EU Proposes Multinationals Publish Profits Generated in Tax Havens

April 12 2016 - 9:40AM

Dow Jones News

BRUSSELS—Large multinationals operating in the European Union

will have to publish profits and tax bills generated in countries

considered to be "tax havens," the bloc's executive arm said

Tuesday as it toughened up proposals for fighting tax avoidance

following the "Panama Papers" leak.

The European Commission had already been working on plans to

open up to the public reports by thousands of companies on profits

reaped and taxes paid in individual EU countries—an unprecedented

move for a major jurisdiction.

But the EU reworked its proposals in recent days to also require

public and more exhaustive reporting of companies' operations in

tax havens, after newspapers around the world uncovered thousands

of offshore accounts—allegedly held by officials, executives and

celebrities—via documents leaked from Panamanian law firm Mossack

Fonseca & Co.

"By adopting this proposal, Europe is demonstrating its

leadership in the fight against tax avoidance," said Valdis

Dombrovskis, vice president of the European Commission in charge of

euro and social dialogue.

Tuesday's proposals show how the commission is accelerating

efforts to snuff out large-scale corporate tax avoidance amid

pressure from the public. A previous proposal that would require

national tax authorities to share corporate reports on profits and

taxes was only approved by EU finance ministers last month.

Under Tuesday's plans, companies operating in the EU whose

annual revenue exceeds €750 million ($856 million) would have to

publish the reports, which would include details on business

operations, such as the number of employees and nature of

activities in the different tax jurisdictions.

The EU is still drawing up its list of non-EU countries that

don't meet international standards for good governance in taxation.

For all other non-EU countries whose tax rules are deemed in line

with the standards, companies would only have to publish an

aggregate figure of profits in all those countries.

The EU has been cracking down on companies trying to dodge taxes

following revelations in 2014 that many multinational companies

struck sweetheart deals in countries such as Luxembourg that

allowed them to pay little tax in the bloc. Corporate tax avoidance

costs the bloc's member states between €50 billion and €70 billion

a year in lost tax revenues, according to the EU.

"Our proposal to increase transparency will help make companies

more accountable," said Jonathan Hill, the EU's financial

chief.

Several large companies, including McDonald's Corp. and IKEA,

have questioned plans to make the reports public, claiming that

disclosing such commercially sensitive information would place them

at a disadvantage compared with rivals operating elsewhere.

But transparency campaigners said the additional proposals still

don't go far enough.

"The last minute addition of tax havens smacks of window

dressing," said Elena Gaita, a corporate transparency policy

officer at Transparency International, the global anticorruption

group.

"This proposal cannot be called public country by country

reporting, if it does not include most of the world," said Ms.

Gaita.

The proposal will still have to be agreed by EU governments

before becoming law, a process that could take months.

Write to Natalia Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

April 12, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

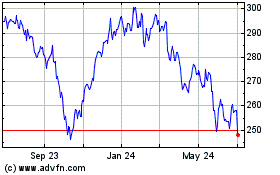

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

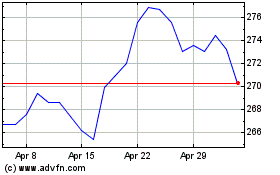

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024