Two Harbors Still Sees 'Big Wildcard' On Mortgage Refinancing

November 03 2011 - 3:48PM

Dow Jones News

Two Harbors Investment Corp. (TWO) on Thursday said it wasn't

backing away from the cautious outlook even as others may now be

more comfortable with the risks of a revised U.S. home loan

refinancing program.

The real estate investment trust, with a $6.6 billion portfolio,

last quarter joined others in selling mortgage bonds backed by

high-interest-rate loans as it became clear the Obama

administration would make it easier for borrowers without home

equity to refinance under a 2009 program. Two Harbors said late

Wednesday that it sold $681 million in mortgage bonds seen as most

vulnerable to refinancing.

Some investors have started to veer from that strategy since the

Federal Housing Finance Agency on Oct. 24 outlined changes,

however, as most analysts doubted the new features would

significantly boost refinancings. Buying has surged in higher-rate

bonds, but potential pitfalls for those MBS persists, warned Bill

Roth, co-chief investment officer of Two Harbors in New York.

"It's a huge focus in Washington, they really want to try and

make this work," Roth said of the Home Affordable Refinance

Program. "I think there's a huge amount of pressure to do something

that works" during a presidential election season.

Potential for faster refinancing has unnerved investors in the

$5 trillion market for mortgage-backed securities of Fannie Mae and

Freddie Mac this year as more government involvement distorts

predictability. MBS are also hovering at record high prices,

setting them up for steep falls as refinancings lead to

"prepayments" of principal at face value, or 100 cents on the

dollar.

Roth's concern is reflected in the portfolio's prepayment rate

of 5% over the past two quarters, the lowest among similar REITs,

according to Keefe, Bruyette & Woods. Agency MBS prepayment

rates last quarter at mortgage REITs Invesco Mortgage Capital and

Annaly Capital Management rose, though those firms this week also

said their portfolios were protected from a refinancing

pick-up.

Under the new plan, the Federal Housing Finance Agency, which

regulates government-owned mortgage-securities issuers Fannie Mae

and Freddie Mac, will allow refinancing of loans guaranteed by

those agencies no matter the home's value. The FHFA also will

extend the term of HARP though 2013 and will waive some liabilities

to banks, giving the lenders more incentive to close loans with

risky characteristics.

Since 2009, only 894,000 borrowers have used the HARP, of which

just 70,000 were significantly underwater. The FHFA said the

changes "may roughly double or more" the number of homeowners who

enroll, while analysts at Barclays Capital estimated up to 3.1

million loans are eligible for the program.

The FHFA is due to give more details at midmonth, including how

it plans to relieve banks of liability of their "representations

and warranties" if a refinancing reveals faults in the initial

loan.

"That's the $64,000 question," Roth said on a conference call

with analysts. Representations and warranties are the "big

wildcard" for whether the plan reaches more or less borrowers than

expected, he said.

Bets that many underwater loans will not meet new HARP rules, or

that banks will be too busy refinancing more preferable loans, have

sparked renewed interest in the high-coupon MBS, however. Fannie

Mae MBS paying 6% interest have recovered their losses since the

FHFA announcement, trading up 2/32 to 109-23/32 on Thursday.

Lower-coupon MBS fell, according to Credit Suisse.

Roth said that the high-coupon 30-year MBS Two Harbors sold at

price above 110 last quarter were still lower today. In their

place, the firm bought 4%-4.5% MBS with low principal balances that

require a bigger drop in interest rates to make the cost of a

refinancing worthwhile.

Two Harbors has also increased its allocation to nonguaranteed

residential mortgage bonds to take advantage of price drops in

recent months.

-By Al Yoon, Dow Jones Newswires; 212-416-3216;

albert.yoon@dowjones.com

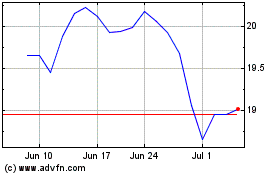

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Aug 2024 to Sep 2024

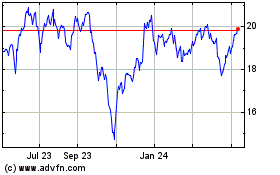

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Sep 2023 to Sep 2024