The European Union (EU) lost its top credit rating from one of the

major credit rating agencies – Standard & Poor’s – on Friday on

falling creditworthiness, rising tension on budget negotiations and

lack of unity among the 28 members. The agency lowered the

long-term debt rating on the region by one notch to AA+.

The move came after the S&P downgraded the Netherlands to AA+

last month and lowered its outlook on six other member unions –

France, Italy, Spain, Malta, Slovenia and Cyprus – last year (read:

Top Ranked Dutch ETF Unscathed by S&P Downgrade).

The S&P warned that the financial profile of the EU is getting

worse and the cohesion among the union members is reducing. This is

especially true given the first spending cut in the history of the

EU. For 2014, the EU budget is set at €135.5 billion ($181.5

billion), which is 7% lower than last year.

The reduced budget indicates that the bloc could fall short of

financing over the coming years if some countries disagree on

contributions to the budget. The U.K., which is leading the

European recovery, has filed for a ‘referendum’ that would allow

the country to exit the EU in 2017. If approved, it could weaken

the relation with the EU and threaten the stability of the

region.

Europe Outlook Still Bright

According to the latest survey, the economic confidence in the Euro

zone climbed to 98.5 in November from 97.7 in October. This

represents the highest level in more than two years and suggests

that the bloc is gaining momentum again after a slowdown in the

third quarter.

Additionally, the unemployment rate fell slightly to 12.1% in

October from a record 12.2% in September while inflation rose to

0.9% in November from 0.7% in October. Investors should note that

unemployment is still higher than last year’s rate of 11.7% and

inflation is below the ECB’s 2% annual target.

Further, the recent cut in the benchmark interest rate to a record

low 0.25% by the European Central Bank (ECB) to support economic

growth in the Euro zone and low inflation reflects optimism and

confidence (read: 3 Top Ranked Europe ETFs to Buy Now).

The European Commission expects the Euro zone economy to grow 1.1%

next year after contracting 0.4% this year thanks to fiscal

consolidation and structural reforms. This outlook appears solid

given that the economy shrank 0.7% 2012.

ETFs in Focus

Given the S&P downgrade but also an improving outlook, the

European ETFs are in focus once again. Investors should closely

watch the movement of these funds on the downgrade news and tap any

opportunity. Below, we have highlighted the three most popular

funds that could see heavy volumes in the days ahead on the news

(see: all the European ETFs here):

Vanguard FTSE Europe ETF (VGK)

This is by far the most popular and liquid ETF in the European

space, having amassed nearly $13.2 billion in AUM and trading in

volumes of more than 3.5 million shares. The ETF tracks the FTSE

Developed Europe Index and primarily focuses on large caps with 85%

of assets while charging a fee of just 12 bps a year.

The product is well spread out across a large basket of 505 stocks,

as each security does not hold more than 2.7% share. In terms of

sector exposure, financials take one-fifth of the assets while

consumer non-cyclical and healthcare together make up for 25%

share.

The British firms dominate the portfolio with 32.9% share, closely

followed by double-digit allocations of 14.4% in France, 13.9% in

Germany and 13.6% in Switzerland. VGK added nearly 19.7% so far

this year.

iShares MSCI EMU Index Fund (EZU)

This ETF provides exposure to the EMU member countries (those

European Union members that use the Euro as its currency) by

tracking the MSCI EMU index. It is also one of the most popular

funds in the space with AUM of $7.8 billion while charging

investors 0.49% in annual fees.

The fund holds about 243 securities in its basket, which is pretty

well spread across each security, as no single firm holds more than

3.20% of the assets. From a sector look, the product has a diverse

approach with financials, industrials, consumer discretionary and

consumer staples having a double-digit allocation.

Country weights for the top three are Germany (30.69%), France

(30.61%) and Spain (10.88%). EZU is a large cap centric fund and is

extremely liquid, trading in volumes of 3.5 million shares per day.

The fund is up 22.6% this year (read: Top Ranked Europe ETF in

Focus: EZU).

SPDR EURO STOXX 50 ETF (FEZ)

This fund tracks the EURO STOXX 50 Index and charges 29 bps in fees

per year from investors. The product has amassed $4.7 billion in

its asset base while it sees volume of more than 1.4 million shares

a day on average.

Holding 50 securities in its basket, the fund puts less than 39% of

its assets in the top 10 holdings. The ETF is skewed toward

financials, as they take roughly one-fourth of the total assets,

while industrials, healthcare and consumer staples round out the

next three spots.

In terms of country allocations, France and Germany are leading

with 36.02% and 33.57% share, respectively (read: Time for This Top

Ranked German ETF?). The fund returned over 21% this year.

Bottom Line

The three products have a Zacks ETF Rank of 1 or ‘Strong Buy’

rating, suggesting that they would outperform the broad market in

the coming months. Plus, they could be ideal choices for investors

to play the European recovery despite the weakened credit outlook

from the S&P.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMU IDX (EZU): ETF Research Reports

SPDR-EU STX 50 (FEZ): ETF Research Reports

VANGD-FTSE EUR (VGK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

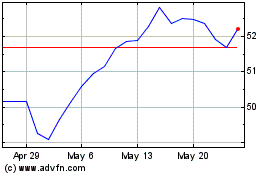

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From May 2024 to Jun 2024

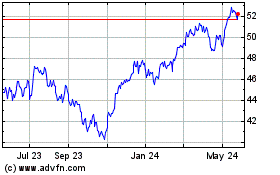

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From Jun 2023 to Jun 2024