Imperial Oil CEO: Expansion Of Pipeline From Canada Vital To US

March 10 2011 - 12:09PM

Dow Jones News

A pipeline project that's pending U.S. approval is necessary to

ensure the reliability and security of oil supplies to the world's

largest oil consumer, said the head of Imperial Oil Ltd. (IMO).

Imperial Oil is a Canadian company that's majority owned by

Irving, Texas-based Exxon Mobil Corp. (XOM), the world's largest

publicly traded oil company.

The Keystone pipeline system currently transports roughly half a

million barrels a day of oil from Canada's oil sands to the U.S.'s

biggest commercial storage hub in Cushing, Okla. A

multibillion-dollar expansion project, dubbed Keystone XL,

envisions another pipeline that would double the system's oil flows

from Canada, the No. 1 oil exporter to the U.S. Keystone XL would

also see the pipeline extend to the Gulf Coast, which would give

Canadian oil producers better market access to the largest refining

hub in the U.S.

Imperial Oil CEO Bruce Marsh noted that Canada, a "strong and

safe" democracy, represents half of the global oil reserves that

are open for private sector investment.

"That is an enormous driver, for countries, for companies...

Really, for anyone that looks to meet their growing energy needs,"

Marsh said in an interview on the sidelines of the annual IHS CERA

energy conference here in Houston.

Marsh's comments highlight the importance of Alberta's oil

sands, not only for Canadian oil companies, but also for oil giants

that see the region as the one of the last few opportunities for

relatively easy access to profitable crude oil.

They also come at a time when the turmoil in Libya and

subsequent disruption to oil supplies there have put the U.S.

economy's vulnerability to rising oil prices in stark relief.

In addition, oil traders are closely watching what happens to

the pipeline. Currently, there's few ways to get oil out of

Cushing. The onslaught of Canadian crude with no outlet has created

a glut, and depressed U.S. oil prices relative to other benchmarks.

On the Gulf Coast, Canadian oil would compete with blends of

similar quality from Mexico and Latin America.

Once Keystone XL is built, "you can go for many, many years

before the production capacity in the oil sands rises above the

limit" imposed by pipeline capacity, Marsh said.

There's some uncertainty as to when or even if the expansion

will become a reality. The pipeline, owned by TransCanada Corp.

(TRP, TRP.T), has become a lightning rod for criticism of the oil

sands. Crude oil there is more expensive to extract, and requires

an energy-intensive process that results in more carbon-dioxide

emissions. A decision on Keystone XL by the State Department,

expected in the second half of this year, also comes amid a spate

of high-profile pipeline ruptures and explosions across the

U.S.

Last month, TransCanada raised its the cost estimate for the

expansion and said it expected a decision by the State Department

to be delayed due to "a heightened political environment and

opposition to the project."

Marsh said that if the Keystone expansion is approved, it would

lessen the urgency for a proposed West Coast pipeline to ship oil

to the Pacific. But over the long term, the Canadian oil industry

would appreciate the flexibility of being able to ship to markets

other than the U.S.

Marsh said that the industry is working hard to reduce its

carbon footprint. Imperial and Exxon's Kearl oil sands mining

project, scheduled for start-up in late 2012, will likely be the

first operation to showcase that reduction.

"When we get done it will be no worse than the average of all

the crude oils," Marsh said. "It'll be an achievement."

Kearl will initially produce about 110,000 barrels a day, and

has regulatory approval for up to 345,000 barrels a day. This crude

will be priced off oil benchmarks tied the U.S. Midcontinent. But

these prices have been well below that of Brent, a European

benchmark that's being viewed increasingly as a better global

indicator.

Marsh said he wasn't concerned about the disparity. "I wouldn't

call it an issue at all," he said.

-By Angel Gonzalez, Dow Jones Newswires; 713-547-9214;

angel.gonzalez@dowjones.com

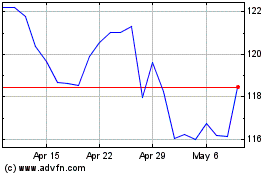

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2024 to May 2024

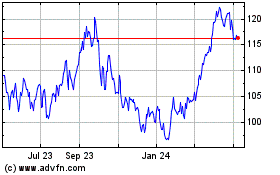

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From May 2023 to May 2024