Safran Reports Rise in Operating Profit

July 29 2016 - 2:00AM

Dow Jones News

LONDON—French aerospace supplier Safran SA Friday said

first-half operating profit rose 11.1%, propelled by strong demand

for new aircraft engines.

Operating profit was 1.3 billion euros ($1.4 billion) compared

with €1.2 in the year prior period. Sales in the January through

June period advanced 6.3% to €8.9 billion.

Safran reported a 25.9% decline in its adjusted net profit to

€862 million after the prior-year figure was bolstered by the

one-time gain from a disposal.

Strong demand for Airbus Group SE and Boeing Co. jetliners has

helped lift Safran's results. The French company makes engines and

other airliner equipment for some of the world's most popular

planes.

"Production rates of equipment and engines for

current-generation aircraft have never been higher," Safran chief

financial officer Philippe Petitcolin said. Operating income

reached a company record 14.6% of sales, he said.

Airbus this month delivered the first A320neo single-aisle jet

powered by Leap-1A engines made by a joint venture of Safran and

General Electric Co. Production of those engines is accelerating

quickly amid strong demand for the plane.

Mr. Petitcolin said "the challenge of the Leap ramp-up will

intensity" and that the company was "fully mobilized" to

deliver.

United Technologies Corp., which offers a rival engine for the

Airbus plane, struggled early to get engines delivered in the

proper configuration. Airbus has been stuck with more than 20

planes without engines as a result. United Technologies has said

the issue was being fixed and that engine deliveries would

accelerate to allow Airbus to meet this year's delivery target for

all A320neo planes using its turbine.

Safran confirmed its full-year guidance, including an increase

in sales at low-single-digit levels and a 5% increase in adjusted

recurring operating income. The company stuck to its plan to reach

break-even on shipments of Leap-1A engines before the end of this

decade.

Engine-related revenue, Safran's biggest business, delivered the

strongest growth at 8.3%, plane equipment sales rose 5.3% and

security sales rose 7.2%. Only defense sales declined, down

5.2%.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

July 29, 2016 01:45 ET (05:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

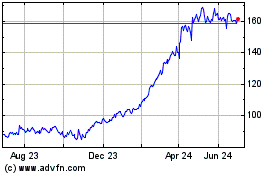

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

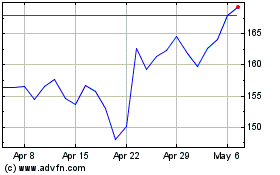

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024