EXHIBIT

INDEX

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

Supplemental

slide presentation to accompany Valspar’s first quarter Fiscal 2015 earnings

conference call.

|

Exhibit 99.1

Information current as of February 24, 2015 First Quarter F2015 Financial Results

Safe Harbor This discussion contains certain statements which constitute “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended and Section 21 E of the Securities Exchange Act of 1934 , as amended . The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward - looking statements . Forward - looking statements are based on management’s current expectations, estimates, assumptions and beliefs about future events, conditions and financial performance . Forward - looking statements are subject to risks, uncertainties and other factors, many of which are outside our control and could cause actual results to differ materially from such statements . Any statement that is not historical in nature is a forward - looking statement . We may identify forward - looking statements with words and phrases such as “expects,” “projects,” “estimates,” “anticipates,” “believes,” “could,” “may,” “will,” “plans to,” “intends,” “should” and similar expressions . These risks, uncertainties and other factors include, but are not limited to, deterioration in general economic conditions, both domestic and international, that may adversely affect our business ; fluctuations in availability and prices of raw materials, including raw material shortages and other supply chain disruptions, and the inability to pass along or delays in passing along raw material cost increases to our customers ; dependence of internal sales and earnings growth on business cycles affecting our customers and growth in the domestic and international coatings industry ; market share loss to, and pricing or margin pressure from, larger competitors with greater financial resources ; significant indebtedness that restricts the use of cash flow from operations for acquisitions and other investments ; dependence on acquisitions for growth, and risks related to future acquisitions, including adverse changes in the results of acquired businesses, the assumption of unforeseen liabilities and disruptions resulting from the integration of acquisitions ; risks and uncertainties associated with operating in foreign markets, including achievement of profitable growth in developing markets ; impact of fluctuations in foreign currency exchange rates on our financial results ; loss of business with key customers ; damage to our reputation and business resulting from product claims or recalls, litigation, customer perception and other matters ; our ability to respond to technology changes and to protect our technology ; possible interruption, failure or compromise of the information systems we use to operate our business ; changes in governmental regulation, including more stringent environmental, health and safety regulations ; our reliance on the efforts of vendors, government agencies, utilities and other third parties to achieve adequate compliance and avoid disruption of our business ; unusual weather conditions adversely affecting sales ; changes in accounting policies and standards and taxation requirements such as new tax laws or revised tax law interpretations ; the nature, cost and outcome of pending and future litigation and other legal proceedings ; and civil unrest and the outbreak of war and other significant national and international events . We undertake no obligation to subsequently revise any forward - looking statement to reflect new information, events or circumstances after the date of such statement, except as required by law . Investor Contact: Bill Seymour, VP Finance and Investor Relations william.seymour@valspar.com 612 - 856 - 1328 Additional Information: More about Valspar and copies of recent SEC filings can be found at: www.valspar.com 2 February 24, 2015

1Q:F15 Highlights Strong sales growth x Net sales increased 4% (up 7% in local currency) x Both Coatings and Paints had positive sales growth in local currency: Coatings up 10%, Paints up 2% x Continued momentum in Coatings with sales and volume growth in all product lines and geographies x Volume growth in Paint segment international regions: Asia, Australia, Europe Strong earnings growth x Adjusted earnings per diluted share up 21% year - over - year x Adjusted EBIT up 9% year - over - year 3 February 24, 2015

Historical Volume Trends 4 11% 5% 7% 8% 7% 4% 4% 5% 9% 10% 23% 9% 9% 7% 5% 1Q:14 2Q:14 3Q:14 4Q:14 1Q:15 Volume Growth vs. Prior Year Total Valspar Coatings Segment Paints Segment February 24, 2015

Total Company Financial Summary 1Q:F15 as Adjusted* 5 $ million, except for EPS and share count Q1:F15 Q1:F14 Δ Sales 992.0 956.1 +35.9 Growth 3.7% 9.2% Gross Profit 338.1 325.2 +13.0 Gross margin (%) 34.1% 34.0% +10 bps EBIT 116.9 107.0 +9.9 EBIT margin (%) 11.8% 11.2% +60 bps EBITDA 140.8 135.1 Tax Rate 29.5% 32.9% (340 bps) Avrg . shares, diluted 83.87mn 87.64mn (3.77mn) EPS diluted $0.85/ sh $0.70/ sh +0.15/ sh *Non - GAAP measure. Please refer to the Reconciliation of non - GAAP Measures slide Numbers subject to rounding Consolidated Sales comparison Q1:F15 vs. Q1:F14 Volume Price/Mix FX Acquis./Divest Total Sales +7% (1%) (3%) - +4% February 24, 2015

Coatings Segment Financial Summary 1Q:F15 as Adjusted* 6 $ million 1Q:F15 1Q:F14 Δ Sales 586.4 548.6 +37.8 Growth 6.9% 10.2% EBIT 91.0 78.6 +12.4 EBIT margin (%) 15.5% 14.3% +120 bps • Strong growth in General Industrial and Wood, driven by new business wins • Coil benefitted from new business wins • Packaging grew sales • Operating margin increased 120 bps due to volume growth and productivity initiatives Legend: LSD – low single digit % yoy change MSD – mid single digit % yoy change HSD – high single digit % yoy change DD – double digit % yoy change *Non - GAAP measure. Please refer to the Reconciliation of non - GAAP Measures slide Numbers subject to rounding Parenthesis indicates negative Coatings Sales comparison 1Q:F15 vs. 1Q:F14 Volume Price/Mix FX Acquis. Total Sales +10% - (3%) - +7% Product Line Performance 1Q:F15 vs. 1Q:F14 Volume Sales Packaging +MSD +MSD General Industrial +DD +DD Coil +MSD +MSD Wood +DD +DD February 24, 2015

Paints Segment Financial Summary 1Q:F15 as Adjusted* 7 $ million 1Q:F15 1Q:F14 Δ Sales 358.6 361.4 (2.8) Growth (0.8%) 9.8% EBIT 28.5 33.8 (5.3) EBIT margin (%) 8.0% 9.4% (140 bps) • Strong volume growth in international businesses: Europe, Australia and Asia • North American performance was impacted by (1) difficult comps vs. 1Q of last year and (2) previously disclosed adjustment to our product line offering at a customer in North America Paints Sales comparison 1Q:F15 vs. 1Q:F14 Volume Price/Mix FX Acquis. Total Sales +5% (3%) (3%) - (1%) Product Line Performance 1Q:F15 vs. 1Q:F14 Volume Sales North America (MSD) (LSD) Asia +HSD (LSD) Australia +DD (MSD) *Non - GAAP measure. Please refer to the Reconciliation of non - GAAP Measures slide Numbers subject to rounding Parenthesis indicates negative Legend: LSD – low single digit % yoy change MSD – mid single digit % yoy change HSD – high single digit % yoy change DD – double digit % yoy change February 24, 2015

Non - GAAP Financial Measures 8 This discussion includes financial information prepared in accordance with accounting principles generally accepted in the United States ( GAAP ), as well as certain non - GAAP financial measures such as adjusted return on invested capital, adjusted operating cash flow, adjusted operating margin, and adjusted net income per common share – diluted . Generally, a non - GAAP financial measure is a numerical measure of financial performance that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP . The non - GAAP financial measures should be viewed as a supplement to, and not a substitute for, financial measures presented in accordance with GAAP . Non - GAAP measures as presented herein may not be comparable to similarly titled measures used by other companies . We believe that the non - GAAP financial measures provide meaningful information to assist investors in understanding our financial results and assessing prospects for future performance without regard to restructuring charges . We believe adjusted return on invested capital, adjusted operating cash flow, adjusted operating margin, net income per common share – diluted are important indicators of our operations because they exclude items that may not be indicative of or are unrelated to our core operating results and provide a baseline for analyzing trends in our underlying business . To measure adjusted operating cash flow and adjusted operating margin we remove the impact of before - tax restructuring charges . Adjusted return on invested capital and adjusted net income per common share – diluted are calculated by removing the after - tax impact of restructuring charges from our calculated net income and net income per common share – diluted . Since non - GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non - GAAP financial measures . These non - GAAP financial measures are an additional way to view aspects of our operations that, when viewed with our GAAP results included in our financial statements and publicly filed reports, provide a more complete understanding of our business . We strongly encourage investors and shareholders to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure . February 24, 2015

Reconciliation of non - GAAP Financial Measures 9 Three Months Ended Three Months Ended January 30, 2015 January 24, 2014 Dollars % of Net Sales Dollars % of Net Sales Coatings Segment Earnings Before Interest and Taxes (EBIT) $ 135,609 23.1% $ 69,975 12.8% Restructuring Charges - Cost of Sales 2,390 0.4% 4,265 0.8% Restructuring Charges - Operating Expense 963 0.2% 4,355 0.8% Gain on Sale of Certain Assets (48,001) (8.2%) — 0.0% Adjusted EBIT $ 90,961 15.5% $ 78,595 14.3% Paints Segment EBIT $ 25,329 7.1% $ 30,997 8.6% Restructuring Charges - Cost of Sales 2,459 0.7% 1,775 0.5% Restructuring Charges - Operating Expense 731 0.2% 1,044 0.3% Adjusted EBIT $ 28,519 8.0% $ 33,816 9.4% Other and Administrative EBIT $ (2,617) (5.6%) $ (5,783) (12.5%) Restructuring Charges - Cost of Sales — 0.0% 66 0.1% Restructuring Charges - Operating Expense — 0.0% 301 0.7% Adjusted EBIT $ (2,617) (5.6%) $ (5,416) (11.7%) Total Gross Profit $ 333,292 33.6% $ 319,053 33.4% Restructuring Charges - Cost of Sales 4,849 0.5% 6,106 0.6% Adjusted Gross Profit $ 338,141 34.1% $ 325,159 34.0% Operating Expenses $ 223,937 22.6% $ 223,493 23.4% Restructuring Charges - Operating Expense (1,694) (0.2%) (5,700) (0.6%) Adjusted Operating Expenses $ 222,243 22.4% $ 217,793 22.8% EBIT $ 158,321 16.0% $ 95,189 10.0% Restructuring Charges - Total 6,543 0.7% 11,806 1.2% Gain on Sale of Certain Assets (48,001) (4.8%) — 0.0% Adjusted EBIT $ 116,863 11.8% $ 106,995 11.2% Net Income $ 103,974 $ 53,553 After Tax Restructuring Charges - Total 4,118 7,581 After Tax Gain on Sale of Certain Assets (37,216) — Adjusted Net Income $ 70,876 $ 61,134 Net Income per Common Share - diluted $ 1.24 $ 0.61 After Tax Restructuring Charges - Total 0.05 0.09 After Tax Gain on Sale of Certain Assets (0.44) — Adjusted Net Income per Common Share - diluted $ 0.85 $ 0.70 February 24, 2015

Appendix F2014 Historical Information 10 February 24, 2015

Historical Sales Detail – Segments 11 Q1:2014 Total Volume Price/Mix FX Acquisition Coatings Segment 10% 4% (3%) (1%) 11% Paints Segment 10% 23% (14%) (2%) 3% Total Valspar 9% 11% (8%) (1%) 7% Q2:2014 Total Volume Price/Mix FX Acquisition Coatings Segment 12% 4% (1%) (2%) 11% Paints Segment 8% 9% 1% (2%) - Total Valspar 10% 5% - (2%) 6% Q3:2014 Total Volume Price/Mix FX Acquisition Coatings Segment 16% 5% 1% - 10% Paints Segment 4% 9% (4%) (1%) - Total Valspar 10% 7% (1%) (1%) 5% Q4:2014 Total Volume Price/Mix FX Acquisition Coatings Segment 15% 9% 2% - 4% Paints Segment 7% 7% (1%) - - Total Valspar 11% 8% 1% - 2% FY2014 Total Volume Price/Mix FX Acquisition Coatings Segment 14% 6% - (1%) 9% Paints Segment 7% 11% (3%) (1%) 1% Total Valspar 10% 8% (2%) (1%) 5% February 24, 2015 Numbers subject to rounding Parenthesis indicates negative

Historical Sales Detail – Key Product Lines 12 Q1:2014 Q2:2014 Q3:2014 Q4:2014 F2014 Sales Volume Sales Volume Sales Volume Sales Volume Sales Volume Coatings Segment 10% 4% 12% 4% 16% 5% 15% 9% 14% 6% Packaging (LSD) HSD (LSD) MSD MSD LSD DD DD MSD HSD Industrial General Industrial DD (LSD) DD (MSD) DD (LSD) DD DD DD LSD Coil (MSD) (MSD) (MSD) (MSD) MSD MSD DD HSD LSD LSD Wood MSD LSD LSD LSD MSD DD Flat LSD LSD MSD Paints Segment 10% 23% 8% 9% 4% 9% 7% 7% 7% 11% North America DD DD DD DD LSD (LSD) LSD (LSD) HSD MSD Asia DD DD (LSD) LSD MSD DD LSD DD HSD DD Australia (HSD) LSD (DD) LSD LSD DD DD DD (LSD) HSD Legend: LSD – low single digit % yoy change MSD – mid single digit % yoy change HSD – high single digit % yoy change DD – double digit % yoy change Volumes reflect core business growth ex - acquisition Numbers subject to rounding Parenthesis indicates negative February 24, 2015

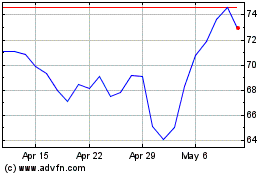

Valaris (NYSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

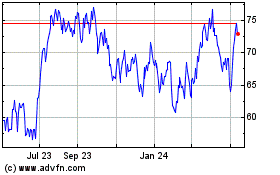

Valaris (NYSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024