2nd UPDATE: MCC, Minara To Launch Joint Bid For Ravensthorpe

November 25 2009 - 1:39AM

Dow Jones News

Two major nickel miners will launch a joint bid for BHP Billiton

Ltd.'s (BHP) idled Ravensthorpe nickel mine, a person familiar with

the situation said Wednesday, signaling support for future metal

demand.

China Metallurgical Group Corp. and Minara Resources Ltd.

(MRE.AU) will bid in equal parts for the failed US$2.1 billion

mine. The bidding process closes later Wednesday.

Aside from tying up a key producer and a Chinese entity, this

also enters Minara's major shareholder commodity trader Glencore

International AG into the equation. Glencore owns over 70% of

Minara.

Minara -- which is in need of funding and previously sought to

pair up with a bid by Jinchuan Group, later withdrawn -- and MCC

have emerged as strong contenders given their technical experience

with nickel laterite mines.

Aside from MCC and Minara, Poseidon Nickel Ltd. (POS.AU) and

Canada's First Quantum Ltd. (FM.T) remain in the running, a second

person familiar with the sale process said.

Poseidon has a market capitalization of only A$44 million. It

lacks the financial muscle to purchase Ravensthorpe but counts

mining billionaire and Fortescue Metals Group Ltd. Chief Executive

Andrew Forrest as its chairman.

First Quantum is cash-rich but focused on copper production and

only has early-stage nickel projects. A spokesman for Poseidon

declined to comment and First Quantum and MCC weren't

available.

"Glencore via Minara and MCC are both groups that have a vested

interest in nickel and it's easy to see the link to a perception of

long-term growth opportunities in the stainless steel market in

general and in nickel in particular," said one senior commodity

strategist.

BHP is seeking up to A$500 million for the mine but the acquirer

would also have to invest substantially to improve the operation's

performance as well as covering restart costs.

"There's a disconnect between BHP's internal thinking about the

price versus reality. Ravensthorpe is a very poorly defined ore

body and the company has written its value down to zero. BHP isn't

having the kind of auction they want," the first person familiar

said.

A BHP spokeswoman reiterated that the company was investigating

a divestment, a restart or a permanent closure.

Ravensthorpe has a nameplate capacity of 50,000 metric tons and

cost US$2.1 billion to build after huge cost overruns and delays,

only to be commissioned in May last year at a time when nickel

prices rapidly plummeted from around US$30,000/ton to a five-year

low of $8,850/ton in October 2008.

In January this year, BHP shut the mine and subsequently wrote

the value of the operation down to zero, failing to turn a profit

and struggling with technical issues.

Attempts to work nickel laterite ore bodies using high pressure

acid leach extraction have produced a number of failed attempts

since the 1990s.

There are few new nickel sulfide discoveries, leaving the deeply

weathered laterite ores as the nickel source of the future.

The highly corrosive nature of the high pressure extraction

process is technically challenging and laterite mines have to

process large amounts of low-grade material, meaning treatment

plants are prone to maintenance outages.

"Bidders for Ravensthorpe are aware of the problems with new

projects, which in the future will put a floor under the nickel

price. If someone can get Raventhorpe to work, you'd get your money

back fairly quickly," the strategist said.

Minara has technical expertise it can apply at Ravensthorpe,

having already successfully revived one troubled nickel laterite

project at its Murrin Murrin mine in Western Australia using a

high-pressure acid leach process.

Minara, which has a market capitalization of A$987 million, has

confirmed its participation in the sale.

Meanwhile, MCC operates the US$1.4 billion Ramu nickel venture,

which is due to finish construction by the end of the year.

Forecast to produce 31,150 metric tons a year of nickel, Ramu is

also a high-pressure laterite processing venture and MCC could use

expertise gained in its construction to speed up the revamp of

Ravensthorpe.

MCC is making increasing inroads into Australia's resources

sector. Last year it bought the Cape Lambert Iron magnetite project

in the Pilbara region in a A$400 million deal and took a 20% in

Citic Pacific's US$3.8 billion Sino Iron project at Cape

Preston.

Last week MCC agreed to back Australian mining magnate Clive

Palmer's -- who was also an early bidder for Ravensthorpe -- A$7.5

billion China First Coal project in Queensland.

-By Elisabeth Behrmann, Dow Jones Newswires;

61-2-8272-4689 elisabeth.behrmann@dowjones.com

(Alex Wilson in Melbourne contributed to this article)

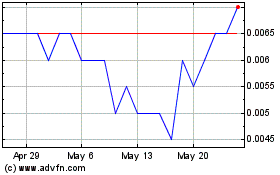

Poseidon Nickel (ASX:POS)

Historical Stock Chart

From Apr 2024 to May 2024

Poseidon Nickel (ASX:POS)

Historical Stock Chart

From May 2023 to May 2024