false2022FY000129996900012999692022-01-012022-12-3100012999692022-06-30iso4217:USD0001299969us-gaap:CommonClassAMember2023-02-28xbrli:shares0001299969us-gaap:CommonClassBMember2023-02-2800012999692022-12-3100012999692021-12-310001299969us-gaap:SeriesCPreferredStockMember2021-12-31iso4217:USDxbrli:shares0001299969us-gaap:SeriesCPreferredStockMember2022-12-310001299969us-gaap:CommonClassAMember2022-12-310001299969us-gaap:CommonClassAMember2021-12-310001299969us-gaap:CommonClassBMember2021-12-310001299969us-gaap:CommonClassBMember2022-12-3100012999692021-01-012021-12-310001299969us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2020-12-310001299969us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001299969us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-12-310001299969us-gaap:AdditionalPaidInCapitalMember2020-12-310001299969us-gaap:TreasuryStockMember2020-12-310001299969us-gaap:RetainedEarningsMember2020-12-3100012999692020-12-310001299969us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-012021-12-310001299969us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001299969us-gaap:RetainedEarningsMember2021-01-012021-12-310001299969us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2021-12-310001299969us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001299969us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001299969us-gaap:AdditionalPaidInCapitalMember2021-12-310001299969us-gaap:TreasuryStockMember2021-12-310001299969us-gaap:RetainedEarningsMember2021-12-310001299969us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-12-310001299969us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001299969us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2022-01-012022-12-310001299969us-gaap:RetainedEarningsMember2022-01-012022-12-310001299969us-gaap:SeriesCPreferredStockMemberus-gaap:PreferredStockMember2022-12-310001299969us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001299969us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001299969us-gaap:AdditionalPaidInCapitalMember2022-12-310001299969us-gaap:TreasuryStockMember2022-12-310001299969us-gaap:RetainedEarningsMember2022-12-310001299969us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberchci:ComstockEnvironmentalServicesMember2022-03-31chci:subsidiary00012999692021-06-292021-06-29chci:segment0001299969chci:BusinessConcentrationRiskMemberchci:RelatedPartiesMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-31xbrli:pure0001299969chci:BusinessConcentrationRiskMemberus-gaap:AccountsReceivableMemberchci:RelatedPartiesMember2022-01-012022-12-310001299969us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001299969us-gaap:OfficeEquipmentMember2022-01-012022-12-310001299969us-gaap:VehiclesMember2022-01-012022-12-310001299969us-gaap:ComputerEquipmentMember2022-01-012022-12-310001299969us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-012022-12-310001299969us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberchci:ComstockEnvironmentalServicesMember2022-03-312022-03-310001299969us-gaap:DiscontinuedOperationsHeldforsaleMemberchci:ComstockEnvironmentalServicesMember2022-01-012022-12-310001299969us-gaap:DiscontinuedOperationsHeldforsaleMemberchci:ComstockEnvironmentalServicesMember2021-01-012021-12-3100012999692022-03-312022-03-310001299969us-gaap:DiscontinuedOperationsHeldforsaleMemberchci:ComstockEnvironmentalServicesMember2021-12-310001299969chci:ComputerEquipmentAndCapitalizedSoftwareMember2022-12-310001299969chci:ComputerEquipmentAndCapitalizedSoftwareMember2021-12-310001299969us-gaap:FurnitureAndFixturesMember2022-12-310001299969us-gaap:FurnitureAndFixturesMember2021-12-310001299969us-gaap:OfficeEquipmentMember2022-12-310001299969us-gaap:OfficeEquipmentMember2021-12-310001299969us-gaap:VehiclesMember2022-12-310001299969us-gaap:VehiclesMember2021-12-3100012999692022-05-060001299969chci:InvestorsXMember2022-12-310001299969chci:InvestorsXMember2021-12-310001299969chci:TheHartfordMember2022-12-310001299969chci:TheHartfordMember2021-12-310001299969chci:BLVDFortyFourMember2022-12-310001299969chci:BLVDFortyFourMember2021-12-310001299969chci:BLVDAnselMember2022-12-310001299969chci:BLVDAnselMember2021-12-310001299969chci:TheHartfordMember2019-12-012019-12-31utr:sqft0001299969chci:TheHartfordMember2020-02-290001299969chci:TheHartfordMembersrt:AffiliatedEntityMember2022-12-310001299969chci:BLVDFortyFourMember2021-10-012021-10-31chci:unit0001299969chci:BLVDFortyFourMembersrt:AffiliatedEntityMember2022-12-310001299969chci:BLVDAnselMember2022-03-012022-03-310001299969srt:AffiliatedEntityMemberchci:BLVDAnselMember2022-12-310001299969us-gaap:FairValueInputsLevel3Member2020-12-310001299969us-gaap:FairValueInputsLevel3Member2021-01-012021-12-310001299969us-gaap:FairValueInputsLevel3Member2021-12-310001299969us-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001299969us-gaap:FairValueInputsLevel3Member2022-12-310001299969srt:MinimumMember2022-12-310001299969srt:MaximumMember2022-12-310001299969chci:CreditFacilityMemberchci:ComstockDevelopmentServicesMemberus-gaap:SecuredDebtMember2020-03-190001299969chci:CreditFacilityMemberchci:WallStreetJournalPrimeRateMember2020-03-192020-03-190001299969chci:CreditFacilityMemberchci:ComstockDevelopmentServicesMemberus-gaap:SecuredDebtMember2022-09-30chci:vote0001299969us-gaap:CommonClassAMember2022-06-132022-06-1300012999692022-06-132022-06-1300012999692022-06-130001299969us-gaap:CommonClassAMemberchci:TwoThousandNineteenOmnibusIncentivePlanMember2019-02-120001299969us-gaap:CommonClassAMemberchci:TwoThousandNineteenOmnibusIncentivePlanMember2022-12-310001299969us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-31chci:installment0001299969srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001299969srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001299969us-gaap:RestrictedStockUnitsRSUMember2021-12-310001299969us-gaap:RestrictedStockUnitsRSUMember2022-12-310001299969us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001299969us-gaap:AssetManagement1Member2022-01-012022-12-310001299969us-gaap:AssetManagement1Member2021-01-012021-12-310001299969chci:PropertyManagementMember2022-01-012022-12-310001299969chci:PropertyManagementMember2021-01-012021-12-310001299969us-gaap:ParkingMember2022-01-012022-12-310001299969us-gaap:ParkingMember2021-01-012021-12-310001299969chci:RelatedPartyMember2022-01-012022-12-310001299969chci:RelatedPartyMember2021-01-012021-12-310001299969chci:CommercialCustomersMember2022-01-012022-12-310001299969chci:CommercialCustomersMember2021-01-012021-12-310001299969us-gaap:FixedPriceContractMember2022-01-012022-12-310001299969us-gaap:FixedPriceContractMember2021-01-012021-12-310001299969chci:CostplusContractMember2022-01-012022-12-310001299969chci:CostplusContractMember2021-01-012021-12-310001299969chci:VariableContractMember2022-01-012022-12-310001299969chci:VariableContractMember2021-01-012021-12-3100012999692021-04-012021-06-300001299969us-gaap:SegmentContinuingOperationsMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001299969us-gaap:SegmentContinuingOperationsMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001299969us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001299969us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001299969us-gaap:SegmentContinuingOperationsMemberus-gaap:WarrantMember2022-01-012022-12-310001299969us-gaap:SegmentContinuingOperationsMemberus-gaap:WarrantMember2021-01-012021-12-310001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMemberchci:AssetManagementFeeMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMemberchci:AssetManagementFeeMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:EntitlementFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMemberchci:DevelopmentAndConstructionFeeMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:DevelopmentAndConstructionFeeMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:PropertyManagementFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:PropertyManagementFeeMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:AcquisitionFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMembersrt:MinimumMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:AcquisitionFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMemberchci:AssetManagementAgreementMember2022-06-132022-06-130001299969srt:MaximumMemberchci:ComstockDevelopmentServicesMemberchci:AcquisitionFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:AcquisitionFeeMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:DispositionFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMembersrt:MinimumMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:DispositionFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMemberchci:AssetManagementAgreementMember2022-06-132022-06-130001299969srt:MaximumMemberchci:ComstockDevelopmentServicesMemberchci:DispositionFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:DispositionFeeMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMember2022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:IncentiveFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMember2022-06-132022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:IncentiveFeeMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMember2022-06-132022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:InvestmentOriginationFeeMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMember2022-06-132022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:InvestmentOriginationFeeMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMember2022-06-132022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMemberchci:LeasingFeeMember2022-06-132022-06-13iso4217:USDutr:sqft0001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMemberchci:LeasingFeeMember2022-06-132022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMemberchci:LoanOriginationFeeMember2022-06-132022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandNineteenAmendedAndRestatedAssetManagementAgreementMemberchci:LoanOriginationFeeMember2022-06-132022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:TwoThousandTwentyTwoAmendedAndRestatedAssetManagementAgreementMember2022-06-132022-06-130001299969chci:ComstockDevelopmentServicesMemberchci:ResidentialPropertyManagementAgreementsMember2022-01-012022-12-310001299969chci:ComstockDevelopmentServicesMembersrt:MinimumMemberchci:ConstructionManagementAgreementMember2022-01-012022-12-310001299969srt:MaximumMemberchci:ComstockDevelopmentServicesMemberchci:ConstructionManagementAgreementMember2022-01-012022-12-310001299969chci:ComstockDevelopmentServicesMemberchci:LeaseProcurementAgreementMembersrt:MinimumMember2022-01-012022-12-310001299969srt:MaximumMemberchci:ComstockDevelopmentServicesMemberchci:LeaseProcurementAgreementMember2022-01-012022-12-310001299969chci:BusinessManagementAgreementMemberchci:ComstockInvestorsXMember2019-04-300001299969chci:BusinessManagementAgreementMemberchci:ComstockInvestorsXMember2019-04-302019-04-300001299969chci:BusinessManagementAgreementMember2019-07-012019-07-010001299969chci:BusinessManagementAgreementMember2019-07-010001299969chci:DWCOperatingAgreementMembersrt:AffiliatedEntityMember2020-02-070001299969srt:AffiliatedEntityMember2020-11-010001299969chci:LeaseExpansionAgreementMembersrt:AffiliatedEntityMember2022-11-012022-11-010001299969chci:ParkXManagementLCMember2022-01-010001299969srt:MinimumMember2022-01-012022-12-310001299969srt:MaximumMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission File Number 001-32375

Comstock Holding Companies, Inc.

(Exact name of Registrant as specified in its Charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

1900 Reston Metro Plaza, 10th Floor

Reston, VA

(Address of principal executive offices)

20-1164345

(I.R.S. Employer

Identification No.)

20190

(Zip Code)

Registrant’s telephone number, including area code: (703) 230-1985

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value | | CHCI | | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The Nasdaq Capital Market on June 30, 2022, was $16,801,319.

The number of shares of registrant’s common stock outstanding as of February 28, 2023 was 9,370,616 (Class A) and 220,250 (Class B).

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III (Items 10, 11, 12, 13 and 14) are incorporated by reference from the registrant’s definitive proxy statement filed with the U.S. Securities and Exchange Commission on May 1, 2023 for its 2023 Annual Meeting of Stockholders that was held on June 14, 2023.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A to the Comstock Holding Companies, Inc. Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the U.S. Securities and Exchange Commission on March 29, 2023 (the “Original 10-K”), is being filed solely for the purpose of correcting exhibits 31.1, 31.2 and 32.1 of the Original 10-K (the “Certifications”), which identified the wrong periodic report in paragraph 1 of the Certifications. The Certifications incorrectly referred to the filing as a quarterly report on Form 10-Q, rather than an annual report on Form 10-K.

No other changes have been made to any of the disclosures in the Original 10-K. This Amendment No. 1 speaks as of the original filing date of the Original 10-K, does not reflect events that may have occurred subsequent to such original filing date, and does not modify or update in any way disclosures made in the Original 10-K, except as set forth above.

COMSTOCK HOLDING COMPANIES, INC.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2022

TABLE OF CONTENTS

| | | | | | | | |

PART I..................................................................................................................................................................................... | |

| Item 1. | Business........................................................................................................................................................... | |

| Item 1B. | Unresolved Staff Comments............................................................................................................................ | |

| Item 2. | Properties......................................................................................................................................................... | |

| Item 3. | Legal Proceedings............................................................................................................................................ | |

| Item 4. | Mine Safety Disclosures.................................................................................................................................. | |

| |

| |

| Item 5. | | |

| Item 6. | [Reserved]........................................................................................................................................................ | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | Controls and Procedures.................................................................................................................................. | |

| Item 9B. | Other Information............................................................................................................................................ | |

| |

PART III.................................................................................................................................................................................. | |

| |

PART IV.................................................................................................................................................................................. | |

| Item 15. | | |

| Item 16. | 10-K Summary................................................................................................................................................. | |

| |

SIGNATURES........................................................................................................................................................................ | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the matters disclosed in this Annual Report on Form 10-K may include forward-looking statements. Any forward-looking statements are based on current management expectations that involve substantial risks and uncertainties, which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. These statements do not relate strictly to historical or current facts, and can be identified by the use of words such as “anticipate,” “believe,” “estimate,” “may,” “likely,” “intend,” “expect,” “will,” “should,” “seeks” or other words and terms of similar meaning used in conjunction with a discussion of future operating or financial performance.

The Company acknowledges the importance of communicating future expectations to investors, however there will always remain future events and circumstances that are unable to be accurately predicted or controlled. When considering forward-looking statements, investors should keep in mind the risks and uncertainties that may cause actual results to differ materially from the expectations described, and consequently should place no undue reliance on any of these statements. There are several factors that may affect the accuracy of the forward-looking statements, including, but not limited to: general economic and market conditions, including inflation and interest rate levels; changes in the real estate markets; inherent risks in investment in real estate; the ability to attract and retain clients; the ability to compete in the markets in which the Company operates; regulatory actions; fluctuations in operating results; shortages and increased costs of labor or materials; adverse weather conditions and natural disasters; public health emergencies, including potential risks and uncertainties relating to the coronavirus (COVID-19) pandemic; the ability to raise debt and equity capital and grow operations on a profitable basis; and continuing relationships with affiliates. The factors can apply both directly to the Company and generally to the real estate industry as a whole.

Forward-looking statements speak only as of the date of this Form 10-K. Except as required under federal securities laws and the rules and regulations of the Securities and Exchange Commission ("SEC"), the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances arising after the date of this Annual Report on Form 10-K, whether as a result of new information, future events, or otherwise, except as required by law.

PART I

Item 1. Business

As used herein, "Comstock", "CHCI", "the Company," "we," "us," "our," and similar terms are referring to Comstock Holding Companies, Inc. and its subsidiaries, unless the context indicates otherwise.

Overview

Comstock is a leading real estate asset manager and developer of mixed-use and transit-oriented properties in the Washington, D.C. region. Since 1985, we have acquired, developed, operated, and sold millions of square feet of residential, commercial, and mixed-use properties. We benefit from our market-leading position in Northern Virginia's Dulles Corridor, one of the nation’s fastest growing real estate markets that is undergoing an urban transformation thanks to the recently completed construction of a Metro commuter rail connecting Dulles International Airport and the surrounding areas to Washington, D.C. and beyond.

Our fee-based, asset-light, and substantially debt-free business model allows us to mitigate many of the risks that are typically associated with real estate development. We provide a broad suite of asset management, property management, development and construction management, and other real estate services to our asset-owning clients, composed primarily of institutional real estate investors, high net worth family offices, and governmental bodies with surplus real estate holdings. Our primary focus is the continued growth of our managed portfolio; however, the fundamental strength of our balance sheet permits us to also explore strategic investment opportunities, typically in the form of a minority capital co-investment in select stabilized assets that complement our existing portfolio.

We aspire to be among the most admired real estate asset managers, operators, and developers by creating extraordinary places, providing exceptional experiences, and generating excellent results for all stakeholders. Our commitment to this mission drives our ability to expand our managed portfolio of assets, grow revenue, and deliver value to our shareholders.

Recent Developments

CES Divestiture

On March 31, 2022, we completed the sale of Comstock Environmental Services, LLC ("CES"), a wholly owned subsidiary, to August Mack Environmental, Inc. ("August Mack"). This strategic divestiture was based on the continued growth and future prospects of our asset management business. Accordingly, we have reflected CES as a discontinued operation in our consolidated financial statements for all periods presented, and unless otherwise noted, all amounts and disclosures relate solely to our continuing operations. (See Note 3 in the Notes to Consolidated Financial Statements for additional information).

Series C Preferred Stock Redemption and 2022 Asset Management Agreement

On June 13, 2022, we completed two separate significant transactions to further deleverage our balance sheet and enhance our long-term revenue outlook and growth potential. The first one with CP Real Estate Services, LC (“CPRES”), an entity owned by Christopher Clemente, Comstock’s Chief Executive Officer, redeemed all outstanding Series C preferred stock at a significant discount to carrying value. Secondly, we executed a new asset management agreement with Comstock Partners, LC ("CP"), an entity controlled by Mr. Clemente and wholly owned by Mr. Clemente and certain family members, which covers our Anchor Portfolio of assets (the "2022 AMA"). The 2022 AMA increased the base fees we collect, expanded the services that qualify for additional supplemental fees, extended the term through 2035, and most notably introduced a mark-to-market incentive fee based on the imputed profit of Anchor Portfolio assets, generally as each is stabilized and as further specified in the agreement. (See Notes 10 and 14 in the Notes to Consolidated Financial Statements for additional information).

Our Services

Our experienced team of commercial real estate professionals provides a full range of real estate services related to the acquisition, development, and operation of real estate assets. The services we provide cover all aspects of real estate asset management, including acquisition and disposition management, leasing, design, placemaking, property management, origination and negotiation of debt and equity facilities, risk management, construction and development management, creation of investment opportunities, execution of core-plus, value-add, and opportunistic strategies, and various other property-specific services.

Our asset management services platform is anchored by the 2022 AMA, a long-term full-service asset management agreement with a Comstock affiliate that extends through 2035 and covers most of the properties we currently manage, including two of the largest transit-oriented, mixed-use developments in the Washington, D.C. area: Reston Station and Loudoun Station (see below for details).

As a vertically integrated real estate services company, we self-perform all property management activity through three wholly owned operational subsidiaries: CHCI Commercial Management, LC (“CHCI Commercial”); CHCI Residential Management, LC (“CHCI Residential”); and ParkX Management, LC (“ParkX”). All 41 properties included in our managed portfolio have entered into property management agreements with our operational subsidiaries that provide for market-rate fees related to our services, including 10 commercial parking garages owned by unaffiliated parties and managed by ParkX.

Our Portfolio

The following table summarizes the 41 assets that are included in our managed portfolio:

| | | | | | | | | | | | | | | | | | | | |

| Type | | # of Assets | | Size/Scale | | % Leased |

| Commercial | | 13 | | 2.0 million sqft. | | 87% |

| Residential | | 6 | | 1.7 million sqft. / ~1,700 units | | 89% |

| Parking | | 22 | | 14,000 spaces | | |

| Total | | 41 | | | | |

In addition, in our development pipeline we currently have 16 commercial assets that represent approximately 2.3 million square feet, approximately 3,100 residential units that represent approximately 3.2 million square feet, and 2 hotel assets that will include approximately 380 keys. At full build out, our managed portfolio of assets will total 57 properties representing nearly 10 million square feet.

Anchor Portfolio

Reston Station

Reston Station is one of the largest mixed-use, transit-oriented developments in the mid-Atlantic region. Located at the Wiehle-Reston East station on Metro’s Silver Line, the Reston Station neighborhood spans the Dulles Toll Road and covers approximately 80 acres. The Reston Station neighborhood is being developed in phases and is composed of the following five districts:

•Metro Plaza District

The Metro Plaza District is located adjacent to Wiehle Reston-East Metro Station and contains approximately 1.4 million square feet of mixed-use development, highlighted by three Trophy-Class office buildings and BLVD Reston, a luxury residential tower with 448 units. It is home to corporate and regional headquarters of Google, ICF Global, Spotify, Qualtrics, Rolls-Royce of North America, Neustar, and others. All buildings in the Metro Plaza District have ground floor retail, which has been leased to high-quality tenants, including Starbucks, CVS, Founding Farmers, Matchbox, Scissors & Scotch, and others.

The Metro Plaza District also includes one of the largest underground commuter parking garages and bus transit facilities in the region. The 1.7 million square foot subterranean garage and transit facility is the subject of a public-private partnership between a Comstock affiliate and Fairfax County, Virginia. The Reston Station transit facility provides Metro commuters with an indoor bus transit depot designed to accommodate upwards of 110 buses per hour, 2,300 commuter parking spaces operated by Fairfax County, and approximately 2,750 additional parking spaces for retail, office, and commuter uses, a Tesla Super Charging Station and numerous other electric vehicle charging stations, secure bicycle parking and storage facilities, substantial storm water management vaults, and state-of-the-art water treatment systems.

•Reston Row District

The Reston Row District is currently being developed on approximately 9 acres adjacent to the Metro Plaza District. This newest phase of the Reston Station development has entitlements in place allowing for approximately 1.5 million square feet of mixed-use development, including two Trophy-Class office buildings, more than 500 multifamily units, over 100,000 square feet of retail, and hotel uses. Marriott International has entered into a franchise agreement with a Comstock affiliate concerning the development and operation of Virginia's first JW Marriott Hotel and Condominium residential tower, containing approximately 250 hotel rooms, 100 JW Marriott-branded condominium residences, and 25,000 square feet of meeting space.

•Commerce District

The Commerce District is located on approximately 16 acres adjacent to Wiehle Reston-East Metro Station, directly across the Dulles Toll Road from the Metro Plaza District. It has entitlements in place that allow for approximately 1.5 million square feet of new mixed-use development surrounding the four existing stabilized Class-A office buildings that represent a total of approximately 590,000 square feet. We are currently leasing and managing the four existing office buildings and one existing retail building while finalizing plans for the permitted new development.

•Midline District

The Midline District, located directly across Wiehle Avenue from the Reston Row District and the Metro Plaza District, has entitlements in place that allow for approximately 1.2 million square feet of new mixed-use development on approximately 8 acres. We are currently updating the entitlements secured by the previous owner and plan to commence development and leasing operations after receiving the necessary permits for the new development.

•West District

The West District currently consists of approximately 11 acres of land located adjacent to the Reston Row District and Metro Plaza District and includes a previously developed 90,000 square foot office building owned by one of our affiliates and an apartment building owned by a third party. In 2022, our affiliate acquired an existing 58,000 square foot office building on an adjacent parcel that is planned for demolition and will be incorporated into the West District's development plans, which are planned to commence after entitlements are secured. It is anticipated that entitlements will allow for five mixed-use buildings in the West District, including the aforementioned existing apartment building.

Loudoun Station

Loudoun Station, located in Ashburn, Virginia adjacent to Ashburn Station at the terminus of Metro’s Silver Line, is Loudoun County’s first and only Metro-connected development. With direct rail connectivity to Dulles International Airport, Reston, Tysons, and Washington, D.C., it represents the beginning of Loudoun County’s transformation into a transit-connected community. Loudoun Station has more than 1.0 million square feet of mixed-use development completed and stabilized, including nearly 700 residential units, approximately 50,000 square feet of Class-A office space, and approximately 150,000 square feet of retail space, highlighted by an 11-screen AMC Cinema as well as multiple dining and entertainment venues. It is also home to a 1,500-space Metro commuter parking garage that is the subject of a public-private partnership between a Comstock affiliate and Loudoun County. At full build, the Loudoun Station development will cover nearly 50 acres.

Herndon Station

Herndon Station will include up to approximately 340,000 square feet of residential, retail and entertainment spaces, including a performing arts center, and an approximately 700-space commercial parking garage in the historic downtown portion of the Town of Herndon in western Fairfax County, Virginia. The project is the focus of a public-private partnership between a Comstock affiliate and the Town of Herndon and will include improvements to existing connections to the adjacent WO&D trail, a popular pedestrian and bicycle route that stretches from Washington, D.C. to Loudoun County, Virginia.

Other Portfolio Assets

Investors X

On April 30, 2019, we entered into a Master Transfer agreement with CPRES, that provided for priority distribution of residual cash flow from its Class B membership interest in Comstock Investors X, L.C. ("Investors X"), an unconsolidated variable interest entity that owns Comstock’s residual homebuilding operations. As of December 31, 2022, the residual cash flow primarily relates to anticipated proceeds from the sale of rezoned residential lots and returns of cash securing outstanding letters of credit and cash collateral posted for land development bonds covering work performed by subsidiaries owned by Investors X. The cash will be released to CHCI as bond release work associated with these projects is completed.

The Hartford Building

In December 2019, we entered into a joint venture with CP to acquire a stabilized Class-A office building immediately adjacent to Clarendon Station on Metro’s Orange Line in Arlington County, Virginia’s premier transit-oriented office market, the Rosslyn-Ballston Corridor. Built in 2003, the 211,000 square foot mixed-use Leadership in Energy and Environmental Design (“LEED”) GOLD building is leased to multiple high-quality tenants. In February 2020, we arranged for DivcoWest, an unaffiliated entity, to purchase a majority ownership stake in the Hartford Building and secured a $87 million loan facility from MetLife. As part of the transaction, we entered into asset management and property management agreements to manage the property.

BLVD Forty Four

In October 2021, we entered into a joint venture with CP to acquire a stabilized 15-story, luxury high-rise apartment building in Rockville, Maryland that was built in 2015, which we rebranded as BLVD Forty Four. Located one block from the Rockville Station on Metro's Red Line and in the heart of the I-270 Technology and Life Science Corridor, the 263-unit mixed use property includes approximately 16,000 square feet of retail and a commercial parking garage. In connection with the transaction, we received an acquisition fee and are entitled to receive investment related income and promote distributions in connection with our 5% equity interest in the asset. We also provide asset, residential, retail and parking property management services for the property in exchange for market rate fees.

BLVD Ansel

In March 2022, we entered into a joint venture with CP to acquire BLVD Ansel, a newly completed 18-story, luxury high-rise apartment building with 250 units located adjacent to the Rockville Metro Station and BLVD Forty Four in Rockville, Maryland. BLVD Ansel features approximately 20,000 square feet of retail space, 611 parking spaces, and expansive amenities including multiple private workspaces designed to meet the needs of remote-working residents. In connection with the transaction, we received an acquisition fee and are entitled to receive investment related income and promote distributions in connection with our 5% equity interest in the asset. We also provide residential, retail and parking property management services for the property in exchange for market rate fees.

Our Business Strategy

Comstock has been active in the Washington, D.C. metropolitan area since 1985, having operated, developed, and acquired, and sold millions of square feet of real estate assets, including but not limited to, office buildings, residential developments, parking garages, and retail centers. We have also participated in multiple public-private partnership developments that have included large-scale public infrastructure improvements.

In early 2018, we transitioned our business strategy from the prior focus on the development and sale of residential homes to our current fee-based services model that concentrates on asset management of commercial and mixed-use real estate, primarily in the greater Washington, D.C. region. This shift took us from an approach that was capital-intensive and required significant on-balance sheet land inventory to one that is asset-light and debt-free, thereby substantially reducing the risk typically associated with the development and operation of real estate assets.

We believe that our extensive experience managing a large-scale, diverse portfolio of stabilized assets and assets in development provides us with the knowledge and tools required to execute our unique business strategy, which is primarily focused on:

•Properties that generate stable, recurring cash flows

We primarily operate under long-term asset management agreements that provide a highly visible and reliable source of revenue and position us to grow as our Anchor Portfolio and other assets under management expand. Our Anchor Portfolio provides consistent revenue pursuant to the cost-plus fee structure foundation of the 2022 AMA, also providing multiple stable sources for performance-based incentive fees that may further drive incremental top-line growth. This key aspect of our business model has enabled us to generate positive financial results and earnings in every quarter since transforming to our current asset-light operating platform in 2019.

•Mixed-use and transit-oriented assets in high-growth, high-potential areas

We focus on select transitioning “sub-urban” markets in the greater Washington D.C. metropolitan area. These sub-markets, which include the Dulles Corridor and the Rosslyn-Ballston Corridor in Northern Virginia and the I-270 Technology and Life Science Corridor in Montgomery County, Maryland, are experiencing increased demand resulting from a flight to quality, which we believe will continue to drive commercial tenants’ demand for the type of developments and amenity-rich buildings in our managed portfolio. We believe residential tenant demand will follow a similar trend, increasing the population willing to pay premium rents for high-quality residential units in neighborhoods that are transit-oriented. A significant portion of our portfolio of managed assets are located in these sought-after areas that also feature strong projected long-term economic growth, supported by attractive demographic attributes and superior transportation infrastructure.

•Capitalizing on significant growth trends that drive market demand in Northern Virginia

Significant growth trends in demand for cybersecurity and other technology services in the government sector, as well as in the private sector, have generated substantial growth and attracted large technology companies, such as Microsoft,

Google, and Amazon to the Dulles Corridor and the Rosslyn-Ballston Corridor in Northern Virginia. These areas are home to significant data infrastructure, capable of serving the growing needs of technology companies and the federal government. Specifically, with its vast network of high-capacity data centers, the Dulles Corridor in Loudoun County reportedly hosts upwards of 70% of the world’s internet traffic and has become known as the “Internet Capital of the World”. We believe the continued growth and investment of these large technology companies will continue to benefit Northern Virginia’s employment market, further driving demand for the assets we manage and the communities we are developing.

•Leveraging our expertise to secure public-private partnership development opportunities

We have worked closely with our affiliates to secure public-private partnerships with multiple local governments (including Fairfax County, Loudoun County, and the Town of Herndon, Virginia) to develop and manage large-scale mixed-use, transit-oriented developments. Our knowledge and long track record of developing and managing first-in-class properties across the region positions Comstock as an attractive partner for government entities looking to improve infrastructure and enhance their surrounding communities. In addition, recent changes to the comprehensive land use plans of Fairfax County and Loudoun County that encourage high-density and mixed-use development proximate to the Silver Line Metro Stations may further result in compelling growth opportunities.

•Actively growing our supplemental real estate services and exploring investment opportunities

We provide a variety of fee-based real estate services, such as capital markets, brokerage and title insurance. Providing these supplemental services serves as a catalyst for identifying additional strategic real estate investment opportunities. We seek out opportunities that can provide appropriate risk-adjusted returns and are suitable for co-investment, potentially with institutional investors that may lack the local expertise or operational infrastructure necessary to identify, acquire, and manage such assets. Our acquisition strategy is currently focused on value-add, core, and core-plus opportunities, as well as other opportunistic asset acquisitions.

Our Values – Environment, Social and Governance ("ESG")

We are committed to pursuing environmental sustainability, social responsibility, and robust governance practices across all our operations. We recognize that development of real estate can have significant impact, positive or negative, for the surrounding community, the region, and the environment that we all share. We believe that companies developing real estate have a responsibility to maximize the positive impacts while taking steps to minimize negative impacts. Supporting and fostering these initiatives is instrumental in making our communities better places to live, work, and play while simultaneously bolstering asset value, reducing risk, and positively impacting all stakeholders. The following are highlights from our 2022 ESG Roadmap, the full version of which can be found in the “Corporate Responsibility” section of our website:

Environmental

We believe that environmentally sound business practices are critical to the long-term success of our business and the communities in which we operate. Our managed portfolio already includes multiple assets that are Leadership in Energy and Environmental Design (“LEED”) and Energy Star certified, and multiple initiatives are underway to increase the percentage of LEED and Energy Star certified buildings in our managed portfolio. We continue to expand our capabilities around monitoring energy and utility consumption at all our properties, allowing us to better identify opportunities to maximize efficiency and sustainability through operational and capital improvements.

In 2022, we announced a partnership with DAVIS Construction on the introduction of CarbonCure, a sustainable concrete component, in the construction of Phase II of our Reston Station development (A/K/A Reston Row District). CarbonCure is clean technology that produces greener concrete by recycling carbon dioxide (CO2) produced during the cement manufacturing process and injecting the recycled CO2 into fresh concrete during mixing. Once injected, the CO2 transforms into a mineral that improves the compressive strength of concrete and captures the recycled CO2 emissions which are never re-released into the atmosphere. Every cubic yard of concrete produced with CarbonCure technology saves an average of 25 pounds of carbon from entering the atmosphere, which will save millions of pounds of CO2 emissions from entering the atmosphere. Furthermore, we intend to engage our supply chain to incorporate sustainable designs, materials, and systems into all ongoing or future developments.

Our transit-oriented developments promote the use of mass transit, ride sharing, and alternate modes of transportation. We continue to expand the availability of electronic vehicle charging stations and bike racks at our properties to promote the reduction of congestion and our overall carbon footprint. In recognition of the positive impacts resulting from Reston Station’s design, the development was awarded the designation of Best Workplaces for Commuters in 2020 and 2021 by the Best Workplaces for Commuters Organization created by the National Center for Transit Research at the Center for Urban Transportation Research.

Social (Human Capital)

We strive to create extraordinary places and provide exceptional experiences in places people live, work, and play. We recognize the vital importance of community engagement in achieving this goal, which is why philanthropic partnerships have always been a key focus. We host a variety of community events in the public spaces we develop, aimed at creating rich and meaningful experiences. We support local organizations through charitable events, including Boys & Girls Club of Greater Washington, Habitat for Humanity, St. Jude Children’s Research Hospital, multiple youth sports organizations and local schools, and others. We partner with Cornerstones, Reston’s leading non-profit dedicated to helping underserved populations, to purchase winter coats for children and contribute meals to those in need. We encourage all employees to participate in charitable efforts in the community by providing paid leave to volunteer and numerous charitable contribution matching opportunities.

A key to our success is our ability to attract and retain a talented workforce that understands the numerous benefits of working in-office rather than remotely. We employ a diverse, multi-generational staff that consisted of 152 full-time and 18 part-time employees as of December 31, 2022. We promote collaboration, support, and innovation, providing all our employees the opportunity to achieve their professional and wellness goals. We continuously strive to diversify our workforce, provide equal access to opportunities to our people, and promote a working environment based on mutual trust, confidence, and respect. Our employees have access to a comprehensive suite of benefits, including, but not limited to: medical, dental, vision, and life insurance options; flexible and health savings accounts; 401k plan matching; and professional development reimbursement. We offer numerous wellness initiatives and training opportunities, including diversity training and a broad suite of e-learning courses.

We have continued to enforce certain protocols and procedures related to the COVID-19 pandemic as needed to ensure the safety, health, and comfort of our employees the communities that we manage. and we remain in compliance with all federal and local ordinances and guidelines.

Governance

Our employees, managers and officers conduct our business under the direction of our CEO and the oversight of our Board of Directors (the “Board”) to enhance our long-term value for our stockholders. The core responsibility of our Board is to exercise its fiduciary duty to act in the best interests of our Company and our stockholders. In exercising this obligation, our Board and its individual committees perform several specific functions, including risk assessment, review and oversight. While management is responsible for the day-to-day management of risk, our Board retains oversight of risk management for our company, assisting management by providing guidance on strategic risks, financial risks, and operational risks.

We have established corporate governance guidelines and policies that promote Company values, including a code of conduct as well as a code of ethics. Our information security team deploys an array of cybersecurity capabilities to protect our various business systems and data. We continually invest in protecting against, monitoring, and mitigating risks across the enterprise. We had no material publicly reportable information security incidents in the fiscal year ended December 31, 2022.

Competition

The real estate asset management and services industry is highly competitive. We compete with other businesses in the asset management and real estate-related services businesses on the basis of price, location, experience, service and reputation. Many of these competitors are larger than us, operate on a national or global scale, and some have access to greater technical, marketing and financial resources. These competitors may benefit from lower costs of capital, greater business scale, enhanced operating efficiencies, and greater immunity to localized market downturns due to their broad geographic presence. We also face numerous competitors on a local and regional basis. Certain competitors may also possess greater access to capital, higher risk tolerance, lower return thresholds, or less regulatory restrictions, all which could allow them to consider a broader range of investments and to bid more aggressively for investment opportunities than we are willing to.

Technology and Intellectual Property

We utilize our technology infrastructure to facilitate the management of our client’s assets and the marketing of our services. We use media and internet-based marketing platforms primarily in lieu of print advertisements. We believe that the prospective renters will continue to increase their reliance on information available on the internet to help guide their decisions. Accordingly, through our marketing efforts, we will continue to leverage this trend to lower per lease marketing costs while maximizing potential lease transactions.

Our Chief Executive Officer and Chairman of the Board, Christopher Clemente, has licensed his ownership interest in the “Comstock” brand and trademark to us in perpetuity. We have registered our trademarks and routinely take steps, and

occasionally take legal action, to protect against brand infringement from third parties. Mr. Clemente has retained the right to continue to use the “Comstock” brand and trademark including for real estate development projects in our current or future markets that are unrelated to the Company but, currently, substantially all of Mr. Clemente’s real estate development business is conducted with Comstock, pursuant to the 2022 AMA.

Governmental Regulation and Environmental Matters

We are subject to various local, state and federal statutes, ordinances, rules and regulations concerning finance, banking, investments, zoning, building design, construction, density requirements and similar matters. We may also be subject to periodic delays or may be precluded entirely from developing in certain communities due to building moratoriums or “slow-growth” or “no-growth” initiatives that could be implemented in the future in the states where we operate. Local and state governments also have broad discretion regarding the imposition of development fees for projects in their jurisdiction.

We are also subject to a variety of local, state, and federal statutes, ordinances, rules and regulations concerning protection of the environment. Some of the laws to which we and our properties are subject to may impose requirements concerning development in waters of the United States, including wetlands, the closure of water supply wells, management of asbestos-containing materials, exposure to radon and similar issues. The particular environmental laws that apply to any given real estate asset vary based on several factors, including the environmental conditions related to a particular property and the present and former uses of the property

Additional Information

Comstock Holding Companies, Inc. was incorporated in Delaware in 2004. Our principal executive offices are located at 1900 Reston Metro Plaza, 10th Floor, Reston, VA 20190, and our telephone number is 703-230-1985. Our corporate website address is www.comstock.com.

We maintain an investor relations page on our website where our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, amendments to those reports and other required SEC filings may be accessed free of charge as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

On November 1, 2020, we executed a new lease to relocate our corporate headquarters to new office space located at 1900 Reston Metro Plaza, Reston, Virginia for a ten-year term from an affiliate partially owned by our Chief Executive Officer. In January 2022, we executed a lease for a remote monitoring center for ParkX, our parking management subsidiary, and in November 2022 we executed a lease to expand our corporate headquarters, bringing the total amount of leased space to 25,630 square feet as of December 31, 2022. We believe our properties are adequately maintained and suitable for our needs and their intended use.

Item 3. Legal Proceedings

Currently, we are not subject to any material legal proceedings. From time to time, however, we are named as a defendant in legal actions arising from our normal business activities. Although we cannot accurately predict the amount of our liability, if any, that could arise with respect to legal actions filed against us, it is not anticipated that any such liability will have a material adverse effect on our financial position, operating results, or cash flows. We believe that we have obtained adequate insurance coverage, rights to indemnification, or where appropriate, have established reserves in connection with these legal proceedings.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

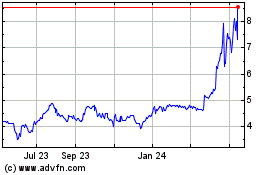

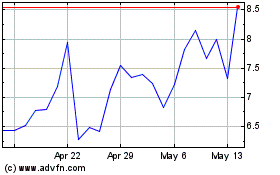

Our Class A common stock is traded on The Nasdaq Capital Market under the symbol “CHCI”. As of December 31, 2022, there were 54 registered holders of record of our Class A common stock and 1 holder of our Class B common stock.

We have never declared or paid any dividends on our common stock. We do not anticipate paying any dividends on our common stock during the foreseeable future but intend to retain any earnings for future growth of our business.

We did not repurchase any securities under our share repurchase program or issue any unregistered securities during the year ended December 31, 2022.

Item 6. [RESERVED]

Not Applicable.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes and other financial information appearing elsewhere in this Annual Report on Form 10-K. All references to “2022” and “2021” are referring to the twelve-month period ended December 31 for each of those respective fiscal years. This section of this Annual Report on Form 10-K generally discusses 2022 and 2021 items and year-to-year comparisons between 2022 and 2021. The following discussion may contain forward-looking statements that reflect our plans and expectations. Our actual results could differ materially from those anticipated by these forward-looking statements due to the factors discussed elsewhere in this Annual Report on Form 10-K. We do not undertake, and specifically disclaim, any obligation to update any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

Overview

Comstock is a leading real estate asset manager and developer of mixed-use and transit-oriented properties in the Washington, D.C. region. Since 1985, we have acquired, developed, operated, and sold millions of square feet of residential, commercial, and mixed-use properties. We benefit from our market-leading position in Northern Virginia's Dulles Corridor, one of the nation’s fastest growing real estate markets that is undergoing an urban transformation thanks to the recently completed construction of a Metro commuter rail connecting Dulles International Airport and the surrounding areas to Washington, D.C. and beyond.

Our fee-based, asset-light, and substantially debt-free business model allows us to mitigate many of the risks that are typically associated with real estate development. We provide a broad suite of asset management, property management, development and construction management, and other real estate services to our asset-owning clients, composed primarily of institutional real estate investors, high net worth family offices, and governmental bodies with surplus real estate holdings. Our primary focus is the continued growth of our managed portfolio; however, the fundamental strength of our balance sheet permits us to also explore strategic investment opportunities, typically in the form of a minority capital co-investment in select stabilized assets that complement our existing portfolio.

Our asset management services platform is anchored by a long-term full-service asset management agreement with a Comstock affiliate (the "2022 AMA" - see below for additional details) that extends through 2035 and covers most of the properties we currently manage, including two of the largest transit-oriented, mixed-use developments in the Washington, D.C. area: Reston Station and Loudoun Station.

As a vertically integrated real estate services company, we self-perform all property management activity through three wholly owned operational subsidiaries: CHCI Commercial Management, LC (“CHCI Commercial”); CHCI Residential Management, LC (“CHCI Residential”); and ParkX Management, LC (“ParkX”). All 41 properties included in our managed portfolio have entered into property management agreements with our operational subsidiaries that provide for market-rate fees related to our services, including 10 commercial parking garages owned by unaffiliated parties and managed by ParkX.

We aspire to be among the most admired real estate asset managers, operators, and developers by creating extraordinary places, providing exceptional experiences, and generating excellent results for all stakeholders. Our commitment to this mission drives our ability to expand our managed portfolio of assets, grow revenue, and deliver value to our shareholders.

Recent Developments

CES Divestiture

On March 31, 2022, we completed the sale of Comstock Environmental Services, LLC ("CES"), a wholly owned subsidiary, to August Mack Environmental, Inc. ("August Mack"). This strategic divestiture was based on the continued growth and future prospects of our asset management business. Accordingly, we have reflected CES as a discontinued operation in our consolidated financial statements for all periods presented, and unless otherwise noted, all amounts and disclosures relate solely to our continuing operations. (See Note 3 in the Notes to Consolidated Financial Statements for additional information).

Series C Preferred Stock Redemption and 2022 Asset Management Agreement

On June 13, 2022, we completed two separate significant transactions to further deleverage our balance sheet and enhance our long-term revenue outlook and growth potential. The first one with CP Real Estate Services, LC (“CPRES”), an entity owned by Christopher Clemente, Comstock’s Chief Executive Officer, redeemed all outstanding Series C preferred stock at a significant discount to carrying value. Secondly, we executed a new asset management agreement with Comstock Partners, LC ("CP"), an entity controlled by Mr. Clemente and wholly owned by Mr. Clemente and certain family members, which covers our Anchor Portfolio of assets (the "2022 AMA"). The 2022 AMA increased the base fees we collect, expanded the services that qualify for additional supplemental fees, extended the term through 2035, and most notably introduced a mark-to-market incentive fee based

on the imputed profit of Anchor Portfolio assets, generally as each is stabilized and as further specified in the agreement. (See Notes 10 and 14 in the Notes to Consolidated Financial Statements for additional information).

COVID-19 Update

The impact of the COVID-19 pandemic has caused uncertainty and business disruptions to both the real estate market in the greater Washington, D.C. region and the U.S. economy as a whole. While we have not experienced a significant impact on our business resulting from COVID-19 to date, the extent to which it will impact our financial results will depend on future developments, which cannot be predicted. We continue to monitor the ongoing impact of the COVID-19 pandemic, including the potential effects of notable variants of the COVID-19 virus. The health and safety of our employees, customers, and the communities in which we operate remains our top priority. Although the long-term impact of the COVID-19 pandemic remains uncertain, we believe that our business model is well-positioned to withstand any future potential negative impacts from the pandemic.

Outlook

Our management team is committed to executing on the Company's mission to create extraordinary places for people to live, work, and play. We believe that we are properly staffed for current market conditions and have the ability to manage risk while pursuing opportunities for additional growth as opportunities arise. Our real estate asset and property management operations are primarily focused on the greater Washington, D.C. area, where we have operated, developed, and acquired high-quality assets for nearly 40 years, providing us with the leverage needed to capitalize on the region's numerous positive growth trends.

Results of Operations

The following tables set forth consolidated statement of operations data for the periods presented (in thousands):

| | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 |

| Revenue | $ | 39,313 | | | $ | 31,093 | |

| Operating costs and expenses: | | | |

| Cost of revenue | 29,371 | | | 24,649 | |

| Selling, general, and administrative | 1,784 | | | 1,285 | |

| Depreciation and amortization | 206 | | | 94 | |

| Total operating costs and expenses | 31,361 | | | 26,028 | |

| Income (loss) from operations | 7,952 | | | 5,065 | |

| Other income (expense): | | | |

| Interest expense | (222) | | | (235) | |

| Gain (loss) on real estate ventures | 121 | | | (14) | |

| Other income | 2 | | | 6 | |

| Income (loss) from continuing operations before income tax | 7,853 | | | 4,822 | |

| Provision for (benefit from) income tax | 125 | | | (11,217) | |

| Net income (loss) from continuing operations | 7,728 | | | 16,039 | |

| Net income (loss) from discontinued operations, net of tax | (381) | | | (2,430) | |

| Net income (loss) | $ | 7,347 | | | $ | 13,609 | |

| Impact of Series C preferred stock redemption | 2,046 | | — | |

| Net income (loss) attributable to common stockholders | $ | 9,393 | | | $ | 13,609 | |

Comparison of the Years Ended December 31, 2022 and 2021

Revenue

The following table summarizes revenue by line of business (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, | | | | |

| 2022 | | 2021 | | Change |

| Amount | | % | | Amount | | % | | $ | | % |

| Asset management | $ | 26,680 | | | 67.9 | % | | $ | 22,539 | | | 72.5 | % | | $ | 4,141 | | | 18.4 | % |

| Property management | 9,398 | | | 23.9 | % | | 6,939 | | | 22.3 | % | | 2,459 | | | 35.4 | % |

| Parking management | 3,235 | | | 8.2 | % | | 1,615 | | | 5.2 | % | | 1,620 | | | 100.3 | % |

| Total revenue | $ | 39,313 | | | 100.0 | % | | $ | 31,093 | | | 100.0 | % | | $ | 8,220 | | | 26.4 | % |

Revenue increased 26.4% in 2022. The $8.2 million comparative increase was primarily driven by a $3.9 million increase in incentive fees, which were earned pursuant to the terms of the 2022 AMA. Also contributing to the increase was the growth and improved performance of our managed portfolio, which included additional properties in 2022 and produced $2.2 million of additional asset management fees, $0.6 million of additional property management fees, a $1.3 million increase in recorded leasing fees, and a $2.8 million increase in reimbursable staffing charges. These increases were partially offset by a $3.1 million decrease in loan origination fees, primarily related to the 2021 refinancing of the Reston Station office portfolio.

Operating costs and expenses

The following table summarizes operating costs and expenses (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, | | Change |

| 2022 | | 2021 | | $ | | % |

| Cost of revenue | $ | 29,371 | | | $ | 24,649 | | | $ | 4,722 | | | 19.2 | % |

| Selling, general, and administrative | 1,784 | | | 1,285 | | | 499 | | | 38.8 | % |

| Depreciation and amortization | 206 | | | 94 | | | 112 | | | 119.1 | % |

| Total operating costs and expenses | $ | 31,361 | | | $ | 26,028 | | | $ | 5,333 | | | 20.5 | % |

Operating costs and expenses increased 20.5% in 2022. The $5.3 million comparative increase was primarily due to a $5.4 million increase in personnel expenses stemming from increased headcount and employee compensation increases (including bonus expense), partially offset by a $0.9 million decrease in co-broker expenses stemming from the 2021 Reston Station refinancing transaction.

Other income (expense)

The following table summarizes other income (expense) (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, | | Change |

| 2022 | | 2021 | | $ | | % |

| Interest expense | $ | (222) | | | $ | (235) | | | $ | 13 | | | (5.5) | % |

| Gain (loss) on real estate ventures | 121 | | | (14) | | | 135 | | | N/M |

| Other income | 2 | | | 6 | | | (4) | | | (66.7) | % |

| Total other income (expense) | $ | (99) | | | $ | (243) | | | $ | 144 | | | (59.3) | % |

Other income (expense) changed by $0.1 million in 2022, primarily driven by primarily driven by higher mark-to-market valuations of the fixed-rate debt associated with our equity method investments in the current period, as well as gains on the performance of our title insurance joint venture with Superior Title Services, Inc., driven by higher volume as compared to the prior period.

Income taxes

Provision for from income tax was $0.1 million in 2022, compared to a tax benefit of $11.2 million in 2021. The significant benefit in 2021 was primarily due to the partial $11.3 million release of a deferred tax asset valuation allowance, which was derived from our ability to consistently deliver positive net income from continuing operations and our expectation that we will continue to generate future taxable income. As of December 31, 2022, we had $131.7 million of net operating loss (“NOL") carryforwards.

Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, we prepare certain financial measures that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”), specifically Adjusted EBITDA.

We define Adjusted EBITDA as net income (loss) from continuing operations, excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, and gain (loss) on equity method investments.

We use Adjusted EBITDA to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts that are used when allocating resources. We expect to compute Adjusted EBITDA consistently using the same methods each period.

We believe Adjusted EBITDA is a useful measure because it permits investors to better understand changes over comparative periods by providing financial results that are unaffected by certain non-cash items that are not considered by management to be indicative of our operational performance.

While we believe that Adjusted EBITDA is useful to investors when evaluating our business, it is not prepared and presented in accordance with GAAP, and therefore should be considered supplemental in nature. Adjusted EBITDA should not be considered in isolation, or as a substitute, for other financial performance measures presented in accordance with GAAP. Adjusted EBITDA may differ from similarly titled measures presented by other companies.

The following table presents a reconciliation of net income (loss) from continuing operations, the most directly comparable financial measure as measured in accordance with GAAP, to Adjusted EBITDA (in thousands):

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | | | 2022 | | 2021 |

| Net income (loss) from continuing operations | | | | | $ | 7,728 | | | $ | 16,039 | |

| Interest expense | | | | | 222 | | | 235 | |

| Income taxes | | | | | 125 | | | (11,217) | |

| Depreciation and amortization | | | | | 206 | | | 94 | |

| Stock-based compensation | | | | | 834 | | | 633 | |

| (Gain) loss on real estate ventures | | | | | (121) | | | 14 | |

| Adjusted EBITDA | | | | | $ | 8,994 | | | $ | 5,798 | |

Seasonality and Quarterly Fluctuations

None.

Liquidity and Capital Resources

Liquidity is defined as the current amount of readily available cash and the ability to generate adequate amounts of cash to meet the current needs for cash. We assess our liquidity in terms of our cash and cash equivalents on hand and the ability to generate cash to fund our operating activities.

Our principal sources of liquidity as of December 31, 2022 were our cash and cash equivalents of $11.7 million and our $10.0 million of available borrowings on our Credit Facility.

Significant factors which could affect future liquidity include the adequacy of available lines of credit, cash flows generated from operating activities, working capital management and investments.

Our primary capital needs are for working capital obligations and other general corporate purposes, including investments and capital expenditures. Our primary sources of working capital are cash from operations and distributions from investments in real estate ventures. We have historically financed our operations with internally generated funds and borrowings from our credit facilities. For additional information, see Note 7 in the Notes to Consolidated Financial Statements.

We believe we currently have adequate liquidity and availability of capital to fund our present operations and meet our commitments on our existing debt.

Cash Flows

The following table summarizes our cash flows for the periods indicated (in thousands):

| | | | | | | | | | | |

| Year Ended December 31, |

| 2022 | | 2021 |

| Continuing operations | | | |

| Net cash provided by (used in) operating activities | $ | 8,397 | | | $ | 8,688 | |

| Net cash provided by (used in) investing activities | (2,099) | | | 1,276 |

| Net cash provided by (used in) financing activities | (10,068) | | | (227) | |

| Total net increase (decrease) in cash - continuing operations | (3,770) | | | 9,737 |

| Discontinued operations, net | (331) | | | (946) | |

| Net increase (decrease) in cash and cash equivalents | $ | (4,101) | | | $ | 8,791 | |

Operating Activities

Net cash provided by operating activities decreased by $0.3 million in 2022, primarily driven by a $3.6 million incremental cash outflow stemming from changes to our net working capital, including increased accounts receivable, partially offset by a $3.3 million increase in net income from continuing operations after adjustments for non-cash items that contributed to the comparative increase.

Investing Activities

Net cash provided by (used in) investing activities decreased by $3.4 million in 2022, primarily driven by primarily driven by a $3.3 million decrease in distributions from real estate investments, a $0.4 million increase in fixed and intangible asset purchases, and a $0.7 million decrease in investments in real estate ventures, partially offset by $1.0 million in proceeds received from the CES divestiture.

Financing Activities

Net cash used in financing activities increased by $9.8 million in 2022, primarily driven a $4.0 million cash payment made in connection with the early redemption of our Series C preferred stock and a $5.5 million payment made to satisfy the outstanding balance of our credit facility.

Off-Balance Sheet Arrangements

From time to time, we may have off-balance-sheet unconsolidated investments in real estate ventures and other unconsolidated arrangements with varying structures. For a full discussion of our current investments in real estate ventures, see Note 5 in the Notes to Consolidated Financial Statements.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with GAAP. Accounting policies, methods and estimates are an integral part of the preparation of consolidated financial statements in accordance with U.S. GAAP and, in part, are based upon management’s current judgments. Those judgments are normally based on knowledge and experience with regard to past and current events and assumptions about future events. Certain accounting policies, methods and estimates are particularly sensitive because of their significance to the consolidated financial statements and because of the possibility that future events affecting them may differ from management’s current judgments. While there are a number of accounting policies, methods and estimates affecting our consolidated financial statements, areas that are particularly significant include:

•Investments in real estate ventures

•Revenue - Incentive Fees

•Income taxes

Investments in real estate ventures

For investments in real estate ventures that we have elected to report at fair value, we maintain an investment account that is increased or decreased each reporting period by contributions, distributions, and the difference between the fair value of the investment and the carrying value as of the balance sheet date. These fair value adjustments are reflected as gains or losses in our consolidated statements of operations. The fair value of these investments as of the balance sheet date is generally determined using a discounted cash flow analysis, income approach, or sales-comparable approach, depending on the unique characteristics of the real estate venture.