TIDMBEH

RNS Number : 2318D

Bayfield Energy Holdings PLC

14 May 2012

14 May 2012

Bayfield Energy Holdings plc

("the Company")

Trinidad: Operational update

Bayfield Energy (Ticker Symbol: BEH), an independent oil and gas

exploration and production group with key assets in Trinidad &

Tobago and South Africa, provides an operational update on its

activities in Trinidad.

Well results from EG7

Well EG7 is drilling ahead, having reached 5,280ft and

encountered all the shallow reservoir objectives. In the interval

between 1,000ft and 3,000ft, the reservoirs identified as the F,G

and H Sands have been found to be predominantly water bearing. Only

one reservoir interval was logged as oil bearing and has been

sampled and tested with a mini drill stem test (mini-DST). The

reservoir intervals encountered had been evaluated to have been oil

bearing in the offset well EG1 (1964). Revised mapping, based on

results from EG7, now suggests, however, that crestal faults may

separate the EG1 oil bearing reservoirs from EG7.

Well data from EG7 will reduce the Contingent Resources volumes

assigned to the EG1 structure in the Company's Competent Person's

Report (the "CPR"), prepared by Gaffney, Cline & Associates

(May 2011). Management has assessed that the Company's net 2C

Contingent Resources of 24.67 mmbbl (37.96 mmbbl gross) will be

reduced by approximately 5.9 mmbbl (9 mmbbl gross).

In addition, the exploration objectives identified from the EG1

Prospect were classified as Prospective Resources in the CPR. The

shallowest of these was the "P Sand" section which has been proven

to be water bearing in EG7. Accordingly, management assesses that

it will no longer be appropriate to recognise the Unrisked

Prospective Resources associated with the "P sands" in the EG1

Prospect.

Following the detailed logging and sampling of the shallow

reservoirs, the well has been sidetracked and is drilling ahead to

the east to evaluate deeper exploration targets in a structurally

optimal position. These targets are located structurally higher

than the nearby well COS1 (1985), where sandstone reservoirs

exhibited oil shows while drilling but were not evaluated due to

mechanical problems. EG7 is planned to drill to a total depth of

6,500ft.

EG8 discovery

On 13 March, Bayfield reported that its exploration well, EG8,

had demonstrated development potential of 32 million barrels

(mmbbl) of oil and 69 billion standard cubic feet (bcf) of gas in

the EG2/EG5/EG8 Central and East fault blocks. Initial

interpretation suggested that substantially all of the gas

potential lies within the Galeota Licence though the oil potential

extends into an adjacent licence in which Bayfield has no

participating interest.

Subsequent to this announcement, Bayfield has signed a

memorandum of understanding ("MoU") with the operator of the

adjacent block, Repsol E&P T&T Limited ("Repsol"). The MoU

confirms the intention of Bayfield and Repsol to cooperate in

establishing a joint technical team to assess and allow for the

potential accelerated development of the accumulations of oil and

gas identified by EG8 and may ultimately lead to a reclassification

of Prospective and Contingent Resources.

Future rig deployment

Following the completion of EG7, the Gorilla III jack-up unit

will return to Niko to drill the second well of its programme and

is then expected to return to Bayfield later in the third quarter

of 2012 for the next planned two wells in its programme, EG9 and

GAL25, which are both structurally independent of EG7.

Bayfield has taken steps to provide greater operational and

financial flexibility concerning the timing of fulfilment of its

committed seven-well drilling programme. Firstly, it has agreed

amendments to the Galeota licence and Farm-out Agreement with

Petrotrin, to extend the period in which it was obligated to drill

the seven wells out to the end of March 2015. Secondly, it is close

to concluding negotiations concerning an assignment of the rig

contract which would allow for a break in the drilling programme

but ensure that Gorilla III was available to complete Bayfield's

commitments in 2013. Thirdly, it is reviewing, with its advisers,

alternatives for raising additional finance in the near-term.

2012 Q3 well prospects

EG9 will target a series of stacked sands and shales in the

western fault block encountered by EG2 and EG5. Best case gross

field oil prospective resources for the C, D and E sands in the

fault block are respectively 28.03 mmbbl (18.22 mmbbl net to

Bayfield), 10.01 mmbbl (6.51 mmbbl net) and 5.35 mmbbl (3.48 mmbbl

net). Best case gross field gas prospective resources for the A, B,

F, G and H sands are respectively 14.62 bcf (9.50 bcf net to

Bayfield), 17.73 bcf (11.52 bcf net), 4.78 bcf (3.11 bcf net), 5.19

bcf (3.37 bcf net) and 13.55 bcf (8.81 bcf net). The EG8 data will

help to optimise the well location.

The location for GAL25 has been determined based upon structural

mapping from Bayfield's new 3D seismic data which indicates that

the North East Trintes Prospect is the crestal part of the Trintes

Field structure. The main prospective targets are the massive

sandstones of the M and N units with additional sands in the O and

the P sands beneath. Best case gross field oil prospective

resources for the M and N sands block are respectively 13.08 mmbbl

(8.50 mmbbl net to Bayfield) and 7.38 mmbbl (4.80 mmbbl net).

Trintes field

Following an encouraging start to the year, production for the

remainder of the first quarter was constrained by a number of

operational and technical factors. This included a catch-up on a

backlog of essential maintenance work, particularly with respect to

hydraulic rod pump wells, which had been deferred as a result of

the extreme weather conditions encountered in December and January.

In addition, and following a series of recurring issues with rig

#2, a decision was taken to suspend the program of new development

wells designed to ramp up production for a 3 week period. Remedial

steps undertaken included inspection, repair, audit of operational

processes of the rig and a review of the well completion

design.

As a consequence, on resumption of operations we have switched

to "cased-hole" from "open-hole" completions using perforation

techniques to more accurately access the oil bearing sands. The rig

has since successfully completed two long sidetrack wells, B6 and

B7 on target, in 32 and 25 days respectively. Well B6, the first to

be completed using the new completions technique is presently

producing around 350 bopd and average gross production for April

was 1,650 bopd compared to the 952 bopd for the first quarter.

Contribution from B7 is approximately only 200 bopd as it is

currently in the process of cleaning up following completion of

drilling operations earlier in May.

-ends-

Enquiries:

Bayfield Energy +44 (0)20 7920 2330

Hywel John, Chief Executive Officer

Seymour Pierce +44 (0)20 7107 8000

Jonathan Wright/Stewart Dickson (Corporate Finance)

Richard Redmayne/David Banks (Corporate Broking)

M:Communications

Patrick d'Ancona +44 (0)20 7920 2347

Ann-marie Wilkinson +44 (0)20 7920 2343

Andrew Benbow +44 (0)20 7920 2344

In accordance with the AIM Rules - Note for Mining and Oil and

Gas Companies, the information contained in this announcement has

been reviewed by Brian Thurley, a geologist with over 38 years'

experience who has a degree in Geology from the Royal School of

Mines, Imperial College, London.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSFAESDFESEFI

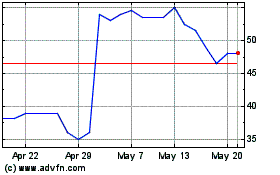

Trinity Exploration & Pr... (LSE:TRIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Exploration & Pr... (LSE:TRIN)

Historical Stock Chart

From Apr 2023 to Apr 2024