As filed with the Securities and Exchange Commission on March 29, 2024

Registration No. 333-276367

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PANBELA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

2834

(Primary Standard Industrial

Classification Code Number)

|

|

88-2805017

(I.R.S. Employer

Identification No.)

|

712 Vista Blvd, Suite 305

Waconia, Minnesota 55387

(952) 479-1196

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jennifer K. Simpson

Chief Executive Officer

712 Vista Blvd, Suite 305

Waconia, Minnesota 55387

(952) 479-1196

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

W. Morgan Burns, Joshua L. Colburn, W. Jason Deppen

Faegre Drinker Biddle & Reath LLP

90 South Seventh Street

2200 Wells Fargo Center

Minneapolis, Minnesota 55402-3901

Telephone: (612) 766-7000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☑

|

Smaller reporting company ☑

|

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

Panbela Therapeutics, Inc. (the “Company”) previously filed a registration statement with the Securities and Exchange Commission (the “SEC”) on Form S-1 (Registration No. 333-276367), which was declared effective by the SEC on January 26, 2024 (the “Registration Statement”).

The Registration Statement, as amended by this Post-Effective Amendment No. 1 (this “Amendment”), pertains solely to the issuance by the Company of the remaining 8,750,000 shares of common stock, $0.001 par value per share, underlying Class E common stock purchase warrants and Class F common stock purchase warrants (collectively, the “Warrants”) previously issued by the Company to investors in a registered public offering. The shares of common stock issuable upon exercise of the Warrants were initially registered on the Registration Statement.

The Company is filing this Amendment to update the financial statements and other information, including pursuant to the undertakings in Item 17 of the Registration Statement, and to update and supplement the information contained in the Registration Statement with the information contained in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2023, that was filed with the SEC on March 26, 2024 and to update certain other information in the Registration Statement.

No additional securities are being registered under this Amendment. All applicable registration fees were paid at the time of the original filing of the Registration Statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED MARCH 29, 2024

|

8,750,000 Shares of Common Stock Underlying Previously Issued Warrants

This prospectus relates to the offer and sale by Panbela Therapeutics, Inc. of up to 8,750,000 shares of our common stock underlying Class E common stock purchase warrants and Class F common stock purchase warrants previously issued by us to investors in a registered public offering that are issuable at an exercise price of $2.06 per share, from time to time upon exercise of such warrants. We are not selling any shares of our common stock in this offering other than pursuant to the exercise of outstanding warrants. We will receive proceeds of up to approximately $18 million from the cash exercise of such warrants. To the extent that any of the warrants are exercised on a “cashless” basis, we will not receive any proceeds upon such exercise.

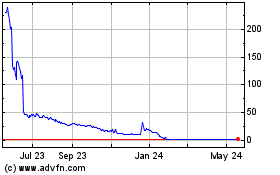

Our common stock is listed on the Nasdaq Capital Market under the symbol “PBLA.” On March 5, 2024, the Nasdaq Stock Market LLC (“Nasdaq”) notified us that the Nasdaq Hearings Panel has determined to delist our common stock and trading of our common stock on Nasdaq was suspended on March 7, 2024. Nasdaq will complete the delisting by filing a Form 25 Notification of Delisting with the U.S. Securities and Exchange Commission (the “SEC”) after applicable appeal periods have lapsed. In the interim, notwithstanding the suspension of trading on Nasdaq, we expect that our common stock will remain eligible for quotation on the OTC Pink Market under our existing symbol, “PBLA.” The last reported sale price on the OTC Pink Market for shares of our common stock on March 26, 2024 was $0.64 per share.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 10 of this prospectus, and under similar headings in any amendments or supplements to this prospectus, including our most recent annual report on Form 10-K and any similar section contained in any documents that are incorporated by reference into this prospectus.

The shares of common stock underlying the warrants will be offered on a continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended. We will deliver all securities to be issued in connection with this offering delivery versus payment upon receipt of investor funds received by us. Accordingly, there is no arrangement to receive or place investor funds in an escrow, trust or any similar account.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

| |

Page |

| PROSPECTUS SUMMARY |

1 |

| THE OFFERING |

8 |

| RISK FACTORS |

9 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

21 |

| USE OF PROCEEDS |

22 |

| DIVIDEND POLICY |

22 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

23 |

| FINANCIAL STATEMENTS |

23 |

| DESCRIPTION OF SECURITIES |

24 |

| SHARES ELIGIBLE FOR FUTURE SALE |

28 |

| PLAN OF DISTRIBUTION |

29 |

| LEGAL MATTERS |

29 |

| EXPERTS |

30 |

| WHERE YOU CAN FIND MORE INFORMATION |

30 |

| INCORPORATION OF DOCUMENTS BY REFERENCE |

30 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with any information other than that contained in this prospectus. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable. We are ultimately responsible for all disclosure included in this prospectus.

You should rely only on the information contained in this prospectus, as supplemented and amended. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the securities being offered.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus. Unless otherwise stated or the context requires otherwise, references in this prospectus to “Panbela,” the “Company,” “we,” “us,” “our” and similar references refer to Panbela Therapeutics, Inc. and its subsidiaries.

Business Overview

Panbela is a clinical stage biopharmaceutical company developing disruptive therapeutics for the treatment of patients with urgent unmet medical needs. We are currently enrolling patients in our randomized double-blind placebo controlled clinical trial for the treatment of pancreatic cancer and we are a regulatory and commercial collaborator in a Phase III clinical trial funded by the National Cancer Institute (the “NCI”) for the study of colon cancer risk reduction and colon adenoma therapy (“CAT”), a preventative treatment approach for survivors of colorectal cancer or those who have high-risk colon polyps. In addition, the Company is designing a global protocol for a Phase III registration trial for familial adenomatous polyposis (“FAP”), a rare inherited condition that can cause the growth of thousands of colorectal adenomas (i.e., adenomatous polyps), which are recognized as a key risk factor for colon cancer. The global protocol will be submitted to the U.S. Federal Drug Administration (“FDA”) and European Medicines Agency (“EMA”) for agreement on the registration pathway. By leveraging Panbela’s extensive experience with FAP and in designing global registration trials, the team can develop a high-quality trial protocol that meets the standards of regulatory agencies and is designed to demonstrate the potential safety and efficacy of Flynpovi ™ efficiently and effectively in the treatment of FAP. We also support several investigator initiated trials and company sponsored preclinical trials including: (1) Phase II clinical trial for the treatment of early-onset type 1 diabetes funded by the Juvenile Diabetes Research Foundation; (2) Phase II clinical trial for treatment of gastric cancer funded by the NCI; (3) Phase I/II clinical trial for the treatment of non-small cell lung cancer (NSCLC) possessing the STK11 mutation; (4) Phase II program for the treatment of Metastatic Castration-Resistant Prostate Cancer; and (5) preclinical studies that we have sponsored in the orphan disease and cancer fields.

The Company’s lead assets are ivospemin (SBP-101), FlynpoviTM (eflornithine (CPP-1X) and sulindac), and eflornithine (CPP-1X) which provides a multi-targeted approach to reset dysregulated biology present in many types of diseases such as cancer and autoimmune disorders. Many tumors require greatly elevated levels of polyamines to support their growth and survival. These agents target the polyamine pathway at complementary junctions, which have been shown to be altered in disease. In particular, our lead assets have the potential to suppress and prevent tumor growth, enhance anti-tumor activity of other anti-cancer agents, and modulate the immune system.

Ivospemin is a proprietary polyamine analogue designed to induce polyamine metabolic inhibition. Ivospemin has demonstrated encouraging activity against metastatic disease in a clinical trial of patients with pancreatic cancer. The efficacy and safety results demonstrated in our completed Phase I clinical trial of ivospemin in combination with gemcitabine and nab-paclitaxel in the first line treatment of metastatic pancreatic cancer provide support for the current randomized, double-blind, placebo-controlled study of ivospemin in combination with gemcitabine and nab-paclitaxel in patients previously untreated for metastatic pancreatic cancer. We believe that ivospemin, if successfully developed, may represent a novel approach that effectively treats patients with pancreatic cancer and could become a dominant product in that market. In the past decade, two combination chemotherapy regimens, a quadruplet of fluorouracil, leucovorin, irinotecan, and oxaliplatin (FOLFIRINOX) and a doublet, nab-paclitaxel and gemcitabine have been utilized as first-line standard of care. The first was based on a phase III trial but not Food and Drug Administration (“FDA”) approved and the latter based on a phase III trial which led to FDA approval. Most recently, the FDA approved Onivyde (irinotecan liposome injection) plus oxaliplatin, fluorouracil and leucovorin (NALIRIFOX) as a first-line treatment in adults living with metastatic pancreatic adenocarcinoma (“mPDAC”). This is the first FDA approval in first line mPDAC in over ten years. Ivospemin has received Fast Track status and orphan drug designation status for pancreatic cancer in the United States and we have also received orphan drug designation in Europe.

Our June 2022 acquisition of Cancer Prevention Pharmaceuticals, Inc. (“CPP”), added the Company’s second lead asset, eflornithine in multiple forms. First, an investigational new drug product, Flynpovi is a combination of the polyamine synthesis inhibitor eflornithine and the non-steroidal anti-inflammatory drug sulindac and then eflornithine as a single agent. Eflornithine is an enzyme-activated, irreversible inhibitor of the enzyme ornithine decarboxylase, the first rate-limiting enzyme in the biosynthesis of polyamines. Sulindac, a non-steroidal anti-inflammatory drug, facilitates the export and catabolism of polyamines. Flynpovi has a unique dual mechanism of action whereby it suppresses the synthesis of new polyamines and increases the export and catabolism of polyamines from the diet and microbiome. We believe Flynpovi is unique in that it is designed to treat the risk factors (e.g., polyps) that are hypothesized to lead to FAP surgeries and colon cancer and therefore may have the ability to prevent various types of colon cancer. In the FAP-310 Phase III trial, the efficacy and safety of the combination of Flynpovi (eflornithine and sulindac), as compared with either drug alone, in adults with FAP was conducted. While the study missed the primary composite endpoint (Burke et al. 2020), a post-hoc analysis showed that none of the patients in the combination arm progressed to a need for lower gastrointestinal (“LGI”) surgery for up to 48 months compared to 13.2% and 15.7% of patients in the sulindac and eflornithine arms (Balaguer et al. 2022). This data corresponded to risk reductions for the need for LGI surgery approaching 100% between combination and either monotherapy. Given the statistical significance of the LGI group, a new drug application (“NDA”) was filed with the FDA; however, since this was based on the results of an exploratory analysis, a complete response letter (“CRL”) was issued. To address the CRL, the Company is designing a Phase III registration trial and will advance this program while not increasing our current cash requirements. There are no currently approved pharmaceutical therapies for FAP.

Additional programs are evaluating a single agent tablet eflornithine or high dose powder eflornithine sachets for several indications including prevention of gastric cancer, recent onset Type 1 diabetes, metastatic castration-resistant prostate cancer, and STK-11 mutant NSCLC. Preclinical studies and Phase I or Phase II investigator-initiated trials suggest that eflornithine treatment is well tolerated and has potential activity.

Flynpovi has received Fast Track designation in the United States and orphan drug designation status for FAP in the United States and Europe. In addition, we have received orphan drug designation status for eflornithine as a single agent for Neuroblastoma in the United States and Europe and for gastric cancer in the United States.

Clinical Trials

Ivospemin (SBP-101)

In August 2015, the FDA accepted our Investigational New Drug (“IND”) application for our ivospemin product candidate. We have completed an initial clinical trial of ivospemin in patients with previously treated locally advanced or metastatic pancreatic cancer. This was a Phase I, first-in-human, dose-escalation, safety study. From January 2016 through September 2017, we enrolled twenty-nine patients into six cohorts, or groups, in the dose-escalation phase of the Phase I trial. No drug-related bone marrow toxicity or peripheral neuropathy was observed at any dose level. In addition to being evaluated for safety, 23 of the 29 patients were evaluable for preliminary signals of efficacy prior to or at the eight-week conclusion of their first cycle of treatment using the Response Evaluation Criteria in Solid Tumors (“RECIST”), the currently accepted standard for evaluating change in the size of tumors.

In 2018, we began enrolling patients in our second clinical trial, a Phase Ia/Ib study of the safety, efficacy, and pharmacokinetics of ivospemin administered in combination with two standard-of-care chemotherapy agents, gemcitabine and nab-paclitaxel. A total of 25 subjects were enrolled in four cohorts to evaluate the dosage level and schedule. An additional 25 subjects were enrolled in the expansion phase of the trial. Interim results were presented in January of 2022. Best response in evaluable subjects (cohorts 4 and Ib N=29) was a Complete Response in 1 (3%), Partial Response in 13 (45%), Stable Disease in 10 (34%) and Progressive Disease in 5 (17%). One subject did not have post baseline scans with RECIST tumor assessments. Median Progression Free Survival (“PFS”), now final at 6.5 months may have been negatively impacted by drug dosing interruptions to evaluate potential toxicity. Median overall survival in Cohort 4 + Phase Ib was 12.0 months when data was presented in January 2022 and is now final at 14.6 months. Two patients from cohort 2 have demonstrated long term survival. One at 30.3 months (final data) and one at 33.0 months and still alive. Seven subjects are still alive at this time, one from cohort 2 and six from cohort 4 plus Ib.

In January of 2022, the Company announced the initiation of a new pancreatic cancer clinical trial. Referred to as ASPIRE, the trial is a randomized double-blind placebo-controlled trial in combination with gemcitabine and nab-paclitaxel, a standard pancreatic cancer treatment regimen, in patients previously untreated for metastatic pancreatic cancer. The trial will be conducted globally at approximately 95 sites in the United States, Europe and Asia – Pacific.

The ASPIRE trial will evaluate overall survival as the primary endpoint and will also be examined at the interim analysis. PFS will also be analyzed to provide additional efficacy evidence. This trial design was supported by the final data from the Phase Ia/Ib first line metastatic pancreatic cancer trial which completed enrollment in December of 2020. The ASPIRE study will enroll 600 subjects and is anticipated to take 36 months to complete enrollment with the interim analysis available in mid- 2024. The Independent Data Safety Monitoring Board (“DSMB”) has met twice, the most recent taking place in November 2023. The DSMB members evaluated the safety of 214 patients. The result of both DSMB meetings confirmed no safety concerns and the trial continuing without modification. On January 25, 2024, the Company announced that the ASPIRE trial had surpassed fifty percent enrollment and expects that the trial will be fully enrolled by the first quarter of 2025.

If we successfully complete all FDA recommended clinical studies, we intend to seek marketing authorization from the FDA, the European Medicines Agency (“EMA”) (European Union), and Therapeutic Goods Administration (“TGA”) (Australia). The submission fees in the US and Europe may be waived for ivospemin as it has been designated an orphan drug in these geographic regions.

In early April 2023, the Company announced a poster presentation highlighting the results for ivospemin as a polyamine metabolism modulator in ovarian cancer at the American Association for Cancer Research Annual Conference The poster concludes that the ivospemin treatment of C57Bl/6 mice injected with VDID8+ ovarian cancer cells significantly prolonged survival and decreased overall tumor burden. The results suggest that ivospemin may have a role in the clinical management of ovarian cancer, and the Company intends to continue pre-clinical and clinical studies in ovarian cancer.

Additional preclinical work is underway evaluating ivospemin (also known as SBP-101) and eflornithine (also known as CPP-1X or DFMO) in multiple myeloma (cell lines). Data published in the November 2023, supplemental issue of the Journal Blood investigated the effects of polyamine inhibition by ivospemin and CPP-1X on myeloma cell lines growth and viability in vitro. Results showed that ivospemin and CPP-1X treatment significantly decreased cell proliferation and induced apoptosis in a panel of multiple myeloma cell lines. When ivospemin and CPP-1X were combined an almost complete abolition of cell growth occurred. These results demonstrate the anti-neoplastic potential of ivospemin and CPP-1X and offer a compelling rationale for its clinical development as a potentially promising treatment option for multiple myeloma. The work reflects the Company’s on-going collaboration with researchers from The University of Texas MD Anderson Cancer Center for the evaluation of polyamine metabolic inhibitor therapies in combination with CAR-T cell therapies in preclinical models.

FLYNPOVI

In December 2009, the FDA accepted our IND application for the combination product, Flynpovi. Flynpovi showed promising results in an NCI supported randomized, placebo-controlled Phase IIb/III clinical trial to prevent recurrent colon adenomas, particularly high-risk pre-cancerous polyps in which 375 subjects who had resected sporadic adenoma were treated for 3 years with eflornithine (500 mg once a day) + sulindac (150 mg once a day [N = 191]) or matched placebo/placebo (N = 184). Results demonstrated a marked risk reduction (70%) in developing metachronous adenomas, 92% risk reduction in developing advanced adenomas, and 95% risk reduction in developing multiple adenomas with the active combination regimen compared to placebo (Meyskens et al. 2008). This combination regimen was generally well tolerated.

Given the similar mechanism of disease in sporadic and FAP-associated adenomatous polyposis, and the mechanism of action of Flynpovi in prevention of progressive polyposis in both the general population with sporadic adenomas and in patients with FAP, a Phase III program in FAP, and a Phase III program to study colon cancer risk reduction in partnership with the Southwest Oncology Group (SWOG) and the NCI were initiated.

In the FAP-310 Phase III study completed in 2019, the efficacy and safety of the combination of eflornithine and sulindac, as compared with either drug alone, in adults with familial adenomatous polyposis was conducted (Burke et al. 2020). The patients were randomly assigned in a 1:1:1 ratio to receive eflornithine, sulindac, or both once daily for up to 48 months. The primary end point, assessed in a time-to-event analysis, was disease progression, defined as a composite of major surgery, endoscopic excision of advanced adenomas, diagnosis of high-grade dysplasia in the rectum or pouch, or progression of duodenal disease. A total of 171 patients underwent randomization. Disease progression occurred in 18 of 56 patients (32%) in the eflornithine-sulindac group, 22 of 58 (38%) in the sulindac group, and 23 of 57 (40%) in the eflornithine group, with a hazard ratio of 0.71 (95% confidence interval [CI], 0.39 to 1.32) for eflornithine-sulindac as compared with sulindac (P = 0.29) and 0.66 (95% CI, 0.36 to 1.23) for eflornithine-sulindac as compared with eflornithine (Burke et al. 2020). Adverse and serious adverse events were similar across the treatment groups. In a post-hoc analysis, none of the patients in the combination arm progressed to a need for LGI surgery for up to 48 months compared with 7 (13.2%) and 8 (15.7%) patients in the sulindac and eflornithine arms (Balaguer et al. 2022). These data corresponded to risk reductions for the need for LGI surgery approaching 100% between combination and either monotherapy with HR = 0.00 (95% CI, 0.00-0.48; p = 0.005) for combination versus sulindac and HR = 0.00 (95% CI, 0.00-0.44; p = 0.003) for combination versus eflornithine. Given the statistical significance of the LGI group, an NDA was filed with the FDA. As the study failed to meet the primary endpoint, and the NDA was based on the results of an exploratory analysis, a complete response letter was issued. To address this deficiency concern, the Company must submit the results of one or more adequate and well-controlled clinical trials which demonstrate an effect on a clinical endpoint.

In collaboration with the NCI, and SWOG, a Phase III clinical trial has been initiated to study the benefits of Flynpovi as a therapeutic treatment for use by colon cancer survivors. The trial is named PACES for “Prevention of Adenomas and Cancer with eflornithine and sulindac.” The PACES trial is funded by the NCI and managed by the Southwest Oncology Group (“SWOG”). This is an ongoing double-blind placebo-controlled trial of Flynpovi to prevent recurrence of high risk adenomas and second primary colorectal cancers in patients with stage 0-III colon or rectal cancer, Phase III – Preventing Adenomas of the Colon With Eflornithine and Sulindac (“PACES”). The purpose of this study is to assess whether Flynpovi (compared to corresponding placebos) has a reduced rate of cancer or high-risk adenoma recurrence compared to comparator arms after three years of daily dosing. We have exclusive rights to the data that comes from the trial for regulatory and commercial purposes. The Company is evaluating its options for CAT in the European Union and Asia.

In April 2023, the Company announced that it regained the North American rights to develop and commercialize Flynpovi in patients with FAP, as a result of the termination of the license agreement between CPP and One-Two Therapeutics Assets Limited effective July 4, 2023.

Eflornithine (CPP-1X) and eflornithine sachets (CPP-1X-S)

For the single agent eflornithine, there is a Phase I/II trial in STK11 mutation patients with non-small cell lung cancer and Phase II trial in Recent Onset Type I diabetes with eflornithine have been initiated and are enrolling. Recently, a phase II trial evaluating eflornithine and High Dose Testosterone With Enzalutamide in Metastatic Castration-Resistant Prostate Cancer started enrolling. Lastly, a Phase II trial evaluating eflornithine for the prevention of gastric cancer was completed in 2021 with data analysis ongoing.

Recent Developments

Nasdaq Staff Determination Letters

On March 5, 2024, Nasdaq notified us that the Nasdaq Hearings Panel had determined to delist our common stock and trading of our common stock was suspended on March 7, 2024. Nasdaq will complete the delisting by filing a Form 25 Notification of Delisting with the SEC after applicable appeal periods have lapsed. The panel reached its decision because our Company was in violation of the minimum $2.5 million stockholders equity requirement in Listing Rule 5550(b)(1) and unable to comply with any of the alternative requirements in Listing Rule 5550(b) (collectively, the “Minimum Stockholders’ Equity Requirement”). The period during which we could appeal the decision to the Nasdaq Listing and Hearing Review Council has lapsed, but the Council may, on its own motion, determine to review the panel’s decision within 45 calendar days after the Company was notified of the decision. Although we are seeking all possible opportunities to regain compliance with the Minimum Stockholders’ Equity Requirement or to obtain an alternative listing on a national securities exchange, we believe that even if we were able to regain compliance with all applicable Nasdaq continued listing requirements, it is likely that Nasdaq will proceed with delisting our common stock.

As previously disclosed, in the past we have received notices from Nasdaq’s Listing Qualifications Department indicating that, for 30 consecutive business days, our common stock had not maintained a minimum closing bid price of $1.00 per share as required by Nasdaq Listing Rule 5550(a)(2) (“Minimum Bid Price Requirement”); (ii) the Minimum Stockholders’ Equity Requirement; and (iii) the minimum requirement of 500,000 publicly held shares as required by Nasdaq Listing Rule 5550(a)(4) (the “Minimum Float Requirement”). In February 2024, we received a letter from Nasdaq confirming that we had cured the most recently identified deficiencies under the Minimum Bid Price Requirement and Minimum Float Requirement.

We are evaluating all available opportunities to obtain a listing on another national securities exchange. In the interim, we may seek eligibility for quotation on the OTCQB Market.

Issuances of common stock and warrants after December 31, 2023

On January 31, 2024, the Company completed a registered public offering and issued an aggregate of 794,000 shares of its common stock, pre-funded warrants to purchase up to an aggregate of 3,581,000 shares of common stock at an exercise price of $0.001 per shares and warrants to purchase up to an aggregate of 8,750,000 shares of its common stock. The initial exercise price of the warrants is $2.06 per underlying share. The securities were issued for a combined offering price of $2.06 per share of common stock and warrants to purchase up to two additional shares of common stock, or $2.059 per pre-funded warrant and warrants. Net proceeds from the offering totaled approximately $8.2 million. As of March 7, 2024 no pre-funded warrants remained outstanding. The securities were offered pursuant to an effective registration statement on Form S-1.

Reverse Stock Splits

Effective January 18, 2024, we completed a 1-for-20 reverse split of our outstanding shares of common stock. Unless specifically provided herein, the share and per-share information that follows in this prospectus, other than in the historical financial statements and related notes included elsewhere in this prospectus, assumes the effect of the reverse stock split.

Our primary objective in effecting the reverse stock split was to attempt to raise the per-share trading price of our common stock to regain compliance with the Minimum Bid Price Requirement.

On March 25, 2024, we filed a preliminary proxy statement for a special meeting of stockholders to seek approval of a reverse stock split of our outstanding common stock at a ratio ranging from any whole number between 1-for-10 and 1-for-45, subject to and as determined by our Board of Directors. Our primary objective to effect the proposed reverse stock split is to attempt to raise the per-share trading price of our common stock to (1) exceed the minimum per share bid price requirements for initial and continued listing on a national securities exchange and (2) exceed minimum criteria to avoid “penny stock” classification. Assuming our common stock is delisted from Nasdaq, we will need to maintain a minimum closing bid price of greater than $1.00, and as much as $3.00 or $4.00 in order to be eligible for uplisting to a national securities exchange.

Although we expect that the reverse stock split would increase the bid price per share of our common stock above any applicable per share minimum price for any required number of days, thereby avoiding a deficiency or regaining compliance with the listing requirement, there can be no assurance that the reverse stock split would have that effect, initially or in the future, or that it would enable us to uplist or maintain the listing of our common stock on a national securities exchange for any particular duration.

There can be no assurance that any reverse stock split will achieve any of the desired results. There also can be no assurance that the price per share of our common stock immediately after any reverse stock split would increase proportionately with the reverse stock split, or that any increase would be sustained for any period of time, as evidenced by the Company’s past reverse stock splits.

Product Developments

Through March 26, 2024, we had:

| |

●

|

secured an orphan drug designation for ivospemin from the FDA;

|

| |

●

|

submitted and received acceptance from the FDA for an IND application for ivospemin;

|

| |

●

|

completed a Phase Ia monotherapy safety study of ivospemin in the treatment of patients with metastatic pancreatic ductal adenocarcinoma;

|

| |

●

|

received “Fast Track” designation from the FDA for ivospemin for metastatic pancreatic cancer;

|

| |

●

|

completed enrollment and released interim results in our second trial a Phase Ia /Ib clinical study of ivospemin, a first-line study with ivospemin given in combination with a current standard of care in patients with pancreatic ductal adenocarcinoma who were previously untreated for metastatic disease; a total of 50 subjects were enrolled in this study, 25 in the Phase Ia and 25 in the Phase Ib or expansion phase;

|

| |

●

|

secured a two-year research agreement with Johns Hopkins School of Medicine led by Professor Robert Casero, an internationally recognized researcher in polyamine biology;

|

| |

●

|

completed process improvement measures expected to be scalable for commercial use and received issue notification for a patent covering this new shorter synthesis of ivospemin in several territories;

|

| |

●

|

initiated a randomized, double-blind, placebo-controlled study, referred to as ASPIRE, with ivospemin given in combination with gemcitabine and nab-paclitaxel in patients with pancreatic ductal adenocarcinoma who are previously untreated for metastatic disease;

|

| |

●

|

completed preclinical evaluation of ivospemin for use as neoadjuvant therapy in resectable pancreatic cancer prior to surgery;

|

| |

●

|

obtained early, preclinical, indication of tumor growth inhibition activity in ovarian cancer and presented the results at ASCO-GI and AACR conferences;

|

| |

●

|

received USAN adoption of the nonproprietary name of ivospemin for SBP-101;

|

| |

●

|

acquired and integrated CPP, adding a second lead asset in multiple forms and an expansive clinical development program ranging from pre-clinical to registration level clinical trials;

|

| |

●

|

EMA Committee for Orphan Medicinal Products issued a positive opinion on Panbela’s application for orphan designation of ivospemin in combination with gemcitabine and nab-Paclitaxel in patients with metastatic pancreatic ductal adenocarcinoma;

|

| |

●

|

announced the initiation of Phase II program through Indiana University for early onset Type I diabetes utilizing eflornithine;

|

| |

●

|

ASPIRE is open to enrollment in every planned country within NA, EMEA, and APAC, Completed two Independent DSMB meetings for ASPIRE with no safety concerns or modifications to study design;

|

| |

●

|

announced the initiation of the Phase I/II clinical trial for the treatment of NSCLC possessing the STK11 mutation through Moffitt Cancer Center;

|

| |

●

|

entered into a sponsored research agreement with The University of Texas MD Anderson Cancer Center for the evaluation of polyamine metabolic inhibitor therapies in combination with CAR-T cell therapies in preclinical models;

|

| |

●

|

announced the SWOG Cancer Research Network’s PACES S0820 Phase III trial passed a single planned futility analysis and will continue;

|

| |

●

|

announced the approval of US WorldMeds’ NDA Approval for Eflornithine (DFMO) in Pediatric Neuroblastoma, the first polyamine approval in oncology; and

|

| |

●

|

exceeded 50% enrollment in ASPIRE global clinical trial.

|

Risks Associated with Our Company

Our business is subject to many significant risks, as more fully described in the section titled “Risk Factors” immediately following this prospectus summary. You should read and carefully consider these risks, together with the risks set forth under the section titled “Risk Factors” and all of the other information in this prospectus, including the financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest in our securities. If any of the risks discussed in this prospectus actually occur, our business, financial condition or operating results could be materially and adversely affected. In particular, our risks include, but are not limited to, the following:

| |

●

|

our ability to obtain additional capital, on acceptable terms or at all, required to implement our business plan;

|

| |

●

|

our lack of diversification and the corresponding risk of an investment in our Company;

|

| |

●

|

our ability to uplist and maintain the listing of our common stock on a national securities exchange;

|

| |

●

|

progress and success of our randomized Phase II/III clinical trial;

|

| |

●

|

our ability to demonstrate the safety and effectiveness of our product candidates: ivospemin ( SBP-101 ), Flynpovi, and eflornithine (CPP-1X);

|

| |

●

|

our ability to obtain regulatory approvals for our product candidates, ivospemin, Flynpovi and eflornithine in the United States, the European Union or other international markets;

|

| |

●

|

the market acceptance and level of future sales of our product candidates, ivospemin, Flynpovi and eflornithine ;

|

| |

●

|

the cost and delays in product development that may result from changes in regulatory oversight applicable to our product candidates, ivospemin, Flynpovi and eflornithine;

|

| |

●

|

the rate of progress in establishing reimbursement arrangements with third-party payors;

|

| |

●

|

the effect of competing technological and market developments;

|

| |

●

|

the costs involved in filing and prosecuting patent applications and enforcing or defending patent claims; and

|

| |

●

|

other risk factors included under the caption “Risk Factors” starting on page Error! Bookmark not defined. of this prospectus.

|

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain scaled disclosure available to smaller reporting companies.

Corporate History

The primary business underlying Panbela Therapeutics, Inc., was originally incorporated under the laws of the State of Delaware under the name “Sun BioPharma, Inc.” in September 2011. In 2015, it became a public company by completing a merger transaction with a wholly owned subsidiary of a public company then organized under the laws of the State of Utah. In 2016, it was reincorporated under the laws of the State of Delaware via a merger with our operating subsidiary. That company changed its name to “Panbela Therapeutics, Inc.” on December 2, 2020. On June 15, 2022, we became a successor issuer to Panbela Therapeutics, Inc. and adopted its name, pursuant to a holding company reorganization via merger by operation of Rule 12g-3(a) promulgated under the Exchange Act, resulting in our current structure – consisting of two wholly owned subsidiaries: Panbela Research, Inc. and Cancer Prevention Pharmaceuticals, Inc.

Corporate Information

Our corporate mailing address is 712 Vista Blvd, #305, Waconia, MN 55387. Our telephone number is (952) 479-1196, and our website is www.panbela.com. The information on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website. The information contained in or connected to our website is not incorporated by reference into, and should not be considered part of, this prospectus. The trade names, trademarks, and service marks of other companies appearing in this prospectus are the property of the respective holders.

THE OFFERING

|

Common stock offered by us

|

Up to 8,750,000 shares of our common stock issuable upon exercise of outstanding warrants with an exercise price of $2.06 per share (collectively, the “Warrants”). Each Warrant is exercisable at any time for the purchase of one share of our common stock and is scheduled to expire on January 30, 2028.

|

| |

|

|

Common stock outstanding as of the date of this prospectus

|

4,845,861 shares

|

| |

|

|

Common stock to be outstanding immediately after completion of this offering

|

13,595,861 shares (assuming full exercise of the Warrants for cash)

|

| |

|

|

Use of proceeds

|

We will receive up to approximately $18 million if all of the currently outstanding Warrants are exercised for cash. We intend to use the net proceeds, if any, from this offering for the continued clinical development of our product candidates ivospemin and eflornithine and for working capital, and other general corporate purposes, which may include repayment of debt. The Warrants contain cashless exercise provisions. As a result, we may receive significantly less in net proceeds. See “Use of Proceeds” on page 22.

|

| |

|

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus beginning on page 10 for a discussion of factors to consider carefully before deciding to invest in our securities.

|

| |

|

|

Trading symbol

|

“PBLA”

|

| |

|

The number of shares of our common stock outstanding as of the date of this prospectus and after this offering is based on 4,854,861 shares of our common stock outstanding as of March 26, 2024, and excludes:

| |

●

|

all shares issuable in this offering;

|

| |

●

|

607 shares of common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $14,410.38 per share;

|

| |

●

|

163,800 additional shares of common stock reserved and available for future issuances under our equity plans; and

|

| |

●

|

345,943 shares of common stock issuable upon exercise of stock purchase warrants not related to this offering at a weighted average exercise price of $39.08 per share.

|

Unless otherwise indicated, all information in this prospectus assumes no exercise of the outstanding options or warrants.

RISK FACTORS

Any investment in our securities involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our securities. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Business and Financial Position

We are a pre revenue company with a history of negative operating cash flow.

We have experienced negative cash flows for our operating activities since inception, primarily due to the investments required to commercialize our primary drug candidates. Our financing cash flows historically have been positive due to proceeds from the sale of equity securities and promissory notes issuances. Our net cash used in operating activities was $25.2 million and $15.3 million for the years ended December 31, 2023, and 2022, respectively, and we had negative working capital of $9.3 million on December 31, 2023, and negative working capital of 6.0 million as December 31, 2022. Working capital is defined as current assets less current liabilities.

Our operations are subject to all the risks, difficulties, complications and delays frequently encountered in connection with the development of new products, as well as those risks that are specific to the pharmaceutical and biotechnology industries in which we compete. Investors should evaluate us considering the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

As a result of our limited financial liquidity, we and our auditors have expressed substantial doubt regarding our ability to continue as a “going concern.”

As a result of our limited financial liquidity, our auditors’ report for our 2023 financial statements, which is incorporated by reference herein, contains a statement concerning our ability to continue as a “going concern.” Our limited liquidity could make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and may materially and adversely affect the terms of any financing that we may obtain and our public stock price generally.

Our continuation as a “going concern” is dependent upon, among other things, achieving positive cash flow from operations and, if necessary, augmenting such cash flow using external resources to satisfy our cash needs. Our plans to achieve positive cash flow primarily include engaging in offerings of securities. Additional potential sources of funds include negotiating up-front and milestone payments on our current and potential future product candidates or royalties from sales of our products that secure regulatory approval and any milestone payments associated with such approved products. These cash sources could, potentially, be supplemented by financing or other strategic agreements. However, we may be unable to achieve these goals or obtain required funding on commercially reasonable terms, or at all, and therefore may be unable to continue as a going concern.

We may be unable to obtain the additional capital that is required to execute our business plan, which could restrict our ability to grow.

Our current capital and our other existing resources will be sufficient only to provide a limited amount of working capital and will not be sufficient to fund our expected continuing opportunities. While we project that our current capital resources will fund our operations, including increased clinical trial costs, into the second quarter of 2024, we will require additional capital to continue to operate our business and complete our clinical development plans.

Future research and development, including clinical trial cost, capital expenditures and possible acquisitions, and our administrative requirements, such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses, will require a substantial amount of additional capital and cash flow. There is no guarantee that we will be able to raise the additional capital required to fund our ongoing business on commercially reasonable terms or at all.

We intend to pursue sources of additional capital through various financing transactions or arrangements, including collaboration arrangements, debt financing, equity financing or other means. We may not be successful in locating suitable financing transactions on commercially reasonable terms, in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, our resources will not be sufficient to fund our operations going forward.

Any additional capital raised through the sale of equity may dilute the ownership percentage of our stockholders. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities which may have a further dilutive effect.

Our ability to obtain needed financing may be impaired by such factors as the capital markets, both generally and in the pharmaceutical and other drug development industries in particular, the limited diversity of our activities and/or the loss of key personnel. If the amount of capital we are able to raise from financing activities is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations, we may be required to cease our operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs, which may adversely impact our financial condition.

The markets for our product candidates are highly competitive and are subject to rapid scientific change, which could have a material adverse effect on our business, results of operations and financial condition.

The pharmaceutical and biotechnology industries in which we compete are highly competitive and characterized by rapid and significant technological change. We face intense competition from organizations such as pharmaceutical and biotechnology companies, as well as academic and research institutions and government agencies. Some of these organizations are pursuing products based on technologies similar to our technology. Other of these organizations have developed and are marketing products or are pursuing other technological approaches designed to produce products that are competitive with our product candidates in the therapeutic effect these competitive products have on the diseases targeted by our product candidates. Our competitors may discover, develop or commercialize products or other novel technologies that are more effective, safer or less costly than any that we may develop. Our competitors may also obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for our product candidates.

Many of our competitors are substantially larger than we are and have greater capital resources, research and development staff and facilities than we have. In addition, many of our competitors are more experienced in drug discovery, development and commercialization, obtaining regulatory approvals and drug manufacturing and marketing.

We anticipate that the competition with our product candidates and technology will be based on a number of factors including product efficacy, safety, availability and price. The timing of market introduction of our planned future product candidates and competitive products will also affect competition among products. We expect the relative speed with which we can develop our product candidates, complete the required clinical trials, establish strategic partners and supply appropriate quantities of the product candidate for late-stage trials, if required, to be important competitive factors. Our competitive position will also depend upon our ability to attract and retain qualified personnel, to obtain patent protection in non-U.S. markets, which we currently do not have, or otherwise develop proprietary products or processes and to secure sufficient capital resources for the period between technological conception and commercial sales or out-license to pharmaceutical partners. If we fail to develop and deploy a proposed product candidate in a successful and timely manner, we will in all likelihood not be competitive.

Our lack of diversification increases the risk of an investment in our Company and our financial condition and results of operations may deteriorate if we fail to diversify.

Our Board of Directors has centered our attention on our drug development activities, which are currently focused on a limited number of product candidates. Our ability to diversify our investments will depend on our access to additional capital and financing sources and the availability and identification of suitable opportunities.

Larger companies have the ability to manage their risk by diversification. However, we lack and expect to continue to lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting pharmaceutical and biotechnology industries in which we compete than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify our operations, our financial condition and results of operations could deteriorate.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting our business. We have a small management team, and the loss of a key individual or inability to attract suitably qualified staff could materially adversely impact on our business.

Our success depends on the ability of our management, employees, consultants and strategic partners, if any, to interpret market data correctly and to interpret and respond to economic market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments, and ultimately, if required, to successfully divest such investments. Further, no assurance can be given that our key personnel will continue their association or employment with us or that replacement personnel with comparable skills can be found. We will seek to ensure that management and any key employees are appropriately compensated; however, their services cannot be guaranteed. If we are unable to attract and retain key personnel, our business may be adversely affected.

We may be required to defend lawsuits or pay damages for product liability claims.

Product liability is a major risk in testing and marketing biotechnology and pharmaceutical products. We may face substantial product liability exposure in human clinical trials and in the sale of products after regulatory approval. Product liability claims, regardless of their merits, could exceed policy limits, divert management’s attention and adversely affect our reputation and the demand for our product. In any such event, your investment in our securities could be materially and adversely affected.

Risks Related to the Development and Approval of New Drugs

Clinical trials required for our product candidates are expensive and time-consuming, and their outcome is highly uncertain. If any of our drug trials are delayed or yield unfavorable results, we will have to delay or may be unable to obtain regulatory approval for our product candidate.

We must conduct extensive testing of each product candidate before we can obtain regulatory approval to market and sell it. We need to conduct both preclinical animal testing and human clinical trials. Conducting these trials is a lengthy, time-consuming and expensive process. These tests and trials may not achieve favorable results for many reasons, including, among others, failure of the product candidate to demonstrate safety or efficacy, the development of serious or life-threatening adverse events, or side effects, caused by or connected with exposure to the product candidate, difficulty in enrolling and maintaining subjects in the clinical trial, lack of sufficient supplies of the product candidate or comparator drug, and the failure of clinical investigators, trial monitors, contractors, consultants, or trial subjects to comply with the trial protocol. A clinical trial may fail because it did not include a sufficient number of patients to detect the endpoint being measured or reach statistical significance. A clinical trial may also fail because the dose(s) of the investigational drug included in the trial were either too low or too high to determine the optimal effect of the investigational drug in the disease setting. Many clinical trials are conducted under the oversight of Independent Data Monitoring Committees (“IDMCs”) also known as DSMB’s. These independent oversight bodies are made up of external experts who review the progress of ongoing clinical trials, including available safety and efficacy data, and make recommendations concerning a trial’s continuation, modification, or termination based on interim, unblinded data. Any of our ongoing clinical trials may be discontinued or amended in response to recommendations made by responsible IDMCs based on their review of such interim trial results.

We will need to reevaluate our product candidates if they do not test favorably and either conduct new trials, which are expensive and time consuming, or abandon our drug development program. Even if we obtain positive results from preclinical or clinical trials, we may not achieve the same success in future trials. Many companies in the biopharmaceutical industry have suffered significant setbacks in clinical trials, even after promising results have been obtained in earlier trials. The failure of clinical trials to demonstrate safety and effectiveness for the desired indication could harm the development of our product candidate and our business, financial condition and results of operations may be materially harmed.

We face significant risks in our product candidate development efforts.

Our business depends on the successful development and commercialization of our product candidates. We are currently focused on developing our initial product candidate, SBP-101, for the treatment of PDA and are not permitted to market it in the United States until we receive approval of an NDA from the FDA, or in any foreign jurisdiction until we receive the requisite approvals from such jurisdiction. The process of developing new drugs and/or therapeutic products is inherently complex, unpredictable, time-consuming, expensive and uncertain. We must make long-term investments and commit significant resources before knowing whether our development programs will result in drugs that will receive regulatory approval and achieve market acceptance. A product candidate that appears to be promising at all stages of development may not reach the market for a number of reasons that may not be predictable based on results and data from the clinical program. A product candidate may be found ineffective or may cause harmful side effects during clinical trials, may take longer to progress through clinical trials than had been anticipated, may not be able to achieve the pre-defined clinical endpoints even though clinical benefit may have been achieved, may fail to receive necessary regulatory approvals, may prove impracticable to manufacture in commercial quantities at reasonable cost and with acceptable quality, or may fail to achieve market acceptance.

We cannot predict whether or when we will obtain regulatory approval to commercialize our product candidates and we cannot, therefore, predict the timing of any future revenues from this or other product candidates, if any. The FDA has substantial discretion in the drug approval process, including the ability to delay, limit or deny approval of a product candidate for many reasons. For example, the FDA:

| |

●

|

could determine that the information provided by us was inadequate, contained clinical deficiencies or otherwise failed to demonstrate the safety and effectiveness of any of our product candidates for any indication;

|

| |

●

|

may not find the data from clinical trials sufficient to support the submission of an NDA or to obtain marketing approval in the United States, including any findings that the clinical and other benefits of our product candidates outweigh their safety risks;

|

| |

●

|

may disagree with our trial design or our interpretation of data from preclinical studies or clinical trials or may change the requirements for approval even after it has reviewed and commented on the design for our trials;

|

| |

●

|

may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we enter into agreements for the manufacturing of our product candidates;

|

| |

●

|

may approve our product candidates for fewer or more limited indications than we request or may grant approval contingent on the performance of costly post-approval clinical trials;

|

| |

●

|

may change its approval policies or adopt new regulations; or

|

| |

●

|

may not approve the labeling claims that we believe are necessary or desirable for the successful commercialization of our product candidates.

|

Any failure to obtain regulatory approval of our initial product candidate or future product candidates we develop, if any, would significantly limit our ability to generate revenues, and any failure to obtain such approval for all of the indications and labeling claims we deem desirable could reduce our potential revenues.

Our product candidates are based on a new formulation of an existing technology which has never been approved for the treatment of any cancer and, consequently, is inherently risky. Concerns about the safety and efficacy of our product candidate could limit our future success.

We are subject to the risks of failure inherent in the development of product candidates based on new technologies. These risks include the possibility that any product candidates we create will not be effective, that our current product candidate will be unsafe, ineffective or otherwise fail to receive the necessary regulatory approvals or that our product candidate will be hard to manufacture on a large scale or will be uneconomical to market.

Many pharmaceutical products cause multiple potential complications and side effects, not all of which can be predicted with accuracy and many of which may vary from patient to patient. Long-term follow-up data may reveal additional complications associated with our product candidate. The responses of potential physicians and others to information about complications could materially affect the market acceptance of our product candidate, which in turn would materially harm our business.

Due to our reliance on third parties to conduct our clinical trials, we are unable to directly control the timing, conduct, expense and quality of our clinical trials, which could adversely affect our clinical data and results and related regulatory approvals.

We extensively outsource our clinical trial activities and expect to directly perform only a small portion of the preparatory stages for planned trials. We rely on independent third-party CROs to perform most of our clinical trials, including document preparation, site identification, screening and preparation, pre-study visits, training, program management and bio-analytical analysis. Many important aspects of the services performed for us by the CROs are out of our direct control. If there is any dispute or disruption in our relationship with our CROs, our clinical trials may be delayed. Moreover, in our regulatory submissions, we rely on the quality and validity of the clinical work performed by third-party CROs. If a CRO’s processes, methodologies or results are determined to be invalid or inadequate, our own clinical data and results and related regulatory approvals could be adversely affected or invalidated.

We rely on third-party suppliers and other third parties for production of our product candidate and our dependence on these third parties may impair the advancement of our research and development programs and the development of our product candidates.

We rely on, and expect to continue to rely on, third parties for the supply of raw materials and manufacture of drug supplies necessary to conduct our preclinical studies and clinical trials. During 2021 the Company, in collaboration with our manufacturing partner confirmed a new shorter and less expensive synthesis of the active drug substance. However, delays in production by third parties could delay our clinical trials or have an adverse impact on any commercial activities. In addition, the fact that we are dependent on third parties for the manufacture of and formulation of our product candidates means that we are subject to the risk that the products may have manufacturing defects that we have limited ability to prevent or control. Although we oversee these activities to ensure compliance with our quality standards, budgets and timelines, we have had and will continue to have less control over the manufacturing of our product candidates than potentially would be the case if we were to manufacture our product candidates. Further, the third parties we deal with could have staffing difficulties, might undergo changes in priorities or may become financially distressed, which would adversely affect the manufacturing and production of our product candidates.

The results of pre-clinical studies and completed clinical trials are not necessarily predictive of future results, and our current product candidates may not have favorable results in later studies or trials.

Pre-clinical studies and Phase I clinical trials are not primarily designed to test the efficacy of a product candidate in the general population, but rather to test initial safety, to study pharmacokinetics and pharmacodynamics, to study limited efficacy in a small number of study patients in a selected disease population, and to identify and attempt to understand the product candidate’s side effects at various doses and dosing schedules. Success in pre-clinical studies or completed clinical trials does not ensure that later studies or trials, including continuing pre-clinical studies and large-scale clinical trials, will be successful nor does it necessarily predict future results. Favorable results in early studies or trials may not be repeated in later studies or trials, and product candidates in later stage trials may fail to show acceptable safety and efficacy despite having progressed through earlier trials.

Risks Related to the Regulation of our Business

Federal and state pharmaceutical marketing compliance and reporting requirements may expose us to regulatory and legal action by state governments or other government authorities.

The Food and Drug Administration Modernization Act (the “FDMA”) established a public registry of open clinical trials involving drugs intended to treat serious or life-threatening diseases or conditions in order to promote public awareness of and access to these clinical trials. Under the FDMA, pharmaceutical manufacturers and other trial sponsors are required to post the general purpose of these trials, as well as the eligibility criteria, location and contact information of the trials. Failure to comply with any clinical trial posting requirements could expose us to negative publicity, fines and other penalties, all of which could materially harm our business.

In recent years, several states, including California, Vermont, Maine, Minnesota, New Mexico and West Virginia, have enacted legislation requiring pharmaceutical companies to establish marketing compliance programs and file periodic reports on sales, marketing, pricing and other activities. Similar legislation is being considered in other states. Many of these requirements are new and uncertain, and available guidance is limited. Unless we are in full compliance with these laws, we could face enforcement actions and fines and other penalties and could receive adverse publicity, all of which could harm our business.

If the product candidate we develop becomes subject to unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives, our ability to successfully commercialize our product candidate may be impaired.

Our future revenues, profitability and access to capital will be affected by the continuing efforts of governmental and private third-party payors to contain or reduce the costs of health care through various means. We expect several federal, state and foreign proposals to control the cost of drugs through government regulation. We are unsure of the impact recent health care reform legislation may have on our business or what actions federal, state, foreign and private payors may take in response to the recent reforms. Therefore, it is difficult to predict the effect of any implemented reform on our business. Our ability to commercialize our product candidate successfully will depend, in part, on the extent to which reimbursement for the cost of such product candidate and related treatments will be available from government health administration authorities, such as Medicare and Medicaid in the United States, private health insurers and other organizations. Significant uncertainty exists as to the reimbursement status of newly approved health care products, particularly for indications for which there is no current effective treatment or for which medical care typically is not sought. Adequate third-party coverage may not be available to enable us to maintain price levels sufficient to realize an appropriate return on our investment in product research and development. If adequate coverage and reimbursement levels are not provided by government and third-party payors for the use of our product candidates, our product candidates may fail to achieve market acceptance and our results of operations will be harmed.

Healthcare legislative reform measures may have a material adverse effect on our business and results of operations.

Legislative and regulatory actions affecting government prescription drug procurement and reimbursement programs occur relatively frequently. In the United States, the ACA was enacted in 2010 to expand healthcare coverage. Since then, numerous efforts have been made to repeal, amend or administratively limit the ACA in whole or in part. For example, the Tax Cuts and Jobs Act, signed into law by President Trump in 2017, repealed the individual health insurance mandate, which is considered a key component of the ACA. In December 2018, a Texas federal district court struck down the ACA on the grounds that the individual health insurance mandate is unconstitutional, although this ruling has been stayed pending appeal. The ongoing challenges to the ACA and new legislative proposals have resulted in uncertainty regarding the ACA's future viability and destabilization of the health insurance market. The resulting impact on our business is uncertain and could be material.

Efforts to control prescription drug prices could also have a material adverse effect on our business. For example, in 2018, President Trump and the Secretary of the U.S. Department of Health and Human Services (“HHS”) released the "American Patients First Blueprint" and have begun implementing certain portions. The initiative includes proposals to increase generic drug and biosimilar competition, enable the Medicare program to negotiate drug prices more directly and improve transparency regarding drug prices and ways to lower consumers' out-of-pocket costs. The Trump administration also proposed to establish an “international pricing index” that would be used as a benchmark to determine the costs and potentially limit the reimbursement of drugs under Medicare Part B. Among other pharmaceutical manufacturer industry-related proposals, Congress has proposed bills to change the Medicare Part D benefit to impose an inflation-based rebate in Medicare Part D and to alter the benefit structure to increase manufacturer contributions in the catastrophic phase. The volume of drug pricing-related bills has dramatically increased under the current Congress, and the resulting impact on our business is uncertain and could be material.

In addition, many states have proposed or enacted legislation that seeks to regulate pharmaceutical drug pricing indirectly or directly, such as by requiring biopharmaceutical manufacturers to publicly report proprietary pricing information or to place a maximum price ceiling on pharmaceutical products purchased by state agencies. For example, in 2017, California’s governor signed a prescription drug price transparency state bill into law, requiring prescription drug manufacturers to provide advance notice and explanation for price increases of certain drugs that exceed a specified threshold. Both Congress and state legislatures are considering various bills that would reform drug purchasing and price negotiations, allow greater use of utilization management tools to limit Medicare Part D coverage, facilitate the import of lower-priced drugs from outside the United States and encourage the use of generic drugs. Such initiatives and legislation may cause added pricing pressures on our products.

Changes to the Medicaid program at the federal or state level could also have a material adverse effect on our business. Proposals that could impact coverage and reimbursement of our products, including giving states more flexibility to manage drugs covered under the Medicaid program and permitting the re-importation of prescription medications from Canada or other countries, could have a material adverse effect by limiting our products’ use and coverage. Furthermore, state Medicaid programs could request additional supplemental rebates on our products as a result of an increase in the federal base Medicaid rebate. To the extent that private insurers or managed care programs follow Medicaid coverage and payment developments, they could use the enactment of these increased rebates to exert pricing pressure on our products, and the adverse effects may be magnified by their adoption of lower payment schedules.