Apple (NASDAQ:AAPL): A Year Of Pent Up Selling Pressure

The inspiration for Lessons From The Financial Markets For 2013 was a two pronged one in the autumn of 2012, with the fiasco of the Facebook (NASDAQ:FB) as well as the rise and rise of Apple. The question is what would happen in 2013. Would Facebook continue to decline from its opening day high above $40 to a more normal rating of say an old economy company that would value it around $10? At the same time, even as recently as the end of September the rise and rise of the iPhone maker seemed to know no bounds. Rather strangely, the stock kept on rising despite the painful lack of personality of the new CEO, the squabbling with Samsung, and the worst aspect, the way that the success of what Steve Jobs did is an impossible act to follow.

In fact, my view was and is that Apple was all about Steve Jobs from the start of the last decade, and the unwinding of that “bubble” will be the story of this decade. But at least to start October when I began Lessons From The Financial Markets For 2013 there was the issue of trying to find out when the stock might crack. As you will read, there was a logical, if not bizarre explanation that a period of mourning was in operation.

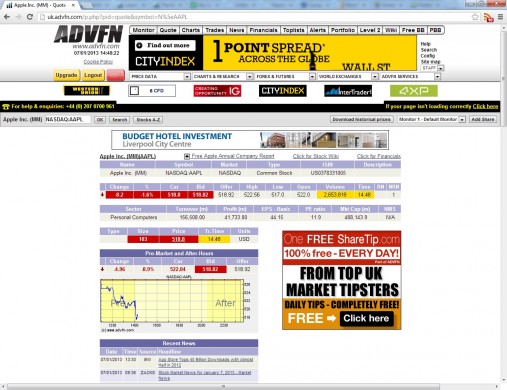

In fact, the idea that the death of Steve Jobs meant that Apple shares were delivered a grace period of almost exactly a year is one that is now relevant once again in the wake of this week’s results. This is because it reminds us that if there was a grace period of a year, there could be a year’s worth of shorting / selling to go here. This would mean that rather than the latest gap down to $450 being a buying opportunity, we could be due to suffering another 10 months of weakness taking us into autumn 2013. Even if relative stability comes into play over the next few days it would be difficult to imagine that Apple shares may not sink towards $400 or even $300 before there is a sustained recovery.

Read Zak’s Amazon eBook bestseller containing highly pertinent outlooks for Apple and Facebook in Lessons From The Financial Markets For 2013 by clicking here

Hot Features

Hot Features