Cheniere Energy To Sell 30% Stake In Freeport LNG To Zachry

April 22 2010 - 6:29PM

Dow Jones News

Cheniere Energy, Inc. (LNG) said Thursday that the company has

agreed to sell its 30% interest in Freeport LNG Development LP to

Zachry American Infrastructure LLC and Hastings Fund Management USA

Inc. for $104 million.

Freeport LNG Development operates an LNG terminal off the Texas

Gulf Coast. Houston-based Cheniere, a developer and owner of

liquefied natural-gas terminals, plans to use the proceeds of the

sale of its stake in the company to pay down part of a $400 million

loan. ConocoPhillips (COP) and Colorado oilman Michael Smith have

stakes in Freeport LNG Development's general partner, the entity

that manages the company and receives a percentage of its

profits.

Zachry American Infrastructure is an independent member of the

Zachry group of construction, engineering and infrastructure

companies based in San Antonio, Texas. Hastings Fund Management USA

is the North American arm of Hastings Fund Management, an

Australian infrastructure fund manager and subsidiary of Westpac

Banking Corp (WBC.AU).

Cheniere's plans to develop the Freeport LNG terminal were

hatched in 2001, when declining U.S. gas supplies were expected to

drive imports of the fuel from overseas. But improved technology

has led to a boom in gas production from onshore fields, and

Cheniere's terminals have seen few LNG cargoes, leaving the company

with meager cash flows. Cheniere also owns the Sabine Pass LNG

terminal in Louisiana.

Gas marketers continue to view the U.S. as a "market of last

resort" for cargoes that aren't needed in Europe and Asia, however.

A unit of Russian energy giant Gazprom announced Thursday that it

had signed an agreement with a subsidiary of San Diego-based Sempra

Energy (SE) for the right to deliver LNG cargoes to the Cameron LNG

terminal in Louisiana. In April, Cheniere announced a pact with

J.P. Morgan Chase & Co. (JPM) that will give J.P. Morgan's

clients access to the Sabine Pass terminal. The two firms will also

work together to find other clients who want to ship through the

terminal.

Cheniere expects the Freeport deal to close in the second

quarter. Shares of Cheniere were up 24 cents, or 4.94%, to trade at

$5.10 after hours.

-By Christine Buurma, Dow Jones Newswires; 212-416-2143;

christine.buurma@dowjones.com

Order free Annual Report for ConocoPhillips

Visit http://djnewswires.ar.wilink.com/?link=COP or call

1-888-301-0513

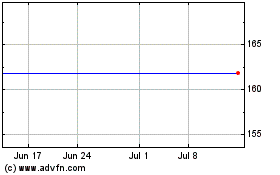

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

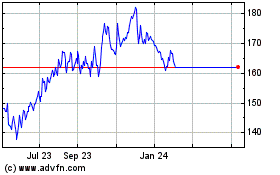

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Apr 2023 to Apr 2024