Majority of businesses likely to add staff, but continue to face

challenges finding qualified talent

A majority of midsize business leaders remain optimistic that

the U.S. economy will continue to improve and plan to engage in

growth activities in 2016, according to The Hartford’s 2015 Midsize

Business Monitor.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20151015005914/en/

The second annual survey of owners and C-level executives of

U.S. businesses with annual sales or revenues of $10 million to $1

billion found that 60 percent are optimistic that the national

economy will strengthen in the next six months, down slightly from

66 percent in 2014. Their optimism is reflected in plans for 2016,

with nearly all (96 percent) midsize businesses likely to engage in

one or more activities that drive growth for their businesses,

including:

- Investing in technology – 87

percent

- Investing in their operations – 87

percent

- Providing new product or service

offerings – 72 percent

- Hiring additional staff – 71

percent

- Expanding into new customers segments –

71 percent

- Expanding into new geographies – 59

percent

The Hartford’s survey also found 44 percent of midsize

businesses are likely to engage in merger and acquisition activity

and 42 percent are likely to engage in business activities outside

the U.S.

“This continued optimism and focus on growth among midsize

businesses is a positive signal for the economy overall and for

businesses that provide the products and services they will need,”

said David Carter, executive vice president of Middle Market

insurance at The Hartford. “As we head into 2016, businesses that

are investing in their operations, expanding their footprint and

growing their customer base will look to business partners and

service providers who can help them protect their business and

manage risk as they capitalize on new and emerging market

opportunities.”

Midsize vs. Small Businesses: More Likely to Add Staff, But

Face Talent Shortage

A majority of midsize businesses (71 percent) are likely to add

staff in 2016. By comparison, nearly half (49 percent) of small

business owners are likely to add staff in 2016, according to The

Hartford’s 2015 Small Business Success Study (SBSS). While most

midsize businesses (86 percent) had hired employees in the prior 12

months, the SBSS found that just 35 percent of small business

owners had hired employees in the 12 months prior to the study.

As midsize business leaders look to add staff in 2016, finding

employees with the desired skills may continue to challenge hiring

plans. Nearly half of midsize businesses that hired employees,

hired fewer than desired. Among those businesses, the most common

reason was a lack of qualified talent (60 percent).

By comparison, the SBSS found that among small business owners

that had either not hired any

employees or hired fewer than desired, just 17 percent cited a lack

of qualified talent as a reason. The most common reasons for these

small business owners not hiring or hiring fewer than desired were

that the business was not growing (34 percent), the business could

not afford to hire (28 percent) or the owner was taking on

additional responsibilities (26 percent).

Retaining Talent, Promoting Wellness

Midsize businesses are offering a variety of benefits to help

retain employees. Aside from health insurance, which 89 percent

offer, common benefits include:

- Paid time off – 69 percent

- Professional training and development –

51 percent

- Flexible work schedule – 50

percent

- Merit-based cash bonuses – 48

percent

Midsize businesses are also offering wellness programs for

employees, with the majority (71 percent) offering at least one

program. The most common offerings include employee assistance (36

percent), programs to encourage physical activity/fitness (32

percent), and smoking cessation (31 percent). One in five (22

percent) midsize businesses offer employees weight management

programs and 10 percent offer biometric screening.

“Attracting and retaining top talent is a priority shared by

business leaders, regardless of the size or industry in which they

operate,” said Carter. “Offering benefits that are meaningful to

employees and support their health and well-being can help midsize

businesses compete effectively for talent, increase productivity

and enhance overall company performance.”

Technology Use

Midsize businesses continue to integrate technologies into their

operation, including employer owned mobile devices (64 percent),

cloud computing (53 percent), Internet phone service (50 percent)

and employee owned devices accessing company systems (34 percent),

among others. Midsize businesses are also considering the use of

newer, cutting edge technologies.

Technology

Currently Using

Considering in the nextthree

years

Internet of Things 16 percent 43 percent 3-D printing

9 percent 33 percent Wearable technology 7

percent 38 percent Drones 3 percent 16 percent

Autonomous/driverless vehicles 2 percent 16 percent

“These and other emerging technologies bring potential benefits

as well as risk considerations,” said Carter. “The technology

landscape is changing rapidly, so it is critical for midsize

businesses to work with insurers, agents and brokers who can guide

them in these new areas of risk, so they can protect their business

and prevail in their pursuit of new opportunities.”

The Hartford’s Middle Market segment provides comprehensive,

multiline commercial insurance coverage for midsize and larger

businesses, associations and organizations. Coverage offerings

include property, general liability, workers’ compensation,

commercial auto, umbrella liability, management and professional

liability and marine protection, as well as specialty coverages for

target industry segments, including technology, life sciences,

construction, manufacturing and private education.

Survey Methodology

The Hartford’s 2015 Midsize Business Monitor was fielded from

August 11-19, 2015. More than 500 owners and C-level executives of

midsize businesses headquartered in the U.S. with annual sales or

revenues of $10 million to $1 billion participated in the online

survey, which had a margin of error of +/- 4.3 percentage points at

the 95 percent confidence level.

More information about this survey is available at

www.thehartford.com/midsizemonitor.

For more information about The Hartford’s 2015 Small Business

Success Study results, including survey methodology, visit

www.thehartford.com/successstudy.

About The Hartford

With more than 200 years of expertise, The Hartford (NYSE: HIG)

is a leader in property and casualty insurance, group benefits and

mutual funds. The company is widely recognized for its service

excellence, sustainability practices, trust and integrity. More

information on the company and its financial performance is

available at www.thehartford.com. Join us on Facebook at

www.facebook.com/TheHartford. Follow us on Twitter at

www.twitter.com/TheHartford.

HIG-M

Some of the statements in this release may be considered

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. We caution investors that these

forward-looking statements are not guarantees of future

performance, and actual results may differ materially. Investors

should consider the important risks and uncertainties that may

cause actual results to differ. These important risks and

uncertainties include those discussed in our 2014 Annual Report on

Form 10-K, subsequent Quarterly Reports on Forms 10-Q, and the

other filings we make with the Securities and Exchange Commission.

We assume no obligation to update this release, which speaks as of

the date issued.

From time to time, The Hartford may use its website to

disseminate material company information. Financial and other

important information regarding The Hartford is routinely

accessible through and posted on our website at

http://ir.thehartford.com. In addition, you may automatically

receive email alerts and other information about The Hartford when

you enroll your email address by visiting the “Email Alerts”

section at http://ir.thehartford.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151015005914/en/

The HartfordPamela Rekow,

860-547-8990pamela.rekow@thehartford.com

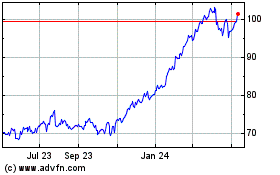

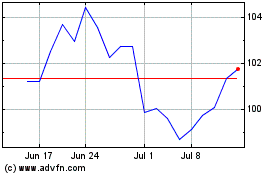

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Sep 2023 to Sep 2024