Securities Registration (section 12(b)) (8-a12b)

September 17 2015 - 11:41AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

PENTAIR PLC

(Exact name of registrant as specified in its charter)

|

|

|

| Ireland |

|

98-1141328 |

| (State of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| P.O. Box 471, Sharp Street,

Walkden, Manchester, United Kingdom |

|

M28 8BU |

| (Address of principal executive offices) |

|

(Zip Code) |

(For Co-Registrants, Please See “Table of Co-Registrants on the Following Page)

Securities to be registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class

to be so registered |

|

Name of each exchange on which

each class is to be registered |

| 2.450% Senior Notes Due 2019 |

|

New York Stock Exchange |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is

effective pursuant to General Instruction A.(c), check the following box. x

If this form

relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), check the following box. ¨

Securities Act registration statement file number to which this form relates:

333-204066

Securities

to be registered pursuant to Section 12(g) of the Act:

None

(Title of class)

TABLE OF CO-REGISTRANTS

|

|

|

|

|

|

|

| Exact Name

as Specified in its Charter |

|

State or Other

Jurisdiction of

Incorporation or Organization |

|

I.R.S.

Employer

Identification

Number |

|

Address, including Zip Code

of Principal Executive Offices |

| Pentair Finance S.A.* |

|

Luxembourg |

|

98-1072493 |

|

26, boulevard Royal

L-2449 Luxembourg, Luxembourg |

|

|

|

|

| Pentair Investments

Switzerland GmbH |

|

Switzerland |

|

98-1176782 |

|

Freier Platz 10

8200 Schaffhausen,

Switzerland |

| |

* |

Pentair Finance S.A. is the issuer of the debt securities registered hereby. Pentair plc and Pentair Investments Switzerland GmbH are guarantors of such debt securities. |

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Pentair plc (the “Registrant”) has filed with the Securities and Exchange Commission (the “SEC”) a prospectus supplement

dated September 14, 2015 (the “Prospectus Supplement”) to a prospectus dated May 11, 2015 (the “Prospectus”), relating to securities to be registered hereunder included in the Registrant’s automatic shelf

Registration Statement on Form S-3 (File No. 333-204066), which became automatically effective on May 11, 2015.

Item

1. Description of Registrant’s Securities to be Registered.

The Registrant and the Co-Registrants on this

registration statement (the “Co-Registrants”) register hereunder €500,000,000 aggregate principal amount of 2.450% Notes Due 2019 (the “Notes”) issued by the Registrant’s subsidiary, Pentair Finance S.A., a

Co-Registrant on this registration statement. For a description of the securities to be registered hereunder, reference is made to the information under the heading “Description of Debt Securities and Guarantees of Debt Securities” of the

Prospectus dated May 11, 2015 (Registration No. 333-204066), as supplemented by the information under the heading “Description of Notes” in the Registrant’s related Prospectus Supplement, dated September 14, 2015, filed

by the Registrant with the SEC on September 15, 2015 (Registration No. 333-204066). Such information is incorporated herein by reference and made a part of this registration statement in its entirety. Copies of such descriptions will be

filed with the New York Stock Exchange, Inc.

Item 2. Exhibits.

|

|

|

|

|

| Exhibit

Number |

|

|

Description |

|

|

| |

4.1 |

|

|

Indenture, dated as of September 16, 2015, among Pentair Finance S.A. (as Issuer), Pentair plc (as Parent and Guarantor), Pentair Investments Switzerland GmbH (as Guarantor) and U.S. Bank National Association (as Trustee)

(Incorporated by reference to Exhibit 4.1 in the Current Report on Form 8-K of Pentair plc filed with the SEC on September 16, 2015 (File No. 001-11625)). |

|

|

| |

4.2 |

|

|

Fourth Supplemental Indenture, dated as of September 17, 2015, among Pentair Finance S.A. (as Issuer), Pentair plc (as Parent and Guarantor), Pentair Investments Switzerland GmbH (as Guarantor) and U.S. Bank National

Association (as Trustee) (Incorporated by reference to Exhibit 4.2 in the Current Report on Form 8-K of Pentair plc filed with the SEC on September 17, 2015 (File No. 001-11625)). |

|

|

| |

4.3 |

|

|

Specimen of 2.450% Note Due 2019 (incorporated by reference to Annex A in Exhibit 4.2 in the Current Report on Form 8-K of Pentair plc filed with the SEC on September 17, 2015 (File No. 001-11625)). |

|

|

| |

99.1 |

|

|

Prospectus dated May 11, 2015, and Prospectus Supplement dated September 14, 2015, relating to the Notes (incorporated by reference to the prospectus and prospectus supplement filed by the Registrant on September 14,

2015 (Registration No. 333-204066)). |

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this registration statement

to be signed on its behalf by the undersigned, thereto duly authorized.

Dated September 17, 2015

|

|

|

| PENTAIR PLC |

|

|

| By: |

|

/s/ Angela D. Lageson |

| Name: |

|

Angela D. Lageson |

| Title: |

|

Senior Vice President, General Counsel and Secretary |

|

|

|

|

| PENTAIR INVESTMENTS SWITZERLAND GMBH |

|

|

| By: |

|

/s/ Mark C. Borin |

| Name: |

|

Mark C. Borin |

| Title: |

|

Managing Director |

|

|

|

|

| PENTAIR FINANCE S.A. |

|

|

| By: |

|

/s/ Mark C. Borin |

| Name: |

|

Mark C. Borin |

| Title: |

|

Director |

Exhibit Index

|

|

|

|

|

| Exhibit

Number |

|

|

Description |

|

|

| |

4.1 |

|

|

Indenture, dated as of September 16, 2015, among Pentair Finance S.A. (as Issuer), Pentair plc (as Parent and Guarantor), Pentair Investments Switzerland GmbH (as Guarantor) and U.S. Bank National Association (as Trustee)

(Incorporated by reference to Exhibit 4.1 in the Current Report on Form 8-K of Pentair plc filed with the SEC on September 16, 2015 (File No. 001-11625)). |

|

|

| |

4.2 |

|

|

Fourth Supplemental Indenture, dated as of September 17, 2015, among Pentair Finance S.A. (as Issuer), Pentair plc (as Parent and Guarantor), Pentair Investments Switzerland GmbH (as Guarantor) and U.S. Bank National

Association (as Trustee) (Incorporated by reference to Exhibit 4.2 in the Current Report on Form 8-K of Pentair plc filed with the SEC on September 17, 2015 (File No. 001-11625)). |

|

|

| |

4.3 |

|

|

Specimen of 2.450% Note Due 2019 (incorporated by reference to Annex A in Exhibit 4.2 in the Current Report on Form 8-K of Pentair plc filed with the SEC on September 17, 2015 (File No. 001-11625)). |

|

|

| |

99.1 |

|

|

Prospectus dated May 11, 2015, and Prospectus Supplement dated September 14, 2015, relating to the Notes (incorporated by reference to the prospectus and prospectus supplement filed by the Registrant on September 14,

2015 (Registration No. 333-204066)). |

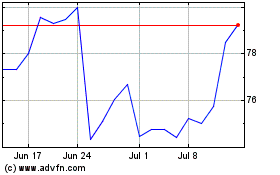

Pentair (NYSE:PNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pentair (NYSE:PNR)

Historical Stock Chart

From Apr 2023 to Apr 2024