UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): April 30, 2015 (April 30, 2015)

________________

Rockwell Automation, Inc.

(Exact name of registrant as specified in its charter)

________________

|

| | |

Delaware | 1-12383 | 25-1797617 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

1201 South Second Street

Milwaukee, Wisconsin 53204

(Address of principal executive offices, including zip code)

+1 (414) 382-2000

(Registrant's telephone number, including area code)

________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d‑2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e‑4(c))

INFORMATION TO BE INCLUDED IN THE REPORT

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

Registrant's press release dated April 30, 2015, announcing its financial results for the quarter ended March 31, 2015, is furnished herewith as Exhibit 99 and is incorporated herein by reference. |

| |

Item 9.01. | Financial Statements and Exhibits. |

|

| | |

Exhibit Number | | Description |

99 | | Press Release of Registrant dated April 30, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| ROCKWELL AUTOMATION, INC. |

| (Registrant) |

| | | |

| By | | /S/ DOUGLAS M. HAGERMAN |

| | | Douglas M. Hagerman |

| | | Senior Vice President, General Counsel and Secretary |

Date: April 30, 2015

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99 | | Press Release of Registrant dated April 30, 2015. |

Exhibit 99

1201 S. Second Street

Milwaukee, WI 53204

USA

News Release

|

| | | | |

| | | | |

Contact | | John Bernaden Media Relations Rockwell Automation 414.382.2555 | | Rondi Rohr-Dralle Investor Relations Rockwell Automation 414.382.8510 |

Rockwell Automation Reports Second Quarter 2015 Results

| |

• | Organic sales up 2.7 percent year over year; reported sales down 3.1 percent |

| |

• | Adjusted EPS of $1.59 — up 18 percent year over year; diluted EPS of $1.51 |

| |

• | Company maintains 2015 Adjusted EPS guidance of $6.50 - $6.80 on lower sales |

MILWAUKEE (April 30, 2015) — Rockwell Automation, Inc. (NYSE: ROK) today reported fiscal 2015 second quarter sales of $1,550.8 million, down 3.1 percent from $1,600.5 million in the second quarter of fiscal 2014. Organic sales grew 2.7 percent, and currency translation reduced sales by 6.0 percent.

Fiscal 2015 second quarter Adjusted EPS was $1.59, up 18 percent compared to $1.35 in the second quarter of fiscal 2014. Total segment operating earnings were $334.2 million in the second quarter of fiscal 2015, up 11 percent from $302.1 million in the same period of fiscal 2014. Total segment operating margin expanded to 21.6 percent from 18.9 percent a year ago, primarily due to higher organic sales, strong productivity and favorable mix, partially offset by increased spending.

On a GAAP basis, fiscal 2015 second quarter net income was $206.0 million or $1.51 per share, compared to $180.3 million or $1.28 per share in the second quarter of fiscal 2014. Pre-tax margin increased to 17.8 percent in the second quarter of fiscal 2015 from 15.5 percent in the same period last year.

Commenting on the results, Keith D. Nosbusch, chairman and chief executive officer, said, "Earnings growth in the quarter was robust in spite of lower sales, as solid organic sales growth was more than offset by a large currency headwind. Margin expansion was very healthy and free cash flow was also strong in the quarter. I am extremely pleased with 15 percent first half growth in Adjusted EPS, an excellent result in this market environment. We have demonstrated that even in a lower growth environment, we can still grow earnings and deliver great value to shareowners."

Outlook

Commenting on the outlook, Nosbusch added, "Based on a softer forecast for industrial production growth, a reduced outlook for oil and gas, and our solutions and services backlog entering the second half, we are lowering our full-year organic growth by 1 point. We are also including a larger currency headwind and now expect fiscal 2015 reported sales of about $6.4 billion. In spite of the top line reduction, our expectation for a higher full-year margin enables us to maintain the Adjusted EPS guidance range of $6.50 to $6.80.

"Revenue diversification and agility are helping us to pursue the best growth opportunities. Our strong productivity culture will enable us to invest in innovation and organic growth."

Following is a discussion of fiscal 2015 second quarter results for both segments.

Architecture & Software

Architecture & Software quarterly sales were $674.3 million, a decrease of 1.8 percent from $686.8 million in the same period last year. Organic sales increased 4.8 percent, and currency translation reduced sales by 6.7 percent. Segment operating earnings were $200.8 million compared to $190.2 million in the same period last year. Segment operating margin increased to 29.8 percent from 27.7 percent a year ago.

Control Products & Solutions

Control Products & Solutions quarterly sales were $876.5 million, a decrease of 4.1 percent compared to $913.7 million in the same period last year. Organic sales increased 1.2 percent, and currency translation reduced sales by 5.5 percent. Segment operating earnings were $133.4 million compared to $111.9 million in the same period last year. Segment operating margin increased to 15.2 percent from 12.2 percent a year ago.

Other Information

In the second quarter of fiscal 2015 free cash flow was $269.4 million and cash flow provided by operating activities was $285.2 million. Return on invested capital was 32.0 percent.

Fiscal 2015 second quarter general corporate-net expense was $21.4 million compared to $18.9 million in the second quarter of fiscal 2014.

The Adjusted Effective Tax Rate for the second quarter of fiscal 2015 was 26.0 percent compared to 27.9 percent in the second quarter of fiscal 2014. The Company continues to expect a full-year Adjusted Effective Tax Rate for fiscal 2015 of approximately 26.5 percent. The full-year rates reflect the retroactive extension of the U.S. research and development credit for 2014. On a GAAP basis, the effective tax rate in the second quarter of fiscal 2015 was 25.5 percent compared to 27.4 percent a year ago.

During the second quarter of fiscal 2015, the Company repurchased 1.14 million shares of its common stock at a cost of $127.1 million. At March 31, 2015, $757.0 million remained available under the existing share repurchase authorization.

Organic sales, total segment operating earnings, total segment operating margin, Adjusted Income, Adjusted EPS, Adjusted Effective Tax Rate, free cash flow and return on invested capital are non-GAAP measures that are reconciled to GAAP measures in the attachments to this release.

Conference Call

A conference call to discuss our financial results will take place at 8:30 a.m. Eastern Time on April 30, 2015. The call and related financial charts will be webcast and accessible via the Rockwell Automation website (http://www.rockwellautomation.com/investors/).

This news release contains statements (including certain projections and business trends) that are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Words such as “believe”, “estimate”, “project”, “plan”, “expect”, “anticipate”, “will”, “intend” and other similar expressions may identify forward-looking statements. Actual results may differ materially from those projected as a result of certain risks and uncertainties, many of which are beyond our control, including but not limited to:

| |

• | macroeconomic factors, including global and regional business conditions, the availability and cost of capital, commodity prices, the cyclical nature of our customers’ capital spending, sovereign debt concerns and currency exchange rates; |

| |

• | laws, regulations and governmental policies affecting our activities in the countries where we do business; |

| |

• | the successful development of advanced technologies and demand for and market acceptance of new and existing products; |

| |

• | the availability, effectiveness and security of our information technology systems; |

| |

• | competitive products, solutions and services and pricing pressures, and our ability to provide high quality products, solutions and services; |

| |

• | a disruption of our business due to natural disasters, pandemics, acts of war, strikes, terrorism, social unrest or other causes; |

| |

• | intellectual property infringement claims by others and the ability to protect our intellectual property; |

| |

• | the uncertainty of claims by taxing authorities in the various jurisdictions where we do business; |

| |

• | our ability to attract and retain qualified personnel; |

| |

• | our ability to manage costs related to employee retirement and health care benefits; |

| |

• | the uncertainties of litigation, including liabilities related to the safety and security of the products, solutions and services we sell; |

| |

• | our ability to manage and mitigate the risks associated with our solutions and services businesses; |

| |

• | a disruption of our distribution channels; |

| |

• | the availability and price of components and materials; |

| |

• | the successful integration and management of acquired businesses; |

| |

• | the successful execution of our cost productivity and globalization initiatives; and |

| |

• | other risks and uncertainties, including but not limited to those detailed from time to time in our Securities and Exchange Commission (SEC) filings. |

These forward-looking statements reflect our beliefs as of the date of filing this release. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Rockwell Automation, Inc. (NYSE: ROK), the world’s largest company dedicated to industrial automation and information, makes its customers more productive and the world more sustainable. Headquartered in Milwaukee, Wis., Rockwell Automation employs over 22,500 people serving customers in more than 80 countries.

ROCKWELL AUTOMATION, INC.

SALES AND EARNINGS INFORMATION

(in millions, except per share amounts and percentages)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | Six Months Ended

March 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Sales | | | | | | | | |

Architecture & Software (a) | | $ | 674.3 |

| | $ | 686.8 |

| | $ | 1,382.1 |

| | $ | 1,382.7 |

|

Control Products & Solutions (b) | | 876.5 |

| | 913.7 |

| | 1,743.1 |

| | 1,809.5 |

|

Total sales (c) | | $ | 1,550.8 |

| | $ | 1,600.5 |

| | $ | 3,125.2 |

| | $ | 3,192.2 |

|

| | | | | | | | |

Segment operating earnings | | | | | | | | |

Architecture & Software (d) | | $ | 200.8 |

| | $ | 190.2 |

| | $ | 422.2 |

| | $ | 402.1 |

|

Control Products & Solutions (e) | | 133.4 |

| | 111.9 |

| | 258.8 |

| | 228.0 |

|

Total segment operating earnings1 (f) | | 334.2 |

| | 302.1 |

| | 681.0 |

| | 630.1 |

|

| | | | | | | | |

Purchase accounting depreciation and amortization | | (5.2 | ) | | (5.8 | ) | | (10.6 | ) | | (10.4 | ) |

General corporate—net | | (21.4 | ) | | (18.9 | ) | | (44.2 | ) | | (40.6 | ) |

Non-operating pension costs | | (15.4 | ) | | (14.0 | ) | | (31.6 | ) | | (28.0 | ) |

Interest expense | | (15.7 | ) | | (15.0 | ) | | (30.6 | ) | | (29.9 | ) |

Income before income taxes (g) | | 276.5 |

| | 248.4 |

| | 564.0 |

| | 521.2 |

|

Income tax provision | | (70.5 | ) | | (68.1 | ) | | (143.8 | ) | | (142.8 | ) |

Net income | | $ | 206.0 |

| | $ | 180.3 |

| | $ | 420.2 |

| | $ | 378.4 |

|

| | | | | | | | |

Diluted EPS | | $ | 1.51 |

| | $ | 1.28 |

| | $ | 3.08 |

| | $ | 2.70 |

|

| | | | | | | | |

Adjusted EPS2 | | $ | 1.59 |

| | $ | 1.35 |

| | $ | 3.23 |

| | $ | 2.82 |

|

| | | | | | | | |

Average diluted shares | | 136.0 |

| | 140.2 |

| | 136.5 |

| | 140.2 |

|

| | | | | | | | |

Segment operating margin | | | | | | | | |

Architecture & Software (d/a) | | 29.8 | % | | 27.7 | % | | 30.5 | % | | 29.1 | % |

Control Products & Solutions (e/b) | | 15.2 | % | | 12.2 | % | | 14.8 | % | | 12.6 | % |

Total segment operating margin1 (f/c) | | 21.6 | % | | 18.9 | % | | 21.8 | % | | 19.7 | % |

| | | | | | | | |

Pre-tax margin (g/c) | | 17.8 | % | | 15.5 | % | | 18.0 | % | | 16.3 | % |

1Total segment operating earnings and total segment operating margin are non-GAAP financial measures. We believe that these measures are useful to investors as measures of operating performance. We use these measures to monitor and evaluate the profitability of our Company. Our measures of total segment operating earnings and total segment operating margin may be different from those used by other companies.

2Adjusted EPS is a non-GAAP earnings measure that excludes the non-operating pension costs and their related income tax effects. See "Other Supplemental Information - Adjusted Income, Adjusted EPS and Adjusted Effective Tax Rate" section for more information regarding non-operating pension costs and a reconciliation to GAAP measures.

ROCKWELL AUTOMATION, INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in millions)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | Six Months Ended

March 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Sales | | $ | 1,550.8 |

| | $ | 1,600.5 |

| | $ | 3,125.2 |

| | $ | 3,192.2 |

|

Cost of sales | | (877.6 | ) | | (944.7 | ) | | (1,764.5 | ) | | (1,872.7 | ) |

Gross profit | | 673.2 |

| | 655.8 |

| | 1,360.7 |

| | 1,319.5 |

|

| | | | | | | | |

Selling, general and administrative expenses | | (382.4 | ) | | (392.5 | ) | | (769.3 | ) | | (777.9 | ) |

Other income | | 1.4 |

| | 0.1 |

| | 3.2 |

| | 9.5 |

|

Interest expense | | (15.7 | ) | | (15.0 | ) | | (30.6 | ) | | (29.9 | ) |

Income before income taxes | | 276.5 |

| | 248.4 |

| | 564.0 |

| | 521.2 |

|

Income tax provision | | (70.5 | ) | | (68.1 | ) | | (143.8 | ) | | (142.8 | ) |

| | | | | | | | |

Net income | | $ | 206.0 |

| | $ | 180.3 |

| | $ | 420.2 |

| | $ | 378.4 |

|

ROCKWELL AUTOMATION, INC.

CONDENSED BALANCE SHEET INFORMATION

(in millions)

|

| | | | | | | | |

| | March 31,

2015 | | September 30,

2014 |

Assets | | | | |

Cash and cash equivalents | | $ | 1,402.9 |

| | $ | 1,191.3 |

|

Short-term investments | | 634.7 |

| | 628.5 |

|

Receivables | | 1,060.3 |

| | 1,215.8 |

|

Inventories | | 595.6 |

| | 588.4 |

|

Property, net | | 598.0 |

| | 632.9 |

|

Goodwill and intangibles | | 1,275.5 |

| | 1,296.8 |

|

Other assets | | 713.2 |

| | 675.8 |

|

Total | | $ | 6,280.2 |

| | $ | 6,229.5 |

|

| | | | |

Liabilities and Shareowners’ Equity | | | | |

Short-term debt | | $ | — |

| | $ | 325.0 |

|

Accounts payable | | 515.4 |

| | 520.6 |

|

Long-term debt | | 1,505.4 |

| | 905.6 |

|

Other liabilities | | 1,692.9 |

| | 1,820.2 |

|

Shareowners’ equity | | 2,566.5 |

| | 2,658.1 |

|

Total | | $ | 6,280.2 |

| | $ | 6,229.5 |

|

ROCKWELL AUTOMATION, INC.

CONDENSED CASH FLOW INFORMATION

(in millions)

|

| | | | | | | | |

| | Six Months Ended

March 31, |

| | 2015 | | 2014 |

Operating activities: | | | | |

Income from continuing operations | | $ | 420.2 |

| | $ | 378.4 |

|

Depreciation and amortization | | 79.7 |

| | 74.3 |

|

Retirement benefits expense | | 71.3 |

| | 66.5 |

|

Pension contributions | | (21.3 | ) | | (25.1 | ) |

Receivables/inventories/payables | | 73.3 |

| | (55.9 | ) |

Advanced payments from customers and deferred revenue | | 24.6 |

| | 39.5 |

|

Compensation and benefits | | (70.3 | ) | | (32.9 | ) |

Income taxes | | (14.0 | ) | | (37.3 | ) |

Other | | (10.1 | ) | | (1.2 | ) |

Cash provided by operating activities | | 553.4 |

| | 406.3 |

|

Investing activities: | | | | |

Capital expenditures | | (58.0 | ) | | (58.3 | ) |

Acquisition of business, net of cash acquired | | (21.2 | ) | | (81.5 | ) |

Purchases of short-term investments | | (338.0 | ) | | (310.8 | ) |

Proceeds from maturities of short-term investments | | 323.8 |

| | 197.8 |

|

Proceeds from sale of property | | 0.2 |

| | 0.2 |

|

Other investing activities | | — |

| | (3.4 | ) |

Cash used for investing activities | | (93.2 | ) | | (256.0 | ) |

Financing activities: | | | | |

Net (repayment) issuance of short-term debt | | (325.0 | ) | | 163.5 |

|

Issuance of long-term debt, net of discount and issuance costs | | 594.3 |

| | — |

|

Cash dividends | | (175.9 | ) | | (160.9 | ) |

Purchases of treasury stock | | (293.0 | ) | | (217.8 | ) |

Proceeds from the exercise of stock options | | 22.7 |

| | 83.9 |

|

Excess income tax benefit from share-based compensation | | 6.6 |

| | 18.6 |

|

Other financing activities | | (1.6 | ) | | — |

|

Cash used for financing activities | | (171.9 | ) | | (112.7 | ) |

Effect of exchange rate changes on cash | | (76.7 | ) | | 1.3 |

|

Increase in cash and cash equivalents | | $ | 211.6 |

| | $ | 38.9 |

|

ROCKWELL AUTOMATION, INC.

OTHER SUPPLEMENTAL INFORMATION

(in millions)

Organic Sales

Our press release contains information regarding organic sales, which we define as sales excluding the effect of changes in currency exchange rates and acquisitions. We believe this non-GAAP measure provides useful information to investors because it reflects regional and operating segment performance from our activities without the effect of changes in currency exchange rates and/or acquisitions. We use organic sales as one measure to monitor and evaluate our regional and operating segment performance. We determine the effect of changes in currency exchange rates by translating the respective period’s sales using the currency exchange rates that were in effect during the prior year. When we acquire businesses, we exclude sales in the current year for which there are no comparable sales in the prior period. Organic sales growth is calculated by comparing organic sales to reported sales in the prior year. Sales are attributed to the geographic regions based on the country of destination.

The following is a reconciliation of reported sales to organic sales for the three and six months ended March 31, 2015 compared to sales for the three and six months ended March 31, 2014:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2015 | | 2014 |

| | Sales | | Effect of Changes in Currency | | Sales Excluding Effect of Changes in Currency | | Effect of Acquisitions | | Organic Sales | | Sales |

United States | | $ | 863.2 |

| | $ | 1.1 |

| | $ | 864.3 |

| | $ | (2.0 | ) | | $ | 862.3 |

| | $ | 832.9 |

|

Canada | | 85.8 |

| | 10.6 |

| | 96.4 |

| | — |

| | 96.4 |

| | 108.1 |

|

Europe, Middle East, Africa | | 285.9 |

| | 58.4 |

| | 344.3 |

| | (0.2 | ) | | 344.1 |

| | 340.0 |

|

Asia Pacific | | 199.4 |

| | 7.6 |

| | 207.0 |

| | — |

| | 207.0 |

| | 200.5 |

|

Latin America | | 116.5 |

| | 17.7 |

| | 134.2 |

| | — |

| | 134.2 |

| | 119.0 |

|

Total | | $ | 1,550.8 |

| | $ | 95.4 |

| | $ | 1,646.2 |

| | $ | (2.2 | ) | | $ | 1,644.0 |

| | $ | 1,600.5 |

|

| | | | | | | | | | | | |

| | Six Months Ended March 31, |

| | 2015 | | 2014 |

| | Sales | | Effect of Changes in Currency | | Sales Excluding Effect of Changes in Currency | | Effect of Acquisitions | | Organic Sales | | Sales |

United States | | $ | 1,700.0 |

| | $ | 1.7 |

| | $ | 1,701.7 |

| | $ | (3.0 | ) | | $ | 1,698.7 |

| | $ | 1,669.3 |

|

Canada | | 185.8 |

| | 18.4 |

| | 204.2 |

| | — |

| | 204.2 |

| | 207.7 |

|

Europe, Middle East, Africa | | 582.8 |

| | 84.9 |

| | 667.7 |

| | (2.7 | ) | | 665.0 |

| | 664.4 |

|

Asia Pacific | | 406.6 |

| | 13.1 |

| | 419.7 |

| | — |

| | 419.7 |

| | 407.3 |

|

Latin America | | 250.0 |

| | 31.3 |

| | 281.3 |

| | — |

| | 281.3 |

| | 243.5 |

|

Total | | $ | 3,125.2 |

| | $ | 149.4 |

| | $ | 3,274.6 |

| | $ | (5.7 | ) | | $ | 3,268.9 |

| | $ | 3,192.2 |

|

The following is a reconciliation of reported sales to organic sales for our operating segments for the three and six months ended March 31, 2015 compared to sales for the three and six months ended March 31, 2014:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2015 | | 2014 |

| | Sales | | Effect of Changes in Currency | | Sales Excluding Effect of Changes in Currency | | Effect of Acquisitions | | Organic Sales | | Sales |

Architecture & Software | | $ | 674.3 |

| | $ | 45.8 |

| | $ | 720.1 |

| | $ | (0.6 | ) | | $ | 719.5 |

| | $ | 686.8 |

|

Control Products & Solutions | | 876.5 |

| | 49.6 |

| | 926.1 |

| | (1.6 | ) | | 924.5 |

| | 913.7 |

|

Total | | $ | 1,550.8 |

| | $ | 95.4 |

| | $ | 1,646.2 |

| | $ | (2.2 | ) | | $ | 1,644.0 |

| | $ | 1,600.5 |

|

| | | | | | | | | | | | |

| | Six Months Ended March 31, |

| | 2015 | | 2014 |

| | Sales | | Effect of Changes in Currency | | Sales Excluding Effect of Changes in Currency | | Effect of Acquisitions | | Organic Sales | | Sales |

Architecture & Software | | $ | 1,382.1 |

| | $ | 71.2 |

| | $ | 1,453.3 |

| | $ | (2.2 | ) | | $ | 1,451.1 |

| | $ | 1,382.7 |

|

Control Products & Solutions | | 1,743.1 |

| | 78.2 |

| | 1,821.3 |

| | (3.5 | ) | | 1,817.8 |

| | 1,809.5 |

|

Total | | $ | 3,125.2 |

| | $ | 149.4 |

| | $ | 3,274.6 |

| | $ | (5.7 | ) | | $ | 3,268.9 |

| | $ | 3,192.2 |

|

ROCKWELL AUTOMATION, INC.

OTHER SUPPLEMENTAL INFORMATION

(in millions, except per share amounts and percentages)

Adjusted Income, Adjusted EPS and Adjusted Effective Tax Rate

Our press release contains financial information and earnings guidance regarding Adjusted Income, Adjusted EPS and Adjusted Effective Tax Rate, which are non-GAAP earnings measures that exclude non-operating pension costs and their related income tax effects. We define non-operating pension costs as defined benefit plan interest cost, expected return on plan assets, amortization of actuarial gains and losses and the impact of any plan curtailments or settlements. These components of net periodic benefit cost primarily relate to changes in pension assets and liabilities that are a result of market performance; we consider these costs to be unrelated to the operating performance of our business. We believe that Adjusted Income, Adjusted EPS and Adjusted Effective Tax Rate provide useful information to our investors about our operating performance and allow management and investors to compare our operating performance period over period. Our measures of Adjusted Income, Adjusted EPS and Adjusted Effective Tax Rate may be different from measures used by other companies. These non-GAAP measures should not be considered a substitute for income from continuing operations, diluted EPS and effective tax rate.

The following are the components of operating and non-operating pension costs for the three and six months ended March 31, 2015 and 2014:

|

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | Six Months Ended

March 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Service cost | $ | 21.5 |

| | $ | 19.6 |

| | $ | 43.2 |

| | $ | 39.3 |

|

Amortization of prior service credit | (0.6 | ) | | (0.7 | ) | | (1.3 | ) | | (1.4 | ) |

Operating pension costs | 20.9 |

| | 18.9 |

| | 41.9 |

| | 37.9 |

|

| | | | | | | |

Interest cost | 41.6 |

| | 43.6 |

| | 83.9 |

| | 87.2 |

|

Expected return on plan assets | (55.8 | ) | | (54.5 | ) | | (111.9 | ) | | (109.0 | ) |

Amortization of net actuarial loss | 29.6 |

| | 24.9 |

| | 59.6 |

| | 49.8 |

|

Non-operating pension costs | 15.4 |

| | 14.0 |

| | 31.6 |

| | 28.0 |

|

| | | | | | | |

Net periodic pension cost | $ | 36.3 |

| | $ | 32.9 |

| | $ | 73.5 |

| | $ | 65.9 |

|

The following are reconciliations of income from continuing operations, diluted EPS from continuing operations, and effective tax rate to Adjusted Income, Adjusted EPS and Adjusted Effective Tax Rate:

|

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | Six Months Ended

March 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Income from continuing operations | $ | 206.0 |

| | $ | 180.3 |

| | $ | 420.2 |

| | $ | 378.4 |

|

Non-operating pension costs | 15.4 |

| | 14.0 |

| | 31.6 |

| | 28.0 |

|

Tax effect of non-operating pension costs | (5.4 | ) | | (5.0 | ) | | (11.0 | ) | | (10.0 | ) |

Adjusted Income | $ | 216.0 |

| | $ | 189.3 |

| | $ | 440.8 |

| | $ | 396.4 |

|

| | | | | | | |

Diluted EPS from continuing operations | $ | 1.51 |

| | $ | 1.28 |

| | $ | 3.08 |

| | $ | 2.70 |

|

Non-operating pension costs per diluted share | 0.12 |

| | 0.10 |

| | 0.23 |

| | 0.19 |

|

Tax effect of non-operating pension costs per diluted share | (0.04 | ) | | (0.03 | ) | | (0.08 | ) | | (0.07 | ) |

Adjusted EPS | $ | 1.59 |

| | $ | 1.35 |

| | $ | 3.23 |

| | $ | 2.82 |

|

| | | | | | | |

Effective tax rate | 25.5 | % | | 27.4 | % | | 25.5 | % | | 27.4 | % |

Tax effect of non-operating pension costs | 0.5 | % | | 0.5 | % | | 0.5 | % | | 0.4 | % |

Adjusted Effective Tax Rate | 26.0 | % | | 27.9 | % | | 26.0 | % | | 27.8 | % |

|

| | | | | | |

| | Fiscal 2015 Guidance | | Year Ended September 30, 2014 |

| | | | |

Diluted EPS from continuing operations | | $6.20 - $6.50 | | $ | 5.91 |

|

Non-operating pension costs per diluted share | | 0.46 | | 0.40 |

|

Tax effect of non-operating pension costs per diluted share | | (0.16) | | (0.14 | ) |

Adjusted EPS | | $6.50 - $6.80 | | $ | 6.17 |

|

ROCKWELL AUTOMATION, INC.

OTHER SUPPLEMENTAL INFORMATION

(in millions, except percentages)

Free Cash Flow

Our definition of free cash flow, which is a non-GAAP financial measure, takes into consideration capital investments required to maintain the operations of our businesses and execute our strategy. We account for share-based compensation under U.S. GAAP, which requires that we report the excess income tax benefit from share-based compensation as a financing cash flow rather than as an operating cash flow. We have added this benefit back to our calculation of free cash flow in order to generally classify cash flows arising from income taxes as operating cash flows.

In our opinion, free cash flow provides useful information to investors regarding our ability to generate cash from business operations that is available for acquisitions and other investments, service of debt principal, dividends and share repurchases. We use free cash flow, as defined, as one measure to monitor and evaluate performance. Our definition of free cash flow may be different from definitions used by other companies.

The following table summarizes free cash flow by quarter:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | Dec. 31,

2013 | | Mar. 31,

2014 | | Jun. 30,

2014 | | Sep. 30, 2014 | | Dec. 31,

2014 | | Mar. 31,

2015 |

Cash provided by continuing operating activities | | $ | 203.5 |

| | $ | 202.8 |

| | $ | 301.1 |

| | $ | 325.9 |

| | $ | 268.2 |

| | $ | 285.2 |

|

Capital expenditures | | (35.6 | ) | | (22.7 | ) | | (38.1 | ) | | (44.6 | ) | | (40.0 | ) | | (18.0 | ) |

Excess income tax benefit from share-based compensation | | 10.7 |

| | 7.9 |

| | 10.5 |

| | 0.8 |

| | 4.4 |

| | 2.2 |

|

Free cash flow | | $ | 178.6 |

| | $ | 188.0 |

| | $ | 273.5 |

| | $ | 282.1 |

| | $ | 232.6 |

| | $ | 269.4 |

|

Return On Invested Capital

Our press release contains information regarding Return On Invested Capital (ROIC), which is a non-GAAP financial measure. We believe that ROIC is useful to investors as a measure of performance and of the effectiveness of the use of capital in our operations. We use ROIC as one measure to monitor and evaluate performance. Our measure of ROIC may be different from that used by other companies. We define ROIC as the percentage resulting from the following calculation:

(a) Income from continuing operations, before interest expense, income tax provision, and purchase accounting depreciation and amortization, for the most recent twelve months; divided by

(b) average invested capital for the year, calculated as a five quarter rolling average using the sum of short-term debt, long-term debt, shareowners’ equity, and accumulated amortization of goodwill and other intangible assets, minus cash and cash equivalents and short-term investments; multiplied by

(c) one minus the effective tax rate for the twelve-month period.

ROIC is calculated as follows:

|

| | | | | | | | |

| | Twelve Months Ended |

| | March 31, |

| | 2015 | | 2014 |

(a) Return | | | | |

Income from continuing operations | | $ | 868.6 |

| | $ | 797.4 |

|

Interest expense | | 60.0 |

| | 60.1 |

|

Income tax provision | | 308.4 |

| | 260.4 |

|

Purchase accounting depreciation and amortization | | 21.8 |

| | 19.5 |

|

Return | | 1,258.8 |

| | 1,137.4 |

|

(b) Average invested capital | | | | |

Short-term debt | | 291.1 |

| | 245.7 |

|

Long-term debt | | 1,025.5 |

| | 905.1 |

|

Shareowners’ equity | | 2,654.6 |

| | 2,410.4 |

|

Accumulated amortization of goodwill and intangibles | | 783.2 |

| | 773.4 |

|

Cash and cash equivalents | | (1,260.2 | ) | | (1,135.7 | ) |

Short-term investments | | (588.8 | ) | | (391.8 | ) |

Average invested capital | | 2,905.4 |

| | 2,807.1 |

|

(c) Effective tax rate | | | | |

Income tax provision | | 308.4 |

| | 260.4 |

|

Income from continuing operations before income taxes | | $ | 1,177.0 |

| | $ | 1,057.8 |

|

Effective tax rate | | 26.2 | % | | 24.6 | % |

(a) / (b) * (1-c) Return On Invested Capital | | 32.0 | % | | 30.6 | % |

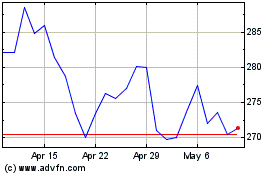

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Apr 2024 to May 2024

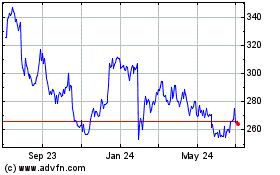

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From May 2023 to May 2024