Enterprise Group, Inc. ("Enterprise," or "the Company") (TSX:E) is pleased to

announce its financial results for the three month period ended March 31, 2014

("the first quarter"). Enterprise's strong first quarter results reflect both

the successful execution of the Company's acquisition strategy and growing

demand for the Company's services.

FIRST QUARTER HIGHLIGHTS

-- Record quarterly revenue of $21.1 million, an increase of $12.2 million

when compared to the prior year, due to both the impact of Enterprise's

acquisitions and strong demand for the Company's services.

-- Record quarterly EBITDAS of $7.0 million, an increase of $3.1 million

when compared to the prior year.

-- On January 3, 2014, the Company completed its acquisition of Hart

Oilfield Rentals ("Hart") for a purchase price of approximately $22.6

million.

-- On March 25, 2014, the Company completed a bought deal equity financing

of 27,600,000 of its Common Shares at a price of $1.00 per Common Share

for aggregate gross proceeds of $27.6 million.

----------------------------------------------------------------------------

Consolidated: Q1/2014 Q1/2013 Change

----------------------------------------------------------------------------

Revenue $21,107,305 $8,904,380 $12,202,925

----------------------------------------------------------------------------

Gross margin $10,529,435 $5,201,966 $5,327,469

----------------------------------------------------------------------------

Gross margin % 50% 58% -8%

----------------------------------------------------------------------------

EBITDAS $7,046,966 $3,901,300 $3,145,666

----------------------------------------------------------------------------

Net Income $4,326,813 $3,166,882 $1,159,931

----------------------------------------------------------------------------

EPS $0.04 $0.05 -$0.01

----------------------------------------------------------------------------

Total Assets $131,378,174 $31,185,747 $100,192,427

----------------------------------------------------------------------------

Enterprise's first quarter results are highlighted by a significant increase in

revenue, reflecting both a strong demand for the Company's services and the

positive impact of acquisitions within both of the Company operating divisions.

While the Company's EBITDAS also witnessed a significant improvement, EBITDAS

margin decreased as a result of the change in revenue mix created by the

acquisitions. The Company's earnings per share decrease slightly, partially as a

result of $550,000 in one-time costs related to the acquisition and integration

of new subsidiaries and adjustments to operational infrastructure.

Enterprise remains on track to deploy $20 million of capital expenditures over

the course of 2014. These capital expenditures are intended to create

improvements in both the Company's revenue and operating margins. Management

believes these improvements will be reflected in the Company's operating results

during the second half of 2014.

"Enterprise's results for the first quarter represent a strong start to what we

believe will be a very exciting year for our business," stated Leonard Jaroszuk,

the Company's Chief Executive Officer. "These results demonstrate both the

benefit of our selective acquisition strategy and the healthy economic

environment, which continues to increase demand for our services."

"The capital raised during the first quarter will allow us to execute upon

investments that will significantly increase Enterprise's operating capacity,"

concluded Mr. Jaroszuk. "As our equipment fleet grows, we expect to improve not

only our revenue, but also our profitability. As a result, I have great

confidence in our ability to continue Enterprise's pattern of growth both

through 2014 and beyond. I look forward to communicating our progress."

Utilities/Infrastructure Division

----------------------------------------------------------------------------

Q1/2014 Q1/2013

----------------------------------------------------------------------------

Revenue $8,477,405 $3,849,208

----------------------------------------------------------------------------

Increase $4,628,196

----------------------------------------------------------------------------

EBITDAS $2,367,758 $1,091,287

----------------------------------------------------------------------------

Increase (decrease) $1,276,471

----------------------------------------------------------------------------

Enterprise's Utilities/Infrastructure Division generated first quarter revenue

of $8.5 million, an increase of $4.6 million when compared to the prior year.

This improvement can be attributed to the acquisition Calgary Tunnelling &

Horizontal Augering Ltd. ("CTHA") in June of 2013, an increase in activity, and

the expansion of Enterprise's service equipment fleet, which has allowed the

Company to both increase its capacity and attract projects from major customers.

This division's EBITDAS margin of 28% reflects both a change in revenue mix due

to the acquisition of CTHA and an increased use of third-party equipment

necessitated by strong demand at T.C. Backhoe. This metric is expected to

improve is expected to improve as new capital assets are purchased and

subcontracted equipment is replaced. Enterprise's capital plan allocates the

funds necessary to increase its hydrovac fleet to 20 units by the conclusion of

2014.

Equipment Rental Division

----------------------------------------------------------------------------

Q1/2014 Q1/2013

----------------------------------------------------------------------------

Revenue $12,629,900 $5,055,171

----------------------------------------------------------------------------

Increase $7,574,729

----------------------------------------------------------------------------

EBITDAS $5,875,401 $3,524,497

----------------------------------------------------------------------------

Increase (decrease) $2,350,904

----------------------------------------------------------------------------

Enterprise's Equipment Rental Division generated first quarter revenue of $12.6

million, an increase of $7.6 million when compared to the prior year. This

improvement was primarily due to the acquisition of Hart at the beginning of the

first quarter. This division's EBITDAS margin of 47% reflects a change in

revenue mix due to the acquisition of Hart, and is expected to improve as new

capital assets are purchased and subcontracted equipment is replaced. Revenue

from the Company's flameless heater fleet continued to be impacted by delays to

certain projects that should recommence during the latter half of 2014.

Major Developments

On January 3, 2014, Enterprise completed its acquisition of Hart, a private

oilfield equipment service provider, for a purchase price of $22.6 million,

subject to closing adjustments. Hart is a full service oilfield site

infrastructure company that provides both site services and equipment rentals to

its oil and gas customers within the Western Canadian Sedimentary Basin. Hart's

equipment fleet consists of approximately 1,500 owned pieces and an additional

500 pieces that have been rented in order to fulfill demand. During December of

2013, in order to fund this acquisition, the Company completed an overnight

market public offering of subscription receipts at a price of $0.72 per

subscription receipt for gross proceeds of approximately $15.0 million. The

purchase price for the acquisition was satisfied through a combination of the

net proceeds from this public offering, the issuance of 1,388,890 common shares

of the Company at a price of $0.72 per share, and funds available from the

Company's credit facility.

Also on January 3, 2014, in conjunction with the close of the Hart acquisition,

Enterprise accepted a term sheet presented by the Canadian branch of PNC Bank.

This term sheet allowed the Company to increase its current senior secured

finance facility from $20.0 million to a maximum of $35.0 million, subject to

certain borrowing base restrictions, at the existing interest rate of prime plus

2%.

On March 25, 2014, Enterprise completed a bought deal equity financing of

27,600,000 common shares of the Company, which included 3,600,000 Common Shares

issued pursuant to the exercise in full of the financing's over-allotment

option, at a price of $1.00 per common share for aggregate gross proceeds of

$27.6 million. The Company has issued 1,380,000 broker warrants to the

Underwriters. Each broker warrant will entitle the holder to acquire one common

share at an exercise price of $1.00 per share for a period of 24 months from the

date of closing. The net proceeds will be used to accelerate the Company's

capital expenditure program, as articulated above, as well as for general

working capital purposes.

About Enterprise Group, Inc.

Enterprise Group, Inc. is a consolidator of construction services companies

operating in the energy, utility and transportation infrastructure industries.

The Company's focus is primarily construction services and specialized equipment

rental. The Company's strategy is to acquire complementary service companies in

Western Canada, consolidating capital, management, and human resources to

support continued growth. Enterprise acquired of Artic Therm International Ltd.

in September 2012, Calgary Tunnelling & Horizontal Augering Ltd. in June 2013,

and Hart Oilfield Rentals in January 2014.

Forward Looking Information

Certain statements contained in this news release constitute forward-looking

information. These statements relate to future events or the Company's future

performance. The use of any of the words "could", "expect", "believe", "will",

"projected", "estimated" and similar expressions and statements relating to

matters that are not historical facts are intended to identify forward-looking

information and are based on the Company's current belief or assumptions as to

the outcome and timing of such future events. Actual future results may differ

materially. The Company's Annual Information Form and other documents filed with

securities regulatory authorities (accessible through the SEDAR website

www.sedar.com) describe the risks, material assumptions and other factors that

could influence actual results and which are incorporated herein by reference.

The Company disclaims any intention or obligation to publicly update or revise

any forward-looking information, whether as a result of new information, future

events or otherwise, except as may be expressly required by applicable

securities laws.

Non-IFRS Measures

The Company uses International Financial Reporting Standards ("IFRS"). EBITDAS

is not a measure that has any standardized meaning prescribed by IFRS and is

therefore referred to as a non-IFRS measure. This news release contains

references to EBITDAS. This non-IFRS measure used by the Company may not be

comparable to a similar measure used by other companies. Management believes

that in addition to net income, EBITDAS is a useful supplemental measure as it

provides an indication of the results generated by the Company's principal

business activities prior to consideration of how those activities are financed

or how the results are taxed. EBITDAS is calculated as net income excluding

depreciation, amortization, interest, taxes and stock based compensation.

FOR FURTHER INFORMATION PLEASE CONTACT:

Assembly Stakeholder Relations

Candace Williams or Nathan Sellyn

780-328-3863

Enterprise Group, Inc.

Leonard D. Jaroszuk

President & CEO

780-418-4400

Enterprise Group, Inc.

Desmond O'Kell

Senior Vice President

780-418-4400

contact@EnterpriseGRP.ca

www.EnterpriseGRP.ca

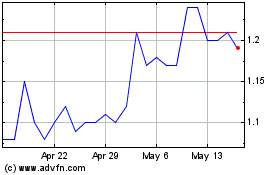

Enterprise (TSX:E)

Historical Stock Chart

From Apr 2024 to May 2024

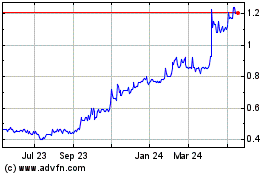

Enterprise (TSX:E)

Historical Stock Chart

From May 2023 to May 2024