Lexington Realty Trust ("Lexington") (NYSE:LXP), a real estate

investment trust focused on single-tenant real estate investments,

today announced results for the third quarter ended

September 30, 2015.

Third Quarter 2015 Highlights

- Generated Company Funds From Operations ("Company FFO")

of $66.9 million, or $0.27 per diluted common share.

- Disposed of three properties for gross disposition

proceeds of $135.7 million.

- Invested $25.5 million in on-going build-to-suit

projects.

- Completed an industrial build-to-suit property for

$22.1 million.

- Leased approximately 800,000 square feet with overall

portfolio 96.5% leased.

- Retired $55.0 million of secured debt.

- Refinanced credit facility and term loans extending the

maturities by two years and reducing interest rates by 15 to 65

basis points.

- Announced a 10.0 million common share repurchase

authorization and repurchased 1.6 million common shares, at an

average price of $8.34 per share, as of the date of this press

release.

T. Wilson Eglin, President and Chief Executive

Officer of Lexington, stated, "We are raising our Company FFO

guidance for 2015 as a result of strong execution in all aspects of

our business. During the third quarter, same-store rent increased

2.8%, reflecting that approximately 80% of our revenue now comes

from leases with escalating rents. In the fourth quarter, we expect

to close on two substantial build-to-suit projects that are

estimated to contribute approximately $22.5 million to revenue next

year."

FINANCIAL RESULTS

Revenues

For the quarter ended September 30, 2015,

total gross revenues were $105.4 million, a 1.1% decrease compared

with total gross revenues of $106.6 million for the quarter ended

September 30, 2014. The decrease is primarily due to 2015

property sales and lease expirations, partially offset by revenue

generated from property acquisitions and new leases signed.

Company FFO

For the quarter ended September 30, 2015,

Lexington generated Company FFO of $66.9 million, or $0.27 per

diluted share, compared to Company FFO for the quarter ended

September 30, 2014 of $68.7 million, or $0.28 per diluted

share. The calculation of Company FFO and a reconciliation to net

income (loss) attributable to common shareholders is included later

in this press release.

Dividends/Distributions

Lexington declared a regular quarterly common

share/unit dividend/distribution for the quarter ended

September 30, 2015 of $0.17 per common share/unit, which was

paid on October 15, 2015 to common shareholders/unitholders of

record as of September 30, 2015. Lexington also declared two

dividends of $0.8125 per share each on its Series C Cumulative

Convertible Preferred Stock ("Series C Preferred Shares"), which

will be paid on November 16, 2015 and February 16, 2016 to Series C

Preferred Shareholders of record as of October 30, 2015 and January

29, 2016, respectively.

Net Income (Loss) Attributable to Common

Shareholders

For the quarter ended September 30, 2015,

net loss attributable to common shareholders was $(7.6) million, or

$(0.03) per diluted share, compared with net income attributable to

common shareholders for the quarter ended September 30, 2014

of $38.7 million, or $0.17 per diluted share.

OPERATING ACTIVITIES

Investment Activity

During the quarter, Lexington completed the

following build-to-suit project, which is subject to a lease having

a term in excess of ten years (an "LTL").

|

Acquisition |

|

|

|

Tenant |

|

Location |

|

PropertyType |

|

InitialBasis($000) |

|

InitialAnnualizedCash

Rent($000) |

|

InitialCashYield |

|

GAAPYield |

|

LeaseTerm (Yrs) |

| Stella & Chewy's

LLC |

|

Oak

Creek, WI |

|

LTL -

Industrial |

|

$ |

22,139 |

|

|

$ |

1,865 |

|

|

|

8.4 |

% |

|

|

9.5 |

% |

|

20 |

In addition, Lexington acquired a consolidated

joint venture partner's interest in an office property in

Philadelphia, Pennsylvania for $4.0 million, raising Lexington's

ownership in the office property from 87.5% to 100.0%.

Lexington also funded $25.5 million of the projected costs of

the following projects:

|

On-going Build-to-Suit Projects |

|

Location |

|

Sq. Ft. |

|

Property Type |

|

Lease Term(Years) |

|

MaximumCommitment/EstimatedCompletion

Cost($000) |

|

GAAP InvestmentBalance as

of9/30/2015($000) |

|

Estimated Completion/Acquisition Date |

| Richmond, VA |

|

330,000 |

|

|

LTL -

Office |

|

15 |

|

$ |

110,137 |

|

|

$ |

97,830 |

|

|

4Q

15 |

| Anderson, SC |

|

1,325,000 |

|

|

LTL -

Industrial |

|

20 |

|

70,012 |

|

|

12,708 |

|

|

2Q

16 |

| Lake Jackson, TX |

|

664,000 |

|

|

LTL -

Office |

|

20 |

|

166,164 |

|

|

45,008 |

|

|

4Q

16 |

| Houston, TX(1) |

|

274,000 |

|

|

LTL -

Retail/Specialty |

|

20 |

|

86,491 |

|

|

28,602 |

|

|

3Q

16 |

| |

|

2,593,000 |

|

|

|

|

|

|

$ |

432,804 |

|

|

$ |

184,148 |

|

|

|

- Lexington has a 25% interest as of September 30, 2015.

Lexington may provide construction financing up to $56.7 million to

the joint venture.

In addition, Lexington has committed to acquire

the following properties upon completion of construction:

|

Forward Commitments |

|

Location |

|

PropertyType |

|

Estimated Acquisition

Cost($000) |

|

Lease Term (Years) |

|

Estimated InitialCash

Yield |

|

Estimated

GAAPYield |

|

Estimated Acquisition Date |

| Richland, WA |

|

LTL -

Industrial |

|

$ |

152,000 |

|

|

20 |

|

|

7.1 |

% |

|

|

8.6 |

% |

|

4Q

15 |

| Detroit, MI |

|

LTL -

Industrial |

|

29,680 |

|

|

20 |

|

|

7.4 |

% |

|

|

7.4 |

% |

|

1Q

16 |

| |

|

|

|

$ |

181,680 |

|

|

|

|

|

7.2 |

% |

|

|

8.4 |

% |

|

|

Capital Recycling

|

Property Dispositions |

|

Tenant |

|

Location |

|

Property Type |

|

Gross DispositionPrice

($000) |

|

AnnualizedNOI

($000) |

|

Month of Disposition |

| Wagner Industries,

Inc. |

|

Jacksonville, FL |

|

Industrial |

|

$ |

1,850 |

|

|

$ |

313 |

|

|

July |

| Lockheed Martin

Corporation |

|

Orlando, FL |

|

Office |

|

12,800 |

|

|

955 |

|

|

July |

| Multi-tenant(1) |

|

Baltimore, MD |

|

Office |

|

121,000 |

|

|

8,318 |

|

|

August |

| |

|

|

|

|

|

$ |

135,650 |

|

|

$ |

9,586 |

|

|

|

- $55.0 million non-recourse mortgage loan assumed at

closing.

Balance Sheet

On September 1, 2015, Lexington entered into a

new $905.0 million unsecured credit agreement, which replaced

Lexington's existing revolving credit facility and term loans. With

lender approval, Lexington can increase the size of the new

facility to an aggregate $1.8 billion. A summary of the significant

terms are as follows:

| |

PriorMaturity Date |

|

NewMaturity Date |

|

PriorInterest Rate |

|

CurrentInterest Rate |

| $400.0 Million

Revolving Credit Facility(1) |

02/2017 |

|

08/2019 |

|

L +

1.15% |

|

L +

1.00% |

| $250.0 Million Term

Loan(2) |

02/2018 |

|

08/2020 |

|

L +

1.35% |

|

L +

1.10% |

| $255.0 Million Term

Loan(3) |

01/2019 |

|

01/2021 |

|

L +

1.75% |

|

L +

1.10% |

1. Maturity date can be extended to

08/2020 at Lexington's option.2. Lexington

previously entered into aggregate interest rate swap agreements,

which fix the LIBOR component of this loan at 1.09% through

02/2018.3. Lexington previously entered

into aggregate interest rate swap agreements, which fix the LIBOR

component of this loan at 1.42% through 01/2019.

In July 2015, Lexington announced a new 10.0 million common

share repurchase authorization (inclusive of all outstanding prior

authorizations). As of the date of this earnings release, 1,594,644

common shares have been repurchased at an average price of $8.34

per share.

In August 2015, approximately $0.4 million

original principal amount 6.00% Convertible Guaranteed Notes due

2030 ("6.00% Notes") were satisfied for cash, reducing the

outstanding balance of this note issuance to $12.4 million. All

common shares that are issuable upon conversion of the 6.00% Notes

are treated as outstanding for diluted Company FFO

calculations.

Leasing

During the third quarter of 2015, Lexington

executed the following new and extended leases:

| |

|

LEASE EXTENSIONS |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Location |

|

Prior Term |

|

Lease Expiration Date |

|

Sq. Ft. |

| |

|

|

|

|

|

|

|

|

|

| |

|

Office/Multi-Tenant Office |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| 1 |

|

Rockaway, NJ |

|

|

06/2026 |

|

12/2027 |

|

60,258 |

|

|

2-4 |

|

Various

(AZ, HI) |

|

|

2015 |

|

2016-2021 |

|

34,758 |

|

|

4 |

|

Total office lease extensions |

|

|

|

|

|

95,016 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Industrial |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| 1 |

|

Erwin, NY |

|

|

11/2016 |

|

11/2026 |

|

408,000 |

|

|

2 |

|

Orlando,

FL |

|

|

03/2016 |

|

03/2021 |

|

205,016 |

|

|

2 |

|

Total industrial lease extensions |

|

|

|

|

|

613,016 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Retail |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| 1 |

|

Tulsa, OK |

|

|

05/2016 |

|

05/2026 |

|

43,123 |

|

|

1 |

|

Total retail lease extensions |

|

|

|

|

|

43,123 |

|

| |

|

|

|

|

|

|

|

|

|

|

7 |

|

Total lease extensions |

|

|

|

|

|

751,155 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

NEW

LEASES |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Location |

|

|

|

Lease Expiration Date |

|

Sq. Ft. |

| |

|

|

|

|

|

|

|

|

|

| |

|

Office/Multi-Tenant Office |

|

|

|

|

|

|

| 1 |

|

Foxboro, MA |

|

|

|

|

02/2017 |

|

8,151 |

|

|

2 |

|

Rockaway,

NJ |

|

|

|

|

12/2027 |

|

32,068 |

|

|

2 |

|

Total new office leases |

|

|

|

|

|

40,219 |

|

| |

|

|

|

|

|

|

|

|

|

|

2 |

|

Total new leases |

|

|

|

|

|

40,219 |

|

| |

|

|

|

|

|

|

|

|

|

|

9 |

|

TOTAL NEW AND EXTENDED LEASES |

|

|

|

|

|

791,374 |

|

As of September 30, 2015, Lexington's

portfolio was 96.5% leased, excluding properties owned subject to

mortgages in default.

2015 EARNINGS GUIDANCE

Lexington raised its Company FFO guidance to an

expected range of $1.05 to $1.07 from $1.02 to $1.06 to per

diluted share for the year ended December 31, 2015. This guidance

is forward looking, excludes the impact of certain items and is

based on current expectations.

THIRD QUARTER 2015 CONFERENCE

CALL

Lexington will host a conference call today,

Thursday, November 5, 2015, at 11:00 a.m. Eastern Time, to discuss

its results for the quarter ended September 30, 2015.

Interested parties may participate in this conference call by

dialing 877-407-0789 or 201-689-8562. A replay of the call will be

available through November 19, 2015, at 877-870-5176 or

858-384-5517, pin: 13622695. A live webcast of the conference call

will be available at www.lxp.com within the Investors section.

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust is a real estate

investment trust that owns a diversified portfolio of equity and

debt interests in single-tenant commercial properties and land.

Lexington seeks to expand its portfolio through acquisitions,

sale-leaseback transactions, build-to-suit arrangements and other

transactions. A majority of these properties and all land interests

are subject to net or similar leases, where the tenant bears all or

substantially all of the operating costs, including cost increases,

for real estate taxes, utilities, insurance and ordinary repairs.

Lexington also provides investment advisory and asset management

services to investors in the single-tenant area. Lexington common

shares are traded on the New York Stock Exchange under the symbol

"LXP". Additional information about Lexington is available

on-line at www.lxp.com or by contacting Lexington Realty Trust, One

Penn Plaza, Suite 4015, New York, New York 10119-4015, Attention:

Investor Relations.

Contact:Investor or Media Inquiries, T. Wilson Eglin,

CEOLexington Realty TrustPhone: (212) 692-7200 E-mail:

tweglin@lxp.com

This release contains certain forward-looking

statements which involve known and unknown risks, uncertainties or

other factors not under Lexington's control which may cause actual

results, performance or achievements of Lexington to be materially

different from the results, performance, or other expectations

implied by these forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, those discussed under the headings "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and "Risk Factors" in Lexington's periodic reports

filed with the Securities and Exchange Commission, including risks

related to: (1) the authorization by Lexington's Board of Trustees

of future dividend declarations, including those necessary to

achieve an annualized dividend level of $0.68 per common

share/unit, (2) Lexington's ability to achieve its estimate of

Company FFO for the year ending December 31, 2015, (3) the

successful consummation of any lease, acquisition, build-to-suit,

disposition, financing or other transaction, (4) the failure to

continue to qualify as a real estate investment trust, (5) changes

in general business and economic conditions, including the impact

of any legislation, (6) competition, (7) increases in real estate

construction costs, (8) changes in interest rates, (9) changes in

accessibility of debt and equity capital markets, and (10) future

impairment charges. Copies of the periodic reports Lexington files

with the Securities and Exchange Commission are available on

Lexington's web site at www.lxp.com. Forward-looking statements,

which are based on certain assumptions and describe Lexington's

future plans, strategies and expectations, are generally

identifiable by use of the words "believes," "expects," "intends,"

"anticipates," "estimates," "projects", "may," "plans," "predicts,"

"will," "will likely result," "is optimistic," "goal," "objective"

or similar expressions. Except as required by law, Lexington

undertakes no obligation to publicly release the results of any

revisions to those forward-looking statements which may be made to

reflect events or circumstances after the occurrence of

unanticipated events. Accordingly, there is no assurance that

Lexington's expectations will be realized.

References to Lexington refer to Lexington

Realty Trust and its consolidated subsidiaries. All interests in

properties and loans are held through special purpose entities,

which are separate and distinct legal entities, some of which are

consolidated for financial statement purposes and/or disregarded

for income tax purposes.

|

|

| LEXINGTON REALTY

TRUST AND CONSOLIDATED SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited and in

thousands, except share and per share data) |

|

|

| |

Three months ended September 30, |

|

Nine months ended September 30, |

| |

2015 |

|

2014 |

|

2015 |

|

2014 |

| Gross revenues: |

|

|

|

|

|

|

|

| Rental |

$ |

98,095 |

|

|

$ |

98,941 |

|

|

$ |

300,551 |

|

|

$ |

292,870 |

|

| Tenant reimbursements |

7,343 |

|

|

7,631 |

|

|

23,662 |

|

|

23,165 |

|

| Total gross revenues |

105,438 |

|

|

106,572 |

|

|

324,213 |

|

|

316,035 |

|

| Expense applicable to

revenues: |

|

|

|

|

|

|

|

| Depreciation and amortization |

(39,712 |

) |

|

(39,022 |

) |

|

(121,795 |

) |

|

(114,732 |

) |

| Property operating |

(13,484 |

) |

|

(15,504 |

) |

|

(45,600 |

) |

|

(46,634 |

) |

| General and

administrative |

(6,734 |

) |

|

(6,426 |

) |

|

(22,526 |

) |

|

(21,035 |

) |

| Non-operating

income |

2,515 |

|

|

4,217 |

|

|

8,213 |

|

|

10,369 |

|

| Interest and

amortization expense |

(21,931 |

) |

|

(24,321 |

) |

|

(68,273 |

) |

|

(73,456 |

) |

| Debt satisfaction gains

(charges), net |

(398 |

) |

|

(455 |

) |

|

13,753 |

|

|

(7,946 |

) |

| Impairment charges |

(32,818 |

) |

|

(2,464 |

) |

|

(34,070 |

) |

|

(18,864 |

) |

| Gains on sales of

properties |

1,733 |

|

|

- |

|

|

23,307 |

|

|

- |

|

| Income (loss) before

provision for income taxes, equity in earnings of non-consolidated

entities and discontinued operations |

(5,391 |

) |

|

22,597 |

|

|

77,222 |

|

|

43,737 |

|

| Provision for income

taxes |

(75 |

) |

|

(72 |

) |

|

(464 |

) |

|

(947 |

) |

| Equity in earnings of

non-consolidated entities |

266 |

|

|

173 |

|

|

938 |

|

|

246 |

|

| Income (loss) from continuing

operations |

(5,200 |

) |

|

22,698 |

|

|

77,696 |

|

|

43,036 |

|

| Discontinued

operations: |

|

|

|

|

|

|

|

| Income from discontinued

operations |

- |

|

|

1,322 |

|

|

109 |

|

|

5,601 |

|

| Provision for income taxes |

- |

|

|

(14 |

) |

|

(4 |

) |

|

(50 |

) |

| Debt satisfaction charges, net |

- |

|

|

- |

|

|

- |

|

|

(299 |

) |

| Gains on sales of properties |

- |

|

|

18,542 |

|

|

1,577 |

|

|

22,052 |

|

| Impairment charges |

- |

|

|

(371 |

) |

|

- |

|

|

(11,062 |

) |

| Total discontinued operations |

- |

|

|

19,479 |

|

|

1,682 |

|

|

16,242 |

|

| Net income (loss) |

(5,200 |

) |

|

42,177 |

|

|

79,378 |

|

|

59,278 |

|

| Less net income attributable to

noncontrolling interests |

(784 |

) |

|

(1,772 |

) |

|

(2,525 |

) |

|

(3,537 |

) |

| Net income (loss)

attributable to Lexington Realty Trust shareholders |

(5,984 |

) |

|

40,405 |

|

|

76,853 |

|

|

55,741 |

|

| Dividends attributable

to preferred shares - Series C |

(1,573 |

) |

|

(1,573 |

) |

|

(4,718 |

) |

|

(4,718 |

) |

| Allocation to

participating securities |

(72 |

) |

|

(112 |

) |

|

(264 |

) |

|

(399 |

) |

| Net income (loss)

attributable to common shareholders |

$ |

(7,629 |

) |

|

$ |

38,720 |

|

|

$ |

71,871 |

|

|

$ |

50,624 |

|

| Income (loss) per

common share - basic: |

|

|

|

|

|

|

|

| Income (loss) from continuing

operations |

$ |

(0.03 |

) |

|

$ |

0.09 |

|

|

$ |

0.30 |

|

|

$ |

0.15 |

|

| Income from discontinued

operations |

- |

|

|

0.08 |

|

|

0.01 |

|

|

0.07 |

|

| Net income (loss) attributable to

common shareholders |

$ |

(0.03 |

) |

|

$ |

0.17 |

|

|

$ |

0.31 |

|

|

$ |

0.22 |

|

| Weighted-average common

shares outstanding - basic |

234,018,062 |

|

|

229,463,522 |

|

|

233,457,400 |

|

|

228,337,871 |

|

| Income (loss) per

common share - diluted: |

|

|

|

|

|

|

|

| Income (loss) from continuing

operations |

$ |

(0.03 |

) |

|

$ |

0.09 |

|

|

$ |

0.30 |

|

|

$ |

0.15 |

|

| Income from discontinued

operations |

- |

|

|

0.08 |

|

|

0.01 |

|

|

0.07 |

|

| Net income (loss) attributable to

common shareholders |

$ |

(0.03 |

) |

|

$ |

0.17 |

|

|

$ |

0.31 |

|

|

$ |

0.22 |

|

| Weighted-average common

shares outstanding - diluted |

234,018,062 |

|

|

229,922,110 |

|

|

233,776,838 |

|

|

228,830,020 |

|

| Amounts attributable to

common shareholders: |

|

|

|

|

|

|

|

| Income (loss) from continuing

operations |

$ |

(7,629 |

) |

|

$ |

20,151 |

|

|

$ |

70,189 |

|

|

$ |

35,330 |

|

| Income from discontinued

operations |

- |

|

|

18,569 |

|

|

1,682 |

|

|

15,294 |

|

| Net income (loss) attributable to

common shareholders |

$ |

(7,629 |

) |

|

$ |

38,720 |

|

|

$ |

71,871 |

|

|

$ |

50,624 |

|

| |

| LEXINGTON REALTY

TRUST AND CONSOLIDATED SUBSIDIARIES |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| (Unaudited and in

thousands, except share and per share data) |

| |

| |

September 30, 2015 |

|

December 31, 2014 |

|

Assets: |

|

|

|

| Real estate, at

cost |

$ |

3,586,435 |

|

|

$ |

3,671,560 |

|

| Real estate -

intangible assets |

669,341 |

|

|

705,566 |

|

| Investments in real

estate under construction |

155,546 |

|

|

106,238 |

|

| |

4,411,322 |

|

|

4,483,364 |

|

| Less: accumulated

depreciation and amortization |

1,153,841 |

|

|

1,196,114 |

|

| Real estate, net |

3,257,481 |

|

|

3,287,250 |

|

| Assets held for

sale |

- |

|

|

3,379 |

|

| Cash and cash

equivalents |

86,269 |

|

|

191,077 |

|

| Restricted cash |

12,327 |

|

|

17,379 |

|

| Investment in and

advances to non-consolidated entities |

28,050 |

|

|

19,402 |

|

| Deferred expenses,

net |

62,225 |

|

|

65,860 |

|

| Loans receivable,

net |

95,806 |

|

|

105,635 |

|

| Rent receivable -

current |

9,896 |

|

|

6,311 |

|

| Rent receivable -

deferred |

78,957 |

|

|

61,372 |

|

| Other assets |

21,614 |

|

|

20,229 |

|

| Total assets |

$ |

3,652,625 |

|

|

$ |

3,777,894 |

|

| |

|

|

|

| Liabilities and

Equity: |

|

|

|

| Liabilities: |

|

|

|

| Mortgages and notes

payable |

$ |

804,238 |

|

|

$ |

945,216 |

|

| Credit facility

borrowings |

73,000 |

|

|

- |

|

| Term loans payable |

505,000 |

|

|

505,000 |

|

| Senior notes

payable |

497,879 |

|

|

497,675 |

|

| Convertible notes

payable |

12,128 |

|

|

15,664 |

|

| Trust preferred

securities |

129,120 |

|

|

129,120 |

|

| Dividends payable |

45,307 |

|

|

42,864 |

|

| Liabilities held for

sale |

- |

|

|

2,843 |

|

| Accounts payable and

other liabilities |

42,692 |

|

|

37,740 |

|

| Accrued interest

payable |

14,679 |

|

|

8,301 |

|

| Deferred revenue -

including below market leases, net |

43,521 |

|

|

68,215 |

|

| Prepaid rent |

16,991 |

|

|

16,336 |

|

| Total liabilities |

2,184,555 |

|

|

2,268,974 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| Equity: |

|

|

|

| Preferred shares, par

value $0.0001 per share; authorized 100,000,000 shares: |

|

|

|

| Series C Cumulative Convertible

Preferred, liquidation preference $96,770; 1,935,400 shares issued

and outstanding |

94,016 |

|

|

94,016 |

|

| Common shares, par

value $0.0001 per share; authorized 400,000,000 shares, 235,179,131

and 233,278,037 shares issued and outstanding in 2015 and 2014,

respectively |

24 |

|

|

23 |

|

| Additional

paid-in-capital |

2,779,836 |

|

|

2,763,374 |

|

| Accumulated

distributions in excess of net income |

(1,422,417 |

) |

|

(1,372,051 |

) |

| Accumulated other

comprehensive income (loss) |

(6,216 |

) |

|

404 |

|

| Total shareholders' equity |

1,445,243 |

|

|

1,485,766 |

|

| Noncontrolling

interests |

22,827 |

|

|

23,154 |

|

| Total equity |

1,468,070 |

|

|

1,508,920 |

|

| Total liabilities and

equity |

$ |

3,652,625 |

|

|

$ |

3,777,894 |

|

|

|

| LEXINGTON REALTY

TRUST AND CONSOLIDATED SUBSIDIARIES |

| EARNINGS PER

SHARE |

| (Unaudited and

in thousands, except share and per share data) |

|

|

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

| |

2015 |

|

2014 |

|

2015 |

|

2014 |

| EARNINGS PER

SHARE: |

|

|

|

|

|

|

|

|

Basic: |

|

|

|

|

|

|

|

| Income (loss) from

continuing operations attributable to common shareholders |

$ |

(7,629 |

) |

|

$ |

20,151 |

|

|

$ |

70,189 |

|

|

$ |

35,330 |

|

| Income from

discontinued operations attributable to common shareholders |

- |

|

|

18,569 |

|

|

1,682 |

|

|

15,294 |

|

| Net income (loss)

attributable to common shareholders |

$ |

(7,629 |

) |

|

$ |

38,720 |

|

|

$ |

71,871 |

|

|

$ |

50,624 |

|

| Weighted-average number

of common shares outstanding |

234,018,062 |

|

|

229,463,522 |

|

|

233,457,400 |

|

|

228,337,871 |

|

| Income (loss) per

common share: |

|

|

|

|

|

|

|

| Income (loss) from

continuing operations |

$ |

(0.03 |

) |

|

$ |

0.09 |

|

|

$ |

0.30 |

|

|

$ |

0.15 |

|

| Income from

discontinued operations |

- |

|

|

0.08 |

|

|

0.01 |

|

|

0.07 |

|

| Net income (loss)

attributable to common shareholders |

$ |

(0.03 |

) |

|

$ |

0.17 |

|

|

$ |

0.31 |

|

|

$ |

0.22 |

|

| |

|

|

|

|

|

|

|

|

Diluted: |

|

|

|

|

|

|

|

| Income (loss) from

continuing operations attributable to common shareholders -

basic |

$ |

(7,629 |

) |

|

$ |

20,151 |

|

|

$ |

70,189 |

|

|

$ |

35,330 |

|

| Impact of assumed

conversions |

- |

|

|

- |

|

|

- |

|

|

- |

|

| Income (loss) from

continuing operations attributable to common shareholders |

(7,629 |

) |

|

20,151 |

|

|

70,189 |

|

|

35,330 |

|

| Income from

discontinued operations attributable to common shareholders -

basic |

- |

|

|

18,569 |

|

|

1,682 |

|

|

15,294 |

|

| Impact of assumed

conversions |

- |

|

|

- |

|

|

- |

|

|

- |

|

| Income from

discontinued operations attributable to common shareholders |

- |

|

|

18,569 |

|

|

1,682 |

|

|

15,294 |

|

| Net income (loss)

attributable to common shareholders |

$ |

(7,629 |

) |

|

$ |

38,720 |

|

|

$ |

71,871 |

|

|

$ |

50,624 |

|

| |

|

|

|

|

|

|

|

| Weighted-average common

shares outstanding - basic |

234,018,062 |

|

|

229,463,522 |

|

|

233,457,400 |

|

|

228,337,871 |

|

| Effect of dilutive

securities: |

|

|

|

|

|

|

|

| Share options |

- |

|

|

458,588 |

|

|

319,438 |

|

|

492,149 |

|

| Weighted-average common

shares outstanding |

234,018,062 |

|

|

229,922,110 |

|

|

233,776,838 |

|

|

228,830,020 |

|

| |

|

|

|

|

|

|

|

| Income (loss) per

common share: |

|

|

|

|

|

|

|

| Income (loss) from

continuing operations |

$ |

(0.03 |

) |

|

$ |

0.09 |

|

|

$ |

0.30 |

|

|

$ |

0.15 |

|

| Income from

discontinued operations |

- |

|

|

0.08 |

|

|

0.01 |

|

|

0.07 |

|

| Net income (loss)

attributable to common shareholders |

$ |

(0.03 |

) |

|

$ |

0.17 |

|

|

$ |

0.31 |

|

|

$ |

0.22 |

|

| LEXINGTON REALTY TRUST AND CONSOLIDATED

SUBSIDIARIES |

| COMPANY FUNDS FROM OPERATIONS & FUNDS

AVAILABLE FOR DISTRIBUTION |

| (Unaudited and in thousands, except share and per

share data) |

| |

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2015 |

|

2014 |

|

2015 |

|

2014 |

|

FUNDS FROM OPERATIONS: (1) |

|

|

|

Basic and Diluted: |

|

|

|

|

|

|

|

| Net income

(loss) attributable to common shareholders |

$ |

(7,629 |

) |

|

$ |

38,720 |

|

|

$ |

71,871 |

|

|

$ |

50,624 |

|

|

Adjustments: |

|

|

|

|

|

|

|

| |

Depreciation and amortization |

38,547 |

|

|

39,030 |

|

|

117,936 |

|

|

117,991 |

|

| |

Impairment charges - real estate,

including non-consolidated entities |

32,818 |

|

|

3,115 |

|

|

34,070 |

|

|

30,856 |

|

| |

Noncontrolling interests - OP

units |

452 |

|

|

1,442 |

|

|

1,542 |

|

|

2,556 |

|

| |

Amortization of leasing

commissions |

1,166 |

|

|

1,580 |

|

|

3,859 |

|

|

4,506 |

|

| |

Joint venture and noncontrolling

interest adjustment |

577 |

|

|

495 |

|

|

1,335 |

|

|

1,733 |

|

| |

Gains on sales of properties |

(1,733 |

) |

|

(18,542 |

) |

|

(24,884 |

) |

|

(22,052 |

) |

| FFO

available to common shareholders and unitholders -

basic |

64,198 |

|

|

65,840 |

|

|

205,729 |

|

|

186,214 |

|

| |

Preferred dividends |

1,573 |

|

|

1,573 |

|

|

4,718 |

|

|

4,718 |

|

| |

Interest and amortization on 6.00%

Convertible Guaranteed Notes |

252 |

|

|

508 |

|

|

795 |

|

|

1,618 |

|

| |

Amount allocated to participating

securities |

72 |

|

|

112 |

|

|

264 |

|

|

399 |

|

| FFO

available to common shareholders and unitholders -

diluted |

66,095 |

|

|

68,033 |

|

|

211,506 |

|

|

192,949 |

|

| |

Debt satisfaction (gains) charges,

net, including non-consolidated entities |

398 |

|

|

455 |

|

|

(13,689 |

) |

|

8,245 |

|

| |

Other / Transaction costs |

405 |

|

|

257 |

|

|

579 |

|

|

1,514 |

|

|

Company FFO available to common shareholders and

unitholders - diluted |

66,898 |

|

|

68,745 |

|

|

198,396 |

|

|

202,708 |

|

| |

|

|

|

|

|

|

|

|

FUNDS AVAILABLE FOR DISTRIBUTION: (2) |

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

| |

Straight-line rents |

(12,899 |

) |

|

(13,478 |

) |

|

(35,242 |

) |

|

(31,057 |

) |

| |

Lease incentives |

212 |

|

|

250 |

|

|

1,157 |

|

|

1,104 |

|

| |

Amortization of below/above market

leases |

287 |

|

|

184 |

|

|

(157 |

) |

|

903 |

|

| |

Non-cash interest, net |

(598 |

) |

|

(1,824 |

) |

|

520 |

|

|

(4,186 |

) |

| |

Non-cash charges, net |

2,205 |

|

|

2,114 |

|

|

6,608 |

|

|

6,563 |

|

| |

Tenant improvements |

(10,562 |

) |

|

(1,961 |

) |

|

(13,184 |

) |

|

(5,960 |

) |

| |

Lease costs |

(1,066 |

) |

|

(1,895 |

) |

|

(4,242 |

) |

|

(8,414 |

) |

|

Company Funds Available for Distribution |

$ |

44,477 |

|

|

$ |

52,135 |

|

|

$ |

153,856 |

|

|

$ |

161,661 |

|

| |

|

|

|

|

|

|

|

|

| Per

Common Share and Unit Amounts |

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

| |

FFO |

$ |

0.27 |

|

|

$ |

0.28 |

|

|

$ |

0.87 |

|

|

$ |

0.80 |

|

| |

|

|

|

|

|

|

|

|

|

Diluted: |

|

|

|

|

|

|

|

| |

FFO |

$ |

0.27 |

|

|

$ |

0.28 |

|

|

$ |

0.87 |

|

|

$ |

0.80 |

|

| |

Company FFO |

$ |

0.27 |

|

|

$ |

0.28 |

|

|

$ |

0.81 |

|

|

$ |

0.84 |

|

| |

Company FAD |

$ |

0.18 |

|

|

$ |

0.22 |

|

|

$ |

0.63 |

|

|

$ |

0.67 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted-Average Common Shares: |

|

|

|

|

|

|

|

| |

Basic(3) |

237,871,036 |

|

|

233,334,560 |

|

|

237,310,374 |

|

|

232,214,620 |

|

| |

Diluted |

244,714,549 |

|

|

242,373,712 |

|

|

244,432,218 |

|

|

241,487,119 |

|

1 Lexington believes that Funds from Operations

("FFO"), which is not a measure under generally accepted accounting

principles ("GAAP"), is a widely recognized and appropriate measure

of the performance of an equity REIT. Lexington believes FFO is

frequently used by securities analysts, investors and other

interested parties in the evaluation of REITs, many of which

present FFO when reporting their results. FFO is intended to

exclude GAAP historical cost depreciation and amortization of real

estate and related assets, which assumes that the value of real

estate diminishes ratably over time. Historically, however, real

estate values have risen or fallen with market conditions. As a

result, FFO provides a performance measure that, when compared year

over year, reflects the impact to operations from trends in

occupancy rates, rental rates, operating costs, development

activities, interest costs and other matters without the inclusion

of depreciation and amortization, providing perspective that may

not necessarily be apparent from net income.

The National Association of Real Estate

Investment Trusts, Inc. ("NAREIT") defines FFO as "net income (or

loss) computed in accordance with GAAP, excluding gains (or losses)

from sales of property, plus real estate depreciation and

amortization and after adjustments for unconsolidated partnerships

and joint ventures." NAREIT clarified its computation of FFO to

exclude impairment charges on depreciable real estate owned

directly or indirectly. FFO does not represent cash generated from

operating activities in accordance with GAAP and is not indicative

of cash available to fund cash needs.

Lexington presents FFO available to common

shareholders and unitholders - basic. Lexington also presents FFO

available to common shareholders and unitholders - diluted on a

company-wide basis as if all securities that are convertible, at

the holder's option, into Lexington's common shares, are converted

at the beginning of the period. Lexington also presents Company FFO

which adjusts FFO for certain items which Management believes are

not indicative of the operating results of its real estate

portfolio. Management believes this is an appropriate presentation

as it is frequently requested by security analysts, investors and

other interested parties. Since others do not calculate funds from

operations in a similar fashion, Company FFO may not be comparable

to similarly titled measures as reported by others. Company FFO

should not be considered as an alternative to net income as an

indicator of our operating performance or as an alternative to cash

flow as a measure of liquidity.

2 Company Funds Available for Distribution

("FAD") is calculated by making adjustments to Company FFO for (1)

straight-line rent revenue, (2) lease incentive amortization, (3)

amortization of above/below market leases, (4) cash paid for tenant

improvements, (5) cash paid for lease costs, (6) non-cash interest,

net and (7) non-cash charges, net. Although FAD may not be

comparable to that of other REITs, Lexington believes it provides a

meaningful indication of its ability to fund cash needs. FAD is a

non-GAAP financial measure and should not be viewed as an

alternative measurement of operating performance to net income, as

an alternative to net cash flows from operating activities or as a

measure of liquidity.

3 Includes OP units other than OP units held by

us.

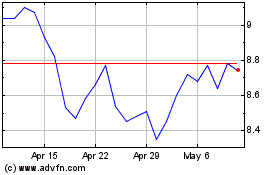

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2024 to May 2024

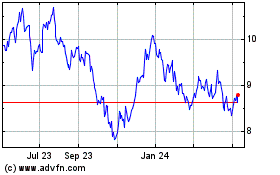

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From May 2023 to May 2024