0001496963FALSE00014969632024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

Squarespace, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) | 001-40393 (Commission File Number) | 20-0375811 (IRS Employer Identification No.) |

| | | | | |

225 Varick Street,12th Floor New York,New York (Address of Principal Executive Offices) | 10014 (Zip Code) |

(646) 580-3456

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | | SQSP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (P30.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 2.02 Results of Operations and Financial Condition.

On February 28, 2024, Squarespace, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein. The press release may contain hypertext links to information on the Company’s website. The information on the Company’s website is not incorporated by reference into this Current Report on Form 8-K and does not constitute a part of this Form 8-K.

The press release is furnished under this Item 2.02 and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, whether made before or after today's date, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

Item 8.01 Other Events.

On February 26, 2024, the board of directors of the Company (the "Board") authorized a general share repurchase program of the Company’s Class A common stock of up to $500 million with no fixed expiration. These Class A common stock repurchases may occur in the open market, through privately negotiated transactions, through block purchases, other purchase techniques including the establishment of one or more plans under Rule 10b5-1 of the Securities Exchange Act of 1934 or by any combination of such methods. The timing and actual amount of shares repurchased will depend on a variety of different factors and may be modified, suspended or terminated at any time at the discretion of the Board.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SQUARESPACE, INC. |

| | |

Dated: February 28, 2024 | By: | /s/ Courtenay O’Connor |

| | | Courtenay O’Connor |

| | | General Counsel and Secretary |

Squarespace Announces Fourth Quarter and Full Year 2023 Financial Results and $500 Million Share Repurchase Authorization

Revenue Increased 18% in the Fourth Quarter and 17% for the Full Year 2023, Topping $1 Billion

Squarespace to Host Investor Day on May 15, 2024

NEW YORK, February 28, 2024 — Squarespace, Inc. (NYSE: SQSP), the design-driven platform helping entrepreneurs build brands and businesses online, today announced results for the fourth quarter and year ended December 31, 2023.

“Squarespace surpassed $1 billion in revenue for the first time in its 20-year history in 2023, driven by new customer growth across markets and strong retention, which speaks to our robust product offering,” said Anthony Casalena, Founder & CEO of Squarespace. “During 2023 we also made important strides in enhancing the foundation of our long-term growth through our acquisition of Google Domains, the launch of Squarespace Payments, and key product and feature introductions including new AI capabilities that expand our ecosystem and broaden accessibility to entrepreneurs wherever they are on their journey. Entering our third decade, we are in a strong position to capitalize across our core verticals of enabling small business, commerce and international expansion.”

“Squarespace delivered a record fourth quarter that exceeded our expectations across the board,” said Nathan Gooden, CFO of Squarespace. “We are combining increased scale and profitability with consistent execution and a relentless focus on innovation for entrepreneurs to set a strong foundation for sustainable growth and value creation. We view share repurchases as an integral part of our capital allocation strategy and the $500 million authorization announced today underscores the strong financial momentum in our business.”

Fourth Quarter 2023 Financial Highlights

•Total revenue grew 18% year over year to $270.7 million in the fourth quarter, compared with $228.8 million in the fourth quarter of 2022, and 16% in constant currency.

◦Presence revenue grew 20% year over year to $188.4 million and 18% in constant currency.

◦Commerce revenue grew 14% year over year to $82.3 million and 13% in constant currency.

•Net income totaled $5.3 million, compared with a net loss of $234.0 million in the fourth quarter 2022. The 2022 result included a $225.2 million non-cash goodwill impairment charge. Excluding the impairment charge, net loss for the fourth quarter of 2022 was $8.8 million.

•Earnings per share totaled $0.04 based on 136,153,002 basic and 139,387,350 dilutive weighted average shares in the fourth quarter, compared with a loss per share of $1.72 based on 136,340,283 basic and dilutive weighted average shares in the fourth quarter of 2022.

•Cash flow from operating activities increased 56% to $61.1 million for the three months ended December 31, 2023, compared with $39.1 million for the three months ended December 31, 2022.

•Total bookings grew 23% year over year to $286.1 million in the fourth quarter, compared to $232.1 million in the fourth quarter of 2022.

•Unlevered free cash flow increased 57% to $65.0 million representing 24% of total revenue for the three months ended December 31, 2023, compared with $41.5 million for the three months ended December 31, 2022.

•Adjusted EBITDA increased to $64.7 million in the fourth quarter, compared with $63.1 million in the fourth quarter of 2022.

Full Year 2023 Financial Highlights

•Total revenue grew 17% year over year to $1,012.3 million in 2023, compared with $867.0 million in 2022, and 16% in constant currency.

◦Presence revenue grew 18% year over year to $704.3 million and 17% in constant currency.

◦Commerce revenue grew 14% year over year to $308.0 million and 14% in constant currency.

•Net loss was $7.1 million, compared with a net loss of $252.2 million in 2022. The 2022 result included a $225.2 million non-cash goodwill impairment charge. Excluding the impairment charge, net loss for the full year 2022 was $27.1 million.

•Loss per share of $0.05 based on 135,531,363 basic and dilutive weighted average shares in 2023, compared with a loss per share of $1.82 based on 138,409,491 basic and dilutive weighted average shares in 2022.

•Cash flow from operating activities increased 41% to $231.1 million in 2023, compared with $164.2 million in 2022.

•Total bookings grew 19% year over year to $1,075.1 million in 2023, compared to $906.1 million in 2022.

•Unlevered free cash flow increased 46% to $241.0 million representing 24% of total revenue in 2023, compared with $165.6 million in 2022.

•Adjusted EBITDA increased to $235.4 million in 2023, compared with $147.5 million in 2022.

•Cash and cash equivalents at year-end 2023 of $257.7 million; total debt was $568.8 million, of which $49.0 million is current, debt net of cash and investments totaled $311.1 million.

•Total unique subscriptions increased 10% year over year to over 4.6 million in 2023, compared to 4.2 million in 2022.

•Average revenue per unique subscription ("ARPUS") increased 9% year over year to $228.02 in 2023, compared to $209.16 in 2022.

•Annual run rate revenue ("ARRR") grew 19% year over year to $1,105.7 million in 2023, compared to $931.7 million in 2022.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release. An explanation of these measures is also included below under the heading "Non-GAAP Financial Measures."

2023 Business Highlights

Product Innovation

Squarespace provides superior design and ease of use technology for entrepreneurs everywhere. Our passion for innovation drove all areas of our business. In 2023, the Company:

•Relaunched Squarespace Domains with a more complete domain management experience for domain-first customers following our acquisition of Google Domains Assets.

•Launched Squarespace Payments, which fully integrates with our customers' online stores to accept fast and secure payments and provides a seamless purchase experience for their customers all in one place.

•Unveiled Squarespace Blueprint, our guided website design system that provides professionally-curated layouts and styling options.

•Advanced Acuity Scheduling’s platform technologies and introduced new branding to help streamline the client booking experience with a centralized dashboard, mobile app tools, and payment features.

•Invested in Squarespace AI to make it easier than ever for users to generate custom content. Generative AI integrations help populate websites, email campaigns, and commerce store descriptions, enabling customers to efficiently publish and specialize content for their brand identity.

•Released our annual compilation of new products and features, Squarespace Refresh, where we showcased new tools spanning commerce, client invoicing, courses, email marketing, enterprise customer collaboration, and more.

•Enhanced Tock’s User System with a new iOS app and new reservation features, and integrated Reserve with Google to help Tock customers increase their visibility and drive diners to their businesses.

•Established a partnership with SoundCloud to bring SoundCloud Next Pro artists the opportunity to create a beautiful website with unique, music-themed domains.

Marketing & Brand

Our marketing investments, design-centric ethos, and go-to-market channels bolster our brand recognition and keep Squarespace top of mind for new audiences. This year, Squarespace:

•Continued to globalize our product suite by increasing our currency options by 5x.

•Introduced the second edition of Squarespace Collection (formerly Squarespace Icons) with Magnum Photos, where we partnered with six world renowned photographers to create signature website designs inspired by each photographer’s creativity and built on our website editor, Fluid Engine™.

•Teamed up with Adam Driver for our 9th Big Game campaign, “The Singularity,” where we honored Squarespace’s founding history as a pioneer in website building.

•Hosted our second Circle Day where we engaged thousands of members of our Circle partner program from around the world. Members shared advice and strategies on how to leverage strengths, skills, and connections to expand every web designer’s professional toolkit.

•Received multiple Fast Company awards, including Fast Company’s Most Innovative Companies and Innovation by Design, won two Webby Awards and our Big Game commercial won top honors from ADC, AICP, Cannes Lions, Ciclope, D&AD and the One Show.

Corporate

Squarespace is focused on creating and delivering value to entrepreneurs, partners, and investors. In 2023, the Company:

•Acquired Google’s Domains business, representing millions of domains, and established an exclusive reseller agreement for any customer purchasing a domain along with their Google Workspace subscription from Google directly.

•Won multiple awards recognizing the excellence of our organization including Comparably’s Best Places to Work in New York.

•Celebrated our 20th anniversary; across two decades the Squarespace platform has been used by millions to build beautiful brands and businesses online.

•Returned approximately $26.0 million to shareholders under our share repurchase program as of December 31, 2023, which represents approximately 1.3 million shares.

Share Repurchase Program

Squarespace's board of directors authorized a general share repurchase program of the Company's Class A common stock of up to $500 million with no fixed expiration. These Class A common stock repurchases may occur in the open market, through privately negotiated transactions, through block purchases, other purchase techniques including the establishment of one or more plans under Rule 10b5-1 of the Securities Exchange Act of 1934 or by any combination of such methods. The timing and actual amount of shares repurchased will depend on a variety of different factors and may be modified, suspended or terminated at any time at the discretion of the board of directors.

Outlook & Guidance

For the first quarter of fiscal year 2024, Squarespace currently expects:

•Revenue of $274 million to $277 million, or year-over-year growth of 16% to 17%.

•Non-GAAP unlevered free cash flow of $83 million to $86 million. This is the result of:

◦Cash flow from operating activities of $77 million to $81 million, minus

◦Capital expenditures, expected to be approximately $2 million to $3 million; plus

◦Cash paid for interest expense net of associated tax benefit, expected to be approximately $8 million.

For the full fiscal year 2024, Squarespace currently expects:

•Revenue of $1,170 million to $1,190 million, or year-over-year growth of 16% to 18%, which includes contributions in the range of $85 million to $88 million related to our acquisition of Google Domains Assets.

•Non-GAAP unlevered free cash flow of $290 million to $310 million. This is the result of:

◦Cash flow from operating activities of $266 million to $288 million, minus

◦Capital expenditures, expected in the range of $4 million to $6 million; plus

◦Cash paid for interest expense net of associated tax benefit, expected to be approximately $28 million.

Webcast Conference Call & Shareholder Letter Information

Squarespace will host a conference call on February 28, 2024 at 8:30 a.m. ET to discuss its financial results. A live webcast of the event will be available in the Events & Presentations section of the Squarespace Investor Relations website. An archived replay of the webcast will be available following the conclusion of the call. Additionally, we invite you to read our shareholder letter available on our Investor Relations website.

Squarespace to Host Investor Day

Squarespace will host an Investor Day on May 15, 2024 in New York City. A live webcast of the event will be available in the Events & Presentations section of the Squarespace Investor Relations website. Interested investors and analysts are encouraged to email investors@squarespace.com for an invitation.

Non-GAAP Financial Measures

Revenue growth in constant currency is being provided to increase transparency and align our disclosures with companies in our industry that receive material revenues from international sources. Revenue constant currency has been adjusted to exclude the effect of year-over-year changes in foreign currency exchange rate fluctuations. We believe providing this information better enables investors to understand our operating performance irrespective of currency fluctuations.

We calculate constant currency information by translating current period results from entities with foreign functional currencies using the comparable foreign currency exchange rates from the prior fiscal year. To calculate the effect of foreign currency translation, we apply the same weighted monthly average exchange rate as the comparative period. Our definition of constant currency may differ from other companies reporting similarly named measures, and these constant currency performance measures should be viewed in addition to, and not as a substitute for, our operating performance measures calculated in accordance with GAAP.

Adjusted EBITDA is a supplemental performance measure that our management uses to assess our operating performance. We calculate adjusted EBITDA as net income/(loss) excluding interest expense, other income/(loss), net (provision for)/benefit from income taxes, depreciation and amortization, stock-based compensation expense and other items that we do not consider indicative of our ongoing operating performance.

Unlevered free cash flow is a supplemental liquidity measure that Squarespace's management uses to evaluate its core operating business and its ability to meet its current and future financing and investing needs. Unlevered free

cash flow is defined as cash flow from operating activities, including one-time expenses related to Squarespace's direct listing, less cash paid for capital expenditures increased by cash paid for interest expense net of the associated tax benefit.

Adjusted EBITDA, unlevered free cash flow and revenue constant currency are not prepared in accordance with generally accepted accounting principles in the United States of America ("GAAP") and have important limitations as an analytical tool. Non-GAAP financial measures are supplemental, should only be used in conjunction with results presented in accordance with GAAP and should not be considered in isolation or as a substitute for such GAAP results.

Further information on these non-GAAP items and reconciliation to their closest GAAP measure is provided below under, “Reconciliation of Non-GAAP Financial Measures.”

Definitions of Key Operating Metrics

On September 7, 2023, we closed an asset purchase agreement between us and Google LLC (“Google”) to acquire, among other things, Google’s domain assets (the “Google Domains Asset Acquisition “). Unique subscriptions and average revenue per unique subscription do not account for single domain subscriptions originally sold by Google as a part of the Google Domains Asset Acquisition (the “Acquired Domain Assets”).

Annual run rate revenue (“ARRR”). We calculate ARRR as the monthly revenue from subscription fees and revenue generated in conjunction with associated fees (fees taken or assessed in conjunction with commerce transactions) in the last month of the period multiplied by 12. We believe that ARRR is a key indicator of our future revenue potential. However, ARRR should be viewed independently of revenue, and does not represent our GAAP revenue on an annualized basis, as it is an operating metric that can be impacted by subscription start and end dates and renewal rates. ARRR is not intended to be a replacement or forecast of revenue.

Unique subscriptions represent the number of unique sites, standalone scheduling subscriptions, Unfold (social) and hospitality subscriptions, as of the end of a period. A unique site represents a single subscription and/or group of related subscriptions, including a website subscription and/or a domain subscription, and other subscriptions related to a single website or domain. Every unique site contains at least one domain subscription or one website subscription. For instance, an active website subscription, a custom domain subscription and a Google Workspace subscription that represent services for a single website would count as one unique site, as all of these subscriptions work together and are in service of a single entity’s online presence. Unique subscriptions do not account for one-time purchases in Unfold or for hospitality services nor do they account for our Acquired Domain Assets. The total number of unique subscriptions is a key indicator of the scale of our business and is a critical factor in our ability to increase our revenue base.

Average revenue per unique subscription (“ARPUS”). We calculate ARPUS as the total revenue during the preceding 12-month period divided by the average of the number of total unique subscriptions at the beginning and end of the period. ARPUS does not account for Acquired Domain Assets or the revenue from Acquired Domain Assets. We believe ARPUS is a useful metric in evaluating our ability to sell higher-value plans and add-on subscriptions.

Total bookings represents cash receipts for all subscriptions purchased, as well as payments due under the terms of contractual agreements for obligations to be fulfilled.

Gross merchandise value (“GMV”) represents the value of physical goods, content and time sold, including hospitality services, net of refunds, on our platform over a given period of time.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These statements include, but are not limited to, statements regarding Squarespace’s future operating results and financial position, including for its first fiscal quarter ending March 31, 2024 and its fiscal year ending December 31, 2024. The words "believe," "may," "will," "estimate," "potential," "continue," "anticipate," "intend," "expect," "could," "would," "project," "plan," "target," and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are based on management's expectations, assumptions, and projections based on information available at the time the statements were made. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including risks and uncertainties related to: Squarespace's ability to attract and retain customers and expand their use of its platform; Squarespace’s ability to anticipate market needs and develop new solutions to meet those needs; Squarespace's ability to improve and enhance the functionality, performance, reliability, design, security and scalability of its existing solutions; Squarespace's ability to compete successfully in its industry against current and future competitors; Squarespace’s ability to manage growth and maintain demand for its solutions; Squarespace's ability to protect and promote its brand; Squarespace's ability to generate new customers through its marketing and selling activities; Squarespace’s ability to successfully identify, manage and integrate any existing and potential acquisitions or achieve the expected benefits of such acquisitions; Squarespace's ability to hire, integrate and retain highly skilled personnel; Squarespace’s ability to adapt to and comply with existing and emerging regulatory developments, technological changes and cybersecurity needs; Squarespace's compliance with privacy and data protection laws and regulations as well as contractual privacy and data protection obligations; Squarespace’s ability to establish and maintain intellectual property rights; Squarespace’s ability to manage expansion into international markets; and the expected timing, amount, and effect of Squarespace’s share repurchases. It is not possible for Squarespace's management to predict all risks, nor can it assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements Squarespace may make. In light of these risks, uncertainties, and assumptions, Squarespace's actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Further information on risks that could cause actual results to differ materially from forecasted results are included in Squarespace's filings with the Securities and Exchange Commission. Except as required by law, Squarespace assumes no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements.

About Squarespace

Squarespace (NYSE: SQSP) is a design-driven platform helping entrepreneurs build brands and businesses online. We empower millions in more than 200 countries and territories with all the tools they need to create an online presence, build an audience, monetize, and scale their business. Our suite of products range from websites, domains, ecommerce, and marketing tools, as well as tools for scheduling with Acuity, creating and managing social media presence with Bio Sites and Unfold, and hospitality business management via Tock. For more information, visit www.squarespace.com.

Contacts

Investors

investors@squarespace.com

Media

press@squarespace.com

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 270,718 | | | $ | 228,812 | | | $ | 1,012,336 | | | $ | 866,972 | |

| Cost of revenue(1) | 69,650 | | | 40,106 | | | 207,520 | | | 152,655 | |

| Gross profit | 201,068 | | | 188,706 | | | 804,816 | | | 714,317 | |

| Operating expenses: | | | | | | | |

| Research and product development(1) | 61,715 | | | 56,828 | | | 242,188 | | | 227,297 | |

| Marketing and sales(1) | 91,513 | | | 66,154 | | | 349,574 | | | 322,051 | |

| General and administrative(1) | 29,922 | | | 37,942 | | | 129,326 | | | 151,620 | |

| Impairment charge | — | | | 225,163 | | | — | | | 225,163 | |

| Total operating expenses | 183,150 | | | 386,087 | | | 721,088 | | | 926,131 | |

| Operating income/(loss) | 17,918 | | | (197,381) | | | 83,728 | | | (211,814) | |

| Interest expense | (10,718) | | | (7,230) | | | (36,768) | | | (18,207) | |

| Other (loss)/income, net | (4,163) | | | (9,567) | | | 3,362 | | | 5,030 | |

| Income/(loss) before benefit from/(provision for) income taxes | 3,037 | | | (214,178) | | | 50,322 | | | (224,991) | |

| Benefit from/(provision for) income taxes | 2,219 | | | (19,784) | | | (57,403) | | | (27,230) | |

| Net income/(loss) | $ | 5,256 | | | $ | (233,962) | | | $ | (7,081) | | | $ | (252,221) | |

| | | | | | | |

Net income/(loss) per share, basic and dilutive | $ | 0.04 | | | $ | (1.72) | | | $ | (0.05) | | | $ | (1.82) | |

Weighted-average shares used in computing net income/(loss) per share, basic | 136,153,002 | | | 136,340,283 | | | 135,531,363 | | | 138,409,491 | |

Weighted-average shares used in computing net income/(loss) per share, dilutive | 139,387,350 | | | 136,340,283 | | | 135,531,363 | | | 138,409,491 | |

(1) Includes stock-based compensation as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenue | $ | 1,451 | | | $ | 944 | | | $ | 5,536 | | | $ | 3,414 | |

| Research and product development | 13,868 | | | 11,099 | | | 54,806 | | | 42,237 | |

| Marketing and sales | 2,921 | | | 2,450 | | | 10,856 | | | 8,696 | |

| General and administrative | 9,587 | | | 12,989 | | | 36,551 | | | 48,186 | |

| Total stock-based compensation | $ | 27,827 | | | $ | 27,482 | | | $ | 107,749 | | | $ | 102,533 | |

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 257,702 | | | $ | 197,037 | |

| Restricted cash | 36,583 | | | 35,583 | |

| Investment in marketable securities | — | | | 31,757 | |

| Accounts receivable | 24,894 | | | 10,748 | |

| Due from vendors | 6,089 | | | 4,442 | |

| Prepaid expenses and other current assets | 48,947 | | | 48,326 | |

| Total current assets | 374,215 | | | 327,893 | |

| Property and equipment, net | 58,211 | | | 51,633 | |

| Operating lease right-of-use assets | 77,764 | | | 86,824 | |

| Goodwill | 210,438 | | | 210,438 | |

| Intangible assets, net | 190,103 | | | 42,808 | |

| Other assets | 11,028 | | | 10,921 | |

| Total assets | $ | 921,759 | | | $ | 730,517 | |

| Liabilities, Redeemable Convertible Preferred Stock and Stockholders’ Deficit | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 12,863 | | | $ | 12,987 | |

| Accrued liabilities | 99,435 | | | 64,360 | |

| Deferred revenue | 333,191 | | | 269,689 | |

| Funds payable to customers | 42,672 | | | 38,845 | |

| Debt, current portion | 48,977 | | | 40,758 | |

| Operating lease liabilities, current portion | 12,640 | | | 11,514 | |

| Total current liabilities | 549,778 | | | 438,153 | |

| Deferred income taxes, non-current portion | 1,039 | | | 788 | |

| Debt, non-current portion | 519,816 | | | 473,167 | |

| Operating lease liabilities, non-current portion | 97,714 | | | 110,169 | |

| Other liabilities | 13,764 | | | 11,231 | |

| Total liabilities | 1,182,111 | | | 1,033,508 | |

| Commitments and contingencies | | | |

| Redeemable convertible preferred stock, par value of $0.0001; zero shares authorized as of December 31, 2023 and 2022, respectively; zero shares issued and outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

| Preferred stock, par value of $0.0001; 100,000,000 shares authorized as of December 31, 2023 and 2022, respectively; zero shares issued and outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

| Stockholders’ deficit: | | | |

| Class A common stock, par value of $0.0001; 1,000,000,000 shares authorized as of December 31, 2023 and 2022, respectively; 88,545,012 and 87,754,534 shares issued and outstanding as of December 31, 2023 and 2022, respectively | 9 | | | 8 | |

| Class B common stock, par value of $0.0001; 100,000,000 shares authorized as of December 31, 2023 and 2022, respectively; 47,844,755 shares issued and outstanding as of December 31, 2023 and 2022, respectively | 5 | | | 5 | |

| Class C common stock (authorized March 15, 2021), par value of $0.0001; zero shares authorized as of December 31, 2023 and 2022, respectively; zero shares issued and outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

| Class C common stock (authorized May 10, 2021), par value of $0.0001; 1,000,000,000 shares authorized as of December 31, 2023 and 2022, respectively; zero shares issued and outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

| Additional paid in capital | 924,634 | | | 875,737 | |

| Accumulated other comprehensive loss | (843) | | | (1,665) | |

| Accumulated deficit | (1,184,157) | | | (1,177,076) | |

| Total stockholders’ deficit | (260,352) | | | (302,991) | |

| Total liabilities, redeemable convertible preferred stock and stockholders’ deficit | $ | 921,759 | | | $ | 730,517 | |

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Years Ended December 31, |

| 2023 | | 2022 |

| OPERATING ACTIVITIES: | | | |

| Net loss | $ | (7,081) | | | $ | (252,221) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 43,927 | | | 31,617 | |

| Stock-based compensation | 107,749 | | | 102,533 | |

| Impairment charge | — | | | 225,163 | |

| Deferred income taxes | 251 | | | 788 | |

| Non-cash lease (income)/expense | (2,286) | | | 2,227 | |

| Other | 831 | | | 832 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable and due from vendors | (15,678) | | | (5,461) | |

| Prepaid expenses and other current assets | (458) | | | 3,699 | |

| Accounts payable and accrued liabilities | 33,519 | | | (2,215) | |

| Deferred revenue | 61,364 | | | 39,464 | |

| Funds payable to customers | 3,827 | | | 8,707 | |

| Other operating assets and liabilities | 5,152 | | | 9,086 | |

| Net cash provided by operating activities | 231,117 | | | 164,219 | |

| INVESTING ACTIVITIES: | | | |

| Proceeds from the sale and maturities of marketable securities | 39,664 | | | 27,193 | |

| Purchases of marketable securities | (7,824) | | | (27,681) | |

| Cash paid for acquisitions, net of acquired cash | (176,721) | | | — | |

| Purchase of property and equipment | (16,998) | | | (11,543) | |

| Net cash used in operating activities | (161,879) | | | (12,031) | |

| FINANCING ACTIVITIES: | | | |

| Borrowings on Term Loan | 99,444 | | | — | |

| Payments of debt issuance costs | (637) | | | — | |

| Principal payments on debt | (44,867) | | | (13,586) | |

| Payments for repurchase and retirement of Class A common stock | (25,989) | | | (120,193) | |

| Taxes paid related to net share settlement of equity awards | (36,366) | | | (21,268) | |

| Proceeds from exercise of stock options | 228 | | | 2,211 | |

| Net cash used in financing activities | (8,187) | | | (152,836) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 614 | | | (412) | |

| Net increase/(decrease) in cash, cash equivalents and restricted cash | 61,665 | | | (1,060) | |

| Cash, cash equivalents and restricted cash at the beginning of the period | 232,620 | | | 233,680 | |

| Cash, cash equivalents and restricted cash at the end of the period | $ | 294,285 | | | $ | 232,620 | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash: | | | |

| Cash and cash equivalents | $ | 257,702 | | | $ | 197,037 | |

| Restricted cash | 36,583 | | | 35,583 | |

| Cash, cash equivalents and restricted cash at the end of the period | $ | 294,285 | | | $ | 232,620 | |

| | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW | | | |

| Cash paid during the year for interest | $ | 35,668 | | | $ | 17,088 | |

| Cash paid during the year for income taxes, net of refunds | $ | 41,747 | | | $ | 10,664 | |

| | | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES | | | |

| Purchases of property and equipment included in accounts payable and accrued liabilities | $ | 129 | | | $ | 1,784 | |

| Accrued taxes related to net share settlement of equity awards | $ | 377 | | | $ | 176 | |

| Non-cash leasehold improvements | $ | — | | | $ | (5,864) | |

| Capitalized stock-based compensation | $ | 3,940 | | | $ | 980 | |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(in thousands)

(unaudited)

The following tables reconcile each non-GAAP financial measure to its most directly comparable GAAP financial measure:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income/(loss) | $ | 5,256 | | | $ | (233,962) | | | $ | (7,081) | | | $ | (252,221) | |

| Interest expense | 10,718 | | | 7,230 | | | 36,768 | | | 18,207 | |

| (Benefit from)/provision for income taxes | (2,219) | | | 19,784 | | | 57,403 | | | 27,230 | |

| Depreciation and amortization | 18,952 | | | 7,844 | | | 43,927 | | | 31,617 | |

| Stock-based compensation expense | 27,827 | | | 27,482 | | | 107,749 | | | 102,533 | |

| Other loss/(income), net | 4,163 | | | 9,567 | | | (3,362) | | | (5,030) | |

| Impairment charge | — | | | 225,163 | | | — | | | 225,163 | |

| Adjusted EBITDA | $ | 64,697 | | | $ | 63,108 | | | $ | 235,404 | | | $ | 147,499 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities | $ | 61,090 | | | $ | 39,102 | | | $ | 231,117 | | | $ | 164,219 | |

| Cash paid for capital expenditures | (3,857) | | | (2,691) | | | (16,998) | | | (11,543) | |

| Free cash flow | $ | 57,233 | | | $ | 36,411 | | | $ | 214,119 | | | $ | 152,676 | |

| Cash paid for interest, net of the associated tax benefit | 7,788 | | | 5,105 | | | 26,894 | | | 12,874 | |

| Unlevered free cash flow | $ | 65,021 | | | $ | 41,516 | | | $ | 241,013 | | | $ | 165,550 | |

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Total debt outstanding | $ | 568,793 | | | $ | 513,925 | |

| Less: total cash and cash equivalents and marketable securities | 257,702 | | | 228,794 | |

| Total net debt | $ | 311,091 | | | $ | 285,131 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue, as reported | $ | 270,718 | | | $ | 228,812 | | | $ | 1,012,336 | | | $ | 866,972 | |

| Revenue year-over-year growth rate, as reported | 18.3 | % | | 10.3 | % | | 16.8 | % | | 10.6 | % |

| Effect of foreign currency translation ($)(1) | $ | 4,664 | | | $ | (8,252) | | | $ | 7,010 | | | $ | (28,318) | |

| Effect of foreign currency translation (%)(1) | 2.0 | % | | (4.0) | % | | 0.8 | % | | (3.6) | % |

| Revenue constant currency growth rate | 16.3 | % | | 14.3 | % | | 16.0 | % | | 14.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Commerce revenue, as reported | $ | 82,285 | | | $ | 71,983 | | | $ | 307,987 | | | $ | 269,672 | |

| Revenue year-over-year growth rate, as reported | 14.3 | % | | 12.1 | % | | 14.2 | % | | 17.5 | % |

| Effect of foreign currency translation ($)(1) | $ | 796 | | | $ | (1,451) | | | $ | 1,204 | | | $ | (4,960) | |

| Effect of foreign currency translation (%)(1) | 1.1 | % | | (2.3) | % | | 0.4 | % | | (2.2) | % |

| Commerce constant currency growth rate | 13.2 | % | | 14.4 | % | | 13.8 | % | | 19.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Presence revenue, as reported | $ | 188,433 | | | $ | 156,829 | | | $ | 704,349 | | | $ | 597,300 | |

| Revenue year-over-year growth rate, as reported | 20.2 | % | | 9.5 | % | | 17.9 | % | | 7.7 | % |

| Effect of foreign currency translation ($)(1) | $ | 3,867 | | | $ | (6,801) | | | $ | 5,806 | | | $ | (23,358) | |

| Effect of foreign currency translation (%)(1) | 2.5 | % | | (4.7) | % | | 1.0 | % | | (4.2) | % |

| Presence constant currency growth rate | 17.7 | % | | 14.2 | % | | 16.9 | % | | 11.9 | % |

(1) To calculate the effect of foreign currency translation, we apply the same weighted monthly average exchange rate as the comparative period.

Amounts may not sum due to rounding.

SUMMARY OF SHARES OUTSTANDING

(unaudited)

| | | | | | | | | | | |

| Years Ended December 31, |

| 2023 | | 2022 |

| Shares outstanding: | | | |

| Class A common stock | 88,545,012 | | 87,754,534 |

| Class B common stock | 47,844,755 | | 47,844,755 |

| Class C common stock | 0 | | 0 |

| Total shares outstanding | 136,389,767 | | 135,599,289 |

KEY PERFORMANCE INDICATORS AND NON-GAAP FINANCIAL MEASURES

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Unique subscriptions (in thousands) | 4,631 | | | 4,204 | | | 4,631 | | | 4,204 | |

| Total bookings (in thousands) | $ | 286,123 | | | $ | 232,145 | | | $ | 1,075,096 | | | $ | 906,056 | |

| ARRR (in thousands) | $ | 1,105,743 | | | $ | 931,708 | | | $ | 1,105,743 | | | $ | 931,708 | |

| ARPUS | $ | 228.02 | | | $ | 209.16 | | | $ | 228.02 | | | $ | 209.16 | |

| Adjusted EBITDA (in thousands) | $ | 64,697 | | | $ | 63,108 | | | $ | 235,404 | | | $ | 147,499 | |

| Unlevered free cash flow (in thousands) | $ | 65,021 | | | $ | 41,516 | | | $ | 241,013 | | | $ | 165,550 | |

| GMV (in thousands) | $ | 1,654,126 | | | $ | 1,556,004 | | | $ | 6,211,823 | | | $ | 6,058,832 | |

Unique subscriptions and average revenue per unique subscription (“ARPUS”) do not account for single domain subscriptions originally sold by Google as a part of the Google Domains Asset Acquisition.

v3.24.0.1

Cover

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity Registrant Name |

Squarespace, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40393

|

| Entity Tax Identification Number |

20-0375811

|

| Entity Address, Address Line One |

225 Varick Street

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10014

|

| City Area Code |

646

|

| Local Phone Number |

580-3456

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value

|

| Trading Symbol |

SQSP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001496963

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

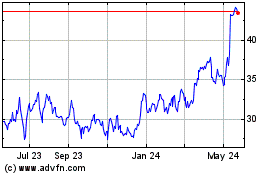

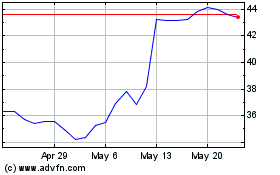

Squarespace (NYSE:SQSP)

Historical Stock Chart

From Apr 2024 to May 2024

Squarespace (NYSE:SQSP)

Historical Stock Chart

From May 2023 to May 2024