Report of Foreign Issuer (6-k)

September 13 2019 - 2:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF SEPTEMBER 2019

COMMISSION FILE NUMBER 0-20115

METHANEX CORPORATION

(Registrant’s name)

SUITE 1800, 200 BURRARD STREET, VANCOUVER, BC V6C 3M1 CANADA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

METHANEX CORPORATION

MATERIAL CHANGE REPORT

FORM 51-102F3

|

|

|

|

1.

|

NAME AND ADDRESS OF COMPANY

|

Methanex Corporation

1800 Waterfront Centre

200 Burrard Street

Vancouver, British Columbia V6C 3M1

|

|

|

|

2.

|

DATE OF MATERIAL CHANGE

|

September 9, 2019

The news release announcing the material change described herein was issued and disseminated on September 9, 2019 in Canada and the United States through the facilities of a newswire service.

4. SUMMARY OF MATERIAL CHANGE

Methanex Corporation announced on September 9, 2019 that it has priced an offering of senior unsecured notes. Methanex will issue US$700 million in aggregate principal amount of 5.250% senior notes due December 15, 2029.

|

|

|

|

5.

|

FULL DESCRIPTION OF MATERIAL CHANGE

|

|

|

|

|

5.1

|

FULL DESCRIPTION OF MATERIAL CHANGE

|

Methanex Corporation announced on September 9, 2019 that it has priced an offering of senior unsecured notes. Methanex will issue US$700 million in aggregate principal amount of 5.250% senior notes due December 15, 2029.

The notes will be issued at a price of 99.969% of the aggregate principal amount, with an effective yield to maturity of 5.255%. The offering is expected to close on or about September 12, 2019, subject to customary closing conditions.

Methanex expects to use the net proceeds from the offering primarily for any one or more of debt repayments (including repayment of its existing 3.25% unsecured notes due on December 15, 2019, of which US$350 million in aggregate principal amount is outstanding), capital expenditures related to plant construction and maintenance (including pre-funding approximately US$250 million of the 2020 expenditures for the construction of our Geismar 3 plant), working capital or other general corporate purposes.

|

|

|

|

5.2

|

DISCLOSURE FOR RESTRUCTURING TRANSACTIONS

|

Not applicable.

|

|

|

|

6.

|

RELIANCE ON SUBSECTION 7.1(2) OF NATIONAL INSTRUMENT 51-102

|

Not applicable.

Not applicable.

For further information, contact:

Kevin Price

General Counsel & Corporate Secretary

604-661-2658

September 13, 2019

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

METHANEX CORPORATION

|

|

|

Date: September 13, 2019

|

By:

|

/s/ KEVIN PRICE

|

|

|

|

|

Name:

|

Kevin Price

|

|

|

|

|

Title:

|

General Counsel & Corporate Secretary

|

|

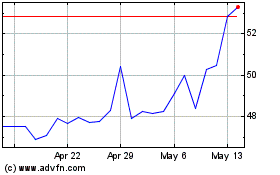

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

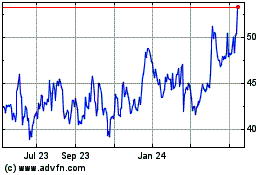

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Apr 2023 to Apr 2024