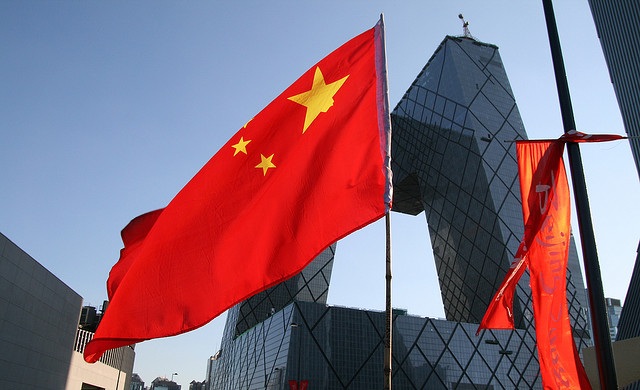

Just like the economies of many European countries and the US, the Chinese economy has been and continues to be a major source of concern for many UK stock market investors, experts, and analysts.

A lot of people are of the opinion that a large majority of economic statistics that have been churned out of China over the years have been fraudulent. This is what has led several stock investors in the UK, and other parts of the world,to factor in unrealistic expectations in any investment decision they make regarding Chinese assets, as well stocks and shares in Chinese companies. Some stock investors, in the UK and US especially, even go as far as shying away from purchasing or trading in any foreign Chinese stocks and shares that happen to be listed on their domestic stock exchanges.

Even now, the sort of weak economic data that has recentlybeen emanating from China has managed to spook stock investors even more as concerns over slowing Chinese growth have increased along with uncertainty over Europe’s debt problems. Moreover, China’s non-manufacturing Purchasing Managers’ Index (PMI) has steadily been falling of late according to surveys released by the country’s own Federation of Logistics and Purchasing.

It hasn’t all been bad news however, as retail companies such as Kingfisher (LSE:KGF), Marks & Spencer (LSE:MKS), and Next (LSE:NXT) – a top riser on the Footsie (FTSE 100), have in fact been faring well on the London stock market following an upbeat broker note from Nomura that predicted future benefits for retail companies from lower input costs,as a result of certain factors inclusive of increasing productivity levels in Chinese factories.

Furthermore, seeing as China is widely considered to be the world’s biggest market for iron ore, an optimistically predicted increase in demand for iron ore in the country has been good news indeed for several mining companies listed on the London Stock Exchange, most especially BHP Billiton (LSE:BLT)- the world’s largest mining company. As a matter of fact, the company has steadily been increasing its iron ore production in spite of earlier contrasting predictions of an imminent fall in Chinese industries’ demand for the steel-making commodity, as well as a slowdown in both the Chinese and global economies. The optimistic predictions on which companies like BHP are basing steps to increase their production levels is primarily hinged on the assumption that demand will rise as a result of the likely migration of many rural Chinese to urban areas in the coming years.

Thus, the grand sum of economic data coming from China appears to be mixed, as some sectors are witnessing recommendable improvements, while others seem to be crumbling by the day.

Hot Features

Hot Features