Verizon Adds Wireless Customers, Takes Another Hit on Yahoo Unit -- Update

January 30 2020 - 8:46AM

Dow Jones News

By Sarah Krouse

Verizon Communications Inc. added lucrative phone customers at a

healthy clip in the final three months of 2019 as it worked to

build out a faster 5G network, but it continued to grapple with its

digital-media business.

The largest U.S. mobile carrier by subscribers added 790,000

postpaid phone connections during the period, compared with 653,000

during the same period a year earlier. JPMorgan Chase analysts

expected the carrier to add about 750,000 such connections.

Postpaid customers are considered lucrative for carriers because

those subscribers typically pay up monthly under longer-term

contracts and are less likely to switch providers. Verizon's

largest rival, AT&T Inc., added 229,000 postpaid phone

connections during the period, while T-Mobile US Inc. added one

million such connections.

Verizon took a roughly $200 million charge to write-down the

value of its media business, which is home to Yahoo and AOL web

properties. Revenue within Verizon Media Group was flat

year-over-year at about $2.1 billion as it continued to confront

declining desktop search revenue.

In late 2018 Verizon took a $4.5 billion accounting charge

related to that business and has since tried to focus on e-commerce

and Yahoo-branded news, sports and entertainment services.

Shares of Verizon slipped 2% in premarket trading. The stock has

advanced about 10% over the past year, lagging behind a broader

market rally.

Verizon has focused on partnerships, rather than major

acquisitions, to attract and retain customers in recent years. The

carrier offers wireless and home-internet customers varying degrees

of free access to streaming services including YouTube TV, Disney+,

Apple Music and Google Stadia videogaming.

The company reported 119.8 million wireless connections,

including tablets, smartwatches and other devices, up from 118.65

million at the end of September.

The mobile carrier, like its rivals, is in the process of

building out 5G service in dozens of cities and is in search of new

business and consumer uses of the next-generation service.

Executives have said 5G's fast speeds and low latency will

transform manufacturing, entertainment and transit.

For now, however, 5G's reach is limited. Verizon is using ultra

high-frequency airwaves for its 5G service, relying in the early

days on spectrum that can't travel long distances or penetrate

walls. That has led to more limited coverage than rivals using mid-

and low-band spectrum.

As it builds out its 5G network, Verizon is trying to generate

more revenue by convincing wireless customers to migrate to

unlimited data plans. It has encouraged families to mix and match

the plans they use, which helps the carrier nudge consumers to

pricier plans when they want higher-quality TV streaming or more

hot-spot usage.

While the carrier added cellphone customers, its pay-television

service, Fios video, lost 51,000 connections in the quarter, and

added 35,000 Fios internet connections.

Verizon earlier this month said it would do away with

traditional cable bundles and allow customers to also mix the home

internet and cable television plans they want without long-term

contracts. That move was the start of a long process of

de-emphasizing video, an area in which Verizon lacks scale in

negotiating programming costs, Citigroup analysts said at the

time.

Overall, net income attributable to Verizon was $5.1 billion in

the fourth quarter, compared with $1.9 billion a year earlier. The

year-ago quarter was weighed down by the large write down on the

media business. Revenue rose to $34.8 billion from $34.3 billion a

year ago.

The company said it has cut $5.7 billion of the $10 billion in

expenses it has vowed to eliminate by 2021. It ended 2019 with

135,000 employees, down from 144,500 at the end of 2018 following a

voluntary buyout program.

Write to Sarah Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

January 30, 2020 08:31 ET (13:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

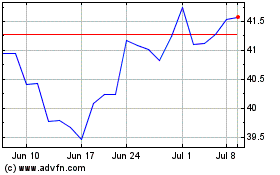

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2024 to May 2024

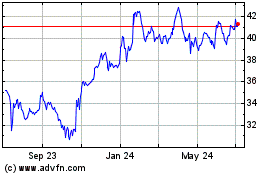

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From May 2023 to May 2024