UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024.

____________________________________

Commission File Number: 001-40627

SOPHiA GENETICS SA

(Exact name of registrant as specified in its charter)

Rue du Centre 172

CH-1025 Saint-Sulpice

Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

SIGNATURE

These sections, “2. Compensation of the Board of Directors” and “3. Compensation of the Members of the Executive Committee” in Exhibit 99.4 of this Report on Form 6-K shall be deemed to be incorporated by reference into the registration statement on Form F-3 (Registration No. 333-266704) of SOPHiA GENETICS SA and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| SOPHiA GENETICS SA |

Date: March 5, 2024 | | |

| | |

| By: | /s/ Daan van Well |

| Name: | Daan van Well |

| Title: | Chief Legal Officer |

EXHIBIT INDEX

SOPHiA GENETICS Reports Fourth Quarter and Full Year 2023 Results

Strong momentum to continue in 2024 as SOPHiA GENETICS announces record revenue, 35 new customer additions in Q4, and 36% cash burn decline in FY 2023

BOSTON, United States and ROLLE, Switzerland, March 5, 2024 — SOPHiA GENETICS (Nasdaq: SOPH), a cloud-native software company and a leader in data-driven medicine, today reported financial results for its fourth quarter and fiscal year ended December 31, 2023.

Fourth Quarter 2023 Financial Highlights

•Revenue grew 27% year-over-year to $17.0 million; Constant currency revenue excluding COVID-related revenue also grew 27% year-over-year

•Gross margins were 70% on a reported basis and 73% on an adjusted basis

•Operating loss was $18.9 million on a reported basis and $13.3 million on an adjusted basis

•Change in cash and cash equivalents and term deposits (cash burn) improved 11% year-over-year to $9.5 million, compared to $10.6 million in Q4 2022, even when factoring in a credit to computational and storage-related expenses related to our strategic agreement with Microsoft in Q4 2022

Full Year 2023 Financial Highlights

•Revenue grew 31% year-over-year to $62.4 million; Constant currency revenue excluding COVID-related revenue grew 32% year-over-year

•Gross margins were 69% on a reported basis and 72% on an adjusted basis

•Operating loss was $74.8 million on a reported basis and $55.9 million on an adjusted basis, representing 15% and 22% year-over-year improvements, respectively

•Cash burn improved 36% year-over-year to $55.4 million, compared to $86.7 million in FY 2022

"We are pleased with the tremendous performance in fiscal year 2023, including 31% year-over-year revenue growth, continued gross margin expansion, and 36% year-over-year improvement in cash burn," said Jurgi Camblong, PhD., Chief Executive Officer and Co-founder. "During 2023, we were excited to see continued, widespread adoption of SOPHiA DDMTM worldwide as the Platform performed a record 317,000+ analyses across the 450 core genomics customers we serve. We are especially proud of the growth we delivered with SOPHiA DDMTM’s Solid Tumor applications, with our BioPharma partners, and in the U.S. market.”

Camblong added, "Looking forward to 2024, we are well positioned to continue delivering strong growth. SOPHiA DDMTM’s new Liquid Biopsy offering, world-class Solid Tumor applications, and the momentum we are building in the U.S. are all exciting catalysts for growth in 2024 as we continue on our path to profitability in the next 2+ years."

Business Highlights

•Performed a record 317,062 analyses on SOPHiA DDMTM in FY 2023, representing 20% year-over-year analysis volume growth including COVID-related analyses or 27% growth excluding COVID-related analyses

•Reached 450 core genomics customers as of December 31, 2023, who use SOPHiA DDMTM regularly to analyze patients with cancer and rare diseases, up from 434 customers as of December 31, 2022

•Signed a record 35 new core genomic customers in Q4 2023 who will implement SOPHiA DDMTM during 2024

•Recently signed new core genomics customers, including Lifespan Health Network, a network of award-winning hospitals in Rhode Island, U.S., and Karkinos Healthcare, a major oncology platform in India

•Built momentum in the U.S. market with 70% year-over-year revenue growth for FY 2023, 9 new U.S. core genomics signed in FY 2023, and Q4 2023 U.S. analysis volume up 51% since Q4 2022

•Launched a new, expanded suite of Liquid Biopsy applications in December 2023, including MSK-ACCESS powered with SOPHiA DDMTM

•Continued expanding usage of SOPHiA DDMTM within existing customer by driving adoption of new applications, resulting in Net Dollar Retention of 130% in Q4 2023, up 2,800 bps from 102% at the end of FY 2022

•Announced new expanded relationships with existing customers, including Vall d'Hebron Institute of Oncology (VHIO) in Spain, one of the top comprehensive cancer centers in Europe, who added a Solid Tumor application for Homologous Recombination Deficiency (HRD) testing and Latin American healthcare network Diagnosticos da America (DASA) who adopted MSK-ACCESS powered with SOPHiA DDMTM for Liquid Biopsy testing

•Delivered strong growth in Solid Tumor applications, and in particular the HRD application, with nearly 50 HRD customers as of December 31, 2023 and over 150% year-over-year revenue growth

•Expanded our partnership with AstraZeneca to sponsor the deployment of SOPHiA DDMTM’s HRD application to additional laboratories throughout Spain

•Reaffirmed commitment to grow sustainably and achieve adjusted operating profitability in the next 2+ years

2024 Financial Outlook

Based on information as of today, SOPHiA GENETICS is providing the following guidance:

•Revenue between $78 million and $81 million, representing growth of 25% to 30% compared to full year 2023 revenue

•Adjusted gross margin between 72.5% and 72.7%, compared to 72.2% in FY 2023

•Adjusted operating loss between $45M and $50M, compared to $55.9 million in FY 2023

Other than with respect to revenue, the Company only provides guidance on a non-IFRS basis. The Company does not provide a reconciliation of forward-looking adjusted gross margin (non-IFRS measure) to gross margin (the most comparable IFRS financial measure), due to the inherent difficulty in forecasting and quantifying amortization of capitalized research & development expenses that are necessary for such reconciliation. In addition, the Company does not provide a reconciliation of forward-looking adjusted operating loss (non-IFRS measure) to operating loss (the most comparable IFRS financial measure), due to the inherent difficulty in forecasting and quantifying amortization of capitalized research & development expenses and intangible assets, share-based compensation expenses, and non-cash portion of pensions paid in excess of actual contributions, that are necessary for such reconciliation.

Earnings Call and Webcast Information

SOPHiA GENETICS will host a conference call and live webcast to discuss the fourth quarter and full year 2023 results, and financial guidance for the full year 2024 on Tuesday, March 5, 2024, at 8:00 a.m. (08:00) Eastern Time / 2:00 p.m. (14:00) Central European Time. The call will be webcast live on the SOPHiA GENETICS Investor Relations website, ir.sophiagenetics.com. Additionally, an audio replay of the conference call will be available on the SOPHiA GENETICS website after its completion.

Non-IFRS Financial Measures

To provide investors with additional information regarding the company’s financial results, SOPHiA GENETICS has disclosed here and elsewhere in this earnings release the following non-IFRS measures:

•Adjusted gross profit, which the company calculates as revenue minus cost of revenue adjusted to exclude amortization of capitalized research and development expenses;

•Adjusted gross profit margin, which the company calculates as adjusted gross profit as a percentage of revenue; and

•Adjusted operating loss, which the company calculates as operating loss adjusted to exclude amortization of capitalized research and development expenses, amortization of intangible assets,

share-based compensation expense, non-cash portion of pensions expense paid in excess of actual contributions to match the actuarial expense, and costs associated with corporate restructuring.

These non-IFRS measures are key measures used by SOPHiA GENETICS management and board of directors to evaluate its operating performance and generate future operating plans. The exclusion of certain expenses facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses and certain variable charges. Accordingly, the company believes that these non-IFRS measures provide useful information to investors and others in understanding and evaluating its operating results in the same manner as its management and board of directors.

These non-IFRS measures have limitations as financial measures, and you should not consider them in isolation or as a substitute for analysis of SOPHiA GENETICS’ results as reported under IFRS. Some of these limitations are:

•These non-IFRS measures exclude the impact of amortization of capitalized research and development expenses and intangible assets. Although amortization is a non-cash charge, the assets being amortized may need to be replaced in the future and these non-IFRS measures do not reflect capital expenditure requirements for such replacements or for new capital expenditures;

•These non-IFRS measures exclude the impact of share-based compensation expenses. Share-based compensation has been, and will continue to be for the foreseeable future, a recurring expense in the company’s business and an important part of its compensation strategy;

•These non-IFRS measures exclude the impact of the non-cash portion of pensions paid in excess of actual contributions to match actuarial expenses. Pension expenses have been, and will continue to be for the foreseeable future, a recurring expense in the business;

•These non-IFRS measures exclude the impact of costs associated with corporate restructuring, which we may incur from time to time; and

•Other companies, including companies in the company’s industry, may calculate these non-IFRS measures differently, which reduces their usefulness as comparative measures.

Because of these limitations, you should consider these non-IFRS measures alongside other financial performance measures, including various cash flow metrics, net income and other IFRS results.

The tables below provide the reconciliation of the most comparable IFRS measures to the non-IFRS measures for the periods presented.

Presentation of Constant Currency Revenue and Excluding COVID-19-Related Revenue

SOPHiA GENETICS operates internationally, and its revenues are generated primarily in the U.S. dollar, the euro and Swiss franc and, to a lesser extent, British pound, Australian dollar, Brazilian real, Turkish lira and Canadian dollar depending on the company’s customers’ geographic locations. Changes in revenue include the impact of changes in foreign currency exchange rates. We present the non-IFRS financial measure “constant currency revenue” (or similar terms such as constant currency revenue growth) to show changes in revenue without giving effect to period-to-period currency fluctuations. Under IFRS, revenues recorded in local (non-U.S. dollar) currencies are translated into U.S. dollars at the average monthly exchange rate for the month in which the transaction occurred. When the company uses the term “constant currency”, it means that it has translated local currency revenues for the current reporting period into U.S. dollars using the same average foreign currency exchange rates for the conversion of revenues into U.S. dollars that we used to translate local currency revenues for the comparable reporting period of the prior year. The company then calculates the difference between the IFRS revenue and the constant currency revenue to yield the “constant currency impact” for the current period.

The company’s management and board of directors use constant currency revenue growth to evaluate growth and generate future operating plans. The exclusion of the impact of exchange rate fluctuations provides comparability across reporting periods and reflects the effects of customer acquisition efforts and land-and-expand strategy. Accordingly, it believes that this non-IFRS measure provides useful information to investors and others in understanding and evaluating revenue growth in the same manner as the management and board

of directors. However, this non-IFRS measure has limitations, particularly as the exchange rate effects that are eliminated could constitute a significant element of its revenue and could significantly impact performance and prospects. Because of these limitations, you should consider this non-IFRS measure alongside other financial performance measures, including revenue and revenue growth presented in accordance with IFRS and other IFRS results.

In addition to constant currency revenue, the company presents constant currency revenue excluding COVID-19-related revenue to further remove the effects of revenues that are derived from sales of COVID-19-related offerings, including a NGS assay for COVID-19 that leverages the SOPHiA DDMTM Platform and related products and solutions analytical capabilities and COVID-19 bundled access products. SOPHiA GENETICS do not believe that these revenues reflect its core business of commercializing its platform because the company’s COVID-19 solution was offered to address specific market demand by its customers for analytical capabilities to assist with their testing operations. The company does not anticipate additional development of its COVID-19-related solution as the pandemic transitions into a more endemic phase and as customer demand continues to decline. Further, COVID-19-related revenues did not constitute, and the company does not expect COVID-19-related revenues to constitute in the future, a significant part of its revenue. Accordingly, the company believes that this non-IFRS measure provides useful information to investors and others in understanding and evaluating its revenue growth. However, this non-IFRS measure has limitations, including that COVID-19-related revenues contributed to the company’s cash position, and other companies may define COVID-19-related revenues differently. Because of these limitations, you should consider this non-IFRS measure alongside other financial performance measures, including revenue and revenue growth presented in accordance with IFRS and other IFRS results.

The table below provides the reconciliation of the most comparable IFRS growth measures to the non-IFRS growth measures for the current period.

About SOPHiA GENETICS

SOPHiA GENETICS (Nasdaq: SOPH) is a software company dedicated to establishing the practice of data-driven medicine as the standard of care and for life sciences research. It is the creator of the SOPHiA DDM™, a cloud-native Platform capable of analyzing data and generating insights from complex multimodal data sets and different diagnostic modalities. SOPHiA DDM™ and related solutions, products, and services are currently used by a broad network of hospital, laboratory, and biopharma institutions globally. For more information, visit SOPHiAGENETICS.COM, or connect on X, LinkedIn, Facebook, and Instagram. Where others see data, we see answers.

Forward-Looking Statements

This press release contains statements that constitute forward-looking statements. All statements other than statements of historical facts contained in this press release, including 2023 guidance and statements regarding our future results of operations and financial position, business strategy, products and technology, partnerships, and collaborations, as well as plans and objectives of management for future operations, are forward-looking statements. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including those described in our filings with the U.S. Securities and Exchange Commission. No assurance can be given that such future results will be achieved. Such forward-looking statements contained in this document speak only as of the date of this press release. We expressly disclaim any obligation or undertaking to update these forward-looking statements contained in this press release to reflect any change in our expectations or any change in events, conditions, or circumstances on which such statements are based, unless required to do so by applicable law. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements.

Investor Contact:

Kellen Sanger

IR@sophiagenetics.com

Media Contact:

Kelly Katapodis

media@sophiagenetics.com

SOPHiA GENETICS SA

Consolidated Statement of Loss

(Amounts in USD thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three months ended December 31, | | Year ended December 31, |

| | | | 2023 | | 2022 | | 2023 | | 2022 | | |

| Revenue | | | | $ | 17,048 | | | $ | 13,384 | | | $ | 62,371 | | | $ | 47,560 | | | |

| Cost of revenue | | | | (5,150) | | | (3,753) | | | (19,458) | | | (16,306) | | | |

| Gross profit | | | | 11,898 | | | 9,631 | | | 42,913 | | | 31,254 | | | |

| Research and development costs | | | | (9,759) | | | (6,790) | | | (36,969) | | | (35,371) | | | |

| Selling and marketing costs | | | | (7,966) | | | (4,247) | | | (28,423) | | | (28,267) | | | |

| General and administrative costs | | | | (13,269) | | | (13,929) | | | (53,301) | | | (55,816) | | | |

| Other operating income, net | | | | 150 | | | 252 | | | 954 | | | 377 | | | |

| Operating loss | | | | (18,946) | | | (15,083) | | | (74,826) | | | (87,823) | | | |

| Interest income, net | | | | 811 | | | 650 | | | 3,959 | | | 684 | | | |

| Foreign exchange and other losses | | | | (5,917) | | | 205 | | | (7,628) | | | (446) | | | |

| Loss before income taxes | | | | (24,052) | | | (14,228) | | | (78,495) | | | (87,585) | | | |

| Income tax (expense) benefit | | | | (8) | | | 257 | | | (486) | | | 136 | | | |

| Loss for the year | | | | (24,060) | | | (13,971) | | | (78,981) | | | (87,449) | | | |

| Attributable to the owners of the parent | | | | (24,060) | | | (13,971) | | — | | (78,981) | | | (87,449) | | | |

| | | | | | | | | | | | |

| Basic and diluted loss per share | | | | $ | (0.37) | | | $ | (0.22) | | | $ | (1.22) | | | $ | (1.36) | | | |

SOPHiA GENETICS SA

Consolidated Statement of Comprehensive Loss

(Amounts in USD thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three months ended December 31, | | Year ended December 31, |

| | | | 2023 | | 2022 | | 2023 | | 2022 | | |

| Loss for the year | | | | $ | (24,060) | | | $ | (13,971) | | | $ | (78,981) | | | $ | (87,449) | | | |

| Other comprehensive income (loss): | | | | | | | | | | | | |

| Items that may be reclassified to statement of loss (net of tax) | | | | | | | | | | | | |

| Currency translation differences | | | | 12,768 | | | 5,913 | | | 15,037 | | | (4,336) | | | |

| Total items that may be reclassified to statement of loss | | | | 12,768 | | | 5,913 | | | 15,037 | | | (4,336) | | | |

| Items that will not be reclassified to statement of loss (net of tax) | | | | | | | | | | | | |

| Remeasurement of defined benefit plans | | | | 71 | | | (299) | | | (212) | | | 2,154 | | | |

| Total items that will not be reclassified to statement of loss | | | | 71 | | | (299) | | | (212) | | | 2,154 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other comprehensive income (loss) for the period | | | | $ | 12,839 | | | $ | 5,614 | | | $ | 14,825 | | | $ | (2,182) | | | |

| Total comprehensive loss for the period | | | | $ | (11,221) | | | $ | (8,357) | | | $ | (64,156) | | | $ | (89,631) | | | |

| Attributable to owners of the parent | | | | $ | (11,221) | | | $ | (8,357) | | | $ | (64,156) | | | $ | (89,631) | | | |

SOPHiA GENETICS SA

Consolidated Balance Sheet

(Amounts in USD thousands)

(Audited)

| | | | | | | | | | | | | | | | |

| | | | December 31, 2023 | | December 31, 2022 |

| Assets | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | | | $ | 123,251 | | | $ | 161,305 | |

| Term deposits | | | | — | | | 17,307 | |

| Accounts receivable | | | | 13,557 | | | 6,649 | |

| Inventory | | | | 6,482 | | | 5,156 | |

| Prepaids and other current assets | | | | 4,757 | | | 5,838 | |

| Total current assets | | | | 148,047 | | | 196,255 | |

| Non-current assets | | | | | | |

| Property and equipment | | | | 7,469 | | | 7,129 | |

| Intangible assets | | | | 27,185 | | | 19,963 | |

| Right-of-use assets | | | | 15,635 | | | 14,268 | |

| Deferred tax assets | | | | 1,720 | | | 1,940 | |

| Other non-current assets | | | | 6,100 | | | 4,283 | |

| Total non-current assets | | | | 58,109 | | | 47,583 | |

| Total assets | | | | $ | 206,156 | | | $ | 243,838 | |

| Liabilities and equity | | | | | | |

| Current liabilities | | | | | | |

| Accounts payable | | | | $ | 5,391 | | | $ | 6,181 | |

| Accrued expenses | | | | 17,808 | | | 14,505 | |

| Deferred contract revenue | | | | 9,494 | | | 3,434 | |

| | | | | | |

| Lease liabilities, current portion | | | | 2,928 | | | 2,690 | |

| | | | | | |

| Total current liabilities | | | | 35,621 | | | 26,810 | |

| Non-current liabilities | | | | | | |

| | | | | | |

| Lease liabilities, net of current portion | | | | 15,673 | | | 14,053 | |

| Defined benefit pension liabilities | | | | 3,086 | | | 2,675 | |

| Other non-current liabilities | | | | 334 | | | 170 | |

| Total non-current liabilities | | | | 19,093 | | | 16,898 | |

| Total liabilities | | | | 54,714 | | | 43,708 | |

| Equity | | | | | | |

| Share capital | | | | 4,048 | | | 3,464 | |

| Share premium | | | | 471,846 | | | 471,623 | |

| Treasury shares | | | | (646) | | | (117) | |

| Other reserves | | | | 53,978 | | | 23,963 | |

| Accumulated deficit | | | | (377,784) | | | (298,803) | |

| Total equity | | | | 151,442 | | | 200,130 | |

| Total liabilities and equity | | | | $ | 206,156 | | | $ | 243,838 | |

SOPHiA GENETICS SA

Consolidated Statement of Cash Flows

(Amounts in USD thousands)

(Audited)

| | | | | | | | | | | | | | | | | | |

| | | | Year ended December 31, |

| | | | 2023 | | 2022 | | |

| Operating activities | | | | | | | | |

| Loss before income tax | | | | $ | (78,495) | | | $ | (87,585) | | | |

| Adjustments for non-monetary items | | | | | | | | |

| Depreciation | | | | 5,508 | | | 3,791 | | | |

| Amortization | | | | 2,828 | | | 1,780 | | | |

| Finance expense (income), net | | | | 2,934 | | | (685) | | | |

| Gain on TriplePoint success fee | | | | — | | | — | | | |

| Expected credit loss allowance | | | | 214 | | | (467) | | | |

| Share-based compensation | | | | 15,242 | | | 13,613 | | | |

| Intangible assets write-off | | | | — | | | 73 | | | |

| Movements in provisions, pensions, and government grants | | | | 308 | | | 953 | | | |

| Research tax credit | | | | (1,129) | | | (1,292) | | | |

| Loss on disposal of property and equipment | | | | 28 | | | — | | | |

| Gain on disposal of lease liability | | | | (733) | | | — | | | |

| Working capital changes | | | | | | | | |

| (Increase) decrease in accounts receivable | | | | (6,500) | | | 1,332 | | | |

| (Increase) decrease in prepaids and other assets | | | | 1,375 | | | (977) | | | |

| (Increase) decrease in inventory | | | | (874) | | | (200) | | | |

| Increase (decrease) in accounts payables, accrued expenses, deferred contract revenue, and other liabilities | | | | 6,871 | | | (1,428) | | | |

| Cash used in operating activities | | | | | | | | |

| Income tax received (paid) | | | | (801) | | | — | | | |

| Interest paid | | | | (6) | | | (266) | | | |

| Interest received | | | | 4,655 | | | 1,265 | | | |

| Net cash flows used in operating activities | | | | (48,575) | | | (70,093) | | | |

| Investing activities | | | | | | | | |

| Purchase of property and equipment | | | | (1,494) | | | (4,097) | | | |

| Acquisition of intangible assets | | | | (263) | | | (464) | | | |

| Capitalized development costs | | | | (7,469) | | | (5,820) | | | |

| Proceeds upon maturity of term deposits and short-term investments | | | | 17,546 | | | 78,533 | | | |

| Purchase of term deposits and short-term investments | | | | — | | | (26,179) | | | |

| Net cash flow provided from (used in) investing activities | | | | 8,320 | | | 41,973 | | | |

| Financing activities | | | | | | | | |

| Proceeds from exercise of share options | | | | 226 | | | 748 | | | |

| Proceeds from issuance of share capital, net of transaction costs | | | | — | | | — | | | |

| Proceeds from initial public offering, net of transaction costs | | | | — | | | — | | | |

| Proceeds from greenshoe, net of transaction costs | | | | — | | | — | | | |

| Proceeds from private placement, net of transaction costs | | | | — | | | — | | | |

| Payment of TriplePoint success fee | | | | — | | | — | | | |

| Proceeds from borrowings | | | | — | | | — | | | |

| Repayments of borrowings | | | | — | | | — | | | |

| Payments of principal portion of lease liabilities | | | | (3,043) | | | (2,316) | | | |

| Net cash flow (used in) provided from financing activities | | | | (2,817) | | | (1,568) | | | |

| Increase (decrease) in cash and cash equivalents | | | | (43,072) | | | (29,688) | | | |

| Effect of exchange differences on cash balances | | | | 5,018 | | | (1,969) | | | |

| Cash and cash equivalents at beginning of the year | | | | 161,305 | | | 192,962 | | | |

| Cash and cash equivalents at end of the year | | | | $ | 123,251 | | | $ | 161,305 | | | |

SOPHiA GENETICS SA

Reconciliation of IFRS Revenue Growth to Constant Currency Revenue Growth

and Constant Currency Revenue Growth Excluding COVID-19-Related Revenue

(Amounts in USD thousands, expect for %)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Year ended December 31, |

| | 2023 | | 2022 | | Growth | | 2023 | | 2022 | | Growth |

| IFRS revenue | | $ | 17,048 | | | $ | 13,384 | | | 27 | % | | $ | 62,371 | | | $ | 47,560 | | | 31 | % |

| Current period constant currency impact | | (177) | | | — | | | | | (527) | | | — | | | |

| Constant currency revenue | | $ | 16,871 | | | $ | 13,384 | | | 26 | % | | $ | 61,844 | | | $ | 47,560 | | | 30 | % |

| COVID-19-related revenue | | (106) | | | (167) | | | | | (319) | | | (1,080) | | | |

| Constant currency impact on COVID-19-related revenue | | 5 | | | | | | | 2 | | | — | | | |

| Constant currency revenue excluding COVID-19-related revenue | | $ | 16,770 | | | $ | 13,217 | | | 27 | % | | $ | 61,527 | | | $ | 46,480 | | | 32 | % |

SOPHiA GENETICS SA

Reconciliation of IFRS to Adjusted Gross Profit and Gross Profit Margin

(Amounts in USD thousands, except percentages)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Year ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 17,048 | | | $ | 13,384 | | | $ | 62,371 | | | $ | 47,560 | |

| Cost of revenue | | (5,150) | | | (3,753) | | | (19,458) | | | (16,306) | |

| Gross profit | | $ | 11,898 | | | $ | 9,631 | | | $ | 42,913 | | | $ | 31,254 | |

Amortization of capitalized research and development expenses (1) | | 619 | | | 378 | | | 2,099 | | | 1,133 | |

| | | | | | | | |

| Adjusted gross profit | | $ | 12,517 | | | $ | 10,009 | | | $ | 45,012 | | | $ | 32,387 | |

| | | | | | | | |

| Gross profit margin | | 70 | % | | 72 | % | | 69 | % | | 66 | % |

Amortization of capitalized research and development expenses (1) | | 3 | % | | 3 | % | | 3 | % | | 2 | % |

Damaged inventory write-off (2) | | — | % | | — | % | | — | % | | — | % |

| Adjusted gross profit margin | | 73 | % | | 75 | % | | 72 | % | | 68 | % |

SOPHiA GENETICS SA

Reconciliation of IFRS to Adjusted Operating Loss

(Amounts in USD thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Year ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Operating loss | | $ | (18,946) | | | $ | (15,083) | | | $ | (74,826) | | | $ | (87,823) | |

Amortization of capitalized research & development expenses (1) | | 619 | | | 378 | | | 2,099 | | | 1,133 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Amortization of intangible assets (2) | | 193 | | | 110 | | | 729 | | | 647 | |

Share-based compensation expense (3) | | 4,211 | | | 2,596 | | | 15,247 | | | 13,613 | |

Non-cash pension expense (4) | | (625) | | | (77) | | | (394) | | | 468 | |

Costs associated with restructuring (5) | | 1,232 | | | — | | | 1,232 | | | — | |

| Adjusted operating loss | | $ | (13,316) | | | $ | (12,076) | | | $ | (55,913) | | | $ | (71,962) | |

Notes to the Reconciliation of IFRS to Adjusted Financial Measures Tables

(1)Amortization of capitalized research and development expenses consists of software development costs amortized using the straight-line method over an estimated life of five years. These expenses do not have a cash impact but remain a recurring expense generated over the course of our research and development initiatives.

(2)Amortization of intangible assets consists of costs related to intangible assets amortized over the course of their useful lives. These expenses do not have a cash impact, but we could continue to generate such expenses through future capital investments.

(3)Share-based compensation expense represents the cost of equity awards issued to our directors, officers, and employees. The fair value of awards is computed at the time the award is granted and is recognized over the vesting period of the award by a charge to the income statement and a corresponding increase in other reserves within equity. These expenses do not have a cash impact but remain a recurring expense for our business and represent an important part of our overall compensation strategy.

(4)Non-cash pension expense consists of the amount recognized in excess of actual contributions made to our defined pension plans to match actuarial expenses calculated for IFRS purposes. The difference represents a non-cash expense but remains a recurring expense for our business as we continue to make contributions to our plans for the foreseeable future.

(5)Costs associated with restructuring consists of compensation paid to employees during their garden leave period, severance, and any other amounts legally owed to the employees resulting from their termination as part of a planned workforce reduction, which we undertook to optimize our operations. Additionally, it includes any legal fees incurred as part of the restructuring process. While such actions are not planned going forward as part of our regular operations, we expect such expenses could still be incurred from time to time based on corporate needs.

Dear Fellow Shareholders,

2023 was a tremendous year for SOPHiA GENETICS. We continued building the future of data-driven medicine, and in doing so, creating long-term value for our customers and our shareholders.

In many ways, 2023 was the year of AI. It was the first time that the general public gained access to powerful AI models and learned what they can do. As the Co-founder and leader of an AI-driven precision medicine company, this movement has been a fulfilling experience for me.

Since SOPHiA GENETICS’ inception in 2011, we have invested over US$400 million to build some of the most advanced AI capabilities in the healthcare sector. We recruited a team of more than 200 of the top data scientists and engineers in the world who contribute daily to building and developing our Platform, SOPHiA DDM™. Today, SOPHiA DDM™ is widely recognized by healthcare professionals and researchers across the globe for its world-class analytical performance and by some of our partners as the leading AI Platform in all of the healthcare space.

However, at SOPHiA GENETICS, we do not look at innovation as the development of new technologies. At SOPHiA GENETICS, we look at innovation as the adoption of those technologies in the market. And in that spirit, I would like to highlight the progress we made driving adoption of SOPHiA DDM™ throughout 2023.

Let me start by acknowledging the strongest evidence of our success. We grew revenue 31% year-over-year to US$62.4 million by continuing to drive widespread adoption of our Platform. At the same time, we improved gross margins and reduced operating costs to achieve a 36% decline in cash burn. In 2023, SOPHiA DDM™ was used by 770+ healthcare institutions across the globe, including by 450 core genomic customers who used SOPHiA DDM™ to perform over 317,000 analyses.

I am exceptionally proud of the progress made in 2023, and I would like to take a moment to thank the 400+ hard-working SOPHiANs, our partners, and our investors, all of whom helped to make this success a reality.

Our six strategic pillars remain our focus for driving long-term growth. We are as confident as ever in our strategic path, and I am excited to share more detail on our 2023 progress along these pillars with you.

Accelerating adoption of SOPHiA DDM™ by landing new clinical customers

Healthcare institutions around the world continue to choose SOPHiA DDM™ for very good reasons, for example our platform’s top analytical performance, ability to expedite turnaround time, universal compatibility (i.e., we work with all sequencer types, library prep, and technologies), and decentralized approach (i.e., customers maintain ownership of data).

By the end of 2023, we built a network of 450 core genomics customers who use SOPHiA DDM™ regularly to generate insights for patients with cancer or rare and inherited disorders.

I am thrilled to announce that we landed a record 87 new core genomic customers during 2023. This includes 35 new customers signed during Q4. These customers will implement SOPHiA DDM™ over the course of the year and are set to join our network of core genomics customers during 2024.

Growing the adoption of our platform in the US market continues to be a strong focus area as we see large potential for growth. In 2023, we delivered strong progress in this area. In 2023, US revenue grew

70% to US$9.5 million. We signed 9 new core genomic customers in the US in 2023 and were proud to welcome some of the top US cancer centers and research labs to the SOPHiA DDM™ network.

Apart from customer relationships, we also had a landmark year with our partners in the US. Namely, we continued to build our strategic partnership with Memorial Sloan Kettering. During 2023, we entered into a partnership with MSK to help them to decentralize their Liquid Biopsy test MSK-ACCESS® and their Solid Tumor test MSK-IMPACT®, and to make these tests available to healthcare institutions across the globe. We officially launched MSK-ACCESS® powered with SOPHiA DDM™ in December and have been pleased to see strong demand for this application in the market. In the US, we announced a number of new signings for MSK-ACCESS® powered with SOPHiA DDM™ and are looking forward to capitalizing on this momentum going into 2024.

Expanding usage of SOPHiA DDM™ within our existing customer base

We continue to employ a “land and expand” commercial strategy that focuses on winning new customers and then driving usage of our platform by encouraging those customers to adopt more and more SOPHiA DDM™ applications. Our offering includes an impressive suite of applications, including those for Hereditary Cancer, Hematology-Oncology, Solid Tumor, Liquid Biopsy, and Rare & Inherited Disorders.

In 2023, we continued to delight our customers, and in doing so, expand within accounts. Last year, we recorded an impressive NPS score of 75 from our core genomics users. We are incredibly proud of this achievement. We are also proud that our customers continue to adopt more applications once joining our network. As of the end of 2023, 56% of customers were using two or more applications, up from 49% a year ago. 31% of customers were using three or more applications, up from 28% a year ago. And 21% of our customers were using four or more applications, up from 17% a year ago. The continued proof of our ability to expand within existing customers exemplifies the importance of landing new customers across the globe.

Building SOPHiA DDM™’s menu of offerings

2023 was a landmark year for building our menu of offerings. I will highlight 2 major launches from 2023, including how they are already driving significant value for our customers.

First, and as mentioned previously, we launched an expanded suite of Liquid Biopsy applications in December 2023. This includes MSK-ACCESS® powered with SOPHiA DDM™. Our Liquid Biopsy applications are powered by a proprietary molecular barcoding technology named CUMIN™. CUMIN™ uses a unique approach to detecting signal from noise in samples with low input material, such as those collected for liquid biopsies, and differentiates our Liquid Biopsy application in a powerful way. For these reasons, we are excited by the application we developed, especially as we see strong demand already in the market.

The second item I would like to highlight was the launch of our multimodal module on SOPHiA DDM™, SOPHiA CarePath™. SOPHiA CarePath™ enables customers to go beyond genomics and perform longitudinal analysis of multimodal patient data (e.g., imaging data, clinical data, biological data). The multimodal capabilities of SOPHiA CarePath™ are designed to predict treatment effects of different therapy decisions in addition to allowing clinicians to perform patient cohorting and data visualization.

Leveraging SOPHiA DDM™ to provide value to our BioPharma companies

As you can imagine, the multimodal capabilities of SOPHiA CarePath™ provide differentiated value to our BioPharma customers who are willing to pay for the access to the multimodal patient data and to the predictive multimodal models which analyze them.

Towards the end of 2023, we completed a landmark project with one of our key BioPharma partners where SOPHiA CarePath™ identified a signature in subpopulations of lung cancer patients which could indicate different treatment effects for a specific drug. We continue to remain excited about these use cases for our multimodal offering and the substantial value these capabilities bring to our BioPharma customers

In addition to the value our multimodal capabilities bring to BioPharma customers, we also share a mutual interest with BioPharma companies to expand access to cancer testing across the globe. In 2023, we completed a number of partnerships with BioPharma partners where they sponsored the deployment of SOPHiA DDM™.

Our partnership with AstraZeneca has been a major proof point in this area. Last month, we announced that AZ sponsored the deployment of SOPHiA DDM’s HRD application across Spain in 2023 with resounding success. Following up on the success of this program, we also announced a new partnership with AZ to deploy MSK-ACCESS® and MSK-IMPACT® powered with SOPHiA DDM™ to customers across the globe during 2024.

Building partnerships in the ecosystem

As evidenced throughout this note, building the future of data-driven medicine is not something we can do alone. We achieved considerable momentum in 2023 by collaborating with premier leaders in our industry, further enabling our applications to reach more patients.

In 2023, we delivered significant partnerships with Memorial Sloan Kettering Cancer Center, AstraZeneca, Boundless Bio, and Microsoft, among others. We also announced partnerships with Agilent and Qiagen to deliver integrated solutions for Solid Tumors. We look forward to continuing to work with our valued partners in 2024 as we expand access to precision cancer care together.

Excelling operationally within SOPHiA GENETICS

Our final strategic pillar focuses on excelling operationally at every level within SOPHiA GENETICS. Our long-term commitment to operational excellence produces savings that have benefited both growth and margins. I’m proud to announce that our adjusted gross margin was 72% for the full year 2023 compared to 68% for 2022. Moreover, we improved cash burn by 36% in 2023 while maintaining revenue growth of over 30%.

In January of 2024, I was proud to announce our plans to achieve profitability in the next 2+ years. Being a sustainable company is critically important to us and the populations we serve. We have taken the required cost actions to expedite that goal and remain obsessed with capital efficiency. Based on our current trajectory, we remain confident in our ability to execute our ambitious growth plans, and we remain-laser focused on delivering sustainable growth for years to come.

Closing remarks

After a successful and unforgettable 2023, our focus shifts to the future. In 2024, we are looking forward to continuing to execute on our vision and creating value at every turn. Our six strategic pillars remain

our foundation to drive growth and value creation. I am encouraged and as confident as ever about our long-term trajectory.

In closing, I’d like to thank the SOPHiANs, our passionate and dedicated employees, for their hard work and incredible contributions towards building the future of precision medicine. I’d also like to thank our partners, customers, and investors for joining us on this journey. Without you, none of this would be possible. I look forward to continuing to update you on SOPHiA GENETICS’s future success in democratizing data-driven medicine.

Sincerely,

Dr. Jurgi Cambling

Co-Founder and Chief Executive Officer

SOPHiA GENETICS

Consolidated Financial Statements of SOPHiA GENETICS SA for the year ended

December 31, 2023

| | |

SOPHiA GENETICS SA Rolle Report of the statutory auditor to the General Meeting on the consolidated financial statements 2023 |

Report of the statutory auditor

to the General Meeting of SOPHiA GENETICS SA

Rolle

Report on the audit of the consolidated financial statements

Opinion

We have audited the consolidated financial statements of SOPHiA GENETICS SA and its subsidiaries (the Group), which comprise the consolidated statement of loss and the consolidated statement of comprehensive loss for the year ended 31 December 2023, the consolidated balance sheet as at 31 December 2023, the consolidated statement of change in equity and consolidated statement of cash flows for the year then ended, and notes to the consolidated financial statements, including material accounting policy information.

In our opinion, the accompanying consolidated financial statements give a true and fair view of the consolidated financial position of the Group as at 31 December 2023 and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with IFRS Accounting Standards and comply with Swiss law.

Basis for opinion

We conducted our audit in accordance with Swiss law, International Standards on Auditing (ISAs) and Swiss Standards on Auditing (SA-CH). Our responsibilities under those provisions and standards are further described in the 'Auditor’s responsibilities for the audit of the consolidated financial statements' section of our report. We are independent of the Group in accordance with the provisions of Swiss law and the requirements of the Swiss audit profession, as well as the International Code of Ethics for Professional Accountants (including International Independence Standards) issued by the International Ethics Standards Board for Accountants (IESBA Code), and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Our audit approach

| | | | | |

| Overview | Overall Group materiality: USD 3,894 thousand |

| We conducted full scope audit work at the Swiss entity. In addition, specified procedures were performed on the U.S. and French entities. Our audit scope addressed over 90% of the Group’s total revenue. |

As key audit matter the following area of focus has been identified: Revenue from SOPHiA DDM platform

|

Materiality

The scope of our audit was influenced by our application of materiality. Our audit opinion aims to provide reasonable assurance that the consolidated financial statements are free from material misstatement. Misstatements may arise due

| | |

PricewaterhouseCoopers SA, avenue C.-F. Ramuz 45, case postale, 1001 Lausanne, Switzerland Téléphone: +41 58 792 81 00, www.pwc.ch PricewaterhouseCoopers SA is a member of the global PricewaterhouseCoopers network of firms, each of which is a separate and independent legal entity. |

to fraud or error. They are considered material if, individually or in aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of the consolidated financial statements.

Based on our professional judgement, we determined certain quantitative thresholds for materiality, including the overall Group materiality for the consolidated financial statements as a whole as set out in the table below. These, together with qualitative considerations, helped us to determine the scope of our audit and the nature, timing and extent of our audit procedures and to evaluate the effect of misstatements, both individually and in aggregate, on the consolidated financial statements as a whole.

| | | | | |

Overall Group materiality | USD 3,894 thousand |

Benchmark applied | Loss before tax |

Rationale for the materiality benchmark applied | We chose loss before tax as the benchmark because, in our view, it is the benchmark against which the performance of the Group is most commonly measured, and it is a generally accepted benchmark. |

We agreed with the Audit Committee that we would report to them misstatements above USD 389 thousand identified during our audit as well as any misstatements below that amount which, in our view, warranted reporting for qualitative reasons.

Audit scope

We tailored the scope of our audit in order to perform sufficient work to enable us to provide an opinion on the consolidated financial statements as a whole, taking into account the structure of the Group, the accounting processes and controls, and the industry in which the Group operates.

The Group financial statements are a consolidation of 7 reporting entities. We, the Group audit team, identified and performed the audit over 1 reporting entity that, in our view, required an audit of its complete financial information due to its size or risk characteristics. To obtain appropriate coverage of material balances, we also performed specified audit procedures on 2 reporting entities. None of the reporting entities excluded from our Group audit scope individually contributed more than 5% to net sales or total assets. Audit procedures were also performed over the Group’s Corporate activities (including certain employee benefits) and Group consolidation.

Key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

| | |

3 SOPHiA GENETICS SA | Report of the statutory auditor to the General Meeting |

Revenue from SOPHiA DDM platform

| | | | | | | | |

Key audit matter | | How our audit addressed the key audit matter |

During the year ended December 31, 2023, the Group’s revenue from the SOPHiA DDM platform was USD 60,904 thousand. As discussed in note 4 to the consolidated financial statements, the Group has determined that the stand-alone selling price for the analyses, in both a dry lab arrangement and bundle arrangement, is not discernible from past transactions. As a result, the residual approach is used to determine the stand-alone selling price of the analyses for both arrangements. Two different margins have been determined by the Group, one for enrichment kits which are produced and one for enrichment kits which are purchased.

In our view, this is a key audit matter, as the determination of the stand-alone selling price is based to a large extent on estimates made by the Group.

| | We obtained and read the accounting memo and discussed with management the determination of the accounting treatment of the residual approach. We critically challenged the estimates used in the determination of the enrichment kit margin for both produced and purchased enrichment kits by comparing the peer group information included in management’s memo to publicly available information. We assessed the appropriateness of the Group’s conclusions in the application of the accounting policy in accordance with IFRS 15. We tested the application of the estimates throughout our revenue testing and as part of the enrichment kit cost testing. We noted no deviations from the two estimates management outlined in their accounting memo.

In addition, we performed a sensitivity analysis over the Group’s estimate of the margin applied to the enrichment kits to understand the impact on the timing of the revenue recognized.

Based on our procedures we consider management’s approach regarding the determination of the accounting treatment, the approach used to allocate the transaction price to the analyses and estimates used for the determination of the enrichment kit margin to be reasonable.

|

Other information

The Board of Directors is responsible for the other information. The other information comprises the information included in the annual report, but does not include the financial statements, the consolidated financial statements, the compensation report and our auditor’s reports thereon.

Our opinion on the consolidated financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated.

If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Board of Directors' responsibilities for the consolidated financial statements

The Board of Directors is responsible for the preparation of consolidated financial statements that give a true and fair view in accordance with IFRS Accounting Standards and the provisions of Swiss law, and for such internal control as the Board of Directors determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, the Board of Directors is responsible for assessing the Group's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern

| | |

4 SOPHiA GENETICS SA | Report of the statutory auditor to the General Meeting |

basis of accounting unless the Board of Directors either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Swiss law, ISAs and SA-CH will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with Swiss law, ISAs and SA-CH, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

•Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal control.

•Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made.

•Conclude on the appropriateness of the Board of Directors’ use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Group to cease to continue as a going concern.

•Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

•Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.

We communicate with the Board of Directors or its relevant committee regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide the Board of Directors or its relevant committee with a statement that we have complied with relevant ethical requirements regarding independence, and communicate with them regarding all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, actions taken to eliminate threats or safeguards applied.

From the matters communicated with the Board of Directors or its relevant committee, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

| | |

5 SOPHiA GENETICS SA | Report of the statutory auditor to the General Meeting |

Report on other legal and regulatory requirements

In accordance with article 728a para. 1 item 3 CO and PS-CH 890, we confirm the existence of an internal control system that has been designed, pursuant to the instructions of the Board of Directors, for the preparation of the consolidated financial statements.

We recommend that the consolidated financial statements submitted to you be approved.

PricewaterhouseCoopers SA

| | | | | |

| /s/ Michael Foley | /s/ Pierre-Alain Dévaud |

Licensed audit expert Auditor in charge | Licensed audit expert |

Lausanne, 5 March 2024

| | |

6 SOPHiA GENETICS SA | Report of the statutory auditor to the General Meeting |

SOPHiA GENETICS SA, Rolle

Consolidated Statements of Loss

(Amounts in USD thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Year ended December 31, |

| | Notes | | 2023 | | 2022 | | 2021 |

| Revenue | | 4 | | $ | 62,371 | | | $ | 47,560 | | | $ | 40,450 | |

| Cost of revenue | | 5 | | (19,458) | | | (16,306) | | | (15,229) | |

| Gross profit | | | | 42,913 | | | 31,254 | | | 25,221 | |

| Research and development costs | | 6 | | (36,969) | | | (35,371) | | | (26,578) | |

| Selling and marketing costs | | 6 | | (28,423) | | | (28,267) | | | (28,735) | |

| General and administrative costs | | 6 | | (53,301) | | | (55,816) | | | (41,505) | |

| Other operating income, net | | 7 | | 954 | | | 377 | | | 108 | |

| Operating loss | | | | (74,826) | | | (87,823) | | | (71,489) | |

| Interest income (expense), net | | 8 | | 3,959 | | | 685 | | | (638) | |

| Foreign exchange and other losses | | 8 | | (7,628) | | | (447) | | | (1,380) | |

| Loss before income taxes | | | | (78,495) | | | (87,585) | | | (73,507) | |

| Income tax (expense) benefit | | 9 | | (486) | | | 136 | | | (168) | |

| Loss for the year | | | | (78,981) | | | (87,449) | | | (73,675) | |

| Attributable to the owners of the parent | | | | $ | (78,981) | | | $ | (87,449) | | | $ | (73,675) | |

| | | | | | | | |

| Basic and diluted loss per share | | 10 | | $ | (1.22) | | | $ | (1.36) | | | $ | (1.33) | |

The Notes form an integral part of these consolidated financial statements

SOPHiA GENETICS SA, Rolle

Consolidated Statements of Comprehensive Loss

(Amounts in USD thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Year ended December 31, |

| | Notes | | 2023 | | 2022 | | 2021 |

| Loss for the year | | | | $ | (78,981) | | | $ | (87,449) | | | $ | (73,675) | |

| Other comprehensive (loss) income: | | | | | | | | |

| Items that may be reclassified to statement of loss (net of tax) | | | | | | | | |

| Currency translation differences | | | | 15,037 | | | (4,336) | | | (4,736) | |

| Total items that may be reclassified to statement of loss | | | | $ | 15,037 | | | $ | (4,336) | | | $ | (4,736) | |

| Items that will not be reclassified to statement of loss (net of tax) | | | | | | | | |

| Remeasurement of defined benefit plans | | 22 | | (212) | | | 2,154 | | | 461 | |

| Total items that will not be reclassified to statement of loss | | | | $ | (212) | | | $ | 2,154 | | | $ | 461 | |

| Other comprehensive (loss) income for the year | | | | $ | 14,825 | | | $ | (2,182) | | | $ | (4,275) | |

| Total comprehensive loss for the year | | | | $ | (64,156) | | | $ | (89,631) | | | $ | (77,950) | |

| Attributable to owners of the parent | | | | $ | (64,156) | | | $ | (89,631) | | | $ | (77,950) | |

The Notes form an integral part of these consolidated financial statements

SOPHiA GENETICS SA, Rolle

Consolidated Balance Sheets

(Amounts in USD thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | | As of December 31, |

| | Notes | | 2023 | | 2022 |

| Assets | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | 11 | | $ | 123,251 | | | $ | 161,305 | |

| Term deposits | | 12 | | — | | | 17,307 | |

| Accounts receivable | | 13 | | 13,557 | | | 6,649 | |

| Inventory | | 14 | | 6,482 | | | 5,156 | |

| Prepaids and other current assets | | 15 | | 4,757 | | | 5,838 | |

| Total current assets | | | | 148,047 | | | 196,255 | |

| Non-current assets | | | | | | |

| Property and equipment | | 16 | | 7,469 | | | 7,129 | |

| Intangible assets | | 17 | | 27,185 | | | 19,963 | |

| Right-of-use assets | | 18 | | 15,635 | | | 14,268 | |

| Deferred tax assets | | 9 | | 1,720 | | | 1,940 | |

| Other non-current assets | | 19 | | 6,100 | | | 4,283 | |

| Total non-current assets | | | | 58,109 | | | 47,583 | |

| Total assets | | | | $ | 206,156 | | | $ | 243,838 | |

| Liabilities and equity | | | | | | |

| Current liabilities | | | | | | |

| Accounts payable | | 20 | | $ | 5,391 | | | $ | 6,181 | |

| Accrued expenses | | 21 | | 17,808 | | | 14,505 | |

| Deferred contract revenue | | 4 | | 9,494 | | | 3,434 | |

| | | | | | |

| Current portion of lease liabilities | | 18 | | 2,928 | | | 2,690 | |

| | | | | | |

| Total current liabilities | | | | 35,621 | | | 26,810 | |

| Non-current liabilities | | | | | | |

| | | | | | |

| | | | | | |

| Lease liabilities, net of current portion | | 18 | | 15,673 | | | 14,053 | |

| Defined benefit pension liabilities | | 22 | | 3,086 | | | 2,675 | |

| Other non-current liabilities | | | | 334 | | | 170 | |

| Total non-current liabilities | | | | 19,093 | | | 16,898 | |

| Total liabilities | | | | 54,714 | | | 43,708 | |

| Equity | | | | | | |

| Share capital | | | | 4,048 | | | 3,464 | |

| Share premium | | | | 471,846 | | | 471,623 | |

| Treasury shares | | | | (646) | | | (117) | |

| Other reserves | | | | 53,978 | | | 23,963 | |

| Accumulated deficit | | | | (377,784) | | | (298,803) | |

| Total equity | | | | 151,442 | | | 200,130 | |

| Total liabilities and equity | | | | $ | 206,156 | | | $ | 243,838 | |

The Notes form an integral part of these consolidated financial statements

SOPHiA GENETICS SA, Rolle

Consolidated Statements of Changes in Equity

(Amounts in USD thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Notes | | Shares | | Share

capital | | Treasury Shares | | Treasury Share

capital | | Share

premium | | Other

reserves | | Accumulated

deficit | | Total |

| January 1, 2021 | | | | 47,955,700 | | | $ | 2,460 | | | — | | | $ | — | | | $ | 227,429 | | | $ | 8,300 | | | $ | (137,679) | | | $ | 100,510 | |

| Loss for the period | | | | — | | | — | | | — | | | — | | | — | | | — | | | (73,675) | | | (73,675) | |

| Other comprehensive loss | | | | — | | | — | | | — | | | — | | | — | | | (4,275) | | | — | | | (4,275) | |

| Total comprehensive loss | | | | — | | | — | | | — | | | — | | | — | | | (4,275) | | | (73,675) | | | (77,950) | |

| Share-based compensation | | 23 | | — | | | — | | | — | | | — | | | — | | | 8,514 | | | — | | | 8,514 | |

| Transactions with owners | | | | | | | | | | | | | | | | | | |

| Share options exercised | | | | 1,271,300 | | | 69 | | | — | | | — | | | 4,458 | | | — | | | — | | | 4,527 | |

| Sale of ordinary shares in initial public offering, net of transaction costs | | | | 13,000,000 | | | 710 | | | — | | | — | | | 210,953 | | | — | | | — | | | 211,663 | |

| Sale of ordinary shares in private placement, net of transaction costs | | | | 1,111,111 | | | 61 | | | — | | | — | | | 19,587 | | | — | | | — | | | 19,648 | |

| Sale of ordinary shares in greenshoe offering, net of transaction costs | | | | 519,493 | | | 28 | | | — | | | — | | | 8,460 | | | — | | | — | | | 8,488 | |

| December 31, 2021 | | | | 63,857,604 | | | $ | 3,328 | | | — | | | $ | — | | | $ | 470,887 | | | $ | 12,539 | | | $ | (211,354) | | | $ | 275,400 | |

| Loss for the period | | | | — | | | — | | | — | | | — | | | — | | | — | | | (87,449) | | | (87,449) | |

| Other comprehensive loss | | | | — | | | — | | | — | | | — | | | — | | | (2,182) | | | — | | | (2,182) | |

| Total comprehensive loss | | | | — | | | — | | | — | | | — | | | — | | | (2,182) | | | (87,449) | | | (89,631) | |

| Share-based compensation | | 23 | | — | | | — | | | — | | | — | | | — | | | 13,613 | | | — | | | 13,613 | |

| Transactions with owners | | | | | | | | | | | | | | | | | | |

| Share options exercised and vesting of Restricted Stock Units | | 23 | | — | | | — | | | 373,616 | | | 19 | | | 736 | | | (7) | | | — | | | 748 | |

| Issuance of shares to be held as treasury shares | | | | 2,540,560 | | | 136 | | | (2,540,560) | | | (136) | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| December 31, 2022 | | | | 66,398,164 | | | $ | 3,464 | | | (2,166,944) | | | $ | (117) | | | $ | 471,623 | | | $ | 23,963 | | | $ | (298,803) | | | $ | 200,130 | |

| Loss for the period | | | | | | | | | | | | | | | | (78,981) | | | (78,981) | |

| Other comprehensive loss | | | | — | | | — | | | — | | | — | | | — | | | 14,825 | | | — | | | 14,825 | |

| Total comprehensive loss | | | | — | | | — | | | — | | | — | | | — | | | 14,825 | | | (78,981) | | | (64,156) | |

| Share-based compensation | | 23 | | | | | | | | | | | | 15,242 | | | — | | | 15,242 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Transactions with owners | | | | | | | | | | | | | | | | | | |

| Share options exercised and vesting of Restricted Stock Units | | 23 | | — | | | — | | | 999,339 | | | 55 | | | 223 | | | (52) | | | — | | | 226 | |

| Issuance of shares to be held as treasury shares | | | | 10,500,000 | | | 584 | | | (10,500,000) | | | (584) | | | — | | | — | | | — | | | — | |

| December 31, 2023 | | | | 76,898,164 | | | $ | 4,048 | | | (11,667,605) | | | $ | (646) | | | 471,846 | | | 53,978 | | | (377,784) | | | 151,442 | |

The Notes form an integral part of these consolidated financial statements

SOPHiA GENETICS SA, Rolle

Consolidated Statements of Cash Flows

(Amounts in USD thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Year ended December 31, |

| | Notes | | 2023 | | 2022 | | 2021 |

| Operating activities | | | | | | | | |

| Loss before income tax | | | | $ | (78,495) | | | $ | (87,585) | | | $ | (73,507) | |

| Adjustments for non-monetary items | | | | | | | | |

| Depreciation | | 16,18 | | 5,508 | | | 3,791 | | | 2,517 | |

| Amortization | | 17 | | 2,828 | | | 1,780 | | | 1,092 | |

| Finance expense (income), net | | | | 2,934 | | | (685) | | | 638 | |

| Gain on TriplePoint success fee | | | | — | | | — | | | (430) | |

| Expected credit loss allowance | | 13 | | 214 | | | (467) | | | (988) | |

| Share-based compensation | | 23 | | 15,242 | | | 13,613 | | | 8,514 | |

| Intangible assets write-off | | 17 | | — | | | 73 | | | 30 | |

| Movements in provisions, pensions, and government grants | | 14,22 | | 308 | | | 953 | | | (23) | |

| Research tax credit | | 6 | | (1,129) | | | (1,292) | | | (1,597) | |

| Loss on disposal of property and equipment | | 16 | | 28 | | | — | | | 22 | |

| Gain on disposal of lease liability | | | | (733) | | | — | | | — | |

| Working capital changes | | | | | | | | |

| (Increase) decrease in accounts receivable | | | | (6,500) | | | 1,332 | | | 1,806 | |

| (Increase) decrease in prepaids and other assets | | | | 1,375 | | | (977) | | | (2,330) | |

| (Increase) decrease in inventory | | | | (874) | | | (200) | | | (2,336) | |

| Increase (decrease) in accounts payables, accrued expenses, deferred contract revenue, and other liabilities | | | | 6,871 | | | (1,428) | | | 8,980 | |

| Cash used in operating activities | | | | | | | | |

| Income tax received (paid) | | | | (801) | | | — | | | (55) | |

| Interest paid | | | | (6) | | | (266) | | | (286) | |

| Interest received | | | | 4,655 | | | 1,265 | | | 14 | |

| Net cash flows used in operating activities | | | | (48,575) | | | (70,093) | | | (57,939) | |

| Investing activities | | | | | | | | |

| Purchase of property and equipment | | 16 | | (1,494) | | | (4,097) | | | (2,683) | |

| Acquisition of intangible assets | | 17 | | (263) | | | (464) | | | (130) | |

| Capitalized development costs | | 17 | | (7,469) | | | (5,820) | | | (3,858) | |

| Proceeds upon maturity of term deposits and short-term investments | | 12 | | 17,546 | | | 78,533 | | | 21,878 | |

| Purchase of term deposits and short-term investments | | 12 | | — | | | (26,179) | | | (72,141) | |

| Net cash flow provided from (used in) investing activities | | | | 8,320 | | | 41,973 | | | (56,934) | |

| Financing activities | | | | | | | | |

| Proceeds from exercise of share options | | 23 | | 226 | | | 748 | | | 4,527 | |

| | | | | | | | |

| Proceeds from initial public offering, net of transaction costs | | | | — | | | — | | | 211,663 | |

| Proceeds from greenshoe, net of transaction costs | | | | — | | | — | | | 8,488 | |

| Proceeds from private placement, net of transaction costs | | | | — | | | — | | | 19,648 | |

| Payment of TriplePoint success fee | | | | — | | | — | | | (2,468) | |

| | | | | | | | |

| Repayments of borrowings | | 24 | | — | | | — | | | (3,167) | |

| Payments of principal portion of lease liabilities | | 18 | | (3,043) | | | (2,316) | | | (918) | |

| Net cash flow (used in) provided from financing activities | | | | (2,817) | | | (1,568) | | | 237,773 | |

| Increase (decrease) in cash and cash equivalents | | | | (43,072) | | | (29,688) | | | 122,900 | |

| Effect of exchange differences on cash balances | | | | 5,018 | | | (1,969) | | | (4,563) | |

| Cash and cash equivalents at beginning of the year | | | | 161,305 | | | 192,962 | | | 74,625 | |

| Cash and cash equivalents at end of the year | | | | $ | 123,251 | | | $ | 161,305 | | | $ | 192,962 | |

The Notes form an integral part of these consolidated financial statements

SOPHiA GENETICS SA, Rolle

Notes to the Consolidated Financial Statements

1. Company information and operations

General information

SOPHiA GENETICS SA and its consolidated subsidiaries (NASDAQ: SOPH) (“the Company”) is a cloud-native software company in the healthcare space, incorporated on March 18, 2011, and headquartered in Rolle, Switzerland. The Company is dedicated to establishing the practice of data-driven medicine as the standard of care in healthcare and for life sciences research. The Company has built a cloud-native software platform capable of analyzing data and generating insights from complex multimodal datasets and different diagnostic modalities. This platform, commercialized as “SOPHiA DDMTM,” standardizes, computes, and analyzes digital health data and is used in decentralized locations to break down data silos.

On June 26, 2023, during the Company’s Annual General Meeting, the move of the statutory seat from Saint-Sulpice, Canton Vaud, Switzerland to Rolle, Canton Vaud, Switzerland was approved.

As of December 31, 2023, the Company had the following wholly-owned subsidiaries:

| | | | | |

| Name | Country of domicile |

| SOPHiA GENETICS S.A.S. | France |

| SOPHiA GENETICS LTD | UK |

| SOPHiA GENETICS, Inc. | USA |

| SOPHiA GENETICS Intermediação de Negócios LTDA | Brazil |

| SOPHiA GENETICS PTY LTD | Australia |

| SOPHiA GENETICS S.R.L. | Italy |

Interactive Biosoftware S.A.S., a wholly owned subsidiary located in France and acquired in 2018, was merged into SOPHiA GENETICS S.A.S. in 2020.

On April 9, 2021, SOPHiA GENETICS PTY LTD, a wholly owned subsidiary located in Australia, was incorporated.

On May 27, 2021, SOPHiA GENETICS S.R.L., a wholly owned subsidiary located in Italy, was incorporated.

On December 12, 2022, the Company changed the name of SOPHiA GENETICS Intermediação de Negócios EIRELI to SOPHiA GENETICS Intermediação de Negócios LTDA.

The Company’s Board of Directors approved the issue of the consolidated financial statements on March 5, 2024.

Share split

On June 30, 2021, the Company effected a one-to-twenty share split of its outstanding shares. Accordingly, all share and per share amounts for all periods presented in these consolidated financial statements and notes thereto have been adjusted retroactively, where applicable, to reflect this share split.

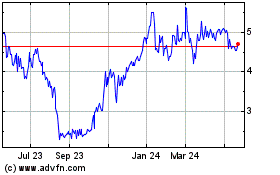

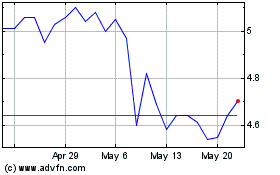

Initial public offering

In July 2021, the Company completed its initial public offering (“IPO”) in the United States on the Nasdaq Global Market (“Nasdaq”) under the trading ticker symbol “SOPH”. Trading on the Nasdaq commenced at market open on July 23, 2021. The Company completed the IPO of 13,000,000 ordinary shares, at an IPO price of $18.00 per share, par value $0.05 (CHF 0.05). The aggregate net proceeds received from the IPO, net of underwriting discounts and commissions and offering expenses, was $211.7 million. Immediately prior to the completion of the IPO, all then outstanding shares of preferred shares were converted into 24,561,200 shares of ordinary shares on a one-to-one basis.

Concurrent with the IPO, the Company closed a private placement, in which it sold 1,111,111 ordinary shares to an affiliate of GE Healthcare at a price of $18.00 per share, par value $0.05 (CHF 0.05). The aggregate net proceeds received from the private placement, net of offering expenses, was $19.6 million.

On August 25, 2021, the underwriters of the IPO elected to exercise in part their option to purchase an additional 519,493 ordinary shares (“greenshoe”) at the IPO price of $18.00 per share, par value $0.05 (CHF 0.05). The aggregate net proceeds received from the greenshoe, net of underwriting discounts and commissions and offering expenses, was $8.5 million.

Issued share capital

As of December 31, 2023, the Company had issued 76,898,164 shares of which 65,230,559 are outstanding and 11,667,605 are held by the Company as treasury shares. As of December 31, 2022, the Company had issued outstanding shares of 64,231,220. All shares were considered paid as of December 31, 2023.

Treasury shares

During the first quarter of 2022, the Company issued 2,540,560 registered shares to SOPHiA GENETICS LTD pursuant to a share delivery and repurchase agreement, which were immediately exercised, and repurchased the shares to hold as treasury shares for the purposes of administering the Company's equity incentive programs. During the second quarter of 2023, the Company issued 10,500,000 registered shares to SOPHiA GENETICS LTD pursuant to a share delivery and repurchase agreement, which were immediately exercised, and repurchased the shares to hold as treasury shares. The Company held 11,667,605 and 2,166,944 treasury shares as of December 31, 2023 and 2022, respectively.

Treasury shares are recognized at acquisition cost and recorded as treasury shares at the time of the transaction. Upon exercise of share options or vesting of restricted stock units, the treasury shares are subsequently transferred. Any consideration received is included in shareholders’ equity.

2. Material accounting policies

Basis of preparation

Compliance with International Financial Reporting Standards