By Jessica Menton

U.S. stocks lost steam in the final hour of trading Friday,

following a week of dramatic swings on Wall Street that underscore

the uncertainty gripping investors heading into 2019.

The Dow Jones Industrial Average lost 77 points, or 0.3%, to

23061, after storming back with a record rebound Thursday. The

S&P 500 declined 0.1% while the Nasdaq Composite rose less than

0.1%.

All three major U.S. indexes rose at least 2.7% this week,

snapping a three-week losing streak. Despite the gains, the indexes

are all poised for annual losses for the first time since 2008,

while the blue chips and the S&P 500 are on pace for their

worst December since 1931.

Despite the rally this week, analysts remain cautious about the

prospects for equity markets into the new year. Top of mind in the

U.S. this week is the partial government shutdown, which is

expected to continue into January.

Concerns that the U.S. economy is set for a slowdown have

weighed on markets in recent months, as the effects of last year's

tax overhaul wear off and the Federal Reserve tightens monetary

policy.

Investors will get more clues on the health of the U.S. economy

next week with data including the U.S. employment report and

manufacturing figures. If manufacturing data confirm a loss of

momentum in December, that will likely make investors more nervous

about the state of economic growth, said Tom Essaye, president of

the Sevens Report.

"We're entering 2019 in a treacherous place," he said. "We all

need to buckle up because it's going to be a bumpy ride for a

while."

Larry Benedict, chief executive of The Opportunistic Trader,

said this week's gyrations have left him with more unanswered

questions, which he says will likely set up 2019 to be a volatile

year because of ongoing political and economic uncertainty.

"My main unanswered question this year is why is everybody in

such a panic?" he said. "If you look at other months that have seen

these kind of sharp losses, they were all during a crisis. But

we're not in one right now, which is shocking."

Mr. Benedict added that this week's unprecedented moves have

been due in part to the lack of liquidity in the market from the

absence of players.

Losses in energy and materials shares weighed in the S&P 500

Friday. Widely held technology stocks fell, with Facebook and

Microsoft losing nearly 1%.

Equity markets rallied earlier this year, led by the technology

sector, but those gains have been reversed in the final three

months of the year. Energy and industrial stocks have also slumped

sharply in 2018 amid falling commodity prices and global trade

tensions. The S&P 500 and the Dow industrials this quarter are

down 15% and 13%, respectively.

Mr. Benedict said he anticipates that investors will want to buy

stocks heading into 2019, but said it was a matter of whether they

will be able to handle the volatility. "Are there going to be any

buyers of the beaten down stocks next year? That's what's going to

be interesting."

The holiday period has been defined by wild market swings, with

U.S. stocks slumping Thursday before staging a dramatic comeback

just before markets closed. The Dow swung from an intraday 2.7%

fall to close 1.1% higher.

"The volatility we're seeing is very reminiscent of some of

those ugly periods like when the dot-com bubble popped in 2000, or

the post-Lehman financial crisis," said Mark Travis, chief

executive and president of Intrepid Capital, which has roughly $1

billion in assets under management. "We don't have the systemic

problems that we had then, but we're seeing a global tantrum," he

said, referring to how long-duration assets such as fixed income

have come under pressure as the Federal Reserve tightens monetary

policy.

Mr. Travis said the firm has used this month's downturn as an

opportunity to add exposure to stocks that have more attractive

valuations, including energy company Cabot Oil & Gas and

footwear company Skechers.

Janet Johnston, portfolio manager at TrimTabs Asset Management,

which has about $119 million in assets under management, has also

been advising clients to use the "buy-the-dip" strategy in stocks

such as Amazon, chip maker Nvidia and Merck.

The S&P 500 and Dow industrials were on the brink of a bear

market, typically defined as at least a 20% decline from a recent

high, at the beginning of the week. Following a rally over the past

two trading days, the indexes were down 15% and 14% from their

respective peaks.

"A bear market doesn't just come on this fast and this strong,"

said Tatyana Bunich, president and founder at Financial 1 Wealth

Management, adding there would need to be signs of a recession,

such as rising unemployment, weak earnings and slumping

consumer-spending data.

"None of that is happening. I do believe there's going to be

slowing in the economy, but it's not going to happen overnight,"

she said.

There have been few havens for investors, with gold,

international bonds and cash equivalents all offering paltry

returns.

The 10-year U.S. Treasury yield fell to 2.740%, from 2.744% on

Thursday. Yields move inversely to prices.

U.S. oil prices rose 1.6% to settle at $45.33 a barrel, despite

a smaller-than-expected drop in crude inventories.

Elsewhere, the Stoxx Europe 600 added 2%. In Asia, Hong Kong's

Hang Seng Index rose 0.1% and China's Shanghai Composite gained

0.4%.

--Avantika Chilkoti contributed to this article.

Write to Jessica Menton at Jessica.Menton@wsj.com

(END) Dow Jones Newswires

December 28, 2018 16:39 ET (21:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

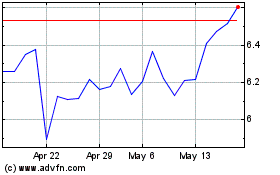

Banco BPM (BIT:BAMI)

Historical Stock Chart

From Apr 2024 to May 2024

Banco BPM (BIT:BAMI)

Historical Stock Chart

From May 2023 to May 2024