negative coverage that may affect how others view our business. If this occurs, we may have difficulty attracting new customers.

We may be unable to acquire the properties that are critical to our proposed business.

Our business plan involves the acquisition of real estate properties, which will be leased to participants in the marijuana industry. The zoning and operational restrictions on marijuana industry participants may limit the availability of properties suitable for this purpose. There can be no assurance that we will be able to obtain the capital needed to purchase any properties.

We may be unable to expand into new markets.

We intend to continue to pursue our aggressive growth strategy for the foreseeable future. Our continued growth and profitability depend on our ability to successfully realize our growth strategy by expanding both inside and outside the state of Arizona and Colorado. We cannot assure that our efforts to expand into new markets, particularly in states where we do not currently operate, will succeed. In order to operate in new markets, we may need to modify our existing business model and cost structure to comply with local regulatory or other requirements, which may expose us to new operational, regulatory or legal risks. In addition, expanding into new states may subject us to unfamiliar or uncertain local regulations that may adversely affect our operations, for example, by applying, obtaining and/or maintaining appropriate licenses. Facilities we open in new markets may also take longer to reach expected revenue and profit levels on a consistent basis and may have higher construction, occupancy or operating costs than facilities we open in existing markets, thereby affecting our overall profitability. New markets may have competitive conditions, consumer preferences and spending patterns that are more difficult to predict or satisfy than our existing markets.

We may need to make greater investments than we originally planned in advertising and promotional activity in new markets to build brand awareness.

We may find it more difficult in new markets to hire, motivate and keep qualified personnel. We may need to augment our labor model to meet regulatory requirements and the overall cost of labor may be higher. As a result, these new facilities may be less successful and may not achieve target facility level profit margins at the same rate or at all. If any steps taken to expand our existing business model into new markets are unsuccessful, we may not be able to achieve our growth strategy and our business, financial condition or results of operations could be adversely affected.

Risks Relating to Ownership of Our Securities

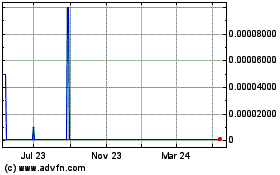

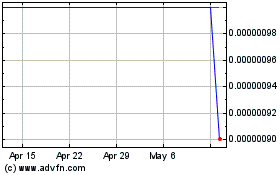

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the Over-the-Counter Bulletin Board quotation system in which shares of our common stock are listed, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

|

·

|

variations in our operating results;

|

|

·

|

changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

|

|

·

|

changes in operating and stock price performance of other companies in our industry;

|

|

·

|

additions or departures of key personnel; and

|

|

·

|

future sales of our common stock.

|

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares are thinly traded and you may be unable to sell at or near ask prices, or at all.

We do not have a liquid market for our common stock, and we cannot predict the extent to which an active public market for trading our common stock will be achieved or sustained.

This situation is attributable to a number of factors, including the fact that we are a small company that is relatively unknown to stock analysts, stockbrokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

An active trading market for our common stock may not develop or be sustained.

As we are in our early stages, an investment in our company will likely require a long-term commitment, with no certainty of return. Although our common stock is listed for quotation on the OTCBB and OTCQB markets under the symbol of MDCN, we cannot predict whether an active market for our common stock will ever develop in the future. In the absence of an active trading market:

|

|

·

|

investors may have difficulty buying and selling or obtaining market quotations;

|

|

|

·

|

market visibility for shares of our common stock may be limited; and

|

|

|

·

|

a lack of visibility for shares of our common stock may have a depressive effect on the market price for shares of our common stock.

|

The OTCBB and OTCQB markets are relatively unorganized, inter-dealer, over-the-counter markets that provide significantly less liquidity than NASDAQ or the NYSE MKT (formerly known as the NYSE AMEX). In this event, there would be a highly illiquid market for our common stock and you may be unable to dispose of your common stock at desirable prices, or at all. Moreover, there is a risk that our common stock could be delisted from the OTCBB and OTCQB, in which case it might be listed on the so called “Pink Sheets”, which is even more illiquid than the OTCQB.

The lack of an active market impairs your ability to sell your shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of your shares. An inactive market may also impair our ability to raise capital to continue to fund operations by selling shares and may impair our ability to acquire additional intellectual property assets by using our shares as consideration.

We may not maintain qualification for OTC Bulletin Board or OTCQB inclusion, and therefore you may be unable to sell your shares.

Trading of our common stock could be suspended. If for any reason our common stock does not become eligible or maintain eligibility for quotation on the OTCBB or OTCQB or a public trading market does not develop, purchasers of shares of our common stock may have difficulty selling their shares should they desire to do so. If we are unable to satisfy the requirements for quotation on the OTCBB and OTCQB, any quotation of in our common stock could be conducted in the “pink” sheets market. As a result, a purchaser of our common stock may find it more difficult to dispose of, or to obtain accurate quotations as to the price of their shares. This would materially and adversely affect the liquidity of our securities.

There may be limitations on the effectiveness of our internal controls, and a failure of our control systems to prevent error or fraud may materially harm our company.

Proper systems of internal controls over financial accounting and disclosure are critical to the operation of a public company. As we are a start-up company, we are at the very early stages of establishing, and we have not yet, and we may be unable to effectively establish, such systems. Our board of directors lacks a functioning, independent audit committee, which could preclude us from establishing effective controls. If this condition persists, we will continue to be subject to the risk of our company not having the ability to reliably assimilate and compile financial information about our company and significantly will continue to impair our ability to prevent error and detect fraud, all of which would have a negative impact on our company from many perspectives. Moreover, we do not expect that disclosure controls or internal controls over financial reporting, even if established, will prevent all error and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. Failure of our control systems to prevent error or fraud could materially adversely impact us.

We do not anticipate paying any cash dividends to our common shareholders.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to deploy available capital to execute our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by Section 15(g) of the Exchange Act which imposes additional sales practice requirements on brokers-dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement prior from you to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

Financial Industry Regulatory Authority (“FINRA”) sales practice requirements may limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

Volatility in our common share price may subject us to securities litigation.