UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

March 4, 2024

Commission File Number 001-10306

NatWest Group plc

Gogarburn

PO Box 1000

Edinburgh EH12 1HQ

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

If "Yes" is marked, indicate below the

file number assigned to

the registrant in connection with Rule 12g3-2(b):

82-

This report on Form 6-K shall be deemed incorporated

by reference into the company’s Registration Statement on Form F-3 (File No. 333-261837) and to be a part thereof from the date

on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Explanatory Note

This report on Form 6-K/A is being filed

by NatWest Group plc (“NWG”) as an amendment to the report on Form 6-K dated March 1, 2024, relating to the closing of NWG’s

offering of USD 1,000,000,000 Fixed-to-Fixed Reset Rate Subordinated Tier 2 Notes due 2034 (the “Original Form 6-K”). The

purpose of this report on Form 6-K/A is to correct a clerical error in Exhibits 5.1 and 5.2 of the Original Form 6-K and therefore replace

Exhibits 5.1 and 5.2 filed with the Original Form 6-K in their entirety with the Exhibits 5.1 and 5.2 filed herewith.

Other than as expressly set forth above,

this Form 6-K/A does not amend, update or restate any other information in, or Exhibits filed with, the Original Form 6-K.

Index of Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf by the undersigned, thereunto

duly authorized.

| |

NatWest Group plc

(Registrant) |

| |

|

| |

|

|

| Date: March 4, 2024 |

By: |

/s/ Mark Stevens |

| |

Name: |

Mark Stevens |

| |

Title: |

Assistant Secretary |

Exhibit 5.1

|

NatWest Group plc

36 St Andrew Square

Edinburgh

EH2 2YB |

CMS Cameron McKenna Nabarro Olswang LLP

Saltire Court

20 Castle Terrace

Edinburgh

EH1 2EN

DX 553001, Edinburgh 18

Legal Post LP-2, Edinburgh 6

T +44 131 228 8000

F +44 131 228 8888

cms.law |

| |

|

| |

|

| |

|

1 March 2024 |

| Your ref |

|

|

| Our ref |

STPH/EDN/RBG001 |

|

Dear Sirs

$1,000,000,000 6.475% Fixed-to-Fixed Reset Rate

Subordinated Tier 2 Notes due 2034

We have acted as solicitors

in Scotland for NatWest Group plc (the Company) in connection with (i) the Underwriting Agreement dated as of 28 February

2024 (the Base Underwriting Agreement) between you and the representatives of certain underwriters (the Underwriters) under

which the Underwriters have severally agreed to purchase from the Company US$1,000,000,000 aggregate principal amount of the Company’s

6.475% Fixed-to-Fixed Reset Rate Subordinated Tier 2 Notes due 2034 (the Notes), and (ii) the Pricing Agreement dated as of

28 February 2024 (the Pricing Agreement and, together with the Base Underwriting Agreement, the Underwriting Agreement).

The Notes are to be issued

pursuant to an amended and restated indenture dated as of 4 December 2012 (the Base Indenture), as supplemented and amended by

an eighth supplemental indenture dated as of 1 March 2024, in each case between the Company and The Bank of New York Mellon, London Branch,

as trustee. The Base Indenture, as so supplemented and amended, is herein referred to as the Indenture.

We, as your solicitors, have examined originals

or copies, certified or otherwise identified to our satisfaction, of such documents, corporate records, certificates of public officials

and other instruments as we have deemed necessary for the purposes of rendering this opinion.

On the basis of the foregoing, we advise you that,

in our opinion, the Notes have been duly authorized in accordance with the Indenture, and, when executed and authenticated in accordance

with the provisions of the Indenture and delivered to, and paid for, by the Underwriters in accordance with the terms of the Underwriting

Agreement, will constitute valid and binding obligations of the Company, enforceable against

UK - 690790395.2

CMS Cameron McKenna Nabarro Olswang LLP is a limited

liability partnership registered in England and Wales with registration number OC310335. It is a body corporate which uses the word “partner”

to refer to a member, or an employee or consultant with equivalent standing and qualifications. It is authorised and regulated by the

Solicitors Regulation Authority of England and Wales with SRA number 423370. A list of members and their professional qualifications is

open to inspection at the registered office, Cannon Place, 78 Cannon Street, London EC4N 6AF. Members are either solicitors or registered

foreign lawyers. VAT registration number: 974 899 925. Further information about the firm can be found at cms.law

CMS Cameron McKenna Nabarro Olswang LLP is a member

of CMS Legal Services EEIG (CMS EEIG), a European Economic Interest Grouping that coordinates an organisation of independent law firms.

CMS EEIG provides no client services. Such services are solely provided by CMS EEIG’s member firms in their respective jurisdictions.

CMS EEIG and each of its member firms are separate and legally distinct entities, and no such entity has any authority to bind any other.

CMS EEIG and each member firm are liable only for their own acts or omissions and not those of each other. The brand name “CMS”

and the term “firm” are used to refer to some or all of the member firms or their offices. Further information can be found

at www.cmslegal.com

Notice: the firm does not accept service by e-mail

of court proceedings, other processes or formal notices of any kind without specific prior written agreement.

the Company in accordance with their terms, subject

to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally (including the Banking Act 2009 and

any secondary legislation, instruments or orders made, or which may be made, under it) and equitable principles of general applicability.

The foregoing opinion is limited to the present

laws of Scotland. We have made no investigation of the laws of any jurisdiction other than Scotland and neither express nor imply any

opinion as to any other laws and in particular the laws of the State of New York and the laws of the United States of America, and our

opinion is subject to such laws including the matters stated in the opinion of Davis Polk & Wardwell London LLP dated 1 March 2024,

to be filed on Form 6-K concurrently with this opinion. The laws of the State of New York are the chosen governing law of the Notes, and

we have assumed that the Notes constitute valid, binding and enforceable obligations of the Company, enforceable against the Company in

accordance with their terms, under such laws.

We hereby consent to the filing of this opinion

as an exhibit to a report on Form 6-K to be filed by the Company on the date hereof. In giving this consent, we do not admit that we are

in the category of persons whose consent is required under Section 7 of the US Securities Act of 1933, as amended.

Yours faithfully

/s/ Partner,

for and on behalf of CMS Cameron McKenna Nabarro Olswang LLP

CMS Cameron McKenna Nabarro Olswang LLP

Exhibit 5.2

|

Davis Polk & Wardwell London llp

5 Aldermanbury Square

London EC2V 7HR

davispolk.com

|

|

|

NatWest Group plc

Gogarburn

PO Box 1000

Edinburgh EH12 1HQ

United Kingdom

Ladies and Gentlemen:

We have acted as special United States counsel for NatWest Group plc

(the “Company”), a public limited company organized under the laws of Scotland, in connection with (i) the Underwriting

Agreement dated as of February 28, 2024 (the “Base Underwriting Agreement”) among the Company and the several underwriters

listed in Schedule I to the Pricing Agreement (collectively, the “Underwriters”), under which the Underwriters have

severally agreed to purchase from the Company $1,000,000,000 aggregate principal amount of its Fixed-to-Fixed Reset Rate Subordinated

Tier 2 Notes due 2034 (the “Notes”) and (ii) the Pricing Agreement dated as of February 28, 2024 related thereto (the

“Pricing Agreement” and, together with the Base Underwriting Agreement, the “Underwriting Agreement”).

The Company has filed with the Securities and Exchange Commission a Registration Statement on Form F-3 (File No. 333-261837) (the “Registration

Statement”) for the purpose of registering under the Securities Act of 1933, as amended (the “Securities Act”),

certain securities, including the Notes. The Notes are to be issued pursuant to the provisions of the Subordinated Debt Securities Indenture

dated as of December 4, 2012 (the “Original Base Indenture”), as amended and supplemented by the First Supplemental

Indenture dated as of December 4, 2012 (the “First Supplemental Indenture”), the Fourth Supplemental Indenture dated

as of May 28, 2014 (the “Fourth Supplemental Indenture”) and the Sixth Supplemental Indenture dated August 19, 2020

(the “Sixth Supplemental Indenture” and, together with the Original Base Indenture, the First Supplemental Indenture

and the Fourth Supplemental Indenture, the “Base Indenture”) and the Eighth Supplemental Indenture with respect to

the Notes dated as of March 1, 2024 (the “Eighth Supplemental Indenture” and, together with the Base Indenture, the

“Indenture”), in each case between the Company and The Bank of New York Mellon, London Branch, as trustee.

We, as your counsel, have examined originals or copies of such documents,

corporate records, certificates of public officials and other instruments as we have deemed necessary or advisable for the purpose of

rendering this opinion.

In rendering the opinions expressed herein, we have, without independent

inquiry or investigation, assumed that (i) all documents submitted to us as originals are authentic and complete, (ii) all documents submitted

to us as copies conform to authentic, complete originals, (iii) all documents filed with or submitted to the Securities and Exchange Commission

through its Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system (except for required EDGAR formatting

changes) conform to the versions of such documents reviewed by us prior to such formatting, (iv) all signatures on all documents that

we reviewed are genuine, (v) all natural persons executing documents had and have the legal capacity to do so, (vi) all statements in

certificates of public officials and officers of the Company that we reviewed were and are accurate and (vii) all representations made

by the Company as to matters of fact in the documents that we reviewed or that were otherwise made to us by the Company were and are accurate.

Davis Polk & Wardwell London LLP

is a limited liability partnership formed under the laws of the State of New York, USA and is authorised and regulated by the Solicitors

Regulation Authority with registration number 566321.

Davis Polk includes Davis Polk & Wardwell LLP and its associated entities

Based upon the foregoing and subject to

the additional assumptions and qualifications set forth below, we advise you that, in our opinion, assuming that the Notes have been duly

authorized, executed and delivered by the Company insofar as Scots law is concerned, the Notes (other than the terms expressed

to be governed by Scots law as to which we express no opinion), when executed and authenticated in accordance

with the provisions of the Indenture and delivered to and paid for by the Underwriters pursuant to the Underwriting Agreement, will constitute

valid and binding obligations of the Company, enforceable in accordance with their terms.

In connection with the opinion expressed above, we have assumed that

the Company validly exists as a public limited company under the laws of Scotland. In addition, we have assumed that the Indenture and

the Notes (collectively, the “Documents”) are valid, binding and enforceable agreements of each party thereto. We have

also assumed that the execution, delivery and performance by each party to each Document to which it is a party (a) are within its corporate

powers, (b) do not contravene, or constitute a default under, the certificate of incorporation or bylaws or other constitutive documents

of such party, (c) require no action by or in respect of, or filing with, any governmental body, agency or official and (d) do not contravene,

or constitute a default under, any provision of applicable law or regulation or any judgment, injunction, order or decree or any agreement

or other instrument binding upon such party.

Our opinion is subject to (i) the effects of applicable bankruptcy,

insolvency and similar laws affecting the enforcement of creditors’ rights generally, concepts of reasonableness and equitable principles

of general applicability and (ii) possible judicial or regulatory actions giving effect to governmental actions or foreign laws affecting

creditors’ rights.

We express no opinion with respect to the provisions in the Notes relating

to the acknowledgement of and consent to the exercise of any U.K. bail-in power (as defined therein) or Article 4 of the Eighth Supplemental

Indenture.

We are members of the Bar of the State of New York, and we express no

opinion as to the laws of any jurisdiction other than the laws of the State of New York and the federal laws of the United States. Insofar

as the foregoing opinion involves matters governed by Scots law, we have relied, without independent inquiry or investigation, on the

opinion of CMS Cameron McKenna LLP, special legal counsel in Scotland for the Company, dated as of March 1, 2024, to be filed on Form

6-K concurrently with this opinion.

We hereby consent to the filing of this opinion as an exhibit to a report

on Form 6-K to be filed by the Company on the date hereof and its incorporation by reference into the Registration Statement. In giving

this consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

Very truly yours,

/s/ Davis Polk & Wardwell London LLP

Davis Polk & Wardwell London LLP

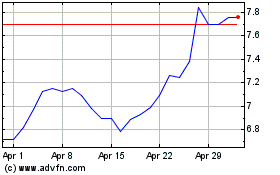

NatWest (NYSE:NWG)

Historical Stock Chart

From Apr 2024 to May 2024

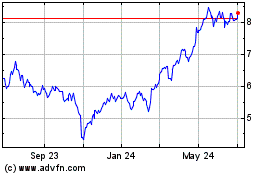

NatWest (NYSE:NWG)

Historical Stock Chart

From May 2023 to May 2024