TIDMALK

RNS Number : 0965H

Alkane Energy PLC

11 March 2015

11 March 2015

Alkane Energy plc

("Alkane", "the Company" or "the Group")

Unaudited preliminary results for the year ended 31 December

2014

Alkane Energy plc (AIM: ALK), the independent gas to power

producer, today announces its unaudited preliminary results for the

year ended 31 December 2014.

Operational Highlights

-- The UK's market leader in cash generative base load coal mine methane

-- Significant increase in output from 95GWh to 195GWh since 2009

-- Power response capacity increased to 98MW (2013: 36MW)

-- Acquired sites now in full operation

-- Secured 82% of expected 2015 base load output at an average price of GBP52/MWh

-- Awarded Capacity Mechanisms Agreements providing over GBP14m revenue from 2018 to 2033

Financial Highlights

-- Revenue fell 22% to GBP16.0m (2013: GBP20.6) due to lower

design build and operate ("DBO") business as anticipated

-- Core generation revenue has grown 10% to GBP14.8m (2013: GBP13.4m)

-- Group PBT of GBP3.2m (2013: GBP2.7m)

-- Adjusted EBITDA was in line with last year at GBP7.6m (2013: GBP7.5m)

-- Adjusted EPS of 2.61p per share (2013: 3.01p per share)

-- Proposed dividend increase to 0.3p per share (2013: 0.2p per share)

2015 Outlook

-- Strong start to 2015 - step change in performance from H1 to

H2 continuing into current year

-- 82% of output already contracted at prices in line with 2014

-- Business benefitting from full impact of prior year acquisitions

Commenting on the preliminary results, Chief Executive Officer,

Neil O'Brien, said:

"2014 saw a major advance in Alkane's development. We

successfully transferred our shale assets to Egdon, made two

acquisitions and secured pricing for 82% of 2015 output, as well as

winning contracts in the initial Capacity Market auction. These

events, combined with record output within the existing business,

leave us well placed to grow further in 2015."

For more information please contact:

Alkane Energy plc

Neil O'Brien, Chief Executive

Officer

Steve Goalby, Finance Director 01623 827 927

Liberum Capital Limited

Clayton Bush

Joshua Hughes 020 3100 2000

VSA Capital Limited

Andrew Raca 020 3005 5000

Hudson Sandler

Nick Lyon

Alex Brennan 020 7796 4133

Background information

Alkane is one of the UK's fastest growing independent power

generators. The Company operates mid-sized "gas to power"

electricity plants providing both base load and fast response

capacity to the grid. Alkane has a total installed generating

capacity of 145MW and an electricity grid capacity of 160MW.

Alkane's base load operations, where power is generated 24/7,

are centred on a portfolio of coal mine methane ("CMM") sites.

Alkane has the UK's leading portfolio of CMM licences, enabling the

Company to extract gas from abandoned coal mines.

Power response sites are connected to mains gas and produce

electricity at times of high electrical demand through peak

running, or in order to balance the electricity grid through

participation in the National Grid's short term operating reserve

programme ("STOR"). Participants in STOR are paid premium rates

when called upon by the Grid to meet temporary supply shortages.

Alkane now operates 98MW of power response, one of the UK's largest

power response businesses, with contracted STOR revenues extending

out to 2025.

The Group operates from 27 mid-size (up to 25MW) power plants

across the UK, 13 CMM only, seven mains gas only, six using both

fuel sources and one using kerosene only. Alkane uses a combination

of standard modular reciprocating engines and gas turbines to

generate the electricity and sells this power through the

electricity network. The engine units and other plant are designed

to be flexible and transportable allowing additional capacity to be

brought onto growing sites and underutilised plant to be moved to

new sites to maximise efficiency.

In June 2014 Alkane transferred its shale gas interests to Egdon

Resources plc. It received 40 million Egdon shares making it the

largest shareholder in Egdon, the UK's third largest shale

operator.

More information is available on our website

www.alkane.co.uk

Overview

Alkane Energy is one of the UK's largest independent power

producers providing both base load generation from coal mine

methane ("CMM") and a network of peak pricing power response assets

using bought in natural gas. Output has increased to 195GWh in 2014

which is enough to supply circa 75,000 homes.

2014 was a year of continuing growth and development for Alkane

which has left the business well positioned for the future. We

transferred our shale gas rights in exchange for an 18% share in

Egdon Resources plc, the well funded UK onshore operator. This has

freed us to focus our cash resources and management time on

developing the core power generation business.

Within the generation business we made two acquisitions during

the year. In total we acquired 56MW of new power response assets

across four sites. This has more than doubled our power response

capacity to 98MW by the end of the year (2013: 36MW). All of this

additional capacity was fully commissioned by Christmas.

Output for the year was 195GWh (2013: 192GWh) which represents

over a decade of consistent growth in generation for the Group.

Revenue was GBP16.0m (2013: GBP20.6m) reflecting a record

performance in generation but as anticipated, lower design, build

and operate ("DBO") revenue. As previously reported there were a

number of operational issues in the last few months of the year

which have impacted on profit before tax. The upgraded capacity at

Wheldale and Shirebrook were commissioned two months later than

expected, and there were fewer than anticipated calls from National

Grid under the STOR programme. As a result, adjusted profit before

tax was GBP3.3m (2013: GBP3.4m) and adjusted earnings per share was

2.61 pence per share (2013: 3.01 pence per share). We are now

seeing the benefit of increased production in the current year.

The Group saw a significant improvement in performance from H1

to H2 with output, generation revenue and adjusted EBITDA all

increasing strongly in the second half.

HI 2014 H2 2014 Increase

Output 85GWh 110 GWh 29%

Generation revenue GBP5.9m 8.8m 51%

Group adjusted EBITDA GBP2.5m GBP5.1m 104%

In addition to this step change in performance we have delivered

on our strategic aim of gaining greater visibility on long term

earnings and cash flow. Our largest individual site, the 25MW

facility at Redditch, is contracted into STOR until 2025, our power

response peak running is already contracted for the 2015/2016

winter, and we have drilled and tested the new CMM base load site

at Markham Main, which is expected to be on stream during H2

2015.

Our Strategy

Alkane is focused on gas to power generation from a portfolio of

27 sites using standardised, modular generators. These assets are

able to provide cost effective base load generation from our CMM

resources; Alkane is the UK's leading CMM operator. In addition,

our power response business, which has grown from 36MW to 98MW over

the last year, uses bought-in gas to provide fast-response capacity

generation during winter evening peak periods and in response to

National Grid STOR calls. Our 27 sites are unmanned - we have a

single control centre monitoring and running the Alkane portfolio

and we use a mobile work force of field technicians to provide

routine and reactive maintenance.

Our mid-sized power plants are ideally suited to the UK energy

mix with the shift away from carbon intensive plant towards more

intermittent sources such as wind and solar. Our plants are located

close to towns and cities which reduces the strain and costs placed

on the nationwide grid network.

Our consistent growth means we are now creating a utility scale

portfolio of embedded generation assets, having increased our

installed capacity by more than 380% from 30MW to 145MW over the

last five years.

Acquisitions

In February 2014 we acquired a 7.5MW embedded gas powered

facility from SSE plc at Wheldale in Yorkshire. This site has

received further investment to an increased installed capacity of

9MW. The site is now integrated into our power response

operation.

In July 2014, we completed the purchase of 49MW of power

response assets across three sites from Carron Energy. This

acquisition gave us our first 25MW long term STOR site which has

committed revenues from National Grid until 2025 and a further 24MW

of gas powered fast response engines which are now integrated into

our operations after final commissioning was completed pre

Christmas 2014.

Capacity Mechanism

The UK Government has launched a number of initiatives to

address the growing structural challenges of the energy market.

With older capacity being removed from the market and margins

tightening for many power producers, the UK power market is

experiencing a far tighter supply position than recent years and

Ofgem forecast that the UK will only have around 5% capacity margin

over the next four winters compared to in excess of 10% in previous

years.

As previously announced, on 5 January 2015, Alkane was awarded

101MW of Capacity Mechanism Agreements in the Capacity Market

auction held in December 2014. Alkane will receive GBP19,400/MW per

annum for making capacity available, with 46MW being secured on new

plant with 15 year agreements and 55MW on existing plant with one

year agreements. Alkane will earn combined additional revenue of

GBP14.4m under the agreements over the period to September

2033.

Shale

Having evaluated Alkane's options and received a number of

proposals in May 2014, the board took the strategic decision to

transfer its shale rights in ten licence areas to Egdon Resources

plc ("Egdon") in return for 40 million shares. Alkane is now

Egdon's largest shareholder. Alkane's view on shale is that it

remains a potentially large and commercial gas resource. To

maximise the prospects of generating value from shale gas there is

the need for well resourced, long term and funded players in the

market with a sufficiently large scale of operation to progress

through the permitting and exploration phase. Egdon is a proven UK

onshore operator and has a well respected exploration team. A GBP7m

fund raising was completed as part of the transaction and as a

consequence Egdon has positive net cash and is funded to see itself

through the permitting phase over the next couple of years. Egdon

is the third largest shale operator in the UK which gives Alkane

shareholders exposure to any potential upside whilst conserving our

own management and cash resources for the expansion of our core

business.

Our Operations

Alkane has grown strongly since 2009, with the number of sites

increasing from 9 to 27; installed capacity from 30MW to 145MW and

output from 95GWh to 195GWh. Our largest site is 25MW and the

smallest is 0.8MW of installed capacity.

In addition to this headline growth, the structure of the

business has evolved considerably. Whilst we remain the UK's market

leader in profitable and cash generative base load CMM, our power

response business has grown from 36MW to 98MW over the last year,

generating during winter evening peak periods and providing an

important resource for the National Grid with fast response

capacity generation during the rest of the year.

Number of operational 2009 2010 2011 2012 2013 2014

sites

-------------------------- ------ ----- ----- ----- ----- -----

Base load 8 10 11 16 18 18

Power response 1 2 2 7 7 11

Gas supply 2 2 2 1 1 1

-------------------------- ------ ----- ----- ----- ----- -----

Total 9 12 13 20 23 27

-------------------------- ------ ----- ----- ----- ----- -----

(note - total does not sum as some sites

operate in more than one category)

------------------------------------------------ ----- ----- -----

Installed capacity 2009 2010 2011 2012 2013 2014

(MW)

-------------------------- ------ ----- ----- ----- ----- -----

Base load 17 23 27 37 45 45

Power response 7 8 8 31 36 98

Gas supply (equivalent

MW) 6 6 6 2 2 2

-------------------------- ------ ----- ----- ----- ----- -----

Total 30 37 41 70 83 145

-------------------------- ------ ----- ----- ----- ----- -----

Output (GWh) 2009 2010 2011 2012 2013 2014

-------------------------- ------ ----- ----- ----- ----- -----

Base load 95 117 135 159 173 174

-------------------------- ------ ----- ----- ----- ----- -----

Power response - 3 5 8 19 21

-------------------------- ------ ----- ----- ----- ----- -----

Total 95 120 140 167 192 195

-------------------------- ------ ----- ----- ----- ----- -----

Financial

Results

Revenue fell by 22% in 2014, to GBP16.0m (2013: GBP20.6m). This

reduction is due to lower revenue from our DBO business, as

anticipated. After an exceptionally busy 2013 for DBO, with six

projects being commissioned including a one-off oil & gas

remedial contract which alone added GBP4.5m to 2013 revenue, we

have seen a return to more normal levels of operation in 2014. More

importantly, our core generation business has seen a growth of 10%

in revenue to GBP14.8m (2013: GBP13.4m). This growth has reflected

an increase in output in the year to 195GWh, a new record for the

Group (2013: 192GWh).

Average base load power prices achieved in the year were

GBP53/MWh (2013: GBP53/MWh). We continue to forward contract on a

rolling basis, selling our base load and peak power output into the

UK wholesale electricity market. We have 82% of expected base load

output in 2015 contracted at an average price of GBP52/MWh and 36%

of 2016 contracted at an average price of GBP51/MWh. Power prices

in the market have been on a downward trend over the last few

months after a period of stability during 2014. The fall in prices

has flattened the forward curve, and as at the end of February

prices for 2015 and 2016 were circa GBP46/MWh and GBP47/MWh

respectively.

Power response prices for peak running average circa GBP220/MWh

including all of the benefits we receive for running during winter

peak periods. STOR includes an availability payment for providing

the capacity and a utilisation payment when we are called to

generate. Average prices in the market are in the ranges nil to

GBP3/MW for availability and GBP70/MWh to GBP150/MWh for

utilisation. We also receive the spot price for the power generated

under a call.

Gross profit was GBP6.5m in the year, slightly down from the

2013 figure of GBP6.9m due to the lower DBO revenue. Gross margin

was 41% (2013: 34%) as there was a smaller contribution from the

lower margin DBO business. In our generation business we earn

higher margins from base load, reflecting the development risk,

than we do in the more predictable power response business. The

gross margin on the generation business was 43% (2013: 39%). The

DBO business gross margin was 15% (2013: 22%).

Adjusted EBITDA was in line with last year at GBP7.6m (2013:

GBP7.5m), giving strong support to our investment programme. The

EBITDA margin was 48% (2013: 37%) as a result of growth in the

generation business and a return to more normal levels of activity

in the DBO business.

The exceptional items comprise the net profit of GBP10.0m on the

transfer of our shale gas interests to Egdon, with our shareholding

being valued at GBP10.5m, against which we have charged associated

costs of GBP0.5m. We have carried out a mark to market calculation

in respect of our investment in Egdon. Egdon's share price fell in

the period between our acquisition of the shares and the year end,

and this has resulted in an impairment charge of GBP5.0m being

charged to the income statement. Secondly we have reviewed the

carrying values of the assets we hold on all of our licences and

concluded that it is appropriate to make an impairment charge of

GBP4.1m. Thirdly we have written off the outstanding debt of

GBP0.3m due from TEG Environmental Limited following their entry

into administration. A further GBP0.6m of exceptional

administrative expenses relates to the costs of corporate

transactions, mainly the acquisition of the three power responses

companies from Carron Energy. The increase in other operating

income represents a reassessment of restoration provisions in

respect of those sites where the provisions have been reduced.

After adjustment for exceptional items, profit before tax was

GBP3.3m (2013: GBP3.4m), principally reflecting the lower level of

gross profit arising from the reduced contribution from the DBO

business. The published profit before tax increased by 21% to

GBP3.2m (2013: GBP2.7m). After an increase in the recognised

deferred tax asset of GBP0.2m in the year (2013: GBP0.1m) the

adjusted profit for the year after tax was GBP3.5m (2013:

GBP3.5m).

The adjusted earnings per share (excluding exceptional items)

for continuing operations is 2.61p per share (2013: 3.01p per

share), with published earnings per share for continuing operations

being 2.56p per share (2013: 2.40p per share).

As a sign of the Board's confidence in the Company's prospects

it is recommending an increased dividend of 0.3 pence per share

(2013: 0.2 pence per share). Subject to shareholder approval, which

will be sought at the Annual General Meeting to be held on 30 April

2015, payment of this dividend will be made on 30 June 2015 to all

shareholders on the register at the close of business on 29 May

2015.

Balance Sheet and Cash Flow

Net assets at 31 December 2014 increased to GBP44.1m (2013:

GBP33.0m) with strong asset backing as Alkane at the year-end had

145MW of generating capacity and the infrastructure for the 27

operating sites. Working capital requirements remain tightly

controlled with the majority of income received within four weeks

of month end and we have a policy to pay creditors on fair terms.

Our capital expenditure programme amounted to GBP18.1m (2013:

GBP12.8m) which incorporates the acquisition of the Wheldale and

Carron Energy power response operations, expenditure on pipeline

CMM projects including Markham Main, which was successfully drilled

in the year and is anticipated to be opened in 2015, and the

continuing investment in engine overhauls.

A deferred tax asset of GBP1.1m (2013: GBP0.9m) has been

recognised in accordance with a prudent estimate of the extent to

which future taxable profits will be available to be utilised

against unused tax losses and other temporary differences. A

deferred tax liability of GBP1.2m has been recognised in the year

as an element of the fair value adjustment applied on the Carron

Energy acquisition. As a result a net deferred tax liability of

GBP0.1m is shown in the statement of financial position.

Operating cash generated by the Group in the year was GBP4.6m

(2013: GBP5.6m), the reduction being due to the additional peak

seasonal working capital requirements of the acquired companies.

Net debt (excluding convertible loan stock) at the year-end was

GBP18.1m (2013: GBP10.2m) as we continued to invest in new sites

and in the acquisitions of power response assets. During the year

the Group raised new asset finance of GBP7.5m, GBP2m for the

acquisition of the Wheldale power response site and GBP5.5m for the

acquisition of the Carron Energy power response companies. We also

took over responsibility for a GBP1.2m term loan facility as part

of the Carron Energy acquisition. The balance of the consideration

for the Carron Energy acquisition was financed by a proportion of

the funds raised in a share placing. A total of GBP8m gross was

raised by the issue of 22 million new ordinary shares at a placing

price of 36 pence per share. The balance of the funds raised in the

placing provided additional working capital to support the

continued investment by the Group in its core gas to power

activities. Gearing has increased to 41% (2013: 31%)and the Group

remains within all of its bank covenants.

Our bank facilities comprise a GBP10.0m revolving credit

facility (of which GBP9.1m was drawn down at the year-end) and term

loans and asset finance totalling GBP10.1m at the year end. We are

repaying GBP3.3m per year on these term loans. We also have GBP2.3m

outstanding in respect of convertible loan stock, which was put in

place as part of the funding package for the acquisition of

Greenpark Energy Limited in 2012. The final date for conversion of

the loan note occurs in April 2015.

Outlook

2015 has started well as we are deriving the benefit from the

sites acquired during 2014 and have been experiencing record levels

of production on both base load and winter peak running. We have

already secured attractive pricing for 2015 and our power response

portfolio is fully contracted until April 2016. We will continue to

open new CMM sites with Markham Main moving into the site build

phase. In summary, we are pleased to report that the momentum of

the second half of 2014 has continued into the start of 2015.

Roger McDowell

Chairman

Neil O'Brien

Chief Executive Officer

Steve Goalby

Finance Director

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (unaudited)

for the year ended 31 December 2014

2014 2013

Notes GBP'000 GBP'000

Revenue 15,961 20,571

Cost of sales (9,445) (13,664)

-------- ---------

Gross profit 6,516 6,907

Impairment of assets (4,069) -

Administrative expenses (2,873) (3,342)

Exceptional administrative expenses 3 (922) (703)

-------- ---------

Return on Group operations (1,348) 2,862

Profit on transfer of licences 9,953 -

Impairment of available for sale financial

asset (5,036)

Other operating income 663 471

-------- ---------

Profit on activities before net finance

costs 4,232 3,333

Finance income 7 18

Finance costs (1,029) (696)

-------- ---------

Net finance costs (1,022) (678)

Profit before tax 3,210 2,655

Taxation 5 228 100

Profit for the year attributable to

equity holders of the parent 3,438 2,755

-------- ---------

Other comprehensive income - -

Total comprehensive income for the

year attributable to

-------- ---------

equity holders of the parent 3,438 2,755

-------- ---------

Earnings per ordinary share

Basic, for profit for the year attributable

to equity holders of the parent 11 2.56p 2.40p

Diluted, for profit for the year attributable

to equity holders of the parent 11 2.39p 2.25p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (unaudited)

at 31 December 2014

2014 2013

Notes GBP'000 GBP'000

NON-CURRENT ASSETS

Property, plant and equipment 12 33,833 23,316

Gas assets 13 26,054 23,335

Intangible assets 1,446 1,633

Derivative financial instrument - 22

Deferred tax asset 5 - 900

Available for sale financial asset 5,464 -

66,797 49,206

CURRENT ASSETS

Inventories 872 464

Trade and other receivables 6,310 4,156

Cash and cash equivalents 1,084 838

8,266 5,458

--------- ---------

TOTAL ASSETS 75,063 54,664

--------- ---------

CURRENT LIABILITIES

Trade and other payables (7,192) (4,616)

Finance lease obligations (446) (343)

Long-term borrowing due within one

year (2,815) (1,500)

7.5% Convertible loan stock 15 (2,337) -

Provisions (81) (146)

(12,871) (6,605)

--------- ---------

NON-CURRENT LIABILITIES

Finance lease obligations (1,377) (69)

Long-term borrowings (14,497) (9,161)

7.5% Convertible loan stock 15 - (2,199)

Deferred payments 9 (480) (900)

Derivative financial instrument (10) -

Deferred tax liability (91) -

Provisions (1,666) (2,737)

(18,121) (15,066)

--------- ---------

TOTAL LIABILITIES (30,992) (21,671)

--------- ---------

NET ASSETS 44,071 32,993

--------- ---------

EQUITY

Share capital 739 618

Share premium 14,557 6,906

Hedging reserve (10) 22

Other reserves 9,198 9,230

Retained earnings 19,587 16,217

TOTAL EQUITY 44,071 32,993

--------- ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (unaudited)

for the year ended 31 December 2014

Attributable to the equity holders of

the parent

------------------------------------------------------------------

Issued Share Hedging Other Retained Total

capital premium(1) reserve reserves(2) earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2014 618 6,906 22 9,230 16,217 32,993

Profit for the year - - - - 3,438 3,438

Dividend - - - - (249) (249)

Fair value of derivative

instrument - - (32) - - (32)

Share based payment - - - 160 - 160

Share options lapsed and

exercised during the year - - - (181) 181 -

Equity component of convertible

loan notes - 11 - (11) - -

Issue of share capital 121 7,640 - - - 7,761

At 31 December 2014 739 14,557 (10) 9,198 19,587 44,071

-------- ----------- -------- ------------ --------- --------

At 1 January 2013 507 1,248 - 9,196 13,451 24,402

Profit and total comprehensive

income for the year - - - - 2,755 2,755

Dividend - - - - (101) (101)

Fair value of derivative

instrument - - 22 - - 22

Share based payment - - - 146 - 146

Share options lapsed and

exercised during the year - - - (112) 112 -

Issue of share capital 111 5,658 - - - 5,769

At 31 December 2013 618 6,906 22 9,230 16,217 32,993

-------- ----------- -------- ------------ --------- --------

(1) During the year GBP364,000 (2013: GBP274,000) was written

off against the share premium account in respect of costs relating

to the issue of shares.

(2) Other reserves comprise the equity component of convertible

loan notes of GBP220,000 (2013: 232,000), a share-based payments

reserve of GBP315,000 (2013: GBP335,000), a merger relief reserve

of GBP244,000 (2013: GBP244,000), and a distributable reserve of

GBP8,419,000 (2013: GBP8,419,000) that was created following a

capital reduction.

CONSOLIDATED STATEMENT OF CASH FLOWS (unaudited)

for the year ended 31 December 2014

2014 2013

Notes GBP'000 GBP'000

Operating activities

Profit before tax from continuing operations 3,210 2,655

Adjustments to reconcile operating profit

to net cash flows:

Transfer of licences (9,953) -

Impairment of available for sale financial 5,036 -

asset

Depreciation of property, plant and equipment 2,462 2,797

Gas asset depletion 756 670

Gas asset impairment 3,832 -

Property, plant and equipment impairment 237 -

Intangible asset amortisation 65 15

Intangible asset impairment - 233

Share-based payments expense 160 146

Finance income (7) (18)

Finance expense 1,029 696

Movements in provisions (615) (463)

(Increase)/decrease in trade and other

receivables (1,666) 573

(Increase)/decrease in inventories (15) 8

Increase/(decrease) in trade and other

payables 112 (1,754)

--------- ---------

Net cash flows from operating activities 4,643 5,558

Cash flows from investing activities

Interest received 7 18

Purchase of property, plant and equipment (5,358) (6,180)

Purchase of gas assets (2,036) (6,193)

Purchase of subsidiaries 8/9 (10,991) -

Purchase of intangible assets - (439)

Cash acquired on acquisition of subsidiaries 323 -

--------- ---------

Net cash flows used in investing activities (18,055) (12,794)

Cash flows from financing activities

Issue of share capital 7,659 5,769

Proceeds from finance leaseback 1,995 -

Sale and finance leaseback rentals (584) (710)

Proceeds from long-term borrowings 9,170 3,516

Repayment of long-term borrowings (3,657) (1,500)

Dividend paid to the equity holders of

the parent (249) (101)

Interest paid (676) (469)

--------- ---------

Net cash flows from financing activities 13,658 6,505

Net increase/(decrease) in cash and cash

equivalents 246 (731)

Cash and cash equivalents at 1 January 838 1,569

--------- ---------

Cash and cash equivalents at 31 December 16 1,084 838

--------- ---------

NOTES TO THE ACCOUNTS

1. CORPORATE INFORMATION

The condensed consolidated financial statements of the Group for

the year ended 31 December 2014 were authorised for issue in

accordance with a resolution of the Directors on 10 March 2015.

Alkane Energy plc is a public limited company incorporated and

domiciled in England whose shares are publicly traded. The

Company's registered number is 2966946.

The principal activities of the Group are described in Note

4.

2. BASIS OF PREPARATION AND ACCOUNTING POLICIES

The condensed consolidated financial statements for the year

ended 31 December 2014 included in this report do not constitute

the Group's statutory accounts for the year ended 31 December 2014,

but are derived from those accounts.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRSs), this announcement does not itself contain

sufficient information to comply with IFRSs.

The condensed consolidated financial statements have been

prepared on a basis consistent with that adopted in the previous

year's published statutory accounts.

The Group expects to publish full financial statements that

comply both with IFRSs as adopted for use in the European Union and

with the Companies Act 2006.

3. EXCEPTIONAL EXPENSES

2014 2013

unaudited

GBP'000 GBP'000

Bad debt written off (310) -

Costs related to the acquisition of Greenpark

Energy Limited - (31)

Non-capital costs relating to the acquisition

of Maltby CMM assets (note 10) (7) (251)

Non-capital costs relating to the acquisition

of Wheldale power response assets (note 6) - (7)

Non-capital costs relating to the acquisition (600) -

of Welsh Power power response assets (note 8)

Costs relating to the acquisition of a licence - (25)

Costs relating to other corporate transactions - (108)

Costs of aborted corporate transactions (5) (48)

Impairment of biogas development costs - (233)

----------- --------

(922) (703)

Impairment of assets (4,069) -

----------- --------

(4,991) (703)

----------- --------

4. SEGMENT INFORMATION

Operating segments

The directors consider that there are two operating

segments:

-- The extraction and utilisation of gas for power generation

and for direct sale;

-- The design, build and operation of projects for external

customers.

The operating segment reporting format reflects the Group's

management and reporting structure.

Seasonality of operations

There is no significant seasonal nature to either of the Group's

business segments.

The following table sets out total revenue, depreciation,

interest expense and profit before tax for each segment.

2014 2013

unaudited

GBP'000 GBP'000

Extraction and utilisation of gas

Total segment revenue 14,811 13,439

Depreciation and impairment (7,340) (3,469)

Interest expense (793) (492)

----------- --------

Segment profit before tax 287 3,526

Design, build and operate projects for

external customers

Total segment revenue 1,158 7,142

Impairment - (233)

----------- --------

Segment profit before tax (516) 599

Total

Total revenue 15,969 20,581

Total depreciation and impairment (7,340) (3,702)

Total interest expense (793) (492)

----------- --------

Profit before tax from operating segments (229) 4,125

Corporate centre (1,499) (1,491)

Profit on sale of licences 9,953 -

Impairment of available for sale financial (5,036) -

asset

Consolidation adjustment 21 21

Profit before tax 3,210 2,655

----------- --------

The following table reconciles total segment assets, total

segment liabilities and segment additions to non-current

assets.

2014 unaudited 2013

GBP'000 GBP'000

Extraction and utilisation of gas 68,060 52,611

Design, build and operate projects for

external customers 1,616 1,296

--------------- ---------

Total segment assets 69,676 53,907

Corporate centre 5,695 404

Intangible asset arising on consolidation 789 1,209

Consolidation adjustments (1,097) (856)

--------------- ---------

Total consolidated assets 75,063 54,664

--------------- ---------

Extraction and utilisation of gas (31,918) (26,507)

Design, build and operate projects for

external customers (2,063) (917)

--------------- ---------

Total segment liabilities (33,981) (27,424)

Corporate centre (5,362) (7,291)

Consolidation adjustments 8,351 13,044

--------------- ---------

Total consolidated liabilities (30,992) (21,671)

--------------- ---------

Extraction and utilisation of gas 21,629 13,174

Design, build and operate projects for - -

external customers

--------------- ---------

Total segment additions to non-current

assets 21,629 13,174

Available for sale financial asset 5,464 -

Deferred tax asset 228 100

Corporate centre - 22

Total consolidated additions to non-current

assets 27,321 13,296

--------------- ---------

Major customers

In the periods set out below, certain customers accounted for

greater than 10% of the Group's total revenues:

2014 2014 2013 2013

unaudited unaudited

GBP'000 % of revenue GBP'000 % of revenue

Customer A 11,525 72% 10,665 52%

Customer B 1,715 11% 905 4%

Customer C - - 4,461 22%

Customer A and Customer B are from the extraction and

utilisation of gas segment, and Customer C is from the design,

build and operation of projects for external customers segment.

Revenue and non-current assets analysed by geographical

information

All revenue generated and net assets are within the UK.

5. TAXATION

There is no current tax charge in 2014 (2013: nil) as brought

forward tax losses have been utilised to offset the taxable

profits.

A deferred tax asset of GBP1,100,000 (2013: GBP900,000) has been

recognised in accordance with a prudent estimate of the extent to

which future trade profits will be available to be utilised against

unused tax losses and other temporary differences. A deferred tax

liability of GBP1,191,000 (2013: nil) has been recognised in the

year as an element of the fair value adjustment applied on the

Carron Energy acquisition. As a result a net deferred tax liability

of GBP91,000 (2013: deferred tax asset of GBP900,000) is shown in

the consolidated statement of financial position.

6. PURCHASE OF WHELDALE POWER RESPONSE FACILITIES

On 5 February 2014 the Group acquired the Wheldale power

response facilities from SSE plc, for a total consideration of

GBP1,500,000. The initial consideration for the acquisition was

GBP1,100,000 paid in cash on completion, with a GBP400,000 deferred

cash payment which was paid on 31 October 2014. The facilities

comprise an installed engine capacity of 7.5MW and a grid

connection of 10MW. As part of the financial arrangements to fund

the acquisition the Group increased its banking facilities with

Lloyds Bank plc by GBP1,000,000

7. TRANSFER OF LICENCES

On 12 June 2014 the Group transferred its shale gas interests in

certain UK petroleum and development licences to Egdon Resources

plc in exchange for 40,000,000 new ordinary shares of 1 pence each

in Egdon Resources plc an AIM listed company whose registered

office is at The Wheat House, 98 High Street, Odiham, Hampshire

RG29 1LP. At the date of transfer the share price of Egdon

Resources plc was 26.25 pence, valuing the gross consideration at

GBP10,500,000.

A profit of GBP9,953,000 on the transfer has been recognised in

the period. Associated costs of sale attributable to the transfer

of shale gas interests are detailed below:

Year ended

31 December

2014

unaudited

GBP'000

Gross consideration 10,500

Non-capital costs relating to the transfer of licences (334)

Capital costs relating to the transfer of licences (213)

-------------

Profit on transfer of licences 9,953

-------------

The listed equity investment represents an 18% interest in Egdon

Resources plc shares and is classified as an available for sale

financial asset. The Group's interest in Egdon Resources plc has

not been treated as an associated undertaking as the Group does not

have a significant influence over the company. The shares are

revalued at fair value at the end of each period. The change in

fair value in the period of (GBP5,036,000) is shown in the income

statement. The fair value disclosed is the market value at the

statement of financial position date. The movement in the fair

value of available for sale financial assets is determined under

Level 1 Inputs, being quoted prices in active markets that the

Group has the ability to access as of the measurement date.

There is a 12 month lock-in period from the date of issue of the

consideration shares during which time the Company is precluded

from disposal of the shares. The Group does not intend to dispose

of this investment in the foreseeable future.

8. ACQUISITION OF POWER RESPONSE COMPANIES

On 21 July 2014 the Group acquired the entire issued share

capital of three power response companies from Carron Energy

Limited and Dragon Generation Limited. All three companies generate

electricity, with two (Darent Power Limited and Rhymney Power

Limited) generating from natural gas and the third (Leven Power

Limited) generating from kerosene.

Total consideration for the acquisition was GBP12,064,000; cash

consideration comprised GBP10,991,000 and in addition the Group

took on a GBP1,073,000 term loan facility with Lombard North

Central plc. The acquisition was partly funded by a term loan of

GBP5,500,000 provided by Lloyds Bank plc, repayable in monthly

instalments over 5 years commencing in August 2014. The balance was

financed by a proportion of the funds raised by a share placing. A

total of GBP8,000,000 was raised by the issue of 22,222,222 new

Ordinary Shares at a placing price of 36 pence per share.

Net assets with a book value of GBP6,162,000 were acquired at

the date of acquisition. The directors carried out a fair value

assessment of the identifiable assets, liabilities and contingent

liabilities of the three companies acquired and concluded that the

net fair value at the date of acquisition was GBP10,991,000. The

following table shows the identifiable material assets and

liabilities acquired, the fair value adjustments, and the fair

value.

Acquired Fair value Fair value

on 21 July adjustments

2014

GBP'000 GBP'000 GBP'000

Buildings 432 - 432

Plant 5,785 1,873 7,658

Gas assets 347 3,860 4,207

Contract - 298 298

Inventories 393 - 393

Receivables 597 - 597

Payables (626) - (626)

Loan repayable (1,073) - (1,073)

Other provisions (16) (1,202) (1,218)

Cash and cash equivalents 323 - 323

6,162 4,829 10,991

------------ ------------- -----------

GBP'000

Fair value as above 10,991

less Consideration 10,991

-----------

-

-----------

Costs of GBP600,000 were incurred in advisory, professional and

other fees in order to effect the acquisition. The net amount of

GBP600,000 (2013: nil) has been expensed in the Consolidated

Statement of Comprehensive Income under the heading of exceptional

administrative expenses.

The revenue of the acquired companies from the date of

acquisition to 31 December 2014 was GBP1,519,000 and the profit

before tax was GBP882,000.

If the acquired companies had been held within the Group for the

whole reporting period, Group revenue would be GBP17,602,000 and

Group profit before tax would be GBP8,459,000.

9. ACQUISITION OF SEVEN STAR NATURAL GAS LIMITED

On 26 May 2011 the Group completed the purchase of the entire

issued share capital of Seven Star Natural Gas Limited ("Seven

Star"), a company with two petroleum extraction and development

licences covering previously identified onshore gas extraction

prospects.

The consideration for the shares was GBP311,000, with a

contingent consideration of GBP900,000. Following a review by the

directors the effect of discounting the contingent consideration

has been reflected in the fair value of the consideration and as a

result the deferred consideration has been revalued at GBP480,000

payable as follows:

-- GBP207,000 (2013: GBP250,000) within 15 business days of the

satisfaction of certain conditions with respect to the site at

Calow (PL213);

-- Nil (2013: GBP250,000) within 15 business days of the

satisfaction of certain conditions with respect to the site at

Nooks Farm (PEDL141);

-- GBP273,000 (2013: GBP400,000) once Seven Star has produced in

aggregate 1 bcf of natural gas from either or both of the Seven

Star sites under the licences.

10. ACQUISITIONOF MALTBY COAL MINE METHANE ASSETS

On 24 May 2013, the Group completed the purchase of coal mine

methane assets located at Maltby Colliery for a consideration of

GBP5,500,000.

The purchase was partly funded by an extension of the Group's

borrowing facilities with Lloyds Bank plc. A term loan of

GBP3,000,000, secured by way of legal charges over the Group's

assets, has been provided to finance the acquisition, to be repaid

in quarterly payments over two years commencing in July 2014. At

the same time the existing revolving credit facility was increased

from GBP6,500,000 to GBP7,000,000. The balance of the consideration

was financed by a proportion of the funds raised by a share

placing. A total of GBP6,000,000 was raised by the issue of

22,222,223 new Ordinary Shares at a placing price of 27 pence per

share.

The assets acquired comprise plant and machinery of GBP3,000,000

and site infrastructure (including grid connection) of

GBP2,754,000. The Directors have carried out an assessment of the

assets acquired and have concluded that no fair value adjustments

are required.

A further payment of GBP2,000,000 will be made to acquire

additional site infrastructure assets six months after the Maltby

Colliery mine shafts are satisfactorily sealed as part of the

planned closure of Maltby Colliery. The mine works have been signed

off as complete and payment falls due to be made in May 2015.

11. EARNINGS PER ORDINARY SHARE

Basic earnings per share amounts are calculated by dividing net

profit for the period attributable to ordinary equity holders of

the parent by the weighted average number of ordinary shares

outstanding during the year.

Diluted earnings per share amounts are calculated by dividing

net profit for the period attributable to ordinary equity holders

of the parent by the weighted average number of ordinary shares

outstanding during the year plus the weighted average number of

ordinary shares that would be issued on the conversion of all the

dilutive potential ordinary shares into ordinary shares and that

would have been issued on the conversion at the period end of the

convertible loan notes (see note 15) into ordinary shares.

The following reflects the income and share data used in the

basic and diluted earnings per share computations:

2014 2013

unaudited

GBP'000 GBP'000

Profit attributable to equity holders of

the parent 3,438 2,755

------------ ------------

No. No.

Basic weighted average number of ordinary

shares 134,375,182 114,930,148

Dilutive effect of share options 5,918,707 4,992,606

Dilutive effect of convertible loan notes(1) 13,520,000 13,291,428

------------ ------------

Diluted weighted average number of ordinary

shares 153,813,889 133,214,182

------------ ------------

(1) For the purposes of calculating the dilutive earnings per

share, the profit for the year from continuing operations and the

profit attributable to equity holders of the parent have been

adjusted by the transaction costs and interest charges of

GBP234,000 (2013: GBP242,000) that would have been avoided if

conversion was to have occurred. The revised profit for the year

from continuing operations on this basis is GBP3,672,000 (2013:

GBP2,997,000) and the revised profit attributable to equity holders

of the parent is GBP3,672,000 (2013: GBP2,997,000).

There have been no other transactions involving ordinary shares

or potential ordinary shares between the reporting date and the

date of completion of these financial statements that would have

changed significantly the number of ordinary shares or potential

ordinary shares outstanding at the end of the year if those

transactions had occurred before the end of the year.

12. PROPERTY, PLANT AND EQUIPMENT

Acquisitions and disposals

During the year ended 31 December 2014, the Group acquired

assets with a cost of GBP13,216,000 (2013: GBP6,106,000). There

were no disposals during the period (2013: nil) but fully

depreciated assets of GBP320,000 were derecognised (2013:

GBP443,000). Assets of GBP237,000 were impaired (2013: nil).

13. GAS ASSETS

Acquisitions and disposals

During the year ended 31 December 2014, the Group acquired

assets with a cost of GBP8,413,000 (2013: GBP6,629,000). There were

no disposals during the period (2013: nil) But fully depreciated

assets of GBP1,106,000 were derecognised (2013: nil). Assets of

GBP3,832,000 were impaired (2013: nil).

14. CAPITAL COMMITMENTS

At 31 December 2014, the Group had capital commitments

contracted for but not provided in the financial statements of

GBP41,000 for the acquisition of property, plant and equipment

(2013: GBP28,000) and of GBP759,000 for the acquisition of gas

assets (2013: GBP16,000).

15. CONVERTIBLE LOAN NOTES

On 26 April 2012 the Company issued GBP2,000,000 convertible

loan notes, with the proceeds being utilised to partly fund the

acquisition of Greenpark Energy Limited in 2012. Interest is at a

fixed rate of 7.5% per annum, which is rolled up quarterly in

arrears and included as principal to be repaid or converted. The

convertible loan is unsecured. The convertible loan notes are

convertible at any time prior to repayment or automatic conversion

at the holder's option, at a conversion price, fixed at 17.5 pence.

If any element of the convertible loan is not converted, it is

otherwise repayable on the date which is 3 years and 1 day after

the issue date.

The liability component of the convertible loan notes is

GBP1,768,000. This has been calculated by discounting the total sum

payable over the full term of the loan notes by an effective

interest rate of 12%. The equity component of GBP232,000 has been

taken to other reserves. During the year GBP100,000 of the

convertible loan notes that had been issued was converted,

amounting to 645,352 new ordinary shares of 0.5 pence each.

At the year-end the carrying value including rolled up interest

was GBP2,337,000 (2013: GBP2,199,000). The maturity date of the

Convertible Loan Note is April 2015 and it is assumed that the loan

will be converted and hence the liability has been moved to Current

Liabilities.

16. ADDITIONAL CASH FLOW INFORMATION

Analysis of net debt

1 Other Exchange 31

January Cash non-cash rate December

2014 flow movements differences 2014

unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank and in hand 838 246 - - 1,084

Sale and finance leaseback (412) (1,411) - - (1,823)

Long-term loan (10,661) (5,578) (1,073) - (17,312)

Net debt (10,235) (6,743) (1,073) - (18,051)

Securities 257 - - - 257

--------- -------- ----------- ------------- ----------

Adjusted net debt* (9,978) (6,743) (1,073) - (17,794)

========= ======== =========== ============= ==========

1 Other Exchange 31

January Cash non-cash rate December

2013 flow movements differences 2013

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank and in hand 1,569 (731) - - 838

Sale and finance leaseback (1,122) 710 - - (412)

Long-term loan (8,645) (2,016) - - (10,661)

Net debt (8,198) (2,037) - - (10,235)

Securities 256 1 - - 257

--------- -------- ----------- ------------- ----------

Adjusted net debt* (7,942) (2,036) - - (9,978)

========= ======== =========== ============= ==========

The convertible debt has been excluded from the above

calculations as the current share price is above the conversion

price and the directors expect it to be converted rather than

repaid.

*Includes the effect of securities paid on sale and leaseback

transactions that are closely related to those items.

17. GENERAL NOTE

a. The preliminary unaudited financial information set out above

does not constitute full accounts within the meaning of Section 435

of the Companies Act 2006.

b. Audited statutory accounts in respect of the year ended 31

December 2013 have been delivered to the Registrar of Companies and

those accounts were subject to an unqualified report by the

auditors.

c. Copies of the audited annual report and accounts for the year

ended 31 December 2014 will be sent to shareholders during April

2015 and will be available from the Company's registered office -

Edwinstowe House, High Street, Edwinstowe, Nottinghamshire NG21

9PR.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BCGDXUUBBGUG

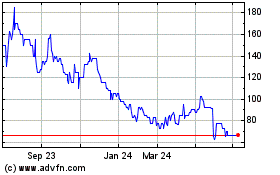

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

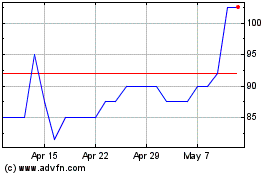

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024