US Wind Developers Struggle To Ink Power Contracts

March 23 2010 - 5:22PM

Dow Jones News

The number of wind-power projects coming online in the U.S. is

expected to decline this year, even with an influx of cash from the

federal government, as developers struggle to find buyers for the

electricity.

A big drop in power demand, expectations that wind-turbine

prices will fall further and uncertainty over federal policy are

making utilities hesitant to sign multiyear power-purchase

agreements to supply their customers. At the same time, wind-farm

developers and their financial backers are less willing to bet on

future power prices and are increasingly looking to seal these

long-term contracts.

The amount of new wind-power capacity coming online this year,

largely spurred by federal grants, is projected to dip 18% to 8,000

megawatts before rebounding in 2011, although this will be slightly

below last year's record level, according to Emerging Energy

Research, a Cambridge, Mass., research firm.

The projected dip comes as the federal government pumps money

into wind-power projects through a grant program. This program can

fund up to 30% of a project, with developers having to start

construction by the end of the year.

Yet even with increased federal support, the wind-power industry

is struggling to reach agreements to sell their output. The main

driver for wind-power demand is state-level renewable energy

mandates, which require a percentage of annual electricity sales to

come from wind, solar and other renewable sources.

Although state mandates rise over time, the math right now

doesn't favor wind energy. Power demand has fallen 5% over the last

two years to levels last seen in 2004, trimming the amount of

renewable generation needed to meet the state standards.

Wind-turbine prices are falling as well, causing utility buyers to

hold off inking deals with developers in the hope of negotiating

lower power prices in the future, said Matthew Kaplan, a senior

analyst at Emerging Energy Research.

Developers are expected to face the greatest difficulty securing

power purchase agreements in the Midwest and Southeast. Demand in

the Mid-Atlantic states is likely to be mixed, while the Northeast

and California will likely see strong demand, according to a

Macquarie Capital report earlier this month.

"It is not an easy environment to get utilities to buy the

output of a wind farm," said Gabriel Alonso, chief executive of

Horizon Wind Energy, a North American unit of EDP Renovaveis SA

(EDRVF, EDPR.LB), in an interview.

Horizon will cut its U.S. build-out by nearly 30% from last year

to 500 megawatts for 2010 and 2011. Developers such as Horizon--and

the manufacturers that supply them--say they need a stable federal

policy around renewable generation to grow. They favor a national

renewable-energy mandate, similar to the state-level programs now

in place.

For now, Kaplan said the federal grants should help wind-power

development grow year-over-year in 2011. Developers must get their

projects started by the end of the year in order to qualify for the

grants, so many of the projects should be completed next year.

But without a federal renewable standard, the wind-power

industry is likely to continue on a boom-and-bust cycle dictated by

short-term federal policies promoting development, said Elizabeth

Salerno, director of industry data and analysis at American Wind

Energy Association, an industry trade group.

"We could be hiring people, or downsizing, at the end of the

year," she said.

Despite efforts by the Obama administration and several U.S.

senators to get an energy and climate bill passed, any action

remains uncertain this year because of the partisan divide and a

focus increasingly shifting to November's mid-term elections.

-By Mark Peters, Dow Jones Newswires; 212-416-2457;

mark.peters@dowjones.com

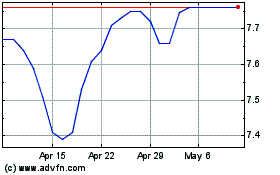

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

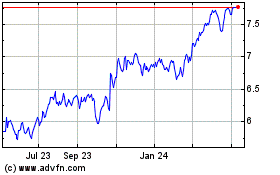

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Apr 2023 to Apr 2024