Alliance Pharma PLC Pre-Close Trading Update (7794U)

January 23 2017 - 2:00AM

UK Regulatory

TIDMAPH

RNS Number : 7794U

Alliance Pharma PLC

23 January 2017

For immediate release 23 January 2017

ALLIANCE PHARMA PLC

("Alliance" or the "Company")

Pre-Close Trading Update

Alliance Pharma plc (AIM: APH), the specialty pharmaceutical

company, announces its pre-close trading update ahead of its

preliminary results for the year ended 31 December 2016.

Group revenue for 2016 is expected to be more than double the

prior year at GBP97.5m (2015: GBP48.3m). This has been driven by

the transformational acquisition of the ex-Sinclair products in

December 2015 and the continued strong performance of the original

Alliance portfolio. Trading profit before tax is expected to be in

line with the Board's expectations.

The ex-Sinclair products delivered sales of approximately

GBP43.8m and represented 45% of total sales, which is in line with

the Board's expectations. The remaining Alliance portfolio

performed strongly and delivered a sales increase of 13% to

approximately GBP53.7m for the year (2015: GBP47.5m).

Group sales were enhanced by approximately GBP4.2m due to the

weakening of Sterling, primarily against the Euro and US Dollar.

However the effect on profits was much smaller due to the increases

in cost of goods and operating costs denominated in these

currencies.

Our key brands delivered a strong performance in 2016.

Kelo-Cote(TM), our scar reduction product, recorded sales of

GBP10.1m, exceeding GBP10m for the first time. MacuShield(TM), our

nutritional supplement product for age-related macular degeneration

(AMD), also performed strongly with sales of GBP5.3m for the year

compared with sales of GBP3.5m in the prior eleven months following

its acquisition in February 2015. On an annualised basis this would

equate to a growth rate of 40%. Hydromol(TM), our emollient range,

grew 6% with sales of GBP7.0m in a competitive market. We were also

pleased with the sales performance of our UK Consumer Health

products, including Ashton & Parsons(R) Infants' Powders whose

sales grew from GBP1.5m in 2015 to GBP1.9m.

Full year free cash flow was approximately double last year at

over GBP12m (2015: GBP6.3m). Cash conversion was particularly good

in the second half of the year with the generation of more than

GBP10m of free cash flow. The first half was affected by the

normalisation of working capital movements following the

acquisition of the ex-Sinclair products. The integration of

operations and systems from Sinclair has progressed well and the

transfer of the cash-generating activities is now complete.

Net debt decreased from GBP79.0m at 30 June 2016 to

approximately GBP76.1m as at 31 December 2016, despite adverse

foreign exchange movements following the weakening of Sterling.

Expressed at 30 June 2016 currency rates, net debt would have been

GBP73.8m. We expect net debt to progressively reduce during 2017,

driven by the Group's strong underlying cash generation.

The UK registration for Diclectin, a product undergoing approval

for the treatment for nausea and vomiting of pregnancy, is

progressing to plan. We expect UK registration mid-year, which will

enable us to begin sales in the second half of 2017 with European

territories following from late 2018.

The Group expects to announce its preliminary results for the

twelve months ended 31 December 2016 on Wednesday 29 March

2017.

For further information:

Alliance Pharma plc + 44 (0) 1249 466966

John Dawson, Chief Executive

Andrew Franklin, Chief Financial

Officer

www.alliancepharma.co.uk

+ 44 (0) 20 7466

Buchanan 5000

Mark Court / Sophie Cowles

/ Jane Glover

+ 44 (0) 20 7260

Numis Securities Limited 1000

Nominated Adviser: Michael

Meade / Freddie Barnfield

Corporate Broking: James

Black / Toby Adcock

Notes to editors:

About Alliance Pharma

Alliance, founded in 1998, is an international speciality

pharmaceutical company based in Chippenham, Wiltshire, UK. The

Company has sales in more than 100 countries worldwide via direct

sales, joint ventures and a network of distributors. Alliance has a

strong track record of acquiring the rights to established niche

products and it currently owns or licenses the rights to

approximately 90 pharmaceutical and consumer healthcare products.

The Company continues to explore opportunities to expand its

product portfolio.

Alliance joined the AIM market of the London Stock Exchange in

December 2003 and trades under the symbol APH.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSEFFWSFWSEEF

(END) Dow Jones Newswires

January 23, 2017 02:00 ET (07:00 GMT)

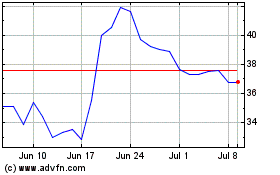

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Apr 2023 to Apr 2024