MUFG Americas Holdings Corporation (the Company), parent company

of San Francisco-based MUFG Union Bank, N.A. (the Bank), today

reported full year 2014 results. Net income for the full year was

$825 million, compared with net income of $667 million in 2013. Net

income for the quarter was $155 million, compared with $246 million

for the prior quarter and $179 million for the year-ago

quarter.

Full Year Highlights:

- Net income was $825 million, up $158

million, or 24 percent, from the prior year.

- Pre-tax pre-provision income was $1,064

million, up $265 million, or 33 percent, from the prior year.

- Solid loan and deposit growth:

- Loans held for investment were $76.8

billion at December 31, 2014, up $8.5 billion, or 12 percent, from

the prior year-end.

- Core deposits were $76.7 billion at

December 31, 2014, up $7.5 billion, or 11 percent, from the prior

year-end.

- Continued strong capital position:

- Capital ratios continued to exceed the

regulatory thresholds for "well-capitalized" bank holding

companies. Basel I Tier 1 and Total risk-based capital ratios were

12.79 percent and 14.73 percent, respectively, at December 31,

2014.

- In December 2014, the Federal Reserve

Board approved the Company's request to opt-out of the advanced

approaches methodology under U.S. Basel III regulatory capital

rules. The Bank will continue to be subject to the advanced

approaches rules.

Fourth Quarter

Highlights:

- Net income for the fourth quarter was

$155 million, down $91 million from the third quarter due to a

decrease in noninterest income and increases in income tax expense

and provision for loan losses.

- Core deposits grew 4 percent from

September 30, 2014 to $76.7 billion. Loans held for investment

grew 3 percent from September 30, 2014 to $76.8 billion.

- Continued disciplined underwriting

standards produced strong credit quality with low levels of

nonperforming assets and charge-offs.

- Nonperforming assets were $411 million,

or 0.36 percent of total assets, compared with $428 million, or

0.39 percent of total assets at September 30, 2014 and $499

million, or 0.48 percent of total assets, at December 31,

2013.

- Net loans recovered were $1 million for

the quarter, compared with net charge-offs of $12 million for the

prior quarter and $11 million in the year-ago quarter.

Business Integration

Initiative

Effective July 1, 2014, the U.S. branch banking operations of

The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU) were integrated under

the Bank's operations. This integration did not involve a legal

entity combination, but rather an integration of personnel and

certain business and support activities. The Bank and BTMU entered

into a master services agreement, which provides for employees of

the Bank to perform and make available various business, banking,

financial, and administrative and support services (the Services)

and facilities to BTMU in connection with the operation and

administration of BTMU's businesses in the U.S. (including BTMU's

U.S. branches). In consideration for the Services, BTMU pays to the

Bank fee income, which reflects market-based pricing. Costs related

to the Services performed by the transferred employees are

primarily reflected as salaries and employee benefits expense.

For the quarter and year ending December 31, 2014, the Company

recorded $168 million and $319 million, respectively, in fee income

from this initiative, including $112 million and $206 million,

respectively, related to support services provided by the Company

to BTMU. Noninterest expense related to the Services was $105

million and $193 million for the quarter and year ending December

31, 2014, respectively, primarily comprised of salaries and

employee benefits. The remaining fee income was recognized through

revenue sharing agreements with BTMU, with associated costs

included within the Company’s results.

Full Year 2014 Results

For the full year 2014, net income was $825 million, compared

with net income of $667 million in 2013. Total revenue for the full

year 2014 was $4.0 billion, an increase of $0.4 billion, or 11

percent, compared with 2013. Net interest income increased $146

million, or 5 percent, primarily due to loan growth, partially

offset by a lower net interest margin. Noninterest income increased

$247 million, or 28 percent, primarily due to fee income from

affiliates resulting from the business integration initiative.

Noninterest expense increased $128 million, or 5 percent, primarily

due to increased salaries and employee benefit costs from the

business integration initiative. The effective tax rate for full

year 2014 was 25.4 percent, compared with an effective tax rate of

23.1 percent for 2013.

Summary of Fourth Quarter

Results

Fourth Quarter Total

Revenue

For the fourth quarter 2014, total revenue (net interest income

plus noninterest income) was $1.1 billion, down $34 million

compared with the third quarter of 2014.

Net interest income increased slightly while noninterest income

decreased 9 percent. Net interest income for the fourth quarter

2014 was $709 million, up slightly compared with the third quarter

of 2014. The increase in net interest income was largely due to

growth in loans held for investment. Average total loans held for

investment increased $2.4 billion, or 3 percent, compared with the

third quarter of 2014 largely due to growth in commercial and

industrial loans and residential mortgages. The net interest margin

was 2.81 percent, down 6 basis points from the prior quarter

substantially due to lower yields on loans held for investment and

investment securities reflecting the low interest rate environment,

partially offset by lower funding costs. Average total deposits

increased $1.8 billion, or 2 percent, during the quarter compared

with the third quarter of 2014.

For the fourth quarter 2014, noninterest income was $352

million, down $36 million, or 9 percent, compared with the third

quarter of 2014, largely due to higher trading account activities

and investment securities gains in the prior quarter.

Compared with the fourth quarter of 2013, total revenue

increased $165 million, with net interest income increasing

slightly while noninterest income increased 85 percent. Noninterest

income increased largely due to fees from affiliates resulting from

the business integration initiative. Average total loans held for

investment increased $8.2 billion, or 12 percent, compared with the

fourth quarter 2013. Average total deposits increased $4.3 billion

compared with the fourth quarter of 2013, with average interest

bearing deposits up $0.8 billion, or 2 percent, and average

noninterest bearing deposits up $3.5 billion, or 13 percent.

Fourth Quarter Noninterest

Expense

Noninterest expense for the fourth quarter 2014 was $807

million, up slightly compared with the third quarter 2014 and up

$118 million from the fourth quarter 2013. The increase from the

fourth quarter 2013 was largely due to increased employee costs as

a result of the business integration initiative. The effective tax

rate for the fourth quarter of 2014 was 38.9 percent, compared with

an effective tax rate of 21.7 percent for the third quarter of

2014. Income tax expense recorded in the fourth quarter includes an

adjustment to align estimated expense with actual full year 2014

results.

Balance Sheet

At December 31, 2014, total assets were $113.7 billion, up

$2.8 billion compared with September 30, 2014, primarily

reflecting loan growth. Total loans held for investment increased 3

percent compared with the third quarter of 2014 reflecting growth

in core customer segments within the commercial and industrial loan

portfolio and continuing growth in residential mortgage lending in

our geographic footprint, with credit quality attributes consistent

with the existing portfolio.

Total liabilities were $98.5 billion, up $2.9 billion compared

with September 30, 2014, primarily due to an increase in

deposit growth. At December 31, 2014, total deposits were

$86.0 billion, up $3.6 billion compared with September 30,

2014. Core deposits at December 31, 2014 were $76.7 billion

compared with $73.6 billion at September 30, 2014.

Credit Quality

Credit quality remained strong in the fourth quarter 2014

reflected by continued low levels of nonperforming assets and a net

recovery of loans previously charged off.

Nonperforming assets as of December 31, 2014 were $411 million,

or 0.36 percent of total assets, compared with $428 million, or

0.39 percent of total assets, at September 30, 2014, and $499

million, or 0.48 percent of total assets at December 31,

2013.

Net loans recovered were $1 million for the fourth quarter of

2014 compared with net loans charged off of $12 million for the

third quarter 2014 and $11 million for the fourth quarter 2013.

The allowance for credit losses as a percentage of total loans

was 0.90 percent at December 31, 2014, compared with 0.92

percent at September 30, 2014, and 1.02 percent at

December 31, 2013. The allowance for credit losses as a

percentage of nonaccrual loans was 184 percent at December 31,

2014, compared with 171 percent at September 30, 2014 and 158

percent at December 31, 2013. In the fourth quarter of 2014,

the overall provision for credit losses was a net reversal of $1

million, compared with a provision of $1 million for the third

quarter of 2014 and a net reversal of $21 million for the fourth

quarter of 2013.

Capital

The Company’s stockholder’s equity was $15.0 billion at

December 31, 2014 compared with $15.1 billion at

September 30, 2014.

In December 2014, the Federal Reserve Board approved the

Company's request to opt-out of the advanced approaches methodology

under U.S. Basel III regulatory capital rules. As required, the

Company will calculate its regulatory capital ratios under the

standardized approach of the U.S. Basel III rules beginning in the

first quarter of 2015, with certain provisions subject to phase-in

periods. The Bank will continue to be subject to the advanced

approaches rules.

The Company's Tier 1 and Total risk-based capital ratios,

calculated in accordance with U.S. Basel I regulatory capital

rules, were 12.79 percent and 14.73 percent, respectively, at

December 31, 2014. The Tier 1 common capital and tangible

common equity ratios were 12.73 percent and 10.54 percent at

December 31, 2014, respectively.

The Company’s estimated Common Equity Tier 1 risk-based capital

ratio under U.S. Basel III regulatory capital rules (standardized

approach, fully phased in) was 12.57 percent at December 31,

2014.

Non-GAAP Financial

Measures

This press release contains certain references to financial

measures identified as privatization transaction impact, fees from

affiliates - support services and associated staff costs,

foreclosed asset expense, other credit costs, (reversal of)

provision for losses on unfunded credit commitments, productivity

initiative costs and gains, low income housing credit (LIHC)

investment amortization expense, expenses of the LIHC consolidated

variable interest entities, merger and business integration costs,

or intangible asset amortization, which are adjustments from

comparable measures calculated and presented in accordance with

accounting principles generally accepted in the United States of

America (GAAP). These financial measures, as used herein, differ

from financial measures reported under GAAP in that they exclude

unusual or non-recurring charges, losses or credits. This press

release identifies the specific items excluded from the comparable

GAAP financial measure in the calculation of each non-GAAP

financial measure. Management believes that financial presentations

excluding the impact of these items provide useful supplemental

information which is important to a proper understanding of the

Company’s business results. This press release also includes

additional capital ratios (Tier 1 common capital, tangible common

equity and Common Equity Tier 1 capital (calculated under the Basel

III standardized approach on a transitional and fully phased-in

basis)) to facilitate the understanding of the Company’s capital

structure and for use in assessing and comparing the quality and

composition of the Company's capital structure to other financial

institutions. These presentations should not be viewed as a

substitute for results determined in accordance with GAAP, nor are

they necessarily comparable to non-GAAP financial measures

presented by other companies.

Headquartered in New York, MUFG Americas Holdings Corporation is

a financial holding company and bank holding company with assets of

$113.7 billion at December 31, 2014. Its principal subsidiary,

MUFG Union Bank, N.A., provides an array of financial services to

individuals, small businesses, middle-market companies, and major

corporations. As of December 31, 2014, MUFG Union Bank, N.A.

operated 414 branches, comprised primarily of retail banking

branches in the West Coast states, along with commercial branches

in Texas, Illinois, New York and Georgia, as well as two

international offices. MUFG Americas Holdings Corporation is a

wholly-owned subsidiary of The Bank of Tokyo-Mitsubishi UFJ, Ltd.

which is a wholly-owned subsidiary of Mitsubishi UFJ Financial

Group, Inc., one of the world’s largest and most diversified

financial groups. Visit www.unionbank.com for more information.

MUFG Americas Holdings Corporation and Subsidiaries

Financial Highlights (Unaudited) Exhibit 1

Percent Change to As of and for the

Three Months Ended December 31, 2014 from December

31, September 30, June 30, March 31,

December 31, September 30, December

31, (Dollars in millions) 2014 2014

2014 2014 2013

2014 2013 Results of operations: Net interest

income $ 709 $ 707 $ 763 $ 683 $ 706 — % — % Noninterest income 352

388 202 181 190 (9 ) 85 Total

revenue 1,061 1,095 965 864 896 (3 ) 18 Noninterest expense 807

805 649 660 689 — 17 Pre-tax,

pre-provision income (1) 254 290 316 204 207 (12 ) 23 (Reversal of)

provision for loan losses 9 (18 ) 9 (16 ) (23 ) 150

139

Income before income taxes and including

noncontrolling interests

245 308 307 220 230 (20 ) 7 Income tax expense 95 67

62 50 55 42 73 Net income including

noncontrolling interests 150 241 245 170 175 (38 ) (14 ) Deduct:

Net loss from noncontrolling interests 5 5 4 5

4 — 25 Net income attributable to MUFG Americas

Holdings Corporation (MUAH) $ 155 $ 246 $ 249

$ 175 $ 179 (37 ) (13 )

Balance sheet (end

of period): Total assets $ 113,678 $ 110,879 $ 108,820 $

107,237 $ 105,894 3 7 Total securities 22,015 22,522 22,847 23,192

22,326 (2 ) (1 ) Total loans held for investment 76,804 74,635

72,369 69,933 68,312 3 12 Core deposits (2) 76,666 73,608 72,058

70,665 69,155 4 11 Total deposits 86,004 82,356 81,566 81,179

80,101 4 7 Long-term debt 6,972 6,984 6,995 6,545 6,547 — 6 MUAH

stockholder's equity 14,985 15,051 14,815 14,460 14,215 — 5

Balance sheet (period average): Total assets $ 112,589 $

109,739 $ 107,871 $ 106,491 $ 104,424 3 8 Total securities 22,171

22,592 22,865 22,611 22,282 (2 ) — Total loans held for investment

75,795 73,353 71,104 69,293 67,619 3 12 Earning assets 101,430

98,933 97,405 96,100 94,707 3 7 Total deposits 84,036 82,239 81,221

80,433 79,747 2 5 MUAH stockholder's equity 15,202 14,969 14,657

14,390 12,604 2 21

Performance ratios: Return on

average assets (3) 0.55 % 0.90 % 0.92 % 0.66 % 0.68 % Return on

average MUAH stockholder's equity (3) 4.06 6.57 6.80 4.87 5.66

Return on average assets excluding the

impact of privatization transaction and merger costs related to

acquisitions (3) (4)

0.62 0.94 0.97 0.72 0.75

Return on average MUAH stockholder's

equity excluding the impact of privatization transaction and merger

costs related to acquisitions (3) (4)

5.27 7.84 8.19 6.11 7.41 Efficiency ratio (5) 76.12 73.51 67.23

76.38 76.89 Adjusted efficiency ratio (6) 67.24 63.42 60.30 67.95

67.08 Net interest margin (3) (7) 2.81 2.87 3.15 2.87 2.99

Capital ratios: Regulatory: U.S. Basel

I U.S. Basel III U.S. Basel I

Common Equity Tier 1 risk-based capital ratio(8) (9) n/a

12.66 % 12.58 % 12.59 % n/a Tier 1 risk-based capital ratio (8) (9)

12.79 % 12.70 12.62 12.62 12.41 % Total risk-based capital ratio

(8) (9) 14.73 14.60 14.57 14.75 14.61 Tier 1 leverage ratio (8) (9)

11.25 11.43 11.35 11.26 11.27

Other: Tangible common

equity ratio (11) 10.54 % 10.79 % 10.84 % 10.65 % 10.54 % Tier 1

common capital ratio (8) (9) (10) 12.73 n/a n/a n/a 12.34 Common

Equity Tier 1 risk-based capital ratio (U.S. Basel III

standardized; transitional) (8) (12) 12.85 n/a n/a n/a n/a

Common Equity Tier 1 risk-based capital

ratio (U.S. Basel III standardized approach; fully phased in) (8)

(13)

12.57 12.47 12.13 11.98 11.51

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries

Financial Highlights (Unaudited) Exhibit 2

As of and for the Year Ended

Percent Change

December 31,

December 31,

to December 31, 2014

(Dollars in millions) 2014 2013

from December 31, 2013

Results of operations: Net interest income $ 2,862 $ 2,716 5

% Noninterest income 1,123 876 28 Total revenue 3,985

3,592 11 Noninterest expense 2,921 2,793 5 Pre-tax,

pre-provision income (1) 1,064 799 33 (Reversal of) provision for

loan losses (16 ) (45 ) 64 Income before income taxes and including

noncontrolling interests 1,080 844 28 Income tax expense 274

195 41 Net income including noncontrolling interests 806 649

24 Deduct: Net loss from noncontrolling interests 19 18

6 Net income attributable to MUAH $ 825 $ 667

24

Balance sheet (end of period): Total assets $

113,678 $ 105,894 7 Total securities 22,015 22,326 (1 ) Total loans

held for investment 76,804 68,312 12 Core deposits (2) 76,666

69,155 11 Total deposits 86,004 80,101 7 Long-term debt 6,972 6,547

6 MUAH stockholder's equity 14,985 14,215 5

Balance sheet

(period average): Total assets $ 109,186 $ 100,355 9 Total

securities 22,559 22,552 — Total loans held for investment 72,406

64,638 12 Earning assets 98,482 90,797 8 Total deposits 81,988

76,714 7 MUAH stockholder's equity 14,808 12,499 18

Performance ratios: Return on average assets (3) 0.76 % 0.66

% Return on average MUAH stockholder's equity (3) 5.57 5.33 Return

on average assets excluding the impact of privatization transaction

and merger costs related to acquisitions (3) (4) 0.81 0.74 Return

on average MUAH stockholders' equity excluding the impact of

privatization transaction and merger costs related to acquisitions

(3) (4) 6.84 7.06 Efficiency ratio (5) 73.31 77.74 Adjusted

efficiency ratio (6) 64.63 67.85 Net interest margin (3) (7) 2.93

3.01

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries Credit Quality (Unaudited) Exhibit 3

Percent Change to As of and

for the Three Months Ended December 31, 2014 from

(Dollars in millions)

December 31,2014

September 30,2014

June 30,2014

March 31,2014

December 31,2013

September 30,2014

December 31,2013

Credit Data:

(Reversal of) provision for loan losses,

excluding purchased credit-impaired loans

$ 9 $ (18 ) $ 9 $ (18 ) $ (22 ) 150 % 141 %

(Reversal of) provision for purchased

credit-impaired loan losses not subject to FDIC indemnification

— — — 2 (1 ) - 100 (Reversal of) provision for losses on unfunded

credit commitments (10 ) 19 (3 ) 16 2

(153 ) nm Total (reversal of) provision for credit losses $ (1 ) $

1 $ 6 $ — $ (21 ) (200 ) 95 Net

loans charged-off (recovered) $ (1 ) $ 12 $ 7 $ (6 ) $ 11 (108 )

(109 ) Nonperforming assets 411 428 547 506 499 (4 ) (18 )

Criticized loans held for investment (14) 1,141 1,245 1,450 1,317

1,274 (8 ) (10 )

Credit Ratios: Allowance for loan

losses to: Total loans held for investment 0.70 % 0.71 % 0.77 %

0.80 % 0.83 % Nonaccrual loans 143.35 131.28 108.90 119.58 128.42

Allowance for credit losses to (15): Total loans held for

investment 0.90 0.92 0.97 1.01 1.02 Nonaccrual loans 183.80 171.42

137.13 151.35 158.30

Net loans charged-off (recovered) to

average total loans held for investment (3)

— 0.06 0.04 (0.04 ) 0.07 Nonperforming assets to total loans held

for investment and

Other Real Estate Owned (OREO)

0.53 0.57 0.75 0.72 0.74 Nonperforming assets to total assets 0.36

0.39 0.50 0.47 0.48 Nonaccrual loans to total loans held for

investment 0.49 0.54 0.71 0.67 0.65

As of and for

the Year Ended Percent Change December 31,

December 31, to December 31, 2014 (Dollars in

millions) 2014 2013 from

December 31, 2013 Credit Data:

(Reversal of) provision for loan losses,

excluding purchased credit-impaired loans

$ (18 ) $ (44 ) 59 %

(Reversal of) provision for purchased

credit-impaired loan losses not subject to FDIC indemnification

2 (1 ) 300 (Reversal of) provision for losses on unfunded credit

commitments 22 16 38 Total (reversal of) provision

for credit losses $ 6 $ (29 ) 121 Net loans

charged-off $ 12 $ 32 (63 ) Nonperforming assets 411 499 (18 )

Credit Ratios: Net loans charged-off to average total loans

held for investment 0.02 % 0.05 % Nonperforming assets to total

assets 0.36 0.48

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries Consolidated Statements of Income

(Unaudited) Exhibit 4 For the

Three Months Ended December 31,

September 30, June 30,

March 31, December 31, (Dollars in

millions) 2014 2014 2014

2014 2013 Interest Income

Loans $ 696 $ 693 $ 749 $ 667 $ 695 Securities 109 113 115 115 115

Other 3 2 3 5 6 Total interest

income 808 808 867 787 816

Interest Expense Deposits 57 58 61 62 64 Commercial

paper and other short-term borrowings 1 1 2 1 1 Long-term debt 41

42 41 41 45 Total interest

expense 99 101 104 104 110

Net Interest Income 709 707 763 683 706 (Reversal of)

provision for loan losses 9 (18 ) 9 (16 ) (23 ) Net

interest income after (reversal of) provision for loan losses 700

725 754 699 729

Noninterest Income Service charges on deposit accounts 50 52

50 51 51 Trust and investment management fees 26 26 26 26 28

Trading account activities 8 33 14 16 20 Securities gains, net 2 13

1 2 8 Credit facility fees 33 30 31 28 28 Merchant banking fees 35

38 27 24 25 Brokerage commissions and fees 13 14 13 13 12 Card

processing fees, net 9 8 9 8 8 Fees from affiliates (16) 168 151 —

— — Other, net 8 23 31 13 10

Total noninterest income 352 388 202 181

190

Noninterest Expense Salaries and

employee benefits 527 492 378 388 406 Net occupancy and equipment

76 74 75 71 70 Professional and outside services 72 66 63 55 64

Intangible asset amortization 13 13 13 13 16 Regulatory assessments

13 13 16 15 14 (Reversal of) provision for losses on unfunded

credit commitments (10 ) 19 (3 ) 16 2 Other 116 128

107 102 117 Total noninterest expense 807

805 649 660 689 Income

before income taxes and including noncontrolling interests 245 308

307 220 230 Income tax expense 95 67 62 50

55

Net Income including Noncontrolling

Interests 150 241 245 170 175 Deduct: Net loss from

noncontrolling interests 5 5 4 5 4

Net Income attributable to MUAH $ 155 $ 246

$ 249 $ 175 $ 179

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and Subsidiaries

Consolidated Statements of Income (Unaudited) Exhibit

5 For the Years Ended December 31,

December 31, (Dollars in millions)

2014 2013 Interest Income Loans

$ 2,805 $ 2,641 Securities 452 469 Other 13 13 Total

interest income 3,270 3,123

Interest

Expense Deposits 238 248 Commercial paper and other short-term

borrowings 5 5 Long-term debt 165 154 Total interest

expense 408 407

Net Interest Income

2,862 2,716 (Reversal of) provision for loan losses (16 ) (45 ) Net

interest income after (reversal of) provision for loan losses 2,878

2,761

Noninterest Income Service

charges on deposit accounts 203 209 Trust and investment management

fees 104 135 Trading account activities 71 61 Securities gains, net

18 178 Credit facility fees 122 111 Merchant banking fees 124 93

Brokerage commissions and fees 53 46 Card processing fees, net 34

34 Fees from affiliates (16) 319 — Other, net 75 9

Total noninterest income 1,123 876

Noninterest Expense Salaries and employee benefits 1,785

1,631 Net occupancy and equipment 296 306 Professional and outside

services 256 250 Intangible asset amortization 52 65 Regulatory

assessments 57 74 (Reversal of) provision for losses on unfunded

credit commitments 22 16 Other 453 451 Total

noninterest expense 2,921 2,793 Income before

income taxes and including noncontrolling interests 1,080 844

Income tax expense 274 195

Net Income including

Noncontrolling Interests 806 649 Deduct: Net loss from

noncontrolling interests 19 18

Net Income

attributable to MUAH $ 825 $ 667

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries Consolidated Balance Sheets (Unaudited)

Exhibit 6 December 31,

September 30, June 30,

March 31, December 31,

(Dollars in millions except for per share amount)

2014 2014 2014 2014 2013

Assets Cash and due from banks $ 1,759 $ 1,593 $ 1,911 $

1,792 $ 1,863 Interest bearing deposits in banks 3,930 2,772 2,353

2,883 4,329 Federal funds sold and securities purchased under

resale agreements 62 154 65 32 11

Total cash and cash equivalents 5,751 4,519 4,329 4,707

6,203 Trading account assets 1,114 883 941 841 851 Securities

available for sale 13,724 14,064 14,670 15,366 15,817 Securities

held to maturity: Securities held to maturity 8,291 8,458 8,177

7,826 6,509 Loans held for investment 76,804 74,635 72,369 69,933

68,312 Allowance for loan losses (537 ) (529 ) (559 ) (557 ) (568 )

Loans held for investment, net 76,267 74,106 71,810 69,376 67,744

Premises and equipment, net 621 617 632 641 688 Goodwill 3,225

3,227 3,227 3,227 3,228 Other assets 4,685 5,005

5,034 5,253 4,854 Total assets $ 113,678

$ 110,879 $ 108,820 $ 107,237 $ 105,894

Liabilities Deposits: Noninterest bearing $

30,534 $ 28,676 $ 27,446 $ 26,881 $ 26,495 Interest bearing 55,470

53,680 54,120 54,298 53,606

Total deposits

86,004 82,356 81,566 81,179 80,101 Commercial paper and other

short-term borrowings 2,704 3,876 2,870 2,660 2,563 Long-term debt

6,972 6,984 6,995 6,545 6,547 Trading account liabilities 894 596

664 531 540 Other liabilities 1,889 1,777 1,666

1,611 1,675 Total liabilities 98,463

95,589 93,761 92,526 91,426

Equity MUAH stockholder's equity: Common stock, par value $1

per share: Authorized 300,000,000 shares; 136,330,831 shares issued

and outstanding as of December 31, 2014 and September 30, 2014; and

136,330,830 as of June 30, 2014, March 31, 2014, and December 31,

2013 respectively 136 136 136 136 136 Additional paid-in capital

7,232 7,223 7,184 7,196 7,191 Retained earnings 8,346 8,191 7,936

7,687 7,512 Accumulated other comprehensive loss (729 ) (499 ) (441

) (559 ) (624 ) Total MUAH stockholder's equity 14,985 15,051

14,815 14,460 14,215 Noncontrolling interests 230 239

244 251 253 Total equity 15,215 15,290

15,059 14,711 14,468 Total liabilities

and equity $ 113,678 $ 110,879 $ 108,820 $

107,237 $ 105,894

MUFG Americas

Holdings Corporation and Subsidiaries Net Interest Income

(Unaudited) Exhibit 7 For the

Three Months Ended December 31, 2014

September 30, 2014 Interest

Average Interest

Average Average Income/

Yield/ Average Income/ Yield/

(Dollars in millions) Balance Expense

(7) Rate (3)(7) Balance

Expense (7) Rate (3)(7)

Assets Loans held for investment: (17) Commercial and

industrial $ 27,138 $ 228 3.33

%

$ 25,746 $ 220 3.39 % Commercial mortgage 13,833 117 3.39 13,643

122 3.57 Construction 1,557 12 3.00 1,336 10 3.12 Lease financing

810 10 4.97 811 12 5.69 Residential mortgage 28,738 253 3.52 27,967

250 3.58 Home equity and other consumer loans 3,137 33

4.20 3,164 32 4.08 Loans, before purchased

credit-impaired loans 75,213 653 3.46 72,667 646 3.54 Purchased

credit-impaired loans 582 44 30.08 686 48

27.70 Total loans held for investment 75,795 697 3.67 73,353

694 3.77 Securities 22,171 113 2.04 22,592 117 2.08 Interest

bearing deposits in banks 2,788 2 0.26 2,380 2 0.26

Federal funds sold and securities

purchased under resale agreements

149 — 0.05 106 — — Trading account assets 196 — 0.72 164 — 0.66

Other earning assets 331 1 0.68 338 1

0.73 Total earning assets 101,430 813 3.20 98,933 814

3.28 Allowance for loan losses (533 ) (566 ) Cash and due from

banks 1,727 1,597 Premises and equipment, net 614 626 Other assets

9,351 9,149 Total assets $ 112,589 $ 109,739

Liabilities Interest bearing deposits: Transaction

and money market accounts $ 39,762 33 0.33 $ 39,128 33 0.34 Savings

5,555 1 0.08 5,574 2 0.08 Time 9,133 23 0.97 9,766

23 0.96 Total interest bearing deposits 54,450

57 0.41 54,468 58 0.42 Commercial paper and

other short-term borrowings (18) 3,257 1 0.19 2,820 1 0.17

Long-term debt 6,983 41 2.36 6,994 42

2.38 Total borrowed funds 10,240 42 1.67 9,814

43 1.75 Total interest bearing liabilities 64,690 99

0.61 64,282 101 0.63 Noninterest bearing deposits 29,586

27,771 Other liabilities 2,873 2,474 Total

liabilities 97,149 94,527

Equity MUAH Stockholder's equity

15,202 14,969 Noncontrolling interests 238 243 Total

equity 15,440 15,212 Total liabilities and equity $

112,589 $ 109,739 Net interest income/spread

(taxable-equivalent basis) 714 2.59

%

713 2.65 % Impact of noninterest bearing deposits 0.19 0.19 Impact

of other noninterest bearing sources 0.03 0.03 Net interest margin

2.81 2.87 Less: taxable-equivalent adjustment 5 6 Net

interest income $ 709 $ 707

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries Net Interest Income (Unaudited) Exhibit

8 For the Three Months Ended

December 31, 2014 December 31, 2013

Interest Average

Interest Average

Average Income/ Yield/ Average

Income/ Yield/ (Dollars in millions)

Balance Expense (7) Rate

(3)(7) Balance Expense

(7) Rate (3)(7) Assets

Loans held for investment: (17) Commercial and industrial $ 27,138

$ 228 3.33 % $ 23,176 $ 196 3.35 % Commercial mortgage 13,833 117

3.39 12,984 123 3.78 Construction 1,557 12 3.00 868 7 3.46 Lease

financing 810 10 4.97 981 8 3.43 Residential mortgage 28,738 253

3.52 25,143 231 3.67 Home equity and other consumer loans 3,137

33 4.20 3,305 35 4.13 Loans, before

purchased credit-impaired loans 75,213 653 3.46 66,457 600 3.60

Purchased credit-impaired loans 582 44 30.08 1,162

96 32.75 Total loans held for investment 75,795 697

3.67 67,619 696 4.10 Securities 22,171 113 2.04 22,282 118 2.12

Interest bearing deposits in banks 2,788 2 0.26 4,242 3 0.26

Federal funds sold and securities

purchased under resale agreements

149 — 0.05 138 — 0.09 Trading account assets 196 — 0.72 203 2 4.36

Other earning assets 331 1 0.68 223 1

1.89 Total earning assets 101,430 813 3.20 94,707 820

3.45 Allowance for loan losses (533 ) (618 ) Cash and due from

banks 1,727 1,553 Premises and equipment, net 614 678 Other assets

9,351 8,104 Total assets $ 112,589 $ 104,424

Liabilities Interest bearing deposits: Transaction

and money market accounts $ 39,762 33 0.33 $ 36,636 35 0.38 Savings

5,555 1 0.08 5,576 1 0.13 Time 9,133 23 0.97 11,431

28 0.96 Total interest bearing deposits 54,450

57 0.41 53,643 64 0.48 Commercial paper and

other short-term borrowings (18) 3,257 1 0.19 2,562 1 0.22

Long-term debt 6,983 41 2.36 7,094 45

2.52 Total borrowed funds 10,240 42 1.67 9,656

46 1.91 Total interest bearing liabilities 64,690 99

0.61 63,299 110 0.69 Noninterest bearing deposits 29,586

26,104 Other liabilities 2,873 2,160 Total

liabilities 97,149 91,563

Equity MUAH Stockholder's equity

15,202 12,604 Noncontrolling interests 238 257 Total

equity 15,440 12,861 Total liabilities and equity $

112,589 $ 104,424 Net interest income/spread

(taxable-equivalent basis) 714 2.59 % 710 2.76 % Impact of

noninterest bearing deposits 0.19 0.20 Impact of other noninterest

bearing sources 0.03 0.30 Net interest margin 2.81 2.99 Less:

taxable-equivalent adjustment 5 4 Net interest income

$ 709 $ 706

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and Subsidiaries

Net Interest Income (Unaudited) Exhibit 9

For the Year Ended December 31, 2014

December 31, 2013

Interest Average

Interest Average Average

Income/ Yield/ Average Income/

Yield/ (Dollars in millions) Balance

Expense (7) Rate (3)(7) Balance

Expense (7) Rate (3)(7)

Assets Loans held for investment: (17) Commercial and

industrial $ 25,321 $ 848 3.35 % $ 22,294 $ 750 3.36 % Commercial

mortgage 13,560 482 3.56 11,928 453 3.80 Construction 1,256 40 3.20

787 29 3.74 Lease financing 827 47 5.71 1,018 36 3.57 Residential

mortgage 27,449 988 3.60 23,903 898 3.76 Home equity and other

consumer loans 3,181 129 4.08 3,447 135 3.92 Loans,

before purchased credit-impaired loans 71,594 2,534 3.54 63,377

2,301 3.63 Purchased credit-impaired loans 812 273 33.54

1,261 341 27.03 Total loans held for investment 72,406 2,807

3.88 64,638 2,642 4.09 Securities 22,559 470 2.09 22,552 483 2.14

Interest bearing deposits in banks 2,898 8 0.25 3,067 8 0.25

Federal funds sold and securities

purchased under resale agreements

122 — 0.06 133 — 0.15 Trading account assets 205 3 1.54 163 3 1.62

Other earning assets 292 3 0.87 244 2 0.91 Total

earning assets 98,482 3,291 3.34 90,797 3,138 3.46 Allowance for

loan losses (559 ) (636 ) Cash and due from banks 1,566 1,405

Premises and equipment, net 632 695 Other assets 9,065 8,094

Total assets $ 109,186 $ 100,355

Liabilities Interest bearing deposits: Transaction and money

market accounts 38,517 137 0.36 33,904 114 0.34 Savings 5,573 5

0.09 5,682 7 0.13 Time 10,211 96 0.94 12,115 127 1.04

Total interest bearing deposits 54,301 238 0.44 51,701

248 0.48 Commercial paper and other short-term borrowings

(18) 2,809 5 0.19 2,751 5 0.20 Long-term debt 6,863 165 2.40

5,998 154 2.56 Total borrowed funds 9,672 170 1.76

8,749 159 1.82 Total interest bearing liabilities 63,973 408

0.64 60,450 407 0.67 Noninterest bearing deposits 27,687

25,013 Other liabilities 2,472 2,128 Total

liabilities 94,132 87,591

Equity MUAH Stockholder's equity

14,808 12,499 Noncontrolling interests 246 265 Total

equity 15,054 12,764 Total liabilities and equity $

109,186 $ 100,355 Net interest income/spread

(taxable-equivalent basis) 2,883 2.70 % 2,731 2.79 % Impact of

noninterest bearing deposits 0.19 0.19 Impact of other noninterest

bearing sources 0.04 0.03 Net interest margin 2.93 3.01 Less:

taxable-equivalent adjustment 21 15 Net interest income $ 2,862 $

2,716

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries Loans and Nonperforming Assets (Unaudited)

Exhibit 10

December 31,

September 30, June 30,

March 31, December 31,

(Dollars in millions)

2014

2014 2014 2014 2013 Loans

held for investment (period end) Loans held for investment:

Commercial and industrial $ 27,623 $ 26,429 $ 25,162 $ 23,654 $

23,528 Commercial mortgage 14,016 13,766 13,549 13,568 13,092

Construction 1,746 1,436 1,248 1,019 905 Lease financing 800 811

829 845 854 Total commercial portfolio 44,185 42,442 40,788 39,086

38,379 Residential mortgage 28,977 28,425 27,619 26,602

25,547 Home equity and other consumer loans 3,117 3,141 3,178 3,194

3,280 Total consumer portfolio 32,094 31,566 30,797 29,796 28,827

Loans held for investment, before purchased credit-impaired loans

76,279 74,008 71,585 68,882 67,206 Purchased credit-impaired loans

525 627 784 1,051 1,106 Total loans held for investment $

76,804 $ 74,635 $ 72,369 $ 69,933 $ 68,312

Nonperforming

Assets (period end) Nonaccrual loans: Commercial and industrial

$ 55 $ 71 $ 161 $ 89 $ 44 Commercial mortgage 40 34 47 46 51

Total commercial portfolio

95 105 208 135 95 Residential mortgage 231 239 243 266 286

Home equity and other consumer loans 40 46 46 49 46 Total consumer

portfolio 271 285 289 315 332 Nonaccrual loans, before

purchased credit-impaired loans 366 390 497 450 427 Purchased

credit-impaired loans 9 13 17 16 15

Total nonaccrual loans

375 403 514 466 442 OREO 12 12 14 17 20 FDIC covered OREO 24

13 19 23 37 Total nonperforming assets $ 411 $ 428 $ 547 $

506 $ 499

Total nonperforming assets, excluding

purchased credit-impaired loans and FDIC covered OREO

$ 378 $ 402 $ 511 $ 467 $ 447 Loans 90 days or more past due

and still accruing (19) $ 3 $ 4 $ 11 $ 4 $ 5

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries Allowance for Credit Losses (Unaudited)

Exhibit 11 As of and for the

Three Months Ended

December 31,

September 30,

June 30, March

31, December 31, (Dollars in

millions)

2014

2014

2014 2014 2013 Analysis of

Allowance for Credit Losses Balance, beginning of period $ 529

$ 559 $ 557 $ 568 $ 608 (Reversal of) provision for loan losses,

excluding purchased credit-impaired loans 9 (18 ) 9 (18 ) (22 )

(Reversal of) provision for purchased credit-impaired loan losses

not subject to FDIC indemnification — — — 2 (1 )

Increase (decrease) in allowance covered

by FDIC indemnification

— — — — (6 ) Other (2 ) — — (1 ) — Loans charged-off: Commercial

and industrial (8 ) (15 ) (6 ) (5 ) (18 ) Commercial mortgage (1 )

— (2 ) (1 ) (2 ) Total commercial portfolio (9 ) (15 ) (8 )

(6 ) (20 ) Residential mortgage — — (2 ) (1 ) (1 ) Home equity and

other consumer loans (2 ) (2 ) (2 ) (2 ) (4 ) Total consumer

portfolio (2 ) (2 ) (4 ) (3 ) (5 ) Purchased credit-impaired loans

— (1 ) — — — Total loans charged-off

(11 ) (18 ) (12 ) (9 ) (25 ) Recoveries of loans previously

charged-off: Commercial and industrial 10 3 3 11 6 Commercial

mortgage — 2 1 — — Construction — — — 3 — Lease financing —

— — — 1 Total commercial portfolio 10 5

4 14 7 Home equity and other consumer loans 2 — 1

1 — Total consumer portfolio 2 —

1 1 — Purchased credit-impaired loans —

1 — — 7 Total recoveries of loans

previously charged-off 12 6 5 15 14

Net loans recovered (charged-off) 1 (12 ) (7 ) 6

(11 ) Ending balance of allowance for loan losses 537

529 559 557 568 Allowance for losses on unfunded credit commitments

152 162 145 148 132 Total

allowance for credit losses $ 689 $ 691 $ 704

$ 705 $ 700 Components of allowance for loan

losses and credit losses:

Allowance for loan losses, excluding

allowance on purchased credit-impaired loans

$ 534 $ 526 $ 556 $ 554 $ 567 Allowance for loan losses on

purchased credit-impaired loans 3 3 3 3

1 Total allowance for loan losses $ 537 $ 529

$ 559 $ 557 $ 568

MUFG

Americas Holdings Corporation and Subsidiaries Securities

(Unaudited) Exhibit 12

Securities Available for Sale

Fair Value Fair Value

December 31, 2014

September 30, 2014

Change from % Change from

Amortized

Fair

Amortized

Fair

September 30, September 30, (Dollars in

millions) Cost Value Cost

Value 2014 2014

Asset Liability Management securities: U.S. Treasury $ — $ — $ 70 $

70 $ (70 ) 100 % Residential mortgage-backed securities: U.S.

government agency and government-sponsored agencies 7,649 7,560

7,886 7,739 (179 ) (2 ) Privately issued 166 168 175 177 (9 ) (5 )

Privately issued - commercial mortgage-backed securities 1,689

1,691 1,770 1,745 (54 ) (3 ) Collateralized loan obligations 2,527

2,494 2,438 2,422 72 3 Asset-backed and other 8 9 13

14 (5 ) (36 ) Asset Liability Management securities

12,039 11,922 12,352 12,167 (245 ) (2 ) Other debt securities:

Direct bank purchase bonds 1,719 1,741 1,819 1,833 (92 ) (5 ) Other

53 52 54 52 — — Equity securities 8 9 10 12

(3 ) (25 ) Total securities available for sale $ 13,819

$ 13,724 $ 14,235 $ 14,064 $ (340 ) (2

)%

Securities Held to Maturity December 31,

2014 September 30, 2014 Carrying Amount

Carrying Amount Carrying Fair Carrying

Fair Change from % Change from (Dollars in

millions) Amount (20) Value

Amount (20) Value September

30, 2014 September 30, 2014 U.S. Treasury

$ 486 $ 489 $ 485 $ 484 $ 1 — % U.S. government-sponsored agencies

125 125 125 125 — —

U.S. government agency and

government-sponsored agencies - residential mortgage-backed

securities

5,942 6,013 6,102 6,107 (160 ) (3 )

U.S. government agency and

government-sponsored agencies - commercial mortgage-backed

securities

1,738 1,785 1,746 1,775 (8 ) — Total

securities held to maturity $ 8,291 $ 8,412 $ 8,458

$ 8,491 $ (167 ) (2 )%

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries

Reconciliation of Non-GAAP Measures

(Unaudited)

Exhibit 13

The following table presents a reconciliation between certain

Generally Accepted Accounting Principles (GAAP) amounts and

specific non-GAAP measures as used to compute selected non-GAAP

financial ratios.

As of and for the Three Months Ended

(Dollars in millions)

December 31,2014

September 30,2014

June 30,2014

March 31,2014

December 31,2013

Net income attributable to MUAH $ 155 $ 246 $ 249 $ 175 $ 179 Net

adjustments for merger costs related to acquisitions, net of tax 12

13 15 11 12 Net adjustments for privatization transaction, net of

tax 6 (8 ) (9 ) 1 2

Net income attributable to MUAH, excluding

impact of privatization transaction and merger costs related to

acquisitions

$ 173 $ 251 $ 255 $ 187 $ 193

Average total assets $ 112,589 $ 109,739 $ 107,871 $ 106,491

$ 104,424 Less: Net adjustments related to privatization

transaction 2,244 2,255 2,260 2,272

2,297 Average total assets, excluding impact of

privatization transaction $ 110,345 $ 107,484 $

105,611 $ 104,219 $ 102,127 Return on average

assets (3) 0.55 % 0.90 % 0.92 % 0.66 % 0.68 %

Return on average assets, excluding impact

of privatization transaction and merger costs related to

acquisitions (3) (4)

0.62 0.94 0.97 0.72 0.75 Average MUAH stockholder's equity $

15,202 $ 14,969 $ 14,657 $ 14,390 $ 12,604 Less: Adjustments for

merger costs related to acquisitions (157 ) (147 ) (132 ) (118 )

(105 ) Less: Net adjustments for privatization transaction 2,279

2,290 2,297 2,302 2,306 Average

MUAH stockholder's equity, excluding impact of privatization

transaction and merger costs related to acquisitions $ 13,080

$ 12,826 $ 12,492 $ 12,206 $ 10,403

Return on average MUAH stockholder's equity (3) 4.06 % 6.57

% 6.80 % 4.87 % 5.66 % Return on average MUAH stockholder's equity,

excluding impact of privatization transaction and merger costs

related to acquisitions (3) (4) 5.27 7.84 8.19 6.11 7.41

Noninterest expense $ 807 $ 805 $ 649 $ 660 $ 689 Less: Staff costs

associated with fees from affiliates - support services 105 88 — —

— Less: Foreclosed asset expense and other credit costs (2 ) (1 ) 1

— 2 Less: (Reversal of) provision for losses on unfunded credit

commitments (10 ) 19 (3 ) 16 2 Less: Productivity initiative costs

2 6 4 1 20 Less: Low income housing credit (LIHC) investment

amortization expense 24 25 20 20 24 Less: Expenses of the LIHC

consolidated VIEs 8 8 8 8 6 Less: Merger and business integration

costs 20 22 25 17 25 Less: Net adjustments related to privatization

transaction 10 11 10 10 14 Less: Intangible asset amortization 3

3 3 3 3 Noninterest expense, as

adjusted (a) $ 647 $ 624 $ 581 $ 585 $

593 Total revenue $ 1,061 $ 1,095 $ 965 $ 864 $ 896

Add: Net interest income taxable-equivalent adjustment 5 6 5 5 4

Less: Fees from affiliates - support services 112 94 — — — Less:

Productivity initiative gains (1 ) — — — 6 Less: Accretion related

to privatization-related fair value adjustments (1 ) 4 9 6 8 Less:

Other credit costs (6 ) 17 (2 ) 2 1 Total

revenue, as adjusted (b) $ 962 $ 986 $ 963 $

861 $ 885 Adjusted efficiency ratio (a)/(b) (6) 67.24

% 63.42 % 60.30 % 67.95 % 67.08 %

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries

Reconciliation of Non-GAAP Measures

(Unaudited)

Exhibit 14

The following table presents a reconciliation between certain

Generally Accepted Accounting Principles (GAAP) amounts and

specific non-GAAP measures as used to compute selected non-GAAP

financial ratios.

As of and for the Three Months Ended

December 31,

September 30,

June 30, March 31,

December 31,

(Dollars in millions)

2014

2014

2014 2014

2013

Total MUAH stockholder's equity $ 14,985 $ 15,051 $ 14,815 $ 14,460

$ 14,215 Less: Goodwill 3,225 3,227 3,227 3,227 3,228 Less:

Intangible assets, except mortgage servicing rights (MSRs) 233 249

262 275 288 Less: Deferred tax liabilities related to goodwill and

intangible assets (99 ) (20 ) (99 ) (102 ) (105 ) Tangible common

equity (c) $ 11,626 $ 11,595 $ 11,425 $ 11,060

$ 10,804 Total assets $ 113,678 $ 110,879 $ 108,820 $

107,237 $ 105,894 Less: Goodwill 3,225 3,227 3,227 3,227 3,228

Less: Intangible assets, except MSRs 233 249 262 275 288 Less:

Deferred tax liabilities related to goodwill and intangible assets

(99 ) (20 ) (99 ) (102 ) (105 ) Tangible assets (d) $ 110,319

$ 107,423 $ 105,430 $ 103,837 $ 102,483

Tangible common equity ratio (c)/(d) (11) 10.54 % 10.79 %

10.84 % 10.65 % 10.54 % Tier 1 capital, determined in

accordance with U.S. Basel I regulatory requirements $ 12,370 n/a

n/a n/a $ 11,471 Less: Junior subordinated debt payable to trusts

52 n/a n/a n/a 66 U.S. Basel I Tier 1 common capital

(e) $ 12,318 n/a n/a n/a $ 11,405 Common Equity Tier 1 capital

under U.S. Basel III (standardized transitional) (f) $ 12,453 $

12,300 $ 11,964 $ 11,750 $ 11,406 Other (9) (105 ) (121 ) (130 )

(138 ) (258 ) Common Equity Tier 1 capital estimated under U.S.

Basel III (standardized approach; fully phased-in) (g) $ 12,348

$ 12,179 $ 11,834 $ 11,612 $ 11,148

Risk-weighted assets, determined in accordance with U.S.

Basel I regulatory requirements (h) $ 96,742 n/a n/a n/a $ 92,410

Add: Adjustments 191 n/a n/a n/a n/a Risk-weighted assets,

estimated under U.S. Basel III (standardized transitional) (i)

96,933 $ 96,239 $ 94,556 $ 92,476 n/a Add: Adjustments 1,285

1,441 2,963 4,427 4,446 Total

risk-weighted assets, estimated under U.S. Basel III (standardized

approach; fully phased in) (j) $ 98,218 $ 97,680 $ 97,519 $ 96,903

$ 96,856 Tier 1 common capital ratio (e)/(h) (8) (9) (10) 12.73 %

n/a n/a n/a 12.34 % Common Equity Tier 1 risk-based capital ratio

(U.S. Basel III standardized; transitional) (f)/(i) (8) (12) 12.85

n/a n/a n/a n/a Common Equity Tier 1 risk-based capital ratio (U.S.

Basel III standardized approach; fully phased in) (g)/(j) (8) (13)

12.57 12.47 % 12.13 % 11.98 % 11.51

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries

Reconciliation of Non-GAAP Measures

(Unaudited)

Exhibit 15

The following table presents a reconciliation between certain

Generally Accepted Accounting Principles (GAAP) amounts and

specific non-GAAP measures as used to compute selected non-GAAP

financial ratios.

For the Year Ended December 31,

December 31, (Dollars in millions) 2014

2013 Net income attributable to MUAH $ 825 $ 667 Net

adjustments for merger costs related to acquisitions, net of tax 51

78 Net adjustments for privatization transaction, net of tax (10 )

(21 ) Net income attributable to MUAH, excluding impact of

privatization transaction and merger costs related to acquisitions

$ 866 $ 724 Average total assets $ 109,186 $

100,355 Less: Net adjustments related to privatization transaction

2,258 2,313 Average total assets, excluding impact of

privatization transaction $ 106,928 $ 98,042 Return

on average assets (3) 0.76 % 0.66 % Return on average assets,

excluding impact of privatization transaction and merger costs

related to acquisitions (3) (4) 0.81 0.74 Average MUAH

stockholder's equity $ 14,808 $ 12,499 Less: Adjustments for merger

costs related to acquisitions (139 ) (80 ) Less: Net adjustments

for privatization transaction 2,292 2,329 Average

MUAH stockholder's equity, excluding impact of privatization

transaction and merger costs related to acquisitions $ 12,655

$ 10,250 Return on average MUAH stockholder's equity

(3) 5.57 % 5.33 % Return on average MUAH stockholder's equity,

excluding impact of privatization transaction and merger costs

related to acquisitions (3) (4) 6.84 7.06 Noninterest

expense $ 2,921 $ 2,793 Less: Staff costs associated with fees from

affiliates - support services 193 — Less: Foreclosed asset expense

and other credit costs (2 ) (4 ) Less: (Reversal of) provision for

losses on unfunded credit commitments 22 16 Less: Productivity

initiative costs 13 51 Less: Low income housing credit (LIHC)

investment amortization expense 89 76 Less: Expenses of the LIHC

consolidated VIEs 32 29 Less: Merger and business integration costs

84 134 Less: Net adjustments related to privatization transaction

41 55 Less: Intangible asset amortization 12 13

Noninterest expense, as adjusted (a) $ 2,437 $ 2,423

Total revenue $ 3,985 $ 3,592 Add: Net interest income

taxable-equivalent adjustment 21 15 Less: Fees from affiliates -

support services 206 — Less: Productivity initiative gains (1 ) 17

Less: Accretion related to privatization-related fair value

adjustments 18 24 Less: Other credit costs 11 (5 ) Total

revenue, as adjusted (b) $ 3,772 $ 3,571 Adjusted

efficiency ratio (a)/(b) (6) 64.63 % 67.85 %

Refer to Exhibit 16 for footnote

explanations.

MUFG Americas Holdings Corporation and

Subsidiaries Footnotes Exhibit 16 (1)

Pre-tax, pre-provision income is total revenue less

noninterest expense. Management believes that this is a useful

financial measure because it enables investors and others to assess

the Company's ability to generate capital to cover loan losses

through a credit cycle. (2) Core deposits exclude brokered

deposits, foreign time deposits and domestic time deposits greater

than $250,000. (3) Annualized. (4) These ratios exclude the impact

of the privatization transaction and merger costs related to

acquisitions. Management believes that these ratios provide useful

supplemental information regarding the Company's business results.

Please refer to Exhibits 13 and 15 for reconciliations between

certain GAAP amounts and these non-GAAP measures. (5) The

efficiency ratio is total noninterest expense as a percentage of

total revenue (net interest income and noninterest income). (6) The

adjusted efficiency ratio, a non-GAAP financial measure, is

adjusted noninterest expense (noninterest expense excluding staff

costs associated with fees from affiliates - support services,

foreclosed asset expense and other credit costs, (reversal of)

provision for losses on unfunded credit commitments, certain costs

related to productivity initiatives, low income housing credit

(LIHC) investment amortization expense, expenses of the LIHC

consolidated variable interest entities, merger and business

integration costs, privatization-related expenses, and intangible

asset amortization) as a percentage of adjusted total revenue (net

interest income (taxable-equivalent basis) and noninterest income),

excluding the impact of fees from affiliates - support services,

gains from productivity initiatives related to the sale of certain

business units and premises, accretion related to

privatization-related fair value adjustments, and other credit

costs. Management discloses the adjusted efficiency ratio as a

measure of the efficiency of our operations, focusing on those

costs most relevant to our business activities. Please refer to

Exhibits 13 and 15 for reconciliations between certain GAAP amounts

and these non-GAAP measures. (7) Yields, interest income and net

interest margin are presented on a taxable-equivalent basis using

the federal statutory tax rate of 35 percent. (8) Estimated as of

December 31, 2014. (9) The capital ratios as of December 31, 2014

and 2013 are calculated under U.S. Basel I rules. The capital

ratios displayed as of September 30, 2014, June 30, 2014, and March

31, 2014 are calculated in accordance with the transition

guidelines set forth in the U.S. federal banking agencies' revised

capital framework for implementing the final U.S. Basel III

regulatory capital rules. (10) The Tier 1 common capital ratio is

the ratio of Tier 1 capital, less qualifying trust preferred

securities, to risk-weighted assets. The Tier 1 common capital

ratio, a non-GAAP financial measure, facilitates the understanding

of the Company's capital structure and may be used to assess and

compare the quality and composition of the Company's capital

structure to other financial institutions. Please refer to Exhibit

14 for a reconciliation between certain GAAP amounts and these

non-GAAP measures. (11) The tangible common equity ratio, a

non-GAAP financial measure, is calculated as tangible common equity

divided by tangible assets. The methodology for determining

tangible common equity may differ among companies. The tangible

common equity ratio facilitates the understanding of the Company's

capital structure and is used to assess and compare the quality and

composition of the Company's capital structure to other financial

institutions. Please refer to Exhibit 14 for a reconciliation

between certain GAAP amounts and these non-GAAP measures. (12) In

December 2014, the Federal Reserve Board approved the Company's

request to opt-out of the advanced approaches methodology under

U.S. Basel III regulatory capital rules. Common Equity Tier 1

risk-based capital is calculated in accordance with the transition

guidelines set forth in the U.S. federal banking agencies' revised

capital framework for implementing the final U.S. Basel III

regulatory capital rules. Management reviews this ratio, which

excludes accumulated other comprehensive loss, along with other

measures of capital as part of its financial analyses and has

included this non-GAAP information, and the corresponding

reconciliation from Tier 1 capital (determined in accordance with

U.S. Basel I) because of current interest in such information by

market participants. Please refer to Exhibit 14 for a

reconciliation between certain GAAP amounts and these non-GAAP

measures. (13) Common Equity Tier 1 risk-based capital

(standardized, fully phased-in basis) is a non-GAAP financial

measure that is used by investors, analysts and bank regulatory

agencies to assess the capital position of financial services

companies as if the transition provisions of the U.S. Basel III

rules were fully phased in for the periods in which the ratio is

disclosed. Management reviews this ratio, which excludes

accumulated other comprehensive loss, along with other measures of

capital as part of its financial analyses and has included this

non-GAAP information, and the corresponding reconciliation from

Tier 1 capital (determined in accordance with U.S. Basel I) because

of current interest in such information by market participants.

Please refer to Exhibit 14 for a reconciliation between certain

GAAP amounts and these non-GAAP measures. (14) Criticized loans

held for investment reflects loans in the commercial portfolio

segment that are monitored for credit quality based on internal

ratings. Amounts exclude small business loans, which are monitored

by business credit score and delinquency status. (15) The allowance

for credit losses ratios include the allowances for loan losses and

losses on unfunded credit commitments against end of period total

loans held for investment or total nonaccrual loans, as

appropriate. (16) Fees from affiliates represents income resulting

from the July 1, 2014 business integration initiative. (17) Average

balances on loans held for investment include all nonperforming

loans. The amortized portion of net loan origination fees (costs)

is included in interest income on loans, representing an adjustment

to the yield. (18) Includes interest bearing trading liabilities.

(19) Excludes loans totaling $47 million, $65 million, $103

million, $123 million, and $124 million that are 90 days or more

past due and still accruing at December 31, 2014, September 30,

2014, June 30, 2014, March 31, 2014, and December 31, 2013,

respectively, which consist of loans accounted for within loan

pools in accordance with the accounting standards for purchased

credit-impaired loans. The past due status of individual loans

within the pools is not a meaningful indicator of credit quality,

as potential credit losses are measured at the loan pool level.

(20) Carrying amount reflects amortized cost except for balances

transferred from available for sale to held to maturity securities.

Those balances reflect amortized cost plus any unrealized gains or

losses at the date of transfer. nm = not meaningful n/a = not

applicable

MUFG Americas Holdings CorporationAlan

GulickCorporate

Communications425-423-7317orDoug

LambertInvestor Relations212-782-5911

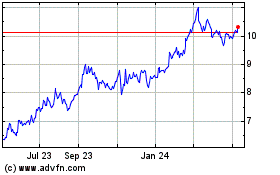

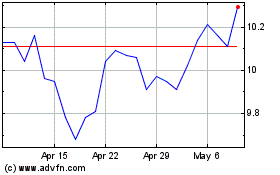

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Sep 2023 to Sep 2024